If you’re a fan of old school spreadsheet budgeting and investment tracking, we think Tiller is one of the best personal finance tools out there.

In this review, we look at how it helps you plan your budget using either Microsoft Excel or Google Sheets.

If you love spreadsheets in Excel and Google Sheets, then you’ll probably love Tiller.

If you don’t, then we’d advise looking at some other personal finance software with a less spreadsheet-style approach to financial management.

Tiller is a personal finance software that aims to simplify and automate your financial tracking and budgeting with spreadsheets.

It is the only automated spreadsheet financial planning software based on Microsoft Excel and Google Sheets.

Tiller is designed to help individuals and households gain better control over their finances by providing tools for budgeting, expense tracking, and financial analysis.

Even for those that hate spreadsheets, Tiller is still remarkably easy to use as it automatically imports huge amounts of financial data and then presents it in an easy to digest and understand way.

Here we take a closer look at Tiller and highlight some of the things we liked and disliked about it.

Tiller Background

The man behind Tiller is Peter Polson who’s most well known for being the founder of Junxion Inc which later became acquired by Sierra Wireless.

He later went onto be CEO of Dashwire where he developed cloud services for mobile carriers.

The inspiration for Tiller however came back in 1994 when Polson was working on Microsoft Money (note that there’s no Mac version of that although there are some excellent Microsoft Money for Mac alternatives).

So what’s Tiller actually like to use?

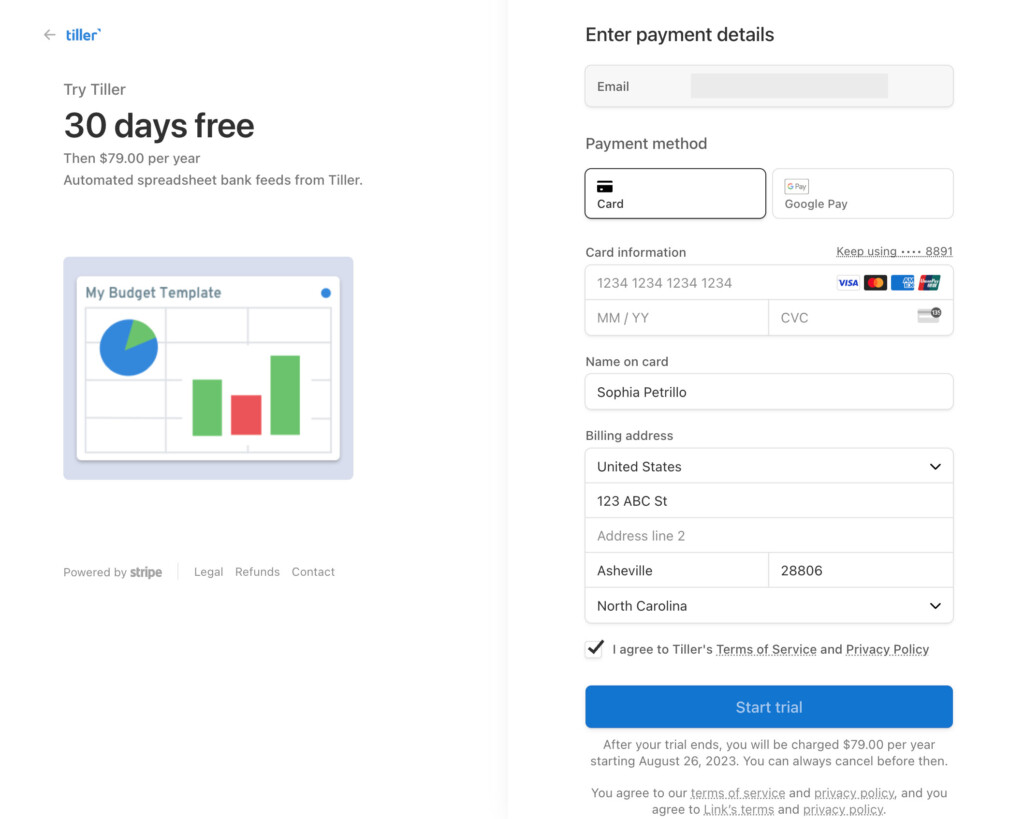

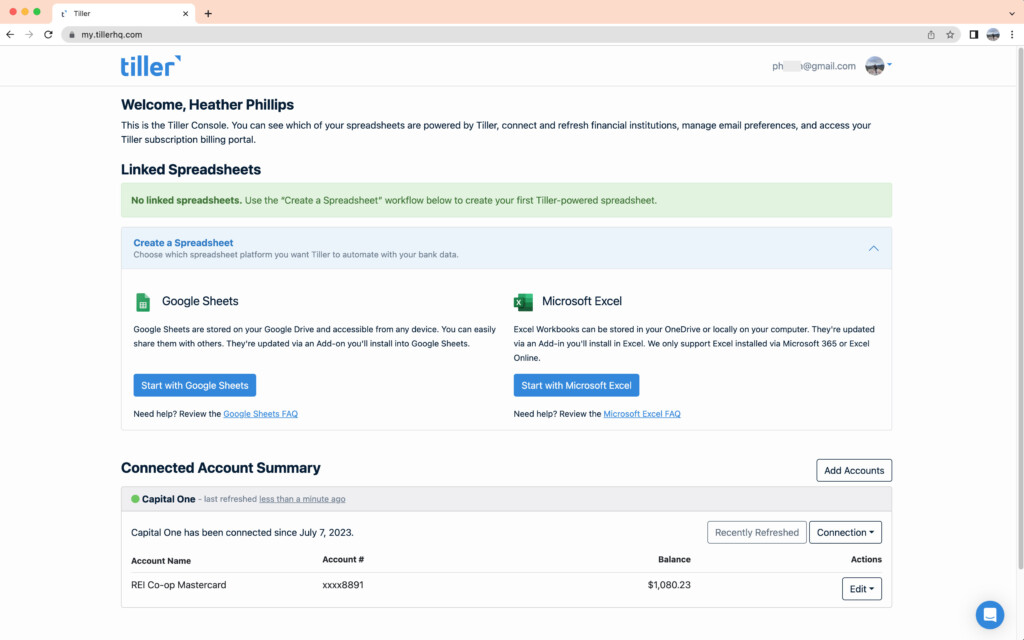

To get started with Tiller you need to start a 30 day free trial. You have to provide credit card details to do this but you will not be charged if you cancel within the 30 days.

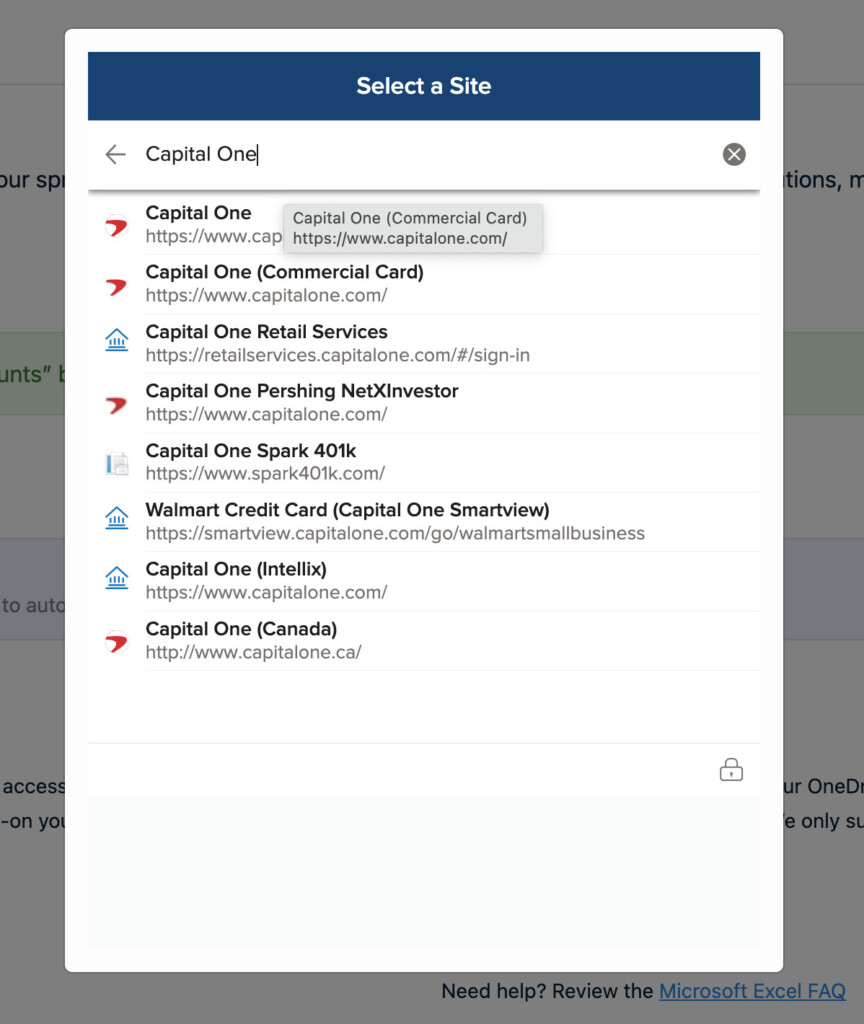

You then need to connect your bank or checking accounts to Tiller with the Tiller Money Feeds feature.

You can search Tiller for your bank in order to start establishing a connection.

Tiller uses Yodlee to connect to your bank account which is one of the most popular, secure and reliable methods of connecting personal finance software to financial institutions.

The fact that Tiller uses Yodlee is a big plus in our opinion due to an increasing number of banking institutions dropping support for Direct Connect.

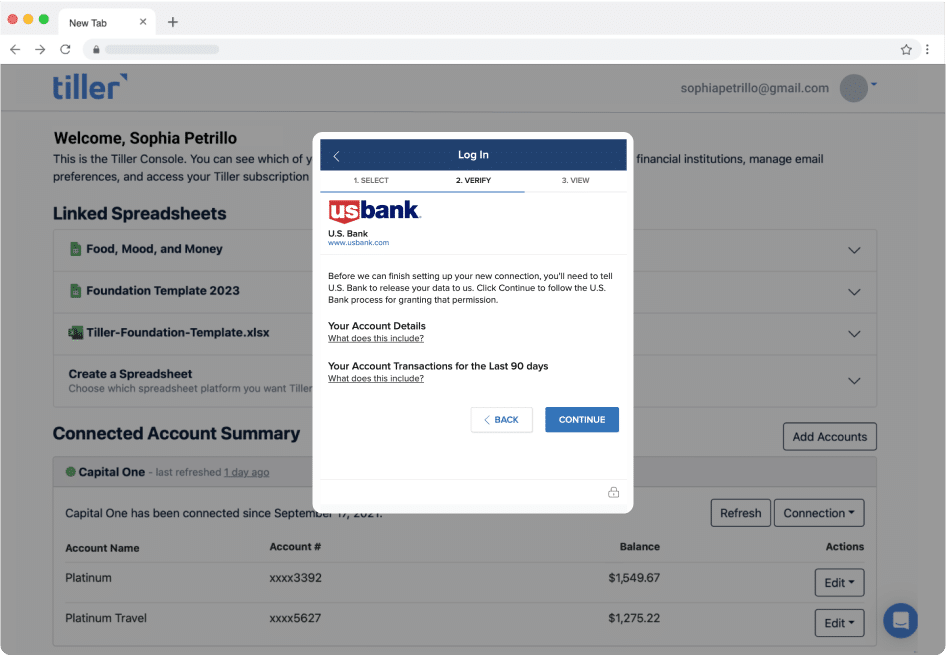

To connect your bank account to Tiller, you will be taken to your bank from Tiller to authorize it to retrieve data by entering your bank login details.

Tiller supports over 21,000 major US banks including Bank of America and U.S Bank so most users will be able to connect their accounts to it.

Tiller also connects to credit cards, brokerage and other financial services.

Once connected, you then need to choose whether to use Excel or Google Docs to import your data.

According to Tiller, Microsoft has even recommended Tiller to users of Money in Excel and subscribers of Microsoft 365 as a way of tracking financial data entered into Microsoft Excel.

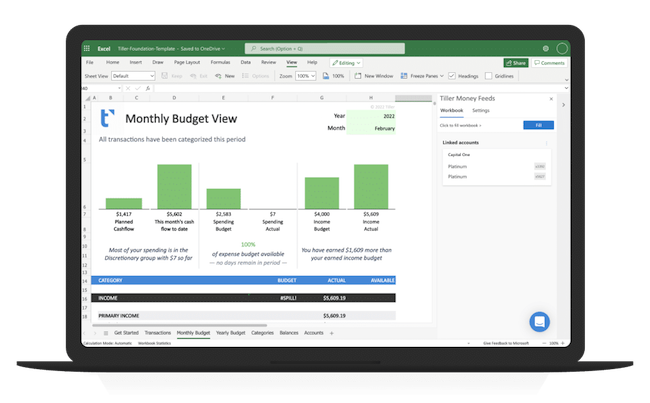

Once you’ve selected either Excel or Google Sheets, Tiller will open with the Foundation Template which is the default template for each platform.

There are also many other templates, many of them user generated on the Tiller Community Solutions add-on.

These templates which range from Envelope Budgeting, Savings Budget and Net Worth Tracking are great for all those that hate setting up formulas and macros in spreadsheets such as Excel as the templates do all the hard work for you.

You can of course also use your own spreadsheet template if you have one and you can create up to a maximum of 5 spreadsheets in total.

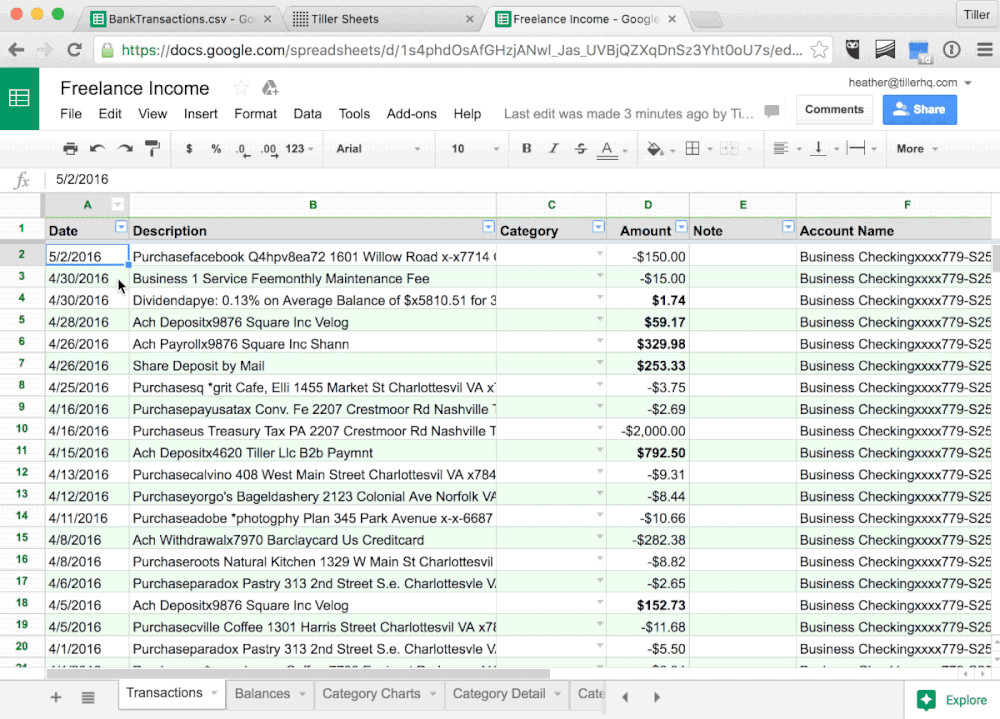

Once you’ve chosen your templates, Tiller will then import data from your bank into the spreadsheet.

Tiller might seem a bit intimidating at first but it’s actually very easy to get started. We recommend taking the Tiller Tour first but you can also feel your way round quite easily.

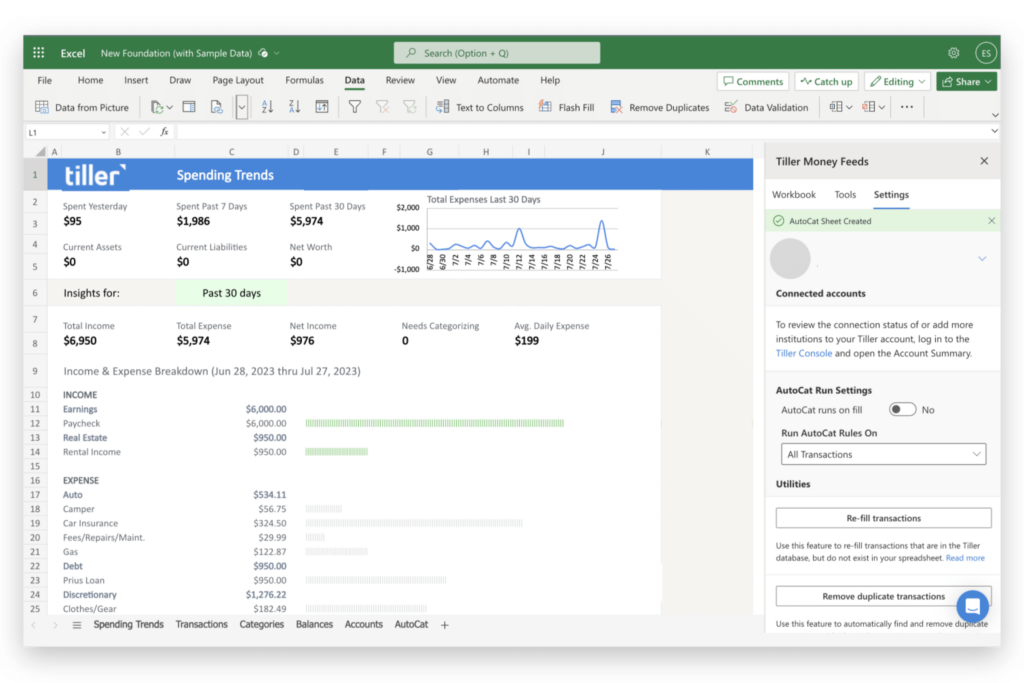

The Foundation Spreadsheet is divided into tabs such as Spending Trends, Transactions, Monthly Budget, Annual Budget and more.

Your banking transactions will be visible in the Transactions tab.

You can change the name of the categories if you want and also add extra tabs such as Net Worth Tracking, Business Reporting and Debt Progress.

The impressive thing is that Tiller generates reports and charts much like any other personal finance software such as Quicken for Mac (you can also import Quicken data in CSV format into Tiller too).

For example, if you import data into Microsoft Excel, you can view a Spending Trends dashboard in the Tiller Foundation Template.

There is no investment tracking although as mentioned earlier, there are templates provided by the Tiller community for tracking Net Worth.

In brief, these are some of the things we really liked about Tiller.

- Automated Transaction Tracking

Tiller connects to your bank and credit card accounts to automatically import your financial transactions. This saves you the time and effort of manually entering each expense although it’s the bare minimum you’d expect in any personal finance software worth its salt nowadays.

- Customizable Budgeting

Tiller allows you to create and customize your budget categories, making it easy to tailor your budget to your unique financial situation. You can set spending limits for different categories and track your progress over time.

- Microsoft Excel and Google Sheets Integration

One of Tiller’s unique features is its integration with Microsoft Excel and Google Sheets. Your financial data is imported directly into an Excel or Google Sheets spreadsheet, giving you full control over how you analyze and visualize your finances.

- Financial Reporting

Tiller provides various financial reports and graphs, helping you gain insights into your spending habits, savings, and investment performance.

- Debt Payoff Tracking

Tiller can help you track your progress in paying off debts, such as credit cards or loans, by providing tools to monitor your debt balances and interest rates.

- Collaborative Budgeting

If you share your finances with a partner or family member, Tiller supports collaborative budgeting in Google Sheets, allowing multiple users to work on the same spreadsheet simultaneously.

However, it’s not all good. There are a number of drawbacks to Tiller.

- Spreadsheet Based: There’s no getting away from the fact that Tiller is a spreadsheet application and if you hate spreadsheets, you’ll probably hate Tiller. Tiller does present spreadsheet data in a really attractive and digestible way but at the end of the day, it is still a spreadsheet application.

- Learning Curve: Compared to most personal finance software, there’s a lot of tinkering and configuring of spreadsheets with Tiller. The templates make things easier but there’s still a lot of manual work needed although once it’s set up, it’s all automated with little else to do.

- No Investment Tracking: Tiller is mainly for budgeting and so there’s no investment tracking features. However, there are plenty of other investment tracking software for Mac the best being Empower.

- Subscription Only: Like many personal finance software nowadays, Tiller charges a subscription fee for its services. There’s no standalone version or one off payment option.

- No Desktop App: Tiller only works via your Mac’s web browser as there’s no desktop app for macOS or Windows. Tiller actually recommends Apple’s Safari as the best browser to use Tiller in which is a bonus for Mac users. There are however mobile apps for iOS and Android.

Tiller Pricing

Tiller currently costs $6.58/month or $79 per year if you pay up front. Students can also get Tiller free for a whole year with the Tiller Student Plan.

Tiller doesn’t try and up-sell you services or products, serve ads, lock you into any contracts or sneak-in any added extra costs.

There’s a 60 day money back guarantee if you’re not happy with your subscription during that period.

Tiller also allows you to try it free for 30 days although you will need to use a credit card.

Tiller Support

Tiller offers phone support 6 AM – 3 PM (PST), Monday to Friday. You can also contact then via email at support@tillerhq.com.

Alternatives To Tiller

If it’s a desktop budgeting app for your Mac that you want then YNAB may be a better option than Tiller. There’s also no spreadsheets to deal with in YNAB.

If you want a free alternative to Tiller, then Mint.com may be for you. Mint.com is from the makers of Quicken but is a lighter version with a focus on budgeting.

For a full roundup of alternatives to Tiller, check out our guide to the best personal finance software for Mac.