We ranked Empower the best personal finance software for Mac of 2024 and in this review, we take a closer look at this powerful financial management software works.

Empower (previously known as Personal Capital) is not only an amazing personal finance tool but it’s also the best investment tracking software and retirement planning software we’ve seen on Macs.

It’s also the perfect replacement for Microsoft Money on Mac which is not available on macOS.

And if you’re one of the many Mac users that was turned-off by the subscription model introduced in Quicken for Mac, we think Empower is the best Quicken for Mac alternative out there.

But the biggest reason we like Empower so much is that not only does it help you get a hold on both daily finances and investments but it’s actually FREE to use.

Not only this, but it even offers a free financial consultation with a financial advisor which most personal finance apps do not.

Table of Contents

What’s The Catch?

How can a serious personal finance software be completely free? Well Empower isn’t just a budgeting app.

It’s aimed primarily at those with investments or pensions and offers some surprisingly good – but optional – wealth optimization tools.

These “robo-advisor” tools both identify areas where you may be being ripped-off in fees and make recommendations how to re-balance your portfolio for better yields.

If you’re a DIY investor, you can simply take the results and recommendations that Empower gives you and manage your investments yourself for free.

However, if you have a significant funds to invest, it also gives you the option of using one of Empower’s Financial Advisors to get a FREE financial consultation for more personalized investment advice (read more on how this works here).

This is where Empower makes its money but you only get charged a commission on the value of your investment portfolio if you choose this option.

The good thing is that Empower’s Financial Advisors are fiduciaries which means that they are legally bound to act in your interests and not the financial instruments or funds they are recommending.

If you do choose to contract a Financial Advisor, bear in mind you need a minimum of $100,000 in assets.

Fees for using an Empower Financial Advisor range between 49 bps (basis points) and go up to 89 bps of your overall portfolio profits although this is on a sliding scale to the more you invest.

Obviously, Empower does encourage you to use one of its Financial Advisors but there’s no hard sell if you don’t want to.

You can also have a personal consultation without even being an Empower user if you prefer.

This “freemium” style formula has proved incredibly successful and Empower estimates it now has around 19 million customers managing over $1.7 trillion in assets.

Getting Started With Empower

If you’re confused over why Personal Capital is now Empower, then it’s due to Empower’s takeover of Personal Capital in August 2020.

It wasn’t until February 2023 that Personal Capital was finally rebranded as Empower although nothing has changed in the product itself.

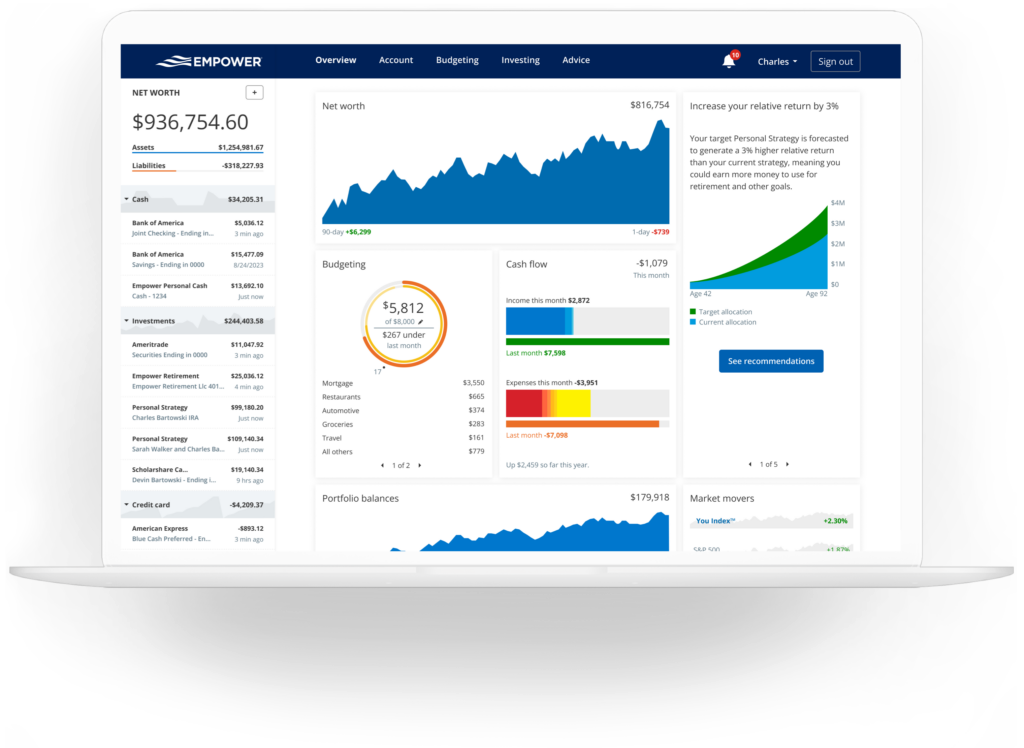

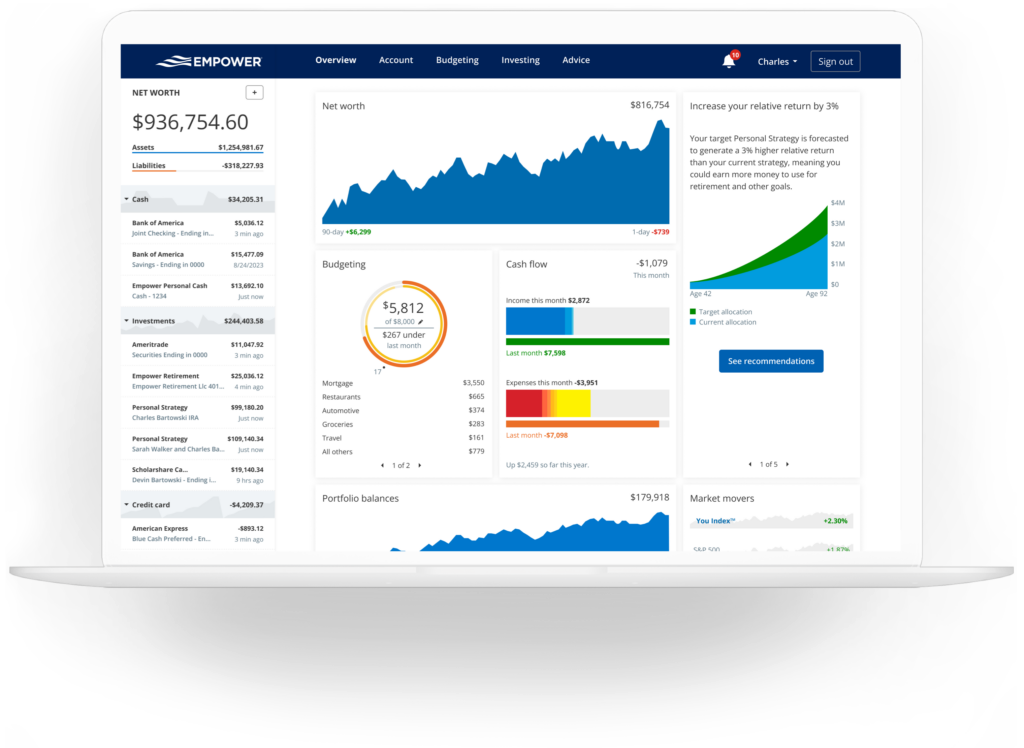

The good thing is that the interface hasn’t changed and Empower looks great in a browser on any Mac.

Since it’s Cloud based there’s nothing to install and yet the interface of Empower feels like something designed for macOS.

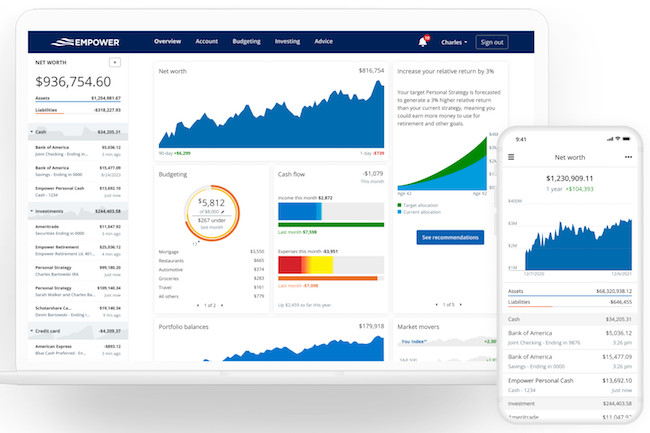

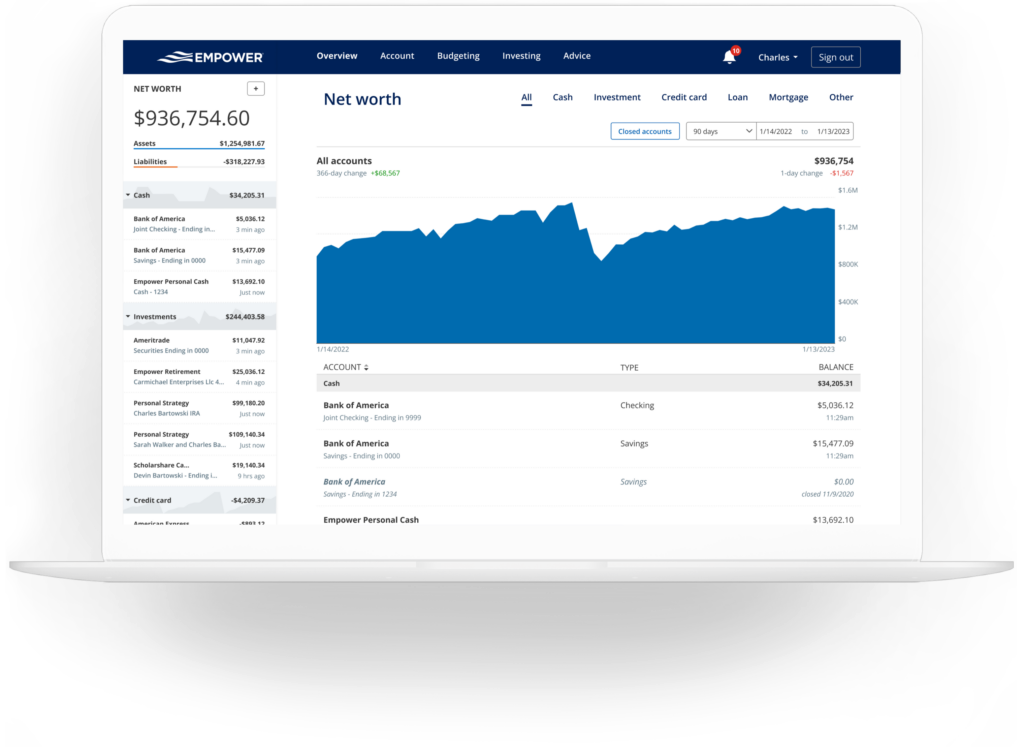

Right from that start, the Empower dashboard impresses thanks to a slick user interface, ease of use and ability to quickly get an overview of your finances.

If you’ve ever used Mint.com, then you’ll already have some idea of how Empower approaches budgeting compared to Quicken. However, Empower has considerably more powerful investment optimization options than Mint.

The free app is built around three main pillars:

- Knowing Your Net Worth

- Analyzing & Optimizing Investments

- Planning For The Future

We’ll now look at these tools in more detail.

1. Knowing Your Net Worth

Everything in Empower starts with the Dashboard which does a very good job of displaying your net worth.

Empower is a type of financial accounts aggregator and you can automatically import all of your accounts including everything from IRA accounts to mortgages and loans by connecting with your investment institution or bank.

This is something that Empower does particularly smoothly with far fewer sync problems compared to Quicken for Mac with around 14,000 institutions supported.

In full, the Empower dashboard shows you:

- Net Worth

- Cash Flow

- Portfolio Balances

- Portfolio Allocations

- Key Holdings

- Top Gainers and Losers

- Account Balances and Transactions

- Spending by Account, Category

- Income Reports

- Spending Reports and Upcoming Bills

- Investment Returns

- Projected Investment Fees

The information is presented very clearly and helps make some surprising discoveries about how much your net worth is and where your major liabilities or debts are.

Some of things we like most are the ability to create and follow budgets, clearly see your cash flow and see detailed income spending by category. You can even link your spending targets to an Apple Watch app which will alert you when you’re about to go over your limits.

2. Analyzing & Optimizing Investments

One of the biggest advantages that Empower has over traditional budgeting tools like Quicken is its investment analysis and optimization features.

Empower does this via a general investment health checkup and by analyzing fees and charges on your investments.

The Investment Analyzer is probably one of the key features behind the success of Empower as it’s a very quick, effective, powerful and free way to maximize your investments.

The two main tools to achieve this are the Fee Analyzer and Investment Checkup Tool which we’ll look at more closely.

- Fee Analyzer

One thing that Empower can help you identify right away is where fund brokers are charging hidden management fees.

If you’ve got several funds, these fees can add up surprisingly quickly and are often hard to identify as they use names such as custodial fees, inactivity fees or 12b-1 fees. These can actually run into thousands if not hundreds of thousands of dollars for very large investments.

Empower uses a nifty Fee Analyzer to identify these fees and graphically displays how much you’re losing in mutual funds, investment accounts, 401k retirement funds etc.

This is particularly useful when analyzing pensions as it also projects what impact it will have on your final retirement fund depending when you plan to retire.

What we like is that Empower will even suggest how you can reduce such fees and make recommendations as to how to change your portfolio

- Investment Checkup

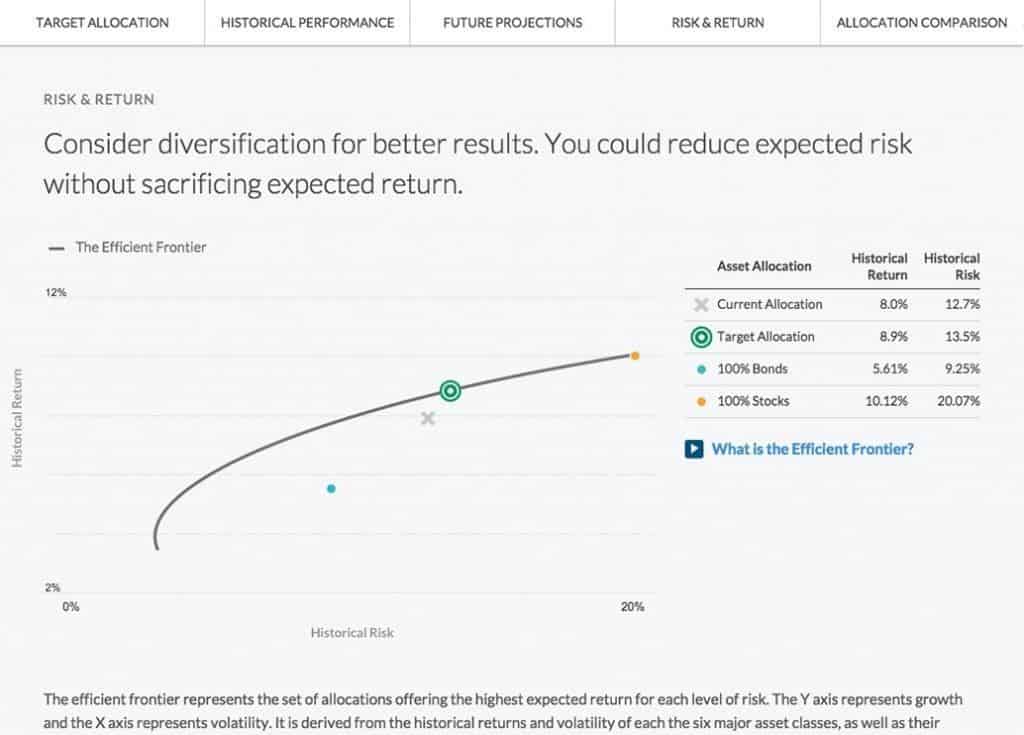

This is one of the quickest and easiest ways to identify where your investments are losing money but you can also do a more general analysis of how your investments are performing. The Investment Checkup tool analyzes your current holdings and suggest where you can make improvements.

One of the smartest components if this feature is the Risk Analysis tool which where possible, identifies investments where you can lower the risk but still get the same level of return.

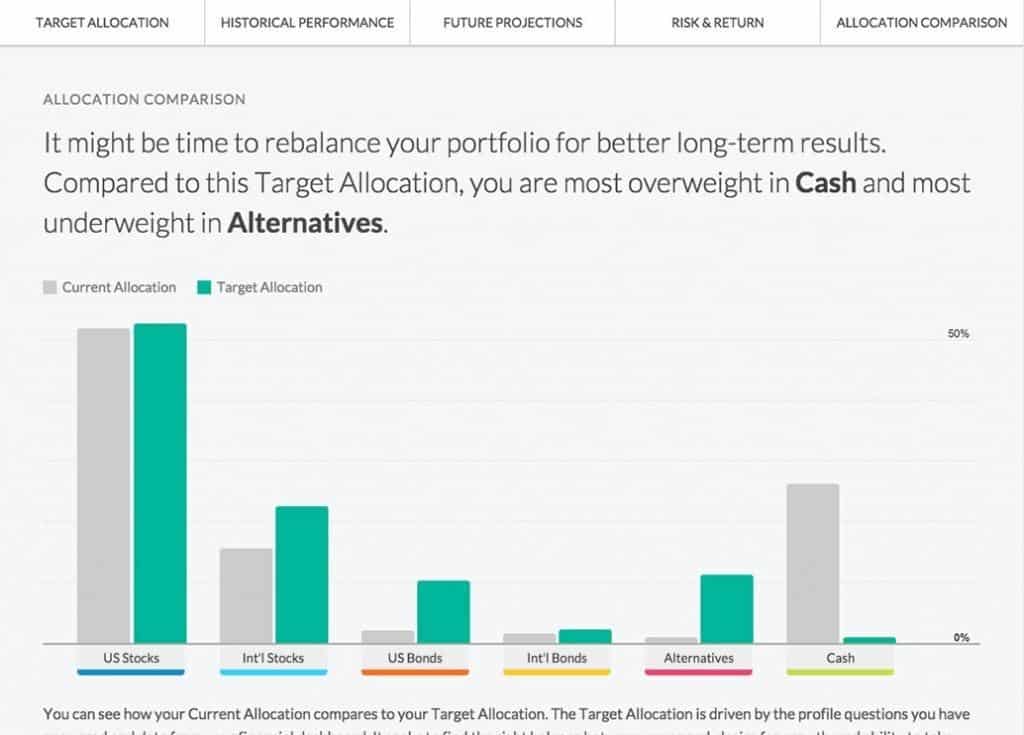

We also like the Allocation Comparison tab which helps to identify areas where you should re-balance your assets to capture the greatest possible returns.

This provides a Current and Target Allocation which Empower recommends you aim for. Quite often, this will recommend significantly reducing your cash holdings and putting them into stocks.

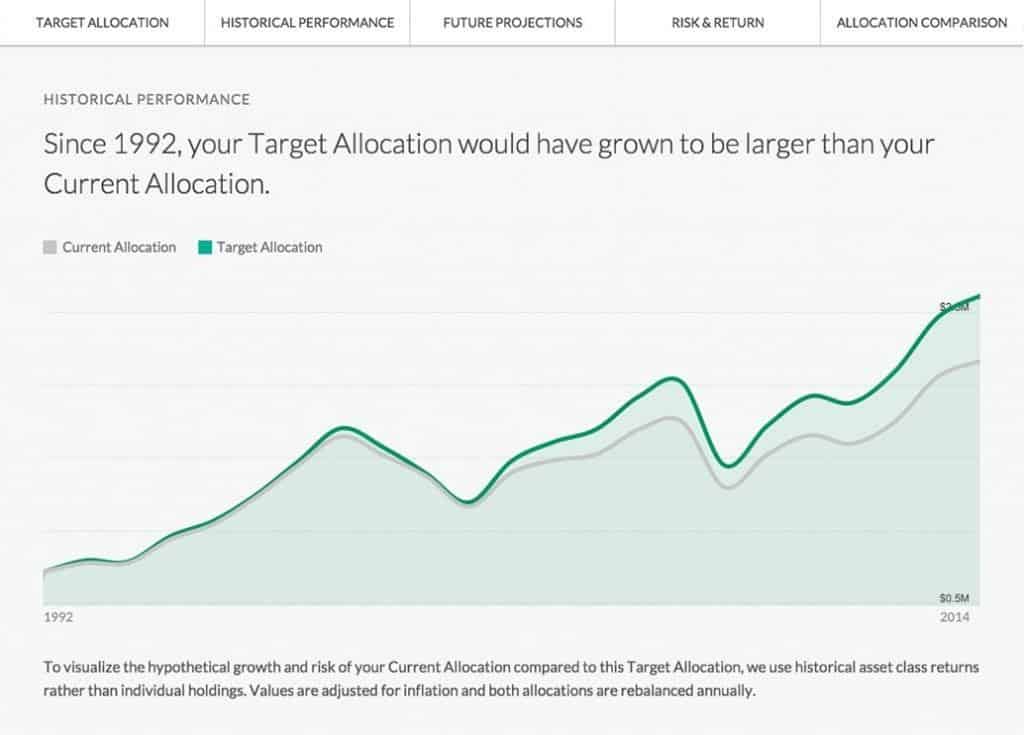

You can even see how your investments would have fared if you’d invested in the Target Allocation that Empower suggests:

Overall, the Investment Analyzer is one of the best features of Empower and genuinely helps you maximize your investments.

Most recently, the app also allows you to align your investments with your own ethical, environmental and social concerns for a more responsible portfolio.

3. Planning For The Future

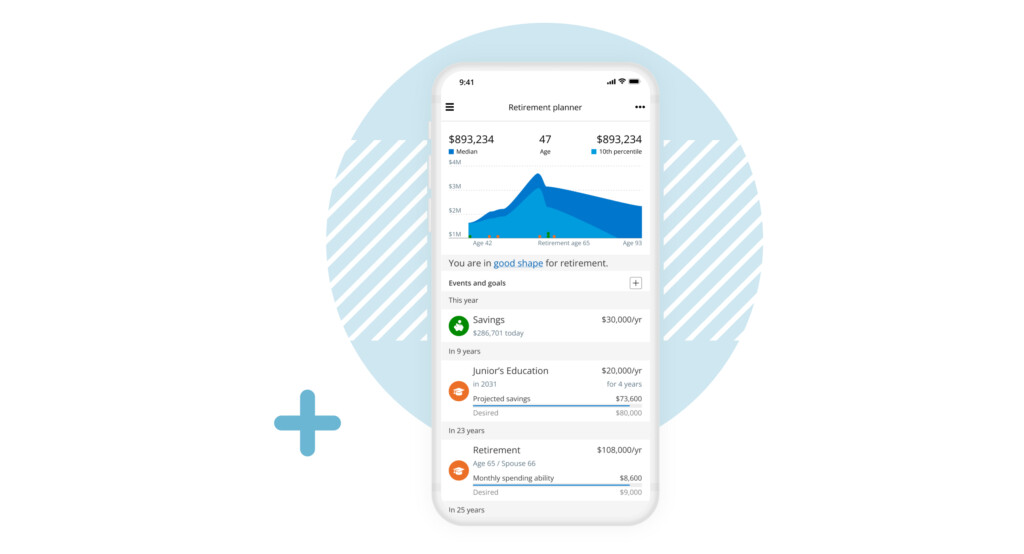

The planning tools in Empower are naturally based around retirement plans. The Retirement Planner shows you exactly how much you can expect to get in your pension based on your retirement age.

You can adjust the tool to select your desired income on retirement and the retirement planning tool will suggest what you need to do to your pension portfolio or 401k in order to reach that point.

We like the fact that the tool is dynamic so you can add events to it such as planning for college, getting married or other assets such as rental income, inheritances and other windfalls to see how they will directly affect your retirement income.

Empower Mobile App

Quite often personal finance mobile apps are a letdown either offering limited features or simply not working well. The Empower mobile app for iPad and iPhone offers pretty much all of the information you can see in the desktop version.

As mentioned earlier, there’s even an Apple Watch app to send alerts regarding account movements and to help keep you on track with your budget.

Can I Trust Empower?

Probably the biggest concern of using online financial applications like Empower is how safe is it to trust them with your financial log on details?

Empower is regulated by the Securities and Exchange Commission (SEC) so is subject to all the same security controls as any other finance house.

It also employs a range of security measures such as AES-256 Encryption, SSL Encryption, device registration and no one at Empower is actually allowed to access your data anyway.

More importantly, your financial credentials are never saved by Empower.

Instead it uses the highly secure Yodlee which is an encrypted platform used by many major financial applications to store and deliver customer financial data.

This adds an extra level of protection compared to Quicken which stores your banking log-on credentials on its own servers.

No one can ever say that a banking system is 100% bullet proof but the measures Empower take are above and beyond those of most.

What Are The Downsides To Empower?

No budgeting software is perfect and there are some drawbacks to Empower too.

One is that you can’t quite perform the same amount of micro analysis on spending like you can on Quicken. If you like to really drill down deep into transactions, it might not be for you.

Empower is certainly more skewed towards investment management than budgeting illustrated by the fact that you can’t change transaction dates.

This means that if you have a fixed payment such as a salary or pension that’s credited on the 1st of every month and it falls on a weekend or holiday, the transaction will appear in Empower as the last banking day before that.

As a result, Empower will show that you have a double payment in the same month which messes up your budget.

There’s also no denying that the investment features are aimed more at those with significant investment holdings although the budgeting tools are useful for rich and poor alike.

If you do have significant investment holdings, it’s well worth at least trying the Empower advisor service especially since they’re fiduciaries.

They will be able to optimize your investments especially when it comes to tax filing or harvesting and creating a custom investment plan based on your circumstances.

For those that have given up on Quicken for Mac or want a better personal finance application that genuinely increases your wealth, we strongly recommend giving Empower a go.

You can start using Empower for free so you don’t have much to lose anyway.