If you want to take control of your finances, we’ve taken a closer look at the best personal finance software for Mac of 2025 that also make excellent alternatives to Quicken for Mac.

We tested a wide range of financial management tools for macOS that not only do a better job of apps like Quicken, they’re often cheaper, offer one-time purchases or are even free.

In our research and testing, we found the best personal finance tool for Macs is Empower (FREE) which has no subscriptions, has excellent bank syncing support and is incredible at optimizing your investments.

| Quicken Import Support | Pricing | Free Trial | Investing | Budgeting | Bank Syncing |

|---|

| Empower | No | Free | N/A | Yes | No | Yes |

| Money-spire | Yes | $59.99 one-time | 30 days | Yes | Yes | No |

| Banktivity | Yes | Starts at $59.99/y | 30 days | Yes | Yes | Yes |

| Money-dance | Yes | $69.99 one-time or $9.00/m with bank syncing | 90 days | Yes | Yes | Yes |

| Copilot | No | $13/m or $95.00/y | 30 days | No | Yes | Yes |

| Money Pro | Yes | $4.99 plus $29.99/y Plus or $69.99/y Gold | 7 days | Limited | Yes | Yes |

| Tiller | Yes (via CSV) | $79/y | 30 days | Yes | Yes | Yes (via Sheets) |

| Money-Manager Ex | Yes (via CSV/QIF) | Free | N/A | Yes | Yes | No |

| YNAB | No | $109/y or $9.08/m | 34 days | No | Yes | No |

| MoneyWiz | Yes | $49.99/y | 30 days | Yes | Yes | Yes |

| Check-Book Pro | No | $29.99 one-time | 30 days | No | Yes | No |

| SEE Finance 2 | Yes | $39.99 one-time | 30 days | Yes | Yes | Yes |

| Count-About | Yes | $9.99/y or $39.99 with Direct Connect | 15 days | No | Yes | Yes |

| Money-Well | Yes | $49.99 one-time or $5.99/m | 60 days | No | Yes | No |

Here then are our extensive reviews of the best Mac compatible personal finance apps of 2025.

Table of Contents

- 1. Empower (Free)

- Quicken vs Empower

- 2. Moneyspire

- 3. Banktivity

- 4. Moneydance

- 5. Copilot

- 6. Money Pro

- 7. Tiller

- 8. Money Manager Ex

- 9. YNAB

- 10. MoneyWiz

- 11. CheckBook Pro

- 12. SEE Finance 2

- 13. CountAbout

- 14. MoneyWell

- What We Looked for in These Apps

- Best Personal Finance Software for Mac Overall

- Best Budgeting Software for Mac

- Best Mint Alternative for Mac

- Best UK Personal Finance Apps for Mac

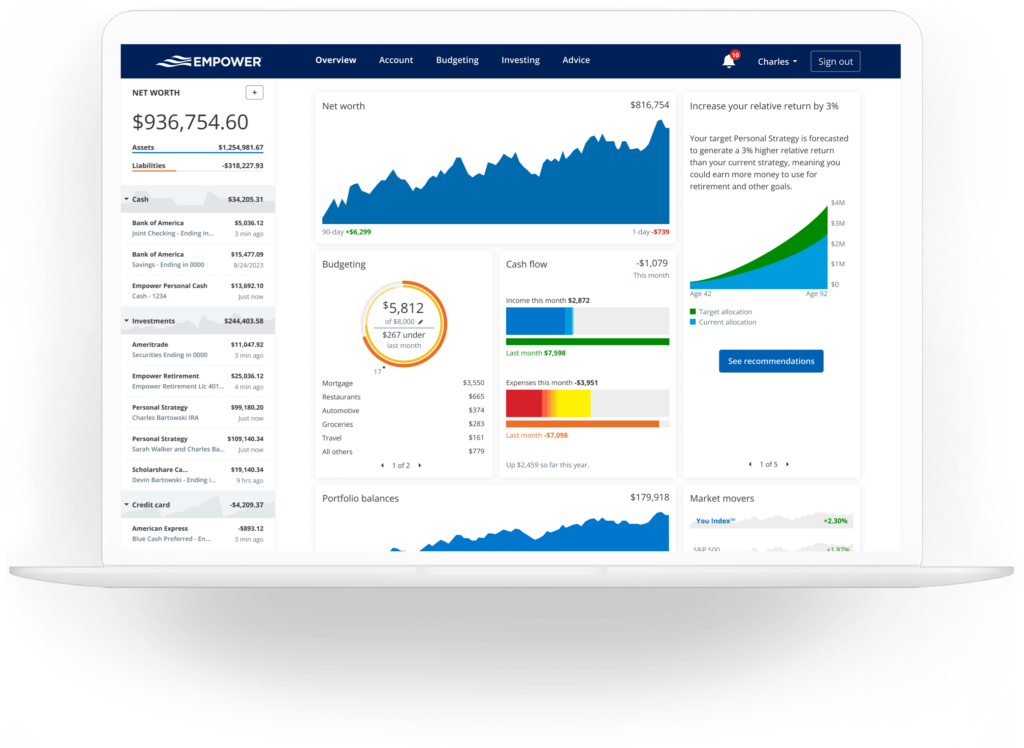

1. Empower (Free)

⭐ Why We Picked It

Empower combines the best investment tracking we’ve seen with reliable budgeting tools—completely free. It syncs smoothly with most major banks and investment platforms using the secure Plaid network (which is far more reliable than Direct Connect used by Quicken and many other finance apps). Unlike many budgeting apps, it also helps analyze your retirement readiness, investment fees, and overall financial health. It does try to to sell you investment advisory services but you don’t have to use them if you don’t want to. While it doesn’t support file imports from Quicken, it’s the best Mac-compatible tool we’ve tried for those managing both personal finances and long-term assets.

👤 Who It’s Aimed At

Empower is ideal for:

- Users with multiple financial accounts or investments

- Those planning for retirement or big life changes

- People seeking a free yet comprehensive financial dashboard

- Mac users tired of Quicken syncing issues

| ✅ Pros | ❌ Cons |

|---|---|

| Completely free to use | No Quicken file import (QIF/QFX) |

| Syncs reliably with banks, credit cards, 401(k), etc. | CSV export only |

| Offers investment & retirement analysis tools | |

| Secure – doesn’t store or transmit your login details | |

| Optional access to live financial advisors | |

| Excellent iOS app for managing on the go |

Quicken vs Empower

| Quicken | Empower | |

|---|---|---|

| Subscription Fee | ||

| Lifetime License | ||

| Easy To Use | ||

| All Accounts In One Place | ||

| Financial Advisors Available | ||

| Personalized Investment Strategy | ||

| Fiduciary | ||

| Smart Indexing | ||

| Mobile App | ||

| Customizable Portfolios | ||

| Tax Loss Harvesting | ||

| 401k Fund Advice | ||

| Portfolio Risk Assessment | ||

| Compare Mutual Funds | ||

| Track Cost Basis & Capital Gains | ||

| Income & Expense Projection | ||

| Spending Targets | ||

| Works on M-Series Macs | ||

| Price | $95.88/year (Premier) | Free |

Free Account Sign Up |

Pricing: Free

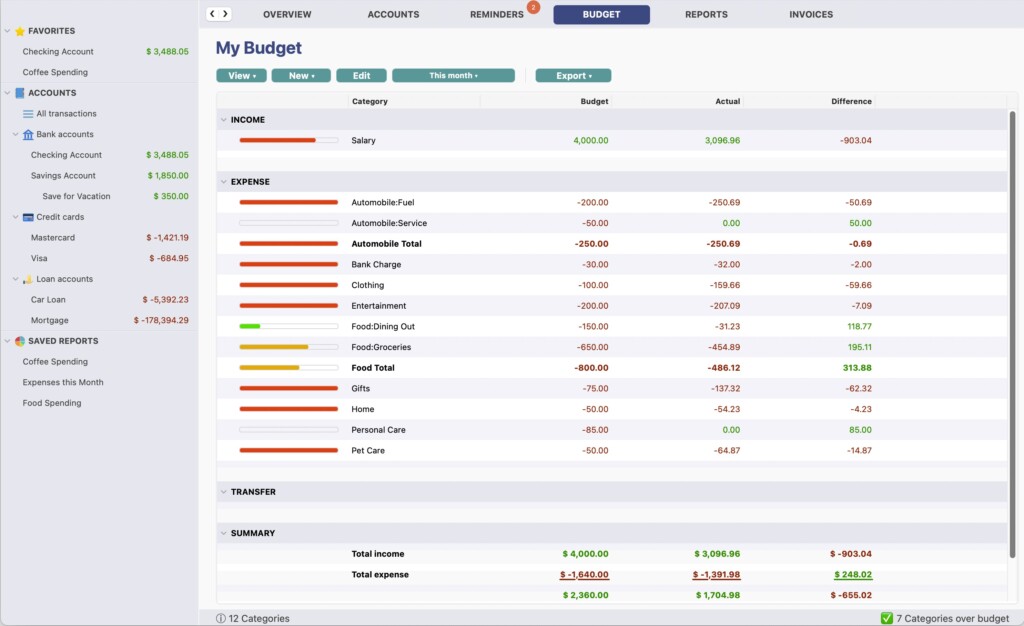

2. Moneyspire

⭐ Why We Picked It

If you prefer a traditional, offline desktop finance app over cloud-based tools, Moneyspire 2025 is one of the best Mac-compatible alternatives to Quicken. It offers customized budgeting, account tracking, and even invoicing—without subscriptions or mandatory cloud syncing. With support for Quicken and Mint file imports, check printing, and detailed financial reporting, it’s ideal for users who want control, simplicity, and privacy in a finance app. It even supports MS Money files making it one of the best alternatives to Microsoft Money we’ve tried too. Plus, it currently offers 40% off standard pricing, making it excellent value.

👤 Who It’s Aimed At

Moneyspire is perfect for:

- Mac users who want a non-cloud-based, offline finance app

- Former Quicken, Mint, or Microsoft Money users migrating data

- Small business owners who need light invoicing tools

- Anyone wanting a one-time purchase without a subscription model

| ✅ Pros | ❌ Cons |

|---|---|

| One-time purchase – no forced subscription | Annual upgrade needed to continue using Moneyspire Connect |

| Import/export support for Quicken, Mint, MS Money files | Syncing via Moneyspire Connect may require occasional re-authentication |

| Supports check printing (rare on Mac apps) | Limited investment analysis tools compared to Empower |

| Includes bill reminders, budget tracking & reporting | Tax features are basic |

| Optional cloud sync + iOS app for on-the-go tracking | No fund transfers through the app |

| Includes invoicing (Pro version only) | Invoicing features not available in Standard edition |

| 30-day money-back guarantee | Major updates require upgrade fee (discounted for existing users) |

Pricing: Standard $59.99 / Pro with Invoicing $79.99. Free Trial available.

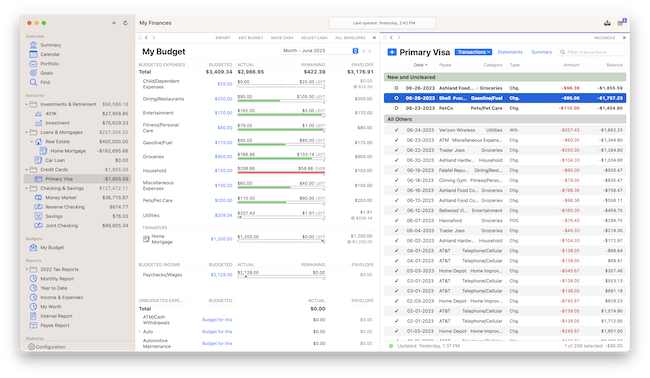

3. Banktivity

⭐ Why We Picked It

Banktivity (formerly iBank) is one of the few personal finance tools built exclusively for Apple users, and it’s long been a favorite for macOS budgeting. Its deep Apple ecosystem integration (including iPhone, iPad, and Apple Watch apps), powerful syncing, and detailed reporting make it a top choice for managing personal finances—especially for users in the UK and EU thanks to its support for PSD2/Open Banking. While it’s now subscription-based, features like Direct Access syncing, customizable reports, and envelope budgeting make it worth the investment.

👤 Who It’s Aimed At

Banktivity is ideal for:

- Long-time Mac users seeking an Apple-native finance tool

- Quicken and Mint users looking to import years of data

- International users needing UK/EU Open Banking support

- Investors who want in-depth portfolio tracking

- Users who prefer a fully-featured desktop and mobile experience

| ✅ Pros | ❌ Cons |

|---|---|

| Designed specifically for Mac, iOS, and Apple Watch | Subscription-only (no one-time purchase option anymore) |

| Imports accounts from Quicken, Mint, and others | Investment and multi-currency features locked behind higher-tier plans |

| Direct Access sync works reliably and supports Open Banking (UK/EU) | Direct Access used to be optional; now bundled with subscription |

| Offers both traditional and envelope budgeting | Costs more annually than some cloud-based competitors |

| Customizable and Quick Reports with tagging | Importing historical data isn’t always perfect |

| Clean, modern UI and good mobile experience | No full tax tools or advisor support |

Pricing: Bronze plan $59.99/year, Silver $79.99/year, Gold $99.99/year billed annually. Free trial available.

4. Moneydance

⭐ Why We Picked It

Moneydance is a longtime favorite for Mac users switching from Quicken, with strong investment tracking, multi-currency support, and powerful budgeting tools. Its straightforward interface offers a comprehensive financial overview, while add-ons and an improved undo feature give it some flexibility. The app also works offline, supports one-time purchases, and doesn’t force users into a subscription—making it a great value pick for desktop budgeting.

👤 Who It’s Aimed At

Moneydance is best for:

- Quicken or Mint users looking to switch

- Investors managing multiple currencies or asset types

- Users wanting a one-time purchase option (non-subscription)

- Those who value offline use and manual control over automation

- Budgeters who want a customizable yet simple desktop tool

| ✅ Pros | ❌ Cons |

|---|---|

| One-time purchase available (no mandatory subscription) | Bank syncing via Direct Connect can be unreliable |

| Strong investment tracking with real-time stock updates | Moneydance+ (via Plaid) costs extra ($40/year or $4/month) |

| Multi-currency support | No EWC+ support for bank syncing |

| Clear calendar view of upcoming transactions | Mobile app syncing only via Dropbox, which isn’t end-to-end encrypted |

| Includes reporting tools and useful add-ons | Imports from Quicken/Mint can generate duplicate transactions |

| New features include Balance Adjustment and Enhanced Undo | Mobile app is mostly for manual entry, not full functionality |

| 90-day money-back guarantee | UI feels dated compared to some modern alternatives |

Pricing: $69.99 one off purchase or $9 per month with bank syncing included. Free trial available. You can also purchase Moneydance as a one-off purchase from the developer for $65 but this does not include MoneyDance+ for connecting to banks.

5. Copilot

⭐ Why We Picked It

Copilot is one of the most visually polished budgeting apps available for macOS, originally exclusive to iOS but now available on Mac too. With daily spending snapshots, net worth tracking, category-based summaries, and a clean interface, it’s a great choice for users who value both design and functionality. It’s also recently added a Mint import tool with seamless syncing of accounts across iPhone, iPad, and Mac, making it one of the best alternatives to Mint on a Mac too.

👤 Who It’s Aimed At

Copilot is ideal for:

- iPhone and iPad users who want a synced Mac budgeting experience

- Visual thinkers who want modern, attractive interfaces

- Former Mint users thanks to the Mint import tool

- U.S.-based users seeking simple yet powerful money tracking

| ✅ Pros | ❌ Cons |

|---|---|

| Slick, intuitive design across all Apple devices | Currently only available in the U.S. |

| Tracks spending, budgets, investments, and net worth | Lacks some advanced features power users may want |

| Daily snapshots and bill reminders for better money awareness | No manual CSV/QIF importing at the moment |

| Syncs automatically across iPhone, iPad, and Mac | $13/month or $95/year – no free version available |

| Supports category rollovers for unused budgets | Import tool for Mint still in development |

| Available on both Intel and Apple Silicon Macs | No investment drill-down like other desktop apps |

👉 Read our full Copilot review →

Pricing: $13/month or $95/year. You can download the Copilot app from the Mac App Store for both Intel and Apple Silicon apps and also get it from the Copilot website.

6. Money Pro

⭐ Why We Picked It

Money Pro combines a clean design with flexible budgeting and bill tracking tools, making it a good option for users who want a simple but functional budgeting app across Mac, iPhone, and iPad. It offers calendar-based bill planning, real-time alerts, and support for syncing accounts and bank data (with a Gold subscription). It’s especially appealing to those that like to stick to Apple devices who don’t need the complexity of Quicken or Banktivity.

👤 Who It’s Aimed At

Money Pro is best suited for:

- Users who want a lightweight, Apple-centric finance app

- Families or couples needing profile-based budgeting

- Manual budgeters who prefer checkbook-style tracking

- Those who want calendar-style scheduling of bills

| ✅ Pros | ❌ Cons |

|---|---|

| Simple and attractive interface across Mac, iPhone & iPad | Key features require multiple in-app purchases (up to $69.99) |

| Calendar and Today views for bill tracking & forecasts | No envelope budgeting feature |

| Supports manual reconciliation and receipt photo attachments | Bank syncing can be inconsistent depending on the institution |

| Syncs via iCloud and supports multiple currencies | iCloud syncing can lag across devices |

| Import bank statements (CSV, OFX) and generate detailed reports | No free trial available |

| Allows multiple user profiles with overspending alerts | Base app is $0.99 but full functionality locked behind subscriptions |

👉 Read our full Money Pro review →

Pricing: $0.99 plus in app purchases for Plus features $29.99 and Gold features $69.99

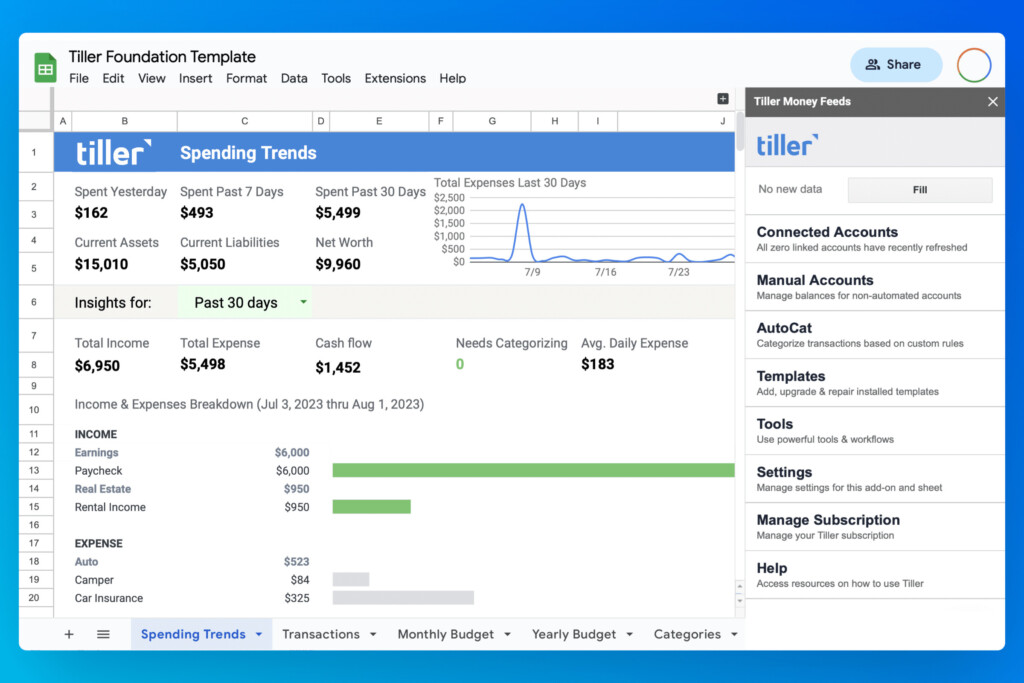

7. Tiller

⭐ Why We Picked It

Tiller is ideal for spreadsheet lovers who want powerful automation without sacrificing flexibility. It connects to your bank accounts and automatically pulls transactions into Google Sheets or Excel, letting you customize every detail of your budget or financial tracking. It’s perfect for anyone who prefers raw data, wants full control over categorization, and appreciates that their financial data stays local, not in the cloud.

👤 Who It’s Aimed At

Tiller is best suited for:

- Spreadsheet users familiar with Excel or Google Sheets

- DIY budgeters who want total customization

- Users who prefer storing data locally

- Those who want advanced tracking dashboards without a full-blown app

| ✅ Pros | ❌ Cons |

|---|---|

| Fully automates bank feeds into spreadsheets | Setup takes time, especially from scratch |

| Works with both Google Sheets and Microsoft Excel | Not ideal for users unfamiliar with spreadsheets |

| Customizable templates and reports | No native desktop or mobile apps |

| New Spending Trends dashboard adds visual insights | Interface not as polished as traditional apps |

| No cloud storage — data stays in your spreadsheet | Limited real-time alerts or automation beyond feeds |

| 30-day free trial | $79/year subscription fee |

👉 Read our full Tiller review →

Pricing: $79/year. You can try a 30 day free trial of Tiller.

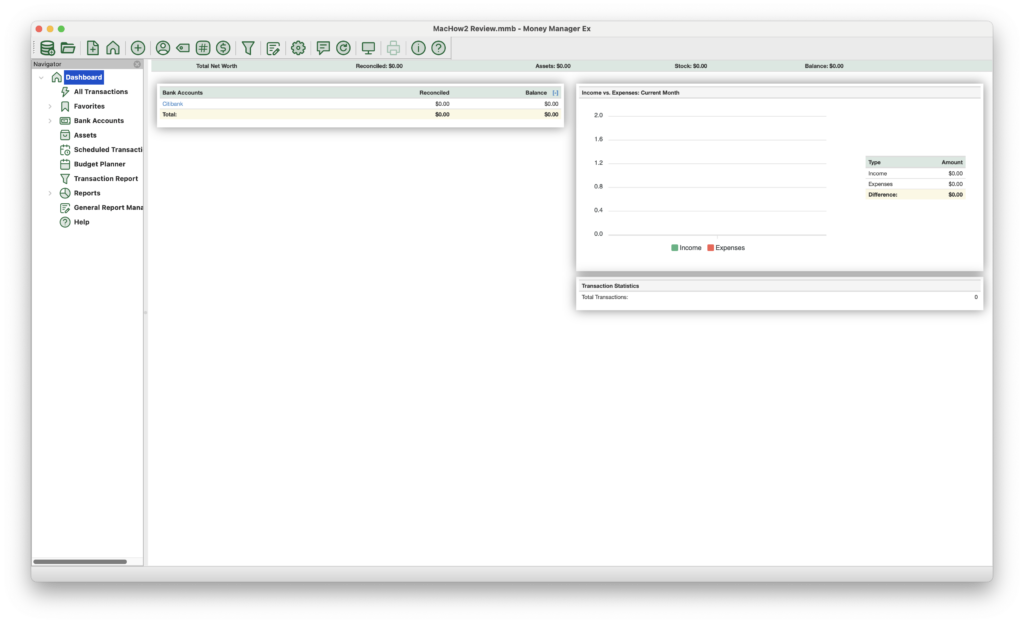

8. Money Manager Ex

⭐ Why We Picked It

Money Manager Ex (MMEX) is a completely free, open-source personal finance app that covers the basics—budgeting, expense tracking, and investment monitoring—all without storing any data in the Cloud. It’s a great no-frills option for those who want full control over their finances offline.

👤 Who It’s Aimed At

Perfect for:

- Users who want free, offline finance software

- Those comfortable without bank syncing

- People looking to import old Quicken data

| ✅ Pros | ❌ Cons |

|---|---|

| Completely free and open source | No online bank syncing |

| Supports budgeting, expense tracking, and basic investment monitoring | Interface is basic and not very modern |

| Imports CSV and Quicken QIF files | No official support (community only) |

| Works entirely offline—no Cloud storage | Features are more limited than paid apps |

👉 Read our full Money Manager Ex review →

Pricing: Free

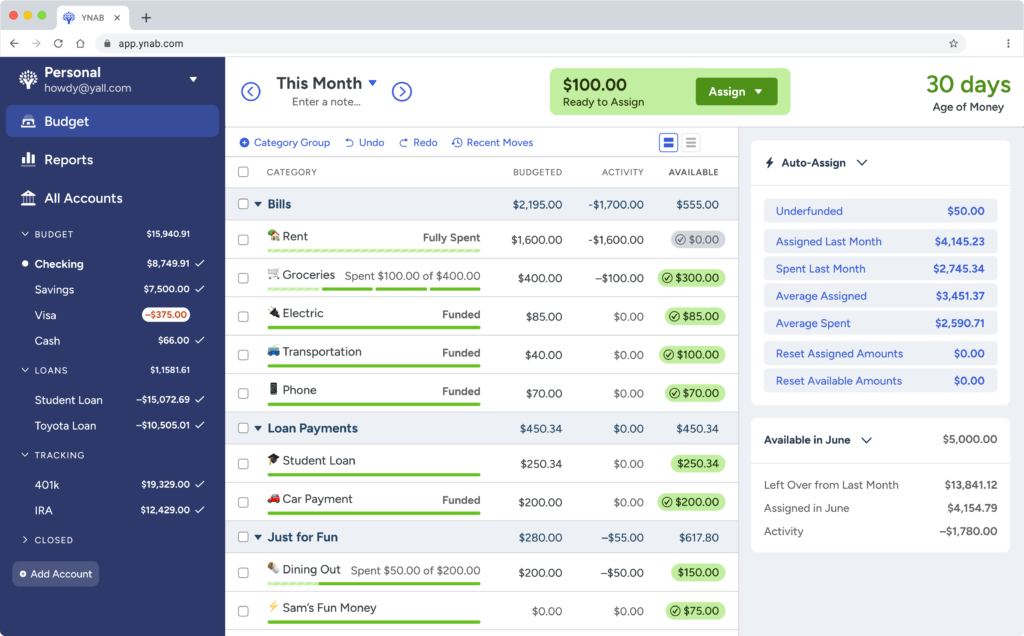

9. YNAB

⭐ Why We Picked It

YNAB is one of the best tools for people who struggle to stick to a budget. It’s built around four powerful money principles that teach you to allocate every dollar, prepare for irregular expenses, and roll with surprises. While it lacks investment tracking and multi-currency support, its approach is transformative for those focused on gaining control of day-to-day spending. It’s also one of the few apps with Apple Watch and Alexa support.

👤 Who It’s Aimed At

YNAB is perfect for:

- Users trying to break the paycheck-to-paycheck cycle

- Students and families looking for financial discipline

- Budgeters who want education, not just software

- Those who don’t need investment features or multi-currency

| ✅ Pros | ❌ Cons |

|---|---|

| Highly effective, rule-based budgeting method | No investment tracking or multi-currency support |

| Syncs with over 12,000 banks via Direct Connect | No support for EWC+ (some banks won’t sync) |

| Connects to UK/EU banks via TrueLayer | No Bill Pay features |

| Works across Mac, iOS, iPad, Apple Watch, and even Alexa | Dropbox-only sync, no iCloud or built-in cloud sync |

| Clear net worth and spending reports | Learning curve for YNAB’s budgeting method |

| 34-day free trial + free for US college students | $109/year or $9.08/month |

Pricing: $109/year or $9.08/month – Free Trial

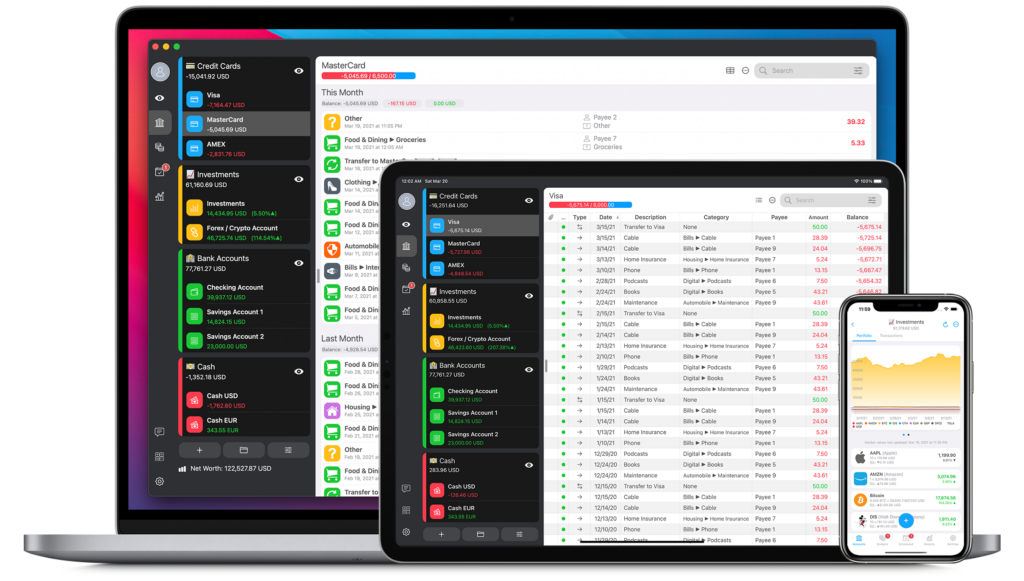

10. MoneyWiz

⭐ Why We Picked It

MoneyWiz offers excellent value for Mac users looking for a full-featured personal finance app with a sleek Apple-native design. It supports nearly every type of account, including crypto and investments, and allows syncing through multiple bank connection services for greater reliability. With a generous free desktop version and low-cost subscriptions, it’s one of the most affordable and flexible alternatives to Quicken.

👤 Who It’s Aimed At

MoneyWiz is ideal for:

- Mac and iOS users who want a consistent experience across devices

- Those managing diverse accounts including crypto and investments

- Budgeters looking for customizable syncing and strong visuals

- Users wanting flexibility in bank connection options

| ✅ Pros | ❌ Cons |

|---|---|

| Free desktop app with optional affordable subscriptions | Syncing requires a subscription |

| Gorgeous Apple-native interface | No live chat support in the Mac version |

| Tracks everything—banking, crypto, loans, stocks, investments | Syncing can occasionally break (often due to third-party aggregators) |

| Flexible bank syncing with 3 connection services | |

| Reliable syncing between macOS and iOS | |

| Investment syncing, including Robinhood | |

| Active developer support |

Pricing: Free desktop app / Standard Subscription $24.99/year / Premium $49.99/year or $4.99/month

11. CheckBook Pro

⭐ Why We Picked It

CheckBook Pro is a no-frills check register app for Mac that does exactly what it promises—tracks your money without the complexity or cost of full finance suites. It’s ideal for users who want a simple, offline solution without subscriptions or cloud dependency.

👤 Who It’s Aimed At

CheckBook Pro is perfect for:

- Users who prefer manual checkbook-style budgeting

- Anyone who wants a lightweight, offline money tracker

- Those migrating from Quicken or similar tools using standard formats like QFX, OFX, or CSV

| ✅ Pros | ❌ Cons |

|---|---|

| One-time payment—no subscription required | No automatic bank syncing |

| Very easy to use | Best suited for 1–2 accounts only |

| Great migration support from Quicken and other formats | Manual data entry is time-consuming |

| Generates detailed reports | Importing and organizing external data can be tedious |

| Check printing and iCloud sync in Pro version |

Pricing: $29.99 from the Mac App Store and there’s a free trial.

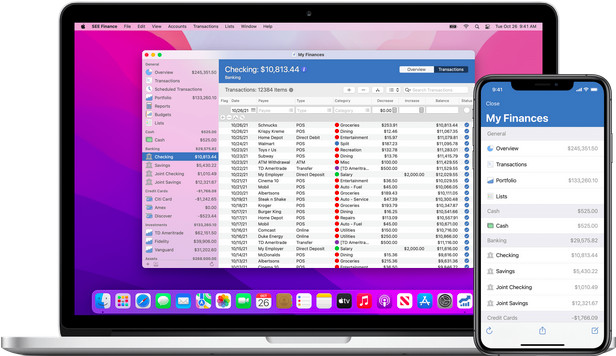

12. SEE Finance 2

⭐ Why We Picked It

SEE Finance 2 is a powerful, Mac-native budgeting app that’s especially good for users migrating from Quicken. With strong investment tracking, accurate import tools, and support for over 150 currencies, it’s one of the most robust personal finance apps designed specifically for macOS.

👤 Who It’s Aimed At

SEE Finance 2 is ideal for:

- Former Quicken or Mint users needing reliable data import

- Investors needing detailed portfolio tracking

- Users with multi-currency accounts

- Those wanting a native macOS experience with iOS syncing

| ✅ Pros | ❌ Cons |

|---|---|

| Designed from the ground up for Mac | No support for Bill Pay |

| Excellent Quicken QIF and Mint CSV import accuracy | No EWC+ support—may limit bank syncing as Direct Connect is phased out |

| Great investment tracking and detailed financial reports | Requires setup for syncing and Direct Connect may not work with all banks |

| Supports 150+ currencies | |

| Syncs via iCloud with the iOS app |

Pricing: $39.99 – Free Trial

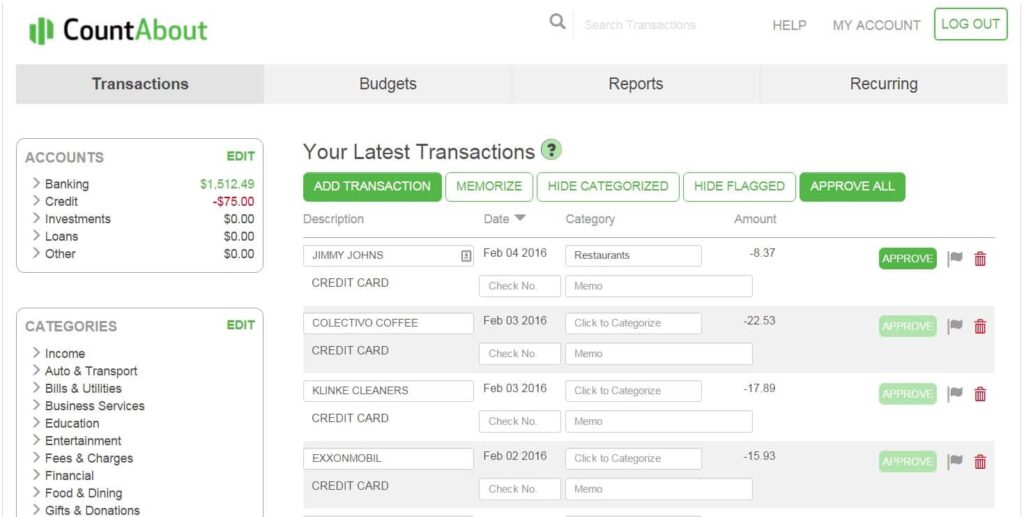

13. CountAbout

⭐ Why We Picked It

CountAbout is a clean, affordable budgeting app that supports direct Quicken file imports with minimal cleanup needed. It’s a great choice for those transitioning from Quicken and looking for a lightweight, subscription-based alternative.

👤 Who It’s Aimed At

CountAbout is ideal for:

- Quicken users who want easy data migration

- Budgeters who want bank syncing at a low cost

- Users who don’t need extras like Bill Pay or investment planning

| ✅ Pros | ❌ Cons |

|---|---|

| Excellent Quicken (QIF) import accuracy | No Bill Pay support |

| Low annual cost compared to alternatives | Limited features beyond budgeting and syncing |

| Direct Connect included with Premium | Direct Connect support may decline as banks switch to EWC+ |

| 45-day free trial | No native macOS desktop app—browser-based only |

Pricing: $9.99/year or $39.99/year with Direct Connect. 45 day free trial.

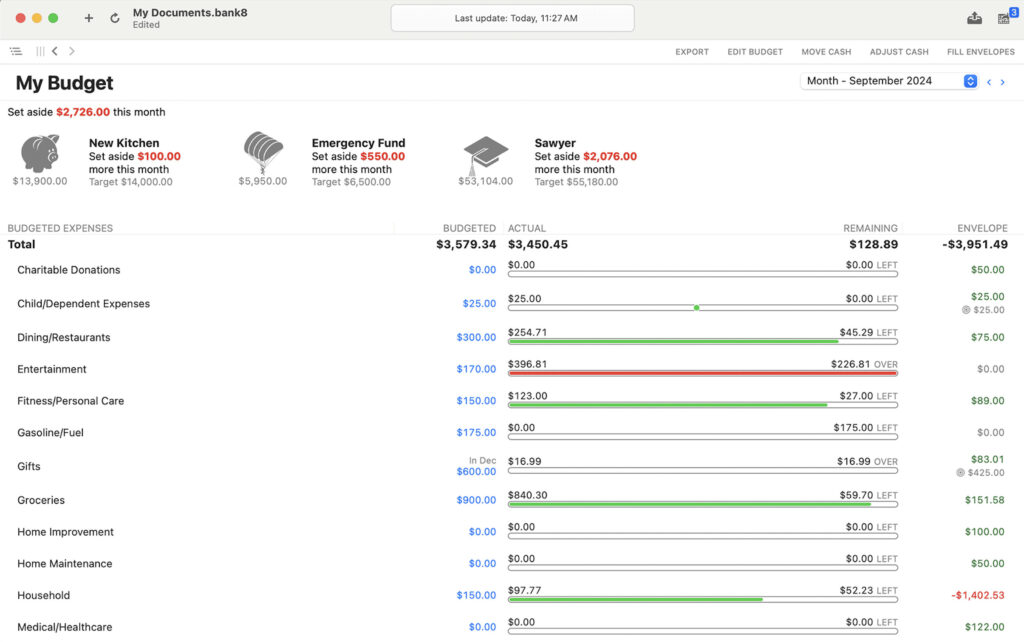

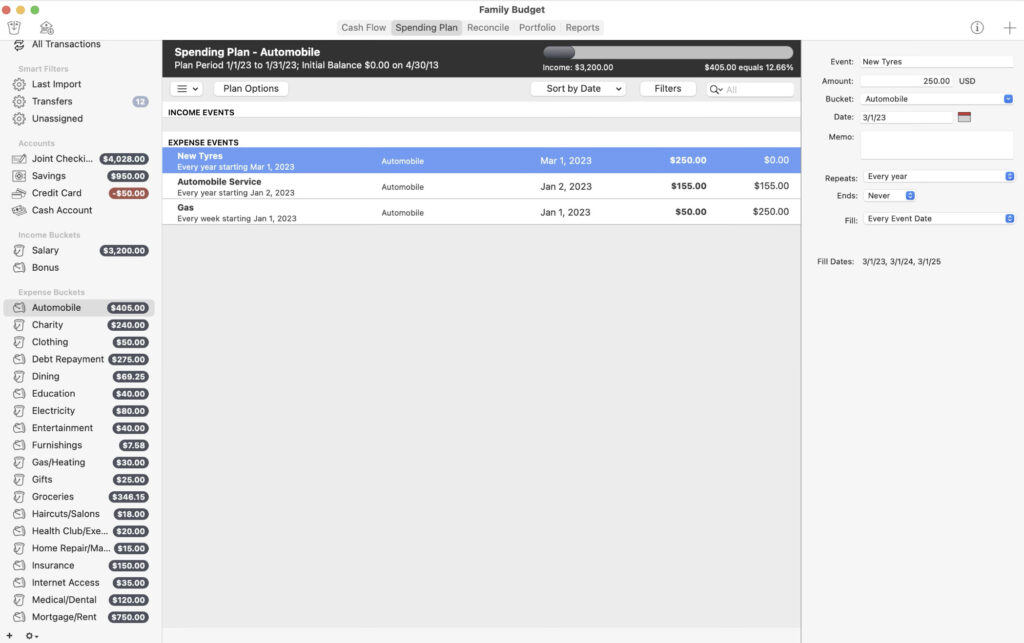

14. MoneyWell

⭐ Why We Picked It

MoneyWell is a Mac-first budgeting app built around envelope-style budgeting—ideal for those who want to manage spending in real time rather than just track it. Its intuitive visualizations and transaction syncing make it a solid choice for Mac users who appreciate simplicity with power under the hood.

👤 Who It’s Aimed At

Perfect for:

- Users who prefer envelope budgeting

- Mac users who want clear visual reports

- Those looking for a balance between manual control and automation

| ✅ Pros | ❌ Cons |

|---|---|

| Uses envelope budgeting to manage spending goals | No support yet for EWC+—Direct Connect is being phased out |

| Built specifically for macOS with a clean interface | Subscription-based pricing only ($49.99/year or $5.99/month) |

| Smart interactive reports and graphs | Free version limits you to 200 transactions if you cancel subscription |

| iOS app (MoneyWell Express) available again for mobile access | Past issues with syncing (now resolved) |

Pricing: $5.99/month or $49.99/year

What We Looked for in These Apps

When selecting the best money management apps for Mac, we focused on features that improve both functionality and user experience:

✅ Mac Compatibility

All apps reviewed are compatible with Apple Silicon and the latest macOS versions, including macOS Sequoia.

🔄 Bank Syncing

Unlike Quicken, which often struggles with bank syncing, these apps offer more reliable options. With Direct Connect being phased out, we prioritized apps that support newer standards like Express Web Connect+ or Plaid.

📱 Mobile App Support

Most apps offer fully-featured iPhone and iPad apps—much better than Quicken’s limited mobile version.

📈 Investment Tracking

Many apps here offer stronger investment tools than Quicken for tracking stocks, retirement accounts, loans, and more.

💰 Budgeting

We focused on tools that make it easy to visualize and manage budgets without the complexity of older apps like Quicken.

📄 Paperless Finance

Several of these apps centralize account and bill management, making it easier to go paperless on your Mac.

🧾 Tax Readiness

Some apps also help organize finances for easier tax preparation.

Best Personal Finance Software for Mac Overall

🏆 Empower – Best for overall financial management and investments.

It’s completely free and makes budgeting and tracking assets far easier than Quicken. Plus, it looks and feels like a native Mac app—unlike Quicken’s ported design.

Best Budgeting Software for Mac

💡 YNAB (You Need A Budget) – Best for pure budgeting.

It’s designed around helping you stick to a budget, with powerful features to stay on track.

📱 Copilot – Best for Apple-focused users.

Slick, well-designed Mac and iOS apps with strong budgeting tools (but no investment features).

Best Mint Alternative for Mac

With Mint now shut down and absorbed into Credit Karma (which lacks full budgeting tools), your best alternatives are:

- 💰 Budgeting: Copilot (not free, but intuitive)

- 📊 Investments: Empower (free and more powerful than Mint)

For more options, check out our full guide to Mint alternatives for Mac.

Best UK Personal Finance Apps for Mac

Most top tools, like Empower, are US-only. However, these are UK-compatible:

- Banktivity: Supports PSD2/Open Banking; connects to many UK/EU banks via Salt Edge.

- YNAB: Since 2023, supports UK/EU banks via TrueLayer.

Note: Money Dashboard is now discontinued.

Other mobile-first UK budgeting apps include:

- Plum – Free, with paid plans from £1/month

- Budget by Koody – Free or £1/month

- Emma – Free, or £9.99/month for premium features

- Moneyhub – Free, with extras from £1.49/month

- Snoop – Free or £3.99/month