If you’re looking for some financial planning help for your retirement, we’ve looked at the best retirement planning software for Mac of 2024.

Nowadays retirement planning requires supplementing what you’ve just paid into Social Security or National Insurance whether it’s in the form of a 401(k) or an ISA.

While most personal finance software cover retirement planning, not of all them do and those that do, often don’t give it much importance compared to budgeting and investment tracking.

Table of Contents

Retirement Software vs Retirement Calculators

Many people start off retirement planning by asking the question “how much income can I afford in retirement?” and retirement calculators can often give misleading picture.

Using retirement planning software is much better than using a simple retirement calculator as they also factor in taxes and can simulate other life or world events that could impact your pension.

Retirement calculators usually fail to do this and do not give an accurate forecast of what you can expect to retire on although some use more advanced methods such as Monte Carlo simulations to factor in more variables than a standard calculator.

Retirement Software For Mac

We found that there are very few desktop retirement software planners for Mac as increasingly, many are moving online.

Many Windows users use Quicken for retirement planning but Quicken For Mac is not exactly the same as the Windows version and does not include retirement planning features.

We’ve therefore looked at the best retirement planning software both online and for Mac desktops to make sure you get the most out of your pension and maximize your retirement nest egg.

All of the retirement software reviewed here work on the latest versions of macOS including Sonoma and Apple Silicon Macs.

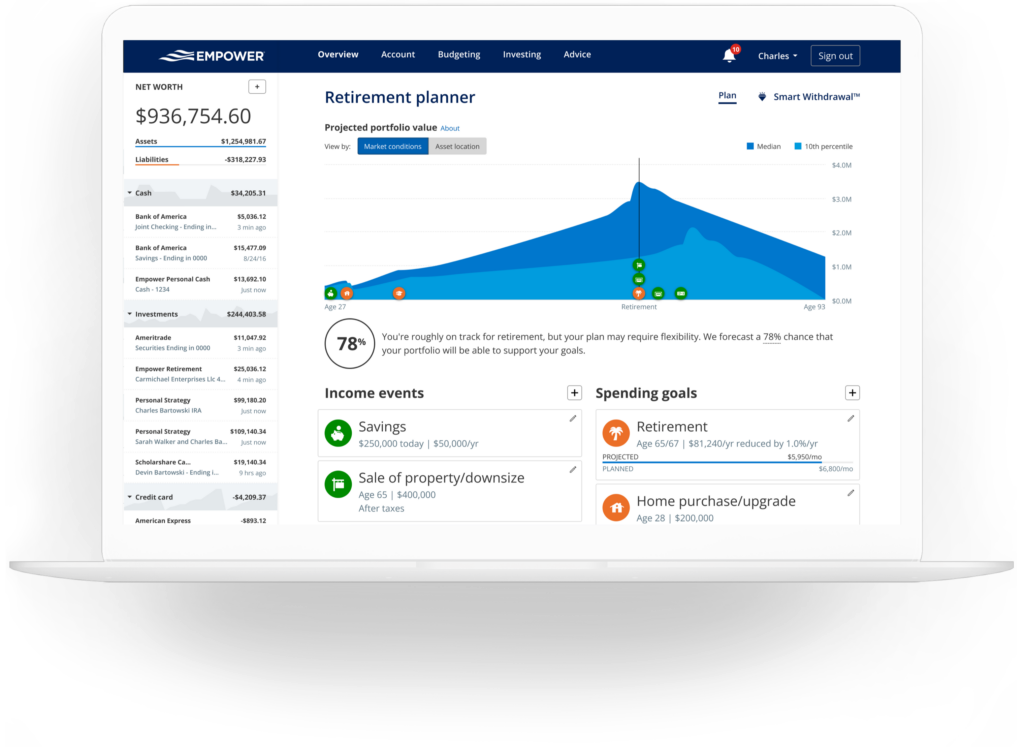

In our research, we found by far the best retirement planning software for Mac is Empower which is not only FREE, but offers a Mac desktop app and some of the most easy to use and powerful retirement planning tools on the market.

Here then are the best retirement software for Mac of 2024 in order of ranking.

1. Empower (Best Overall)

The Empower Retirement Planner is not only FREE To USE but the best retirement planning software on the market due to it’s incredibly easy to use and powerful retirement simulation tools.

It was previously known as Personal Capital which has long been the best personal finance software we’ve seen and the retirement planning tools are one of the reasons it’s such an effective financial planning tool.

Empower Retirement acquired it in August 2020 but it wasn’t until February 2023 that Personal Capital was rebranded as Empower although nothing has changed in the product itself.

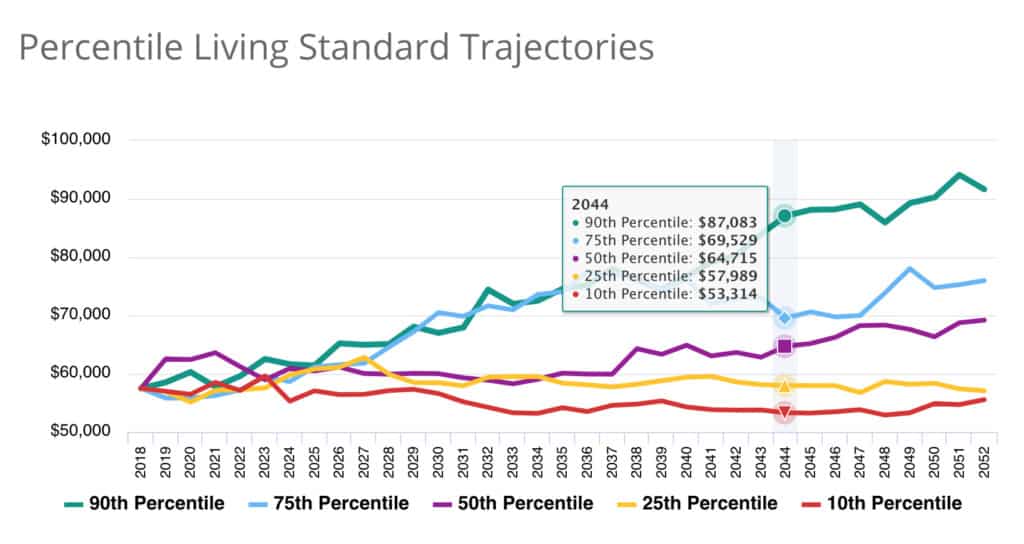

Some of the best features of Empower’s retirement planning tools include:

- Simulation of market crashes and worst case scenarios

- Major life events and unexpected expense impact planning

- Spending estimates to reach your retirement pot target

The Recession Simulator in Empower allows you to see how events like the Financial Crisis of 2008 would impact your retirement savings allowing you to factor in flexibility if the worst should happen.

Empower gives you an easy to digest and realistic overview of your retirement with plenty of scope for factoring in almost any scenario.

You can also get a strategic planning meeting with an Empower advisor about your pension, without even being an Empower customer.

You can sign up for Empower for free to see how it can help you plan your retirement.

If you want to read more you can also check out our full Empower review.

Pricing: Free

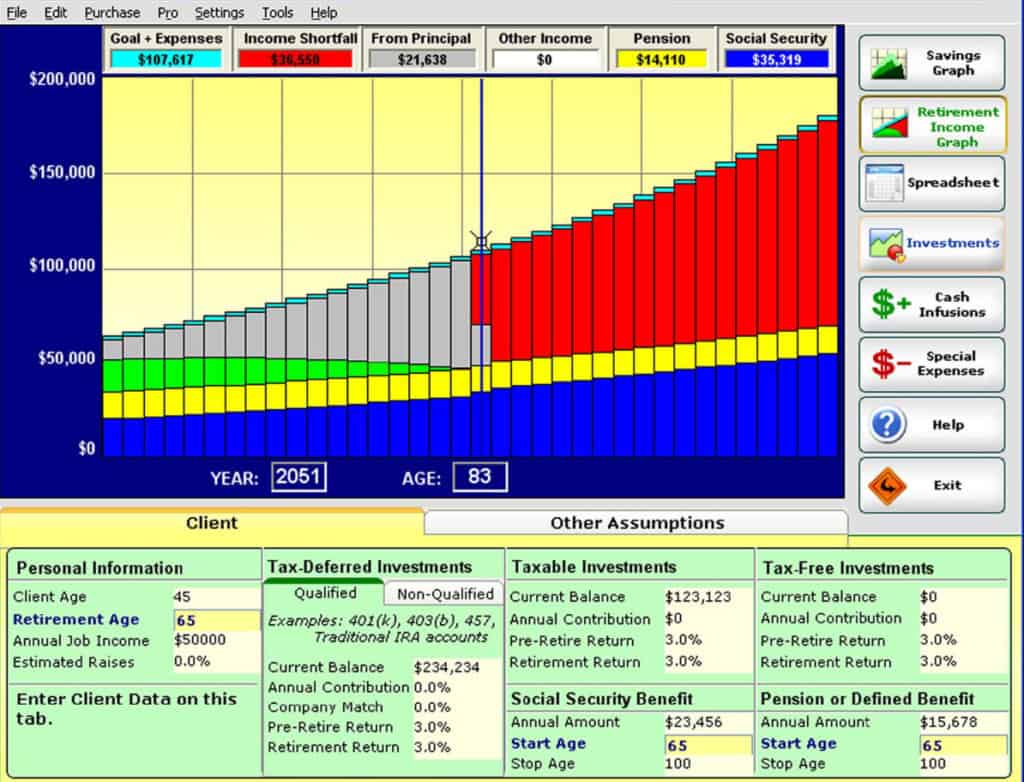

2. RetirementView

RetirementView has been around for Mac and Windows since 1993 although it hasn’t changed much over the past 30 years and it’s looking a bit dated nowadays.

However, RetirementView remains one of the only desktop retirement planning software for Mac users and is very easy to use.

It takes into account income from Social Security, Pensions, Defined Benefits, other cash infusions, special expenses and unlimited Investments including tax-deferred, tax-free and taxable.

The main advantage of RetirementView is that it accounts for taxes which free web calculators often do not or for life events that can significantly affect your retirement funds.

Pricing: RetirementView costs $197 for a new license with a Couples Edition available for $297. For couples that want to enter data separately, you need the Professional Edition for $899. There’s no free trial of RetirementView.

Pricing: Licenses starting from $197.

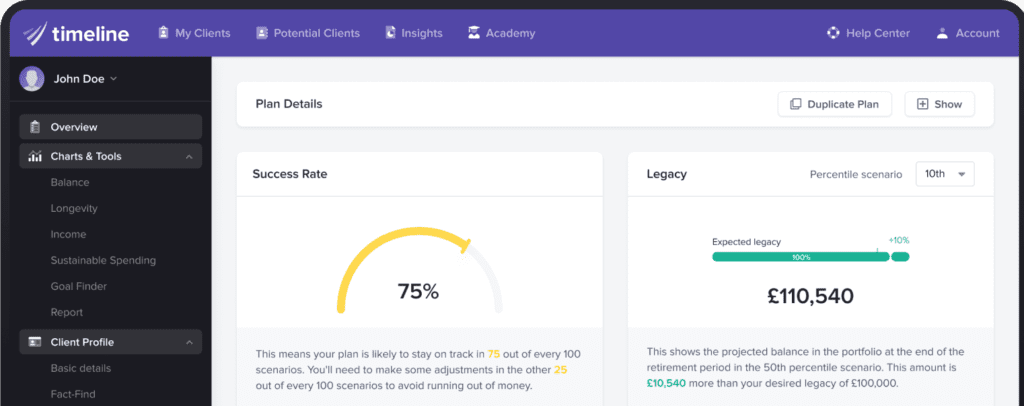

3. Timeline (Best For UK Advisors)

Timeline is an innovative UK based robo-adviser retirement planning platform which is aimed at financial advisors in the UK that need retirement planning software to advise clients.

It provides very clear predictions and modelling of retirement funds based on as many different scenarios as you can throw at it.

Moreover it is designed to replace expensive investment research, financial planning software, risk profiling and fact finding which it claims can save you or your retirement planning advisory business thousands of pounds.

Only financial advisors can sign-up for Timeline so you can’t sign-up for it as an individuals and you must be based in the UK.

Financial advisors can use Timeline for free for up to 3 clients but beyond that you must start paying the monthly subscription fee of £99/month.

Pricing: £99/month

4. The Complete Retirement Planner

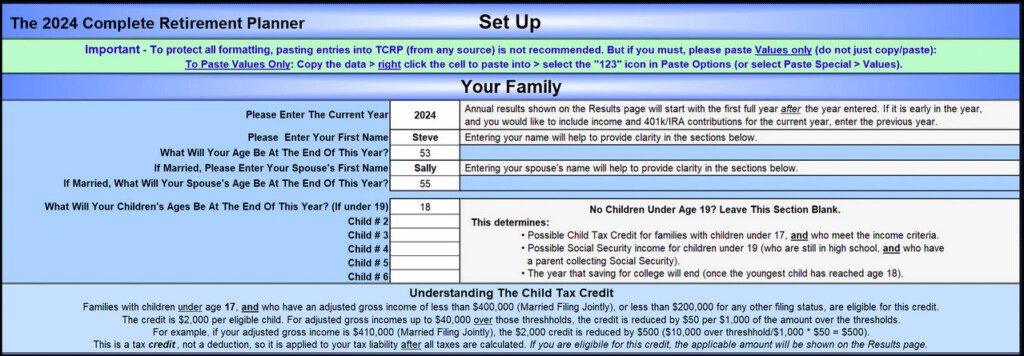

The Complete Retirement Planner or TCRP 2024 is a comprehensive retirement spreadsheet based planning software that offer highly personalized retirement summaries.

TCRP is continually updated with the most current US tax laws, retirement account contribution limits, Medicare costs and I.R.S. divisors for Required Minimum Distributions (RMD’s) so you get a very realistic overview of your retirement funds.

It can be tailored to individual needs with Individualized planning features that give a year-by-year roadmap of what to expect from your retirement planning.

The strongest aspects of TCRP is that it relies on your own specific data and not general assumptions that retirement planning apps often make.

However, it also includes options for “what if?” scenarios, major life events and unexpected costs to give a margin of flexibility.

TCRP supports multiple income sources, traditional and Roth 401k/IRA contributions and investment return rates, employer contributions and HSA contributions by spouse and year.

Social Security income, HSA balances and distributions, non-retirement and retirement savings

balances and distributions, Federal tax deductions and Federal/State tax liability are also calculated for each year.

One of the advantages of TCRP is that all of these can be entered by spouse – you don’t have to enter joint information so it’s easier to see how your individual situation is affected.

At the end of the calculations, TCRP gives you a very accurate idea of how long your savings will last during retirement.

TCRP stores all of your data offline but it does require Microsoft Excel 2013 or later to work as it uses Excel to compile your results.

It does not work with iPads, free online versions of Excel, Apple Numbers, Google Sheets or any other spreadsheet software.

Pricing: $89.99

5. RetireEasy (Best For UK Households)

RetireEasy has been around since 2011 and is the United Kingdom’s only independent retirement planning tool that’s approved by the IFA.

RetireEasy uses a complex retirement planning calculator called LifePlan to give you an overview of all of your assets – including investments, pensions, savings, business assets and properties.

It can then calculate all the income you will receive after liabilities such as debts, mortgages and income tax.

The Premium LifePlan version allow you to model a Lifetime Mortgage, compare up to 10 different “what if?” scenarios and also reduce your life insurance costs through a Life Assurance Premium Checker.

Pricing: Starts at £2.99/month. No free trial.

6. MaxiFi Planner (Best For US Advisors)

MaxiFi Planner is designed to help you not just estimate your retirement funds but also maintain and raise how much you have to retire on.

Instead of asking you to tell the program how much you need to live on, MaxiFi discovers and reveals to you how much is available.

It also offers all round financial planning but puts a strong focus on retirement planning and can be used both by households or financial advisors to plan retirement savings.

MaxiFi doesn’t rely on “guesstimates” or formulas to calculate your retirement but uses it’s own powerful algorithm to take into account many different factors.

It can help stretch your retirement income further via inflation-protected annuities. This enables you to see the effects of annuitizing all or part of your retirement accounts.

In addition, MaxiFi Planner can also run “what if?” situations to take into account worst and best case scenarios.

Pricing: $89/year for households or $599/year for advisors. No free trial.