Although many of the best personal finance software for Macs are great at managing your money, they’re not so good when it comes to tax time.

We’ve therefore looked at the best tax filing software for Mac to help maximize your refund in 2025/26.

We’ve looked at both personal income tax preparation software and software for small businesses that need S-Corp filing alongside their accountancy software.

Remember that the US tax filing deadline is Wednesday 15th of April 2026.

Here then is our selection of the best tax preparation software for Macs with a summary first and then the reviews.

Table of Contents

Tax Software Comparison Table

| TurboTax | H&R Block | TaxAct | TaxSlayer Pro | Cash App Taxes | |

|---|---|---|---|---|---|

| Platform | Desktop & Online | Desktop & Online | Online only | Online only | Online only |

| Ease of Use | Excellent | Very Good | Good | Good | Good |

| Free Version | Yes | Yes | Yes | Yes | Yes |

| Live Support | Yes (add-on) | Yes | Yes (higher tiers) | No | No |

| Best For | Self-employed, complex returns | Simple to complex returns | Budget-conscious filers | Basic to moderate returns | Free filers |

| Mobile Access | Yes | Yes | Yes | Yes | Yes |

1. TurboTax

Intuit’s TurboTax is the most widely used tax preparation app out there and it offers a free Federal Free Edition for simple returns.

It also offers both a Mac desktop app for offline use and an online version.

Simply import your W-2, answer a few questions, and let TurboTax calculate your maximum refund.

It provides 350+ tax deductions, double-checks for accuracy, and guarantees 100% correct calculations.

The range of TurboTax products can be a bit confusing but can be summarized as follows:

Free Edition

- Federal: $0

- State: $0 (for simple Form 1040 returns: W‑2 only, student loan interest, EITC, CTC)

- Eligibility: Less than 37% of filers

Deluxe

- Federal: $89

- State: additional fee

- Ideal for homeowners and deduction seekers (350+ deductions, mortgage, charity)

Premium (Self‑Employed & Investors)

- Federal: $149

- State: additional

- Suitable for investors, rental income, freelance, crypto — includes crypto import and AI‑powered guidance

TurboTax Live & Full Service

These options are billed “start free/pay when you file,” with pricing tailored to your tax situation and complexity:

- Live Assisted

- Includes expert review and support during your DIY process

- Live Assisted Deluxe/Premium

- DIY + unlimited text/chat/phone support. Price depends on selected “Deluxe” or “Premium” versions

- Live Full Service

- A dedicated expert prepares and files your return.

- Availability: Jan 6 through filing season

- Includes audit support, expert matchmaking, and 100% accuracy guarantee

Business Tax Options

- Live Full Service Business

- For S‑Corps, partnerships, multi‑member LLCs

- Unlimited year-round expert support and audit protection included

- Note that the Business edition of TurboTax for filing S-Corp taxes is not available for Macs. However, there is an online version of the Business Edition which can be used for filing an S-Corp in any browser on a Mac.

Pricing Summary

| Product | Federal Price | Best For |

|---|---|---|

| Free Edition | $0 | Simple single‑form returns (W‑2, EITC, etc.) |

| Deluxe | $89 | Homeowners, itemized deductions |

| Premium (Self‑Employed) | $149 | Investors, freelance, crypto, rental income |

| Live Assisted | Varies* | DIY with expert review |

| Live Assisted Deluxe/Premium | Varies* | DIY + unlimited expert support |

| Live Full Service | Varies* | Full expert preparation & filing with audit protection |

| Live Full Service Business (only available online for Macs) | Varies* | Business owner returns, expert support & audit coverage |

*Final pricing depends on your tax complexity, chosen add‑ons, and filing time

Key Features of TurboTax for Mac:

- Easy-to-use interface with tools like “W-2 Snap & Autofill” and “SmartLook” live support.

- Audit Protection offers Risk Meter, Audit Support Guarantee, and optional full representation.

- Accuracy Protection: Intuit covers IRS fees if calculations are incorrect.

- Step-by-step guidance for filing.

- Live CPA assistance (available as an add-on across all versions).

- Supports W-2, 1099, Schedule C, and more.

- Automatic import of tax documents and integration with QuickBooks.

- Premium tier now includes expanded support for self-employed and investors, including crypto import and smart deduction tools

System Requirements Requires macOS Ventura 13 or later for the desktop version.

Summary: TurboTax remains our top choice for tax filing on Macs, especially for self-employed users. While its pricing system and removal of features from lower tiers is a bit confusing, its intuitive interface, accuracy guarantees, and excellent support make it worthwhile for most taxpayers.

You can start filing with TurboTax for free now.

You can also get 30% off TurboTax for Mac for a limited period.

2. H&R Block

H&R Block is one of the most widely used tax return platforms, alongside TurboTax. It’s also one of the few that offer both an online and Mac desktop version.

A unique feature of H&R Block is its network of physical offices across the US, where you can meet with tax specialists in person for assistance, saving you time and stress compared to phone support.

This makes H&R Block ideal for small business owners or anyone with complex tax situations, as you can receive in-person advice on your finances.

H&R Block Versions & Pricing

A little bit like with TurboTax, H&R Block pricing can be confusing but summarized as follows.

Desktop Versions

All desktop software editions include one federal e‑file; state e‑filing is an additional $19.95 per state (except NY):

| Edition | Included Features | Price (federal) |

|---|---|---|

| Basic | Simple tax returns; import W‑2, 1099, previous returns; real-time refund tracking | $39.95 |

| Deluxe + State | Everything in Basic + itemized deductions, mortgage, investment support; includes 1 state file | $39.95 |

| Premium | Adds Schedule D/E/K-1 support, investments, rental property, self-employed guidance; includes 1 state file | Bundled with state; typical desktop price same as others but see bundles |

| Premium & Business | Schedule C support, unlimited business returns, expense tracking; includes 1 state file | Bundled with state; desktop price similar |

Online Version (DIY + Expert Support)

From the online filing pages:

- Free Online – $0 federal, $0 state

- For simple Form 1040 returns (W‑2, child credits, student loan interest, etc.)

- Deluxe Online – $60 federal + $49 per state

- Ideal for homeowners, deductions, freelancers, HSAs

- Premium Online – $100 federal + $49 per state

- Best for investors, rental property owners, K‑1 filers

- Self‑Employed Online – $125 federal + $49 per state

- Includes support for self‑employed, small business, Schedule C forms

All online paid tiers (Deluxe, Premium, Self‑Employed) include unlimited AI Tax Assist and live expert help at no extra cost – a key benefit over other tax filing services.

| Edition | Best For | Federal + State |

|---|---|---|

| Free Online | Simple W‑2 return filers | $0 + $0 |

| Deluxe Online | Homeowners, itemizers, freelancers, HSAs | $60 + $49 per state |

| Premium Online | Investors, rental property, K‑1 returns | $100 + $49 per state |

| Self‑Employed Online | Freelancers, small business, Schedule C | $125 + $49 per state |

Key Features: of H&R Block

- Maximum Refund Guarantee: If you receive a larger refund or owe less with another tax prep product, H&R Block will refund your software purchase price. (Not the difference in refund.)

- 100% Accuracy Guarantee: If an H&R Block software error results in an IRS penalty or interest, they will reimburse you for those charges.

- Audit Support Guarantee: If you’re audited after filing with H&R Block software, they offer guidance on how to respond to the IRS. Full audit representation (where they handle the audit on your behalf) is only available with optional paid add-ons, not by default.

- Data Security & Encryption: All online filings are protected by multiple layers of encryption, secure sign-in, and optional two-factor authentication.

- W-2 Import via Mobile: You can snap a photo of your W-2 using the H&R Block mobile app, or search and import it directly from thousands of employers using the W-2 Finder tool.

While we think TurboTax has a more refined interface, H&R Block’s face-to-face support and overall service make it a good choice for those that prefer the options of speaking to someone face-to-face.

You can start filing for free with H&R Block here.

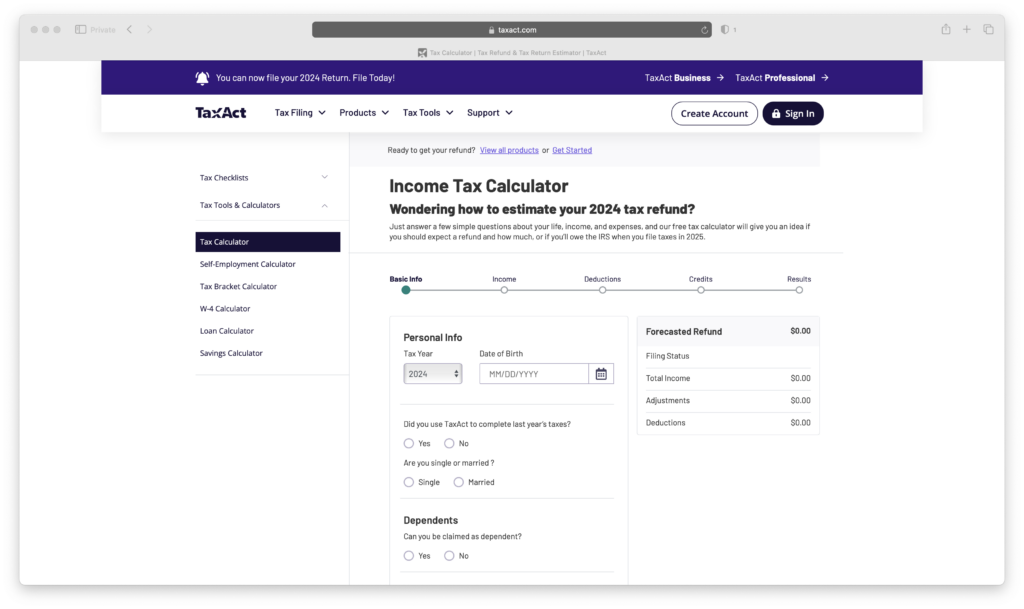

3. TaxAct

TaxAct is a well-known alternative to the major names in tax filing – TurboTax and H&R Block.

While it doesn’t have a dedicated Mac app, it offers an easy to use online platform that works in any browser on macOS.

TaxAct shares some similarities in design and workflow with TurboTax and H&R Block but is more affordable across most versions.

TaxAct Versions & Pricing

| Edition | Best For | Price (Federal) |

|---|---|---|

| Free | Simple returns (W‑2, student credits, unemployment) | $0 + State (~$39.99–$54.99) |

| Deluxe | Homeowners, HSA contributions, child care, deductions | $54.99 + State (~$64.99) |

| Premier | Investors, rental income, home sales, capital gains | $94.99 + State (~$64.99) |

| Self‑Employed | Freelancers, small business, Schedule C/F filers | $109.99 + State (~$64.99) |

Key Features of TaxAct:

- Affordable federal + state filing — all tiers include free federal filing; state fees vary ($39.99–$64.99)

- Online S‑Corp (1120S) business filing available via bundled or business tiers—works on Mac via browser

- Free phone, chat & email support included with all plans

- Deduction Maximizer and TaxAct Alerts help uncover every possible deduction/refund

- Maximum Refund & Accuracy Guarantees: Price Lock Guarantee: guarantees you’ll not pay more if prices increase during filing season. Max Refund Guarantee: refunds your software price if you get a better refund elsewhere. $100K Accuracy Guarantee: covers IRS penalties/interests if due to software errors.

- Import Capabilities: Supports importing W‑2s (photo or direct), 1099s, 1040 PDFs, K‑1s; though broker/institution support is limited to certain providers

Summary: TaxAct is a fast, efficient, and affordable tax filing service. It is particularly appealing to Mac users who need personal tax filing or S-Corp filing capabilities. While it may lack some of the polish and advanced features of its competitors, it remains a reliable and budget-friendly choice for tax preparation.

You can start filing for free now using TaxAct here.

4. TaxSlayer

TaxSlayer is an easy to use, no nonsense tax filing software that offers some of the most competitive prices on the tax prep market.

TaxSlayer is online only so there’s no Mac app but it has a simple, cost effective pricing model depending on your needs.

If you’re just filing a simple tax return, TaxSlayer is completely free including for both federal and state taxes or Form 1040 EZ.

TaxSlayer Versions & Pricing

| Edition | Best For | Federal Price |

|---|---|---|

| Simply Free | Basic returns (Form 1040, student credits, education) | $0 (+$0–$0 state; qualifies under income and filing conditions) |

| Classic | All tax situations (W‑2s, dependents, itemizing) | $42.95 (+ $47.95/state) |

| Premium | Includes live chat support and “Ask a Tax Pro” | $62.95 (+ $47.95/state) |

| Self‑Employed | Freelancers, contractors, 1099, side-gig business | $72.95 (+ $47.95/state) |

All paid tiers include unlimited phone, email support; Premium and Self‑Employed add live chat and tax professional access.

Key Features of Tax Slayer:

- Clean, intuitive interface – designed for ease of use across all tiers.

- Free federal (and sometimes state) filing for simple returns via Simply Free, with qualifying criteria.

- Military filing: Active-duty military can file federal returns for free using Classic (full service across tax situations).

- Fully featured Classic tier includes all IRS forms, schedules A–E, SE, etc., regardless of complexity.

- Live chat and “Ask a Tax Pro” available in Premium and Self‑Employed tiers.

- Maximum Refund Guarantee & 100% Accuracy Guarantee included with all editions.

- Price Lock Guarantee ensures you’re charged what you were quoted when you started filing.

- Import support: W‑2 uploads (photo or import), 1099s, prior year returns; limited broker/institution import.

- Security features: SSL encryption, secure login, support via SMS, and IRS inquiry assistance for Classic users.

You can start filing for free with TaxSlayer now..

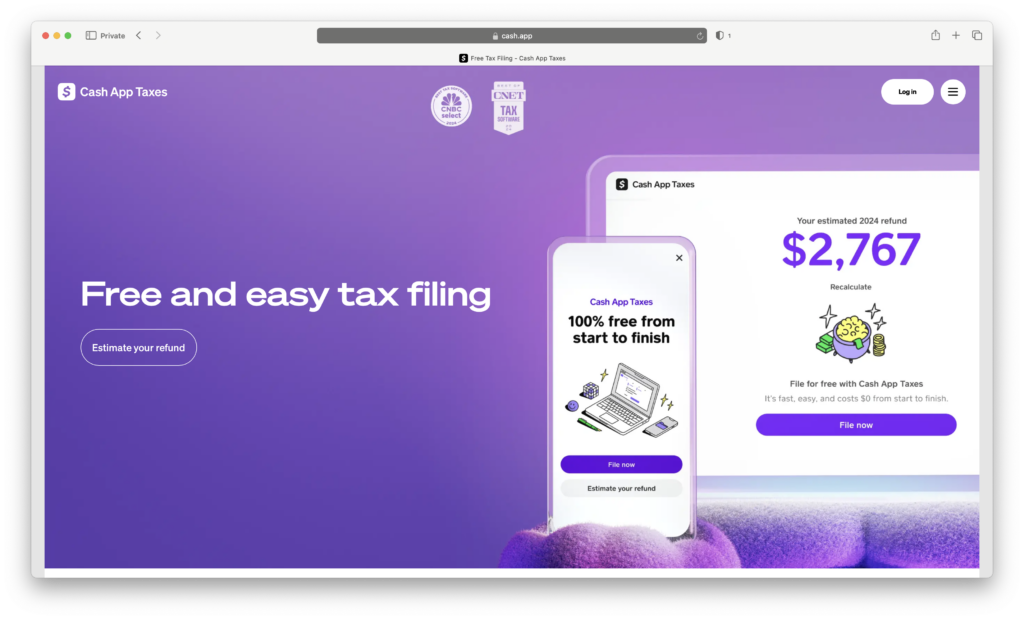

5. Cash App Taxes

Cash App Taxes (formerly Credit Karma Tax), is a free online tax preparation service that offers a straightforward alternative to platforms like TurboTax and H&R Block.

It offers a single version that is completely free for both federal and state tax filing.

There are no separate versions like those in TurboTax or H&R Block.

It supports various IRS forms and schedules, including Schedule C for small business owners, allowing users to file both simple and complex returns, including state returns.

Key Features of Cash App Taxes:

- Supports a wide range of forms, including Schedule C (for small businesses) Schedule E (for rental property income)

- Supports various 1099 forms

- No hidden fees or add-ons.

- Simple and straightforward interface for entering personal info, dependents, and tax data.

- View estimated refund before filing.

On the downside of Cash App Taxes:

- Limited import features: Can import basic W-2s, but no support for investment or interest data.

- No guidance to maximize deductions or tax savings.

- Minimal support if issues arise, unlike larger tax filing platforms.

Overall, Cash App Taxes is ideal for tax-savvy users who are comfortable with tax forms and deductions.

You can start filing with it now.

Business & S-Corp Taxes

Unfortunately, there is no Mac desktop tax software that supports small business or S‑Corp (Form 1120S) tax filing.

The desktop business editions of TurboTax and H&R Block do support S‑Corp and other business entity returns (1120S, 1120, 1065), but they are Windows-only. TurboTax has confirmed this in support threads, citing the relatively low demand among Mac users as the reason for the lack of a macOS version.

However, TurboTax does offer an online business version — TurboTax Live Full Service Business — that supports S‑Corp, partnership, and multi-member LLC returns. It works in any browser, including on a Mac. Note, however, that it is full-service only (an expert prepares and files your business return), and you can’t file it yourself like with the desktop software.

Another alternative is TaxAct’s Online Business 1120S Filing, which allows you to file S‑Corp taxes entirely online from any platform, including macOS. This version is DIY and costs $164.95 for federal filing (state filing is additional if required).

If you want to use a Windows based desktop S-Corp tax filing software then your best option is to run Windows on your Mac using a virtual machine.

Best Tax Filing Software For UK Based Mac Users

Standalone Self Assessment tax software options in the UK are far more limited compared to the United States.

Most of the best tax return tools for UK users are typically bundled within broader accounting software for Macs , rather than offered as dedicated standalone Self Assessment solutions.

The best options for UK tax filing on a Mac are:

- FreshBooks (UK version) is a popular accounting solution for small businesses and is Making Tax Digital (MTD) compliant, but it does not currently offer standalone Self Assessment filing. It’s more focused on invoicing, expenses, and VAT returns. FreshBooks is not HMRC-approved for Self Assessment filing but integrates with other services for tax compliance.

- QuickBooks (UK version) offers more advanced accounting features, including tax estimate tools and MTD VAT filing, but does not support direct Self Assessment submissions. It’s better suited to medium and larger businesses, and like FreshBooks, you may still need to export data into an HMRC-recognized tool for filing.

Dedicated UK Self Assessment Tools:

- GoSimpleTax:

- An HMRC-recognized online Self Assessment tool

- Lets you calculate your return for free; you only pay if you choose to file through it

- Pricing starts around £54.99/year

- Best for individuals, sole traders, landlords, and basic tax situations

- TaxCalc:

- Officially HMRC-recognized and widely used by accountants

- Supports more complex returns, including non-UK residency, trusts, foreign income, capital gains, and more

- Offers a Mac-compatible desktop version (Java-based)

- Pricing starts at around £32 for individuals (one tax year)

FAQ: Tax Filing Software

How to Choose a Tax Filing App

The three most important things to look for in any tax filing app are:

- Accuracy – Ensures calculations are correct and compliant with current IRS/state regulations

- Ease of Use – Walks you through the process in a simple, step-by-step format

- Maximization of Refunds – Helps identify all eligible credits and deductions

Bonus points if the software does all of this for free, but most apps only offer free filing for simple federal and sometimes state returns. More complex filings (e.g., self-employment, investments, rental property) often require a paid plan.

What Documents Do You Need Before You Start?

Having the right paperwork ready will make the filing process much faster and reduce the risk of mistakes or missing out on deductions.

Typical documents and information include:

- W‑2s and 1099s: For employment and contract income

- TurboTax and other platforms allow you to upload a photo or import W‑2s directly

- 1098‑E: For student loan interest

- 1098‑T: For college tuition payments

- 1098: For mortgage interest and property taxes

- Form 5498: For IRA contributions

- Medical expenses exceeding 7.5% of adjusted gross income (AGI)

- Receipts for deductible expenses (e.g., charitable donations, medical bills)

- Business records (for freelancers and self-employed):

- Income, expenses, mileage logs, asset purchases

- Rental property income and expenses

Make sure to have last year’s return on hand as well – it can help auto-fill some information or speed up e-filing with carryover data.

Which Credits, Refunds, and Deductions Are Supported?

Not all tax software supports every type of credit or deduction, so it’s important to check if your situation is covered, especially if you expect a large refund due to a major purchase or life event.

Key deductions and credits to look for:

- Charitable donations

- Medical expenses

- Student loan interest

- Childcare and dependent care (Form 2441)

- Electric vehicle tax credit (Form 8936)

- Education credits (American Opportunity and Lifetime Learning)

- Itemized deductions (Schedule A)

- Home mortgage interest & property taxes

- Self-employment deductions (Schedule C)

- Rental property expenses and depreciation (Schedule E)

💡 Tip: If you bought an electric vehicle or installed solar panels, make sure the software supports those credits – some tools don’t cover Form 5695 or Form 8936 in lower tiers.

Refund Options

Different tax apps offer different refund delivery methods. Common refund options include:

- Direct deposit to your checking or savings account

- Paper check

- Prepaid debit card

- Applied to next year’s taxes

- U.S. Savings Bonds (less common)

- Third-party advance refund loans (available with some paid services)

Not all platforms support every method, especially the more niche ones, so it’s worth checking before filing.

Accuracy and Audit Protection Guarantees

Accuracy guarantees are a key differentiator between free and paid tax filing apps.

Top providers like TurboTax and H&R Block offer:

- 100% Accuracy Guarantee:

They’ll cover any IRS penalties or interest caused by software miscalculations - Audit Assistance or Defense:

- Audit Support (basic): Guidance if you’re audited

- Audit Defense (premium): A tax pro will represent you and deal directly with the IRS on your behalf

TurboTax’s Audit Defense, for example, includes full-service handling of audit correspondence, meetings, and paperwork by a licensed tax professional.

H&R Block’s Peace of Mind plan offers similar services, though at an additional cost.

Important: No tax software can prevent an audit. These services only help you manage the process if one occurs.