Empower won our award as the best Mac personal finance software and one of the reasons is because it offers a FREE remote consultation with a financial professional.

You don’t have to be an existing Empower customer to get a consultation either and there’s no obligation to use their software or financial products afterwards if you choose not to.

The service is however aimed at those with $100,000 to invest which is the minimum to secure a consultation.

Whilst most software based wealth management services are basically robo-advisors, they can’t tailor your financial plan like a wealth professional can, especially for those investing significant sums.

Although Empower’s financial dashboard can help optimize and manage your finances, the meeting with a wealth professional is one of the options that sets it apart from other investment management software on Macs.

Here we look at how an Empower Personal Strategy consultation works and whether it’s worth using outside of the software itself.

Table of Contents

How The Consultation Works

- Initial Contact and Setup

You start by scheduling a free consultation on Empower’s website.

You can check out Empower’s list of financial advisors although you can’t specify which one you want to schedule a meeting with.

After providing basic financial information, a financial professional will reach out to you via phone or video.

The meeting should take around 60 minutes.

During the consultation, they will ask in-depth questions to understand your financial goals, income, assets, debts, and retirement plans.

This meeting is focused on gaining insight into your financial situation and objectives so that a personalized analysis can be performed.

- Customized Financial Plan

Based on your consultation, the Empower professional will prepare a financial analysis based on your needs.

This plan can cover various aspects, such as asset allocation strategies, retirement goals and tax planning.

Some of the things the Empower advisor will do depending on your circumstances are:

- Model different retirement ages

- Look for red flags in your portfolio

- Discuss ways to help lower your tax bill

- Plan for your children’s future

- Factor in Social Security and healthcare coverage

You’ll then receive a summary report from Empower to decide whether you want to go ahead and hire Empower to implement your Personal Strategy and manage your investible assets.

If you decide you want Empower to manage your assets, you’ll need to onboard as a paid Empower Personal Strategy client.

If you don’t want to become a client, you can still use the dashboard to track your portfolio in real-time.

The dashboard and financial consultation are completely free.

- Follow-Up Services & Fees

After the free portfolio review during the 2-part consultation with an Empower financial professional, you have the option of onboarding as an Empower Personal Strategy client.

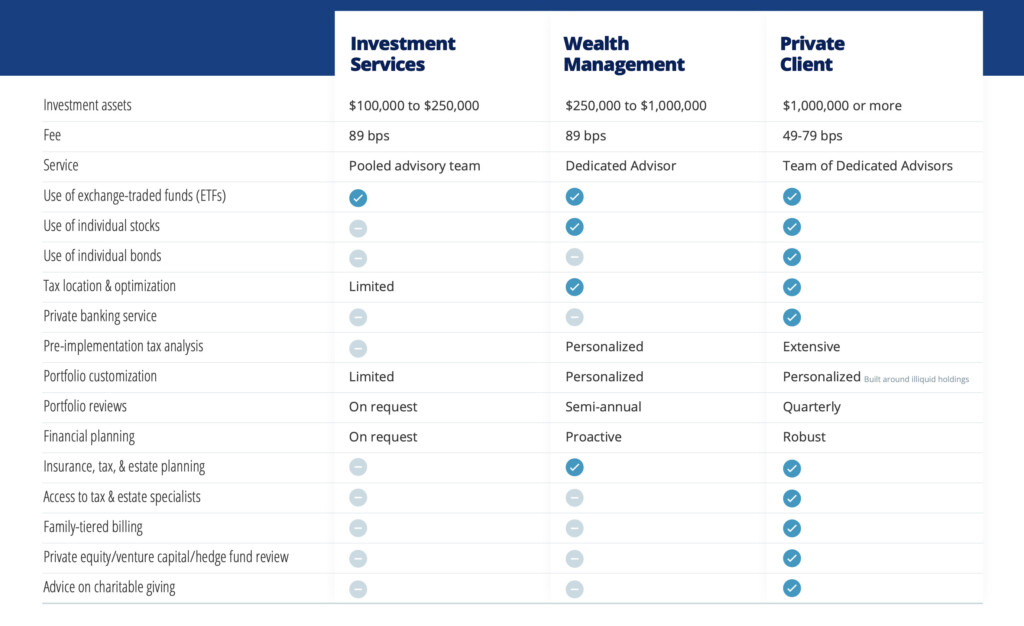

The paid advisory services are charged on Basis Points (bps) which vary depending on the amount invested.

Basis Points (bps) are a measure of 1/100 of a percent of funds invested.

Empower Personal Strategy advisory fees start from 49 bps and go up to 89 bps depending on how much you’ve invested.

Below is a comparison table of Empower’s Personal Strategy fees based on how much of your assets it manages and what you get for it.

Investments over $1 miilion

For high value investors with over $1 million, there is an additional sliding scale of fees which is:

- First $3m: 0.79%

- Next $2m: 0.69%

- Next $5m: 0.59%

- Over $10m: 0.49%

There are however additional advantages for these investors including:

- Private equity access previously restricted to institutional investors

- A range of banking services from BNY Mellon

- Estate planning guidance for legacy planning

- An insurance coverage review to help ensure adequate coverage

Tracking

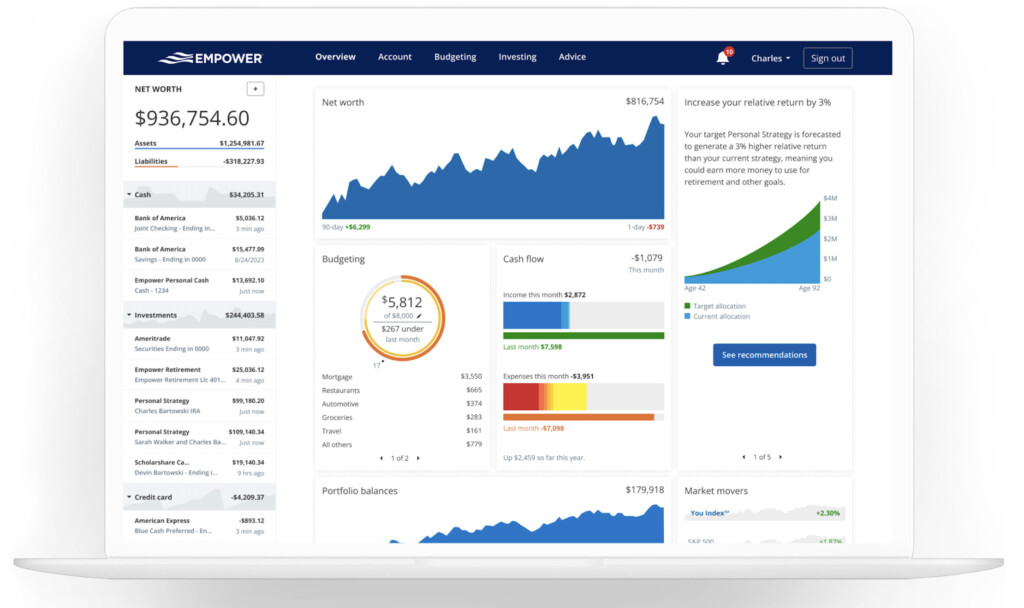

You can track your financial plan in real time using the Empower dashboard which brings together your net worth, investments, and financial health in one place.

Although Empower isn’t the only financial software to offer one-on-one consultations, its Personal Dashboard software is the best platform we’ve used for tracking your finances.

Its free to use and one of the big reasons we ranked Empower the best investment tracking software for Mac users.

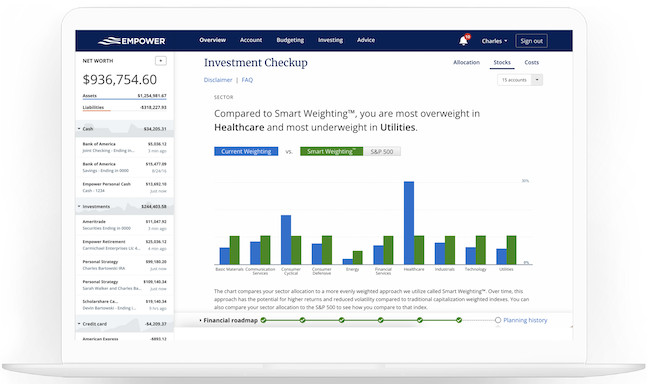

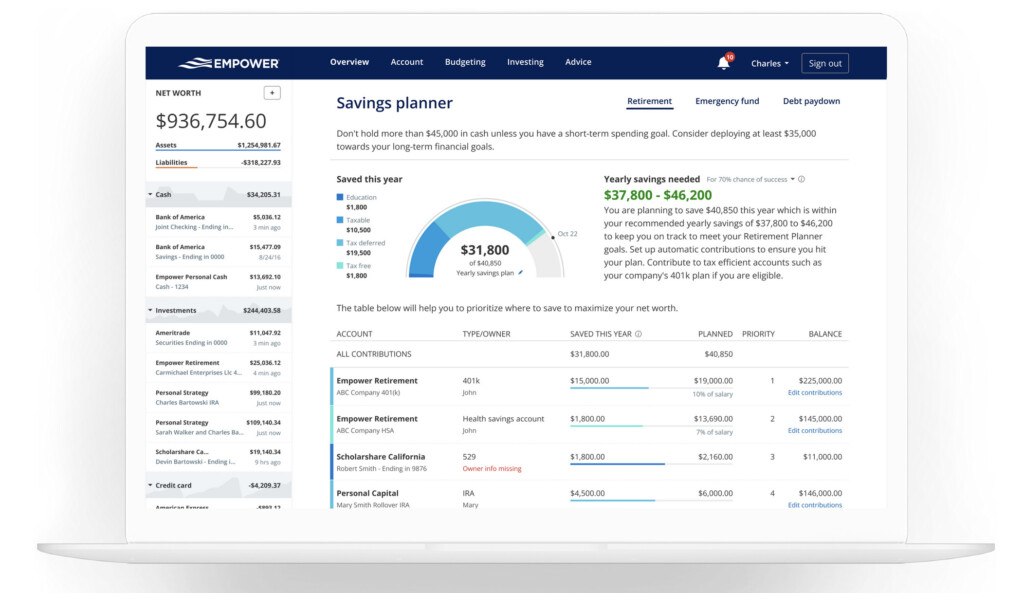

These include everything from an investment checkup to a retirement planner which you can read more about in our full Empower review.

You can continue to use these tools for free even if you don’t want to enroll as an Empower Personal Strategy client.

However, there are also advantages to becoming a Personal Strategy client which include:

- Tax harvesting

- Disciplined rebalancing

- Behavioral coaching

- Customized investment strategy

This service can clearly get pricey but may well be worth it if they help you plan smarter financially.

FAQ

Is the first Empower consultation really free?

Yes, the initial consultation and 2nd analysis call are free.

What does Empower offer that others don’t?

Empower’s biggest strength is the combination of human financial advisors and its financial tracking software, which is free to use even without paid advisory services.

How much do Empower advisory services cost?

Pricing can vary based on the level of service and the complexities of your financial situation. Make sure to clarify costs upfront during your consultation.

Do Others Recommend Empower’s Consultations?

According to Empower’s last survey, 86% felt they had gained more knowledge after a consultation, 84% felt more confident about their retirement and 88% would recommend Empower to someone else (Empower satisfaction survey and IVR data as of March 2024.).

The statement is provided to you by NJM Media (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.