Disclaimer: eToro is a multi-asset platform which offers both stocks and cryptoassets, as well as trading CFD assets. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail trader accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Important Note: If you’re based in the USA, please check our eToro USA review first as not all features of eToro are available in the US yet.

eToro is probably the most popular online stock trading platform for people curious about starting online trading in 2023.

With an easy to use Facebook style interface and simple CopyTrader and CopyPortfolio system, it’s easy to see why eToro is especially attractive to beginners.

eToro is also one of the best cryptocurrency currency platforms to trade on too, especially if you’re new to crypto.

But does it really live up to the hype?

Is it really as simple as automatically copying top traders?

We looked at the reality behind the headlines in our in-depth eToro review for 2023.

Note that if you’re interested in stock trading on Mac, you’ll also find our guide to top stock trading software on Mac useful too.

Table of Contents

- What is eToro?

- Is eToro Available In The USA?

- Is eToro a scam?

- What is eToro’s CopyTrader system?

- How does eToro make money itself?

- How to sign-up for an eToro demo account

- How to choose the best eToro traders to copy

- What are CopyPortfolios?

- What’s the downside?

- Don’t Trade With More Than You Can Afford To Lose

What is eToro?

Big time trading in stocks and shares has traditionally been the preserve of Wall Street traders but a combination of financial deregulation and the internet has brought stock market trading to the masses.

eToro has taken that one step further and made dealing in Forex, stocks and shares much easier.

It’s done this through an easy to use trading platform that even beginners to stock trading can use.

Imagine if you mixed Facebook with a stock trading platform and you get a pretty basic idea of what eToro is all about.

Although some other trading platforms have copied the eToro social trading model, eToro was the first to do it back in 2010.

eToro has in fact been in the trading business since 2006 when it was known as RetailFX. Although RetailFX started life as a Forex trading platform, it was eventually renamed eToro and now allows you to buy Forex, stocks and crypto currencies with a user base of approximately 5 million traders worldwide.

The reality is that you have to spend time choosing your top traders carefully and then monitor them closely.

One thing to remember is that it’s your risk when you copy a trader – you can’t blame them if things turn sour and the market turns against them.

What we like about eToro though is that you can easily interact with traders via their wall, similar to how Facebook works.

Traders can justify trades to copiers this way if they want to, share interesting or exciting news about a stock or generally just socialize with others.

Is eToro Available In The USA?

eToro has been available in Europe since 2007 although it was only rolled out in the USA in 2018 due to trading regulations.

You can still only trade cryptos on eToro USA however – it does not support CFDs.

eToro USA is also only available in some states. According to eToro they are currently:

As of July 2019, Real trading is available to US residents in: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, New Jersey, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Texas, Utah, Vermont, Virginia, Washington, Washington D.C., West Virginia, Wisconsin and Wyoming.

Real trading is also available to residents of the United States Minor Outlying Islands.

For the moment, not all markets are available to trade and certain features are disabled. This is why you will see certain buttons grayed out (such as the option to open SELL trades) and will not be able to comment on the News Feed.

You can read more about this in our eToro USA review.

Is eToro a scam?

We can guarantee you that eToro is definitely not a scam and because it operates worldwide, it is regulated by multiple agencies.

Wherever you are located, eToro will be regulated by at least one financial authority in your region. In Europe for example, eToro is regulated by both CySEC in Cyprus and in the UK by the Financial Conduct Authority (FCA) in the UK.

It also complies and operates under the EU Markets in Financial Instruments Directive (MiFID).

In Australia, eToro is regulated by the Australian Securities and Investments Commission (ASIC). As such, eToro has to comply with strict financial regulations just like a bank does.

We have however noticed that there are some eToro complaints and reports from users claiming that “eToro is a scam” regarding their customer service and withdrawals. Many complaints seem to over problems with payouts because users have not verified their address and phone number with eToro.

Until eToro has verified your identity, it will not payout on any profits so it’s important that you make sure you submit the right documents (more on this below).

If you don’t like the idea of eToro requesting a copy of your passport or national ID for identification purposes, then it’s definitely not for you. Unverified accounts are limited to a maximum deposit of $2250 until verification is complete.

Claims that eToro is actually ripping-off users by somehow manipulating market data simply don’t stand-up to scrutiny however.

The reason for this is that eToro has a vested interest in users making the money – the more money you make, the more money eToro makes from spreads (see section on how eToro makes money below).

All eToro’s financial instruments are based on the same stock markets and indices that other trading platforms are based on. The only difference is the price of their spreads compared to other stock trading platforms.

The bottom line is that eToro is legit but profit and loss is entirely down to how you use it.

eToro can help you trade wisely but it can’t be held responsible for any money you lose.

What is eToro’s CopyTrader system?

What makes eToro stand out from the competition is it was the first to pioneer “Social Trading” and in particular, the CopyTrader system which simply allows you to copy the trades of top traders.

It sounds too good to be true and the reality is that it’s certainly not quite that easy but a lot depends on choosing your traders wisely.

The eToro CopyTrader system is perfectly legit – you just need to know how to use it cautiously and effectively which we’ll go into in more detail later in this review.

However, you should be aware that no trader no matter how good they are can predict the direction of the markets over the long-term, especially when it comes to something as volatile as Forex.

Even if a trader has millions of people copying them, it can all go horribly wrong in an instant. A good recent example is the Brazilian stock market which had been making big gains in 2017 and then suddenly plummeted 10% on 18th of May and was even temporarily shut down as news of a political scandal broke.

The financial markets are extremely sensitive to political instability and as we’ve seen with political shocks such as Trump and Brexit, are increasingly hard to predict for political analysts and stock traders alike.

This is why it’s extremely important to use stop-loss (also known as stop-outs) to automatically pull put of trades if the market takes a sudden turn for the worse. As an added safety measure, eToro only allows you to trade up to 20% of your equity in one trader so avoid the risk of losing it all if it all suddenly goes wrong for a top trader.

Note: Stop Loss and Take Profit are not guaranteed and trading with leverage involves high risk.

Finally, there will always be traders out there looking to make an easy buck. This means that statistically, they may appear successful but behind the numbers they are hiding trades that are either incredibly risky or that could blow up at any minute.

In the past, traders could appear successful by not setting a stop-loss in their trading but eToro has now made this much harder by using a traders percentage “gain” over a set period of time as a barometer of success. We look at how to avoid copying scam traders later on in this eToro review.

How does eToro make money itself?

You need to sign-up with a minimum of $50-1000 to open an eToro account depending on your region. In the UK and Italy for example, its $100 but it may vary in other countries.

However, you can sign-up and use a demo account absolutely free with no real money.

There are also withdrawal fees for withdrawing profits from your eToro account.

In Forex trading, eToro makes most of its money from what’s called the “spread” – the gap between the buy and sell price – measured in “pips” – that it leverages.

This means that you pay above the odds for trading on eToro compared to other stock trading platforms but unlike other services, there’s no direct commission to pay on trades.

Bitcoin transactions for example include a 1.00% spread but currencies such as EUR/USD, USD/RUB USD/CHF and USD/CAD are typically 3 or 4 pips but this can go a lot higher for less commonly traded currencies. eToro also charges a very small fee for positions held overnight.

eToro’s spreads and fees are frequently subject to change though and you can check the latest fees here.

It’s worth reiterating that eToro has a vested interest in making sure that you trade well because the more profit you make, the more it makes from spreads.

How to sign-up for an eToro demo account

Although eToro doesn’t have a Mac desktop client, it works on any platform or computer because it’s completely browser-based. This in itself is a plus – there’s nothing to install, nothing to update and no incompatibility issues with different versions of macOS or Windows.

Using any browser-based software always has some security risks but stock trading sites such as eToro are generally watertight because of the financial sensitive data they’re dealing with.

You’ve got little to worry about security wise from using eToro in a browser although if you want to use an app, you can use the eToro mobile app for iPad, iPhone and Android.

One slightly curious thing we found about eToro is that nowhere on the website does it show you how to sign-up for a demo account.

Almost all trading platforms offer a demo or paper trading account so that you can practice with pretend or fake currency before taking the plunge.

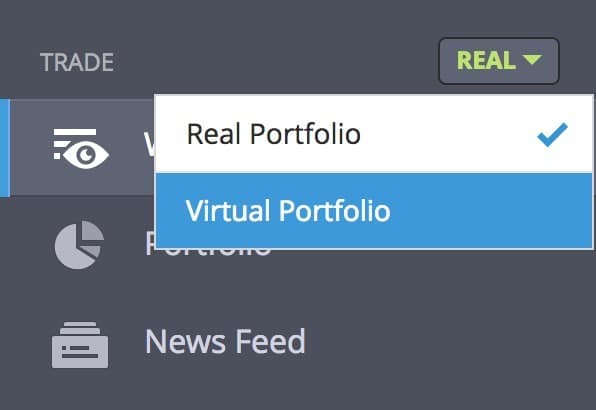

However, it’s actually very easy to sign-up for an eToro demo. You simply sign-up for an eToro account and then switch eToro from “Real” to “Virtual” currency in the dashboard.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

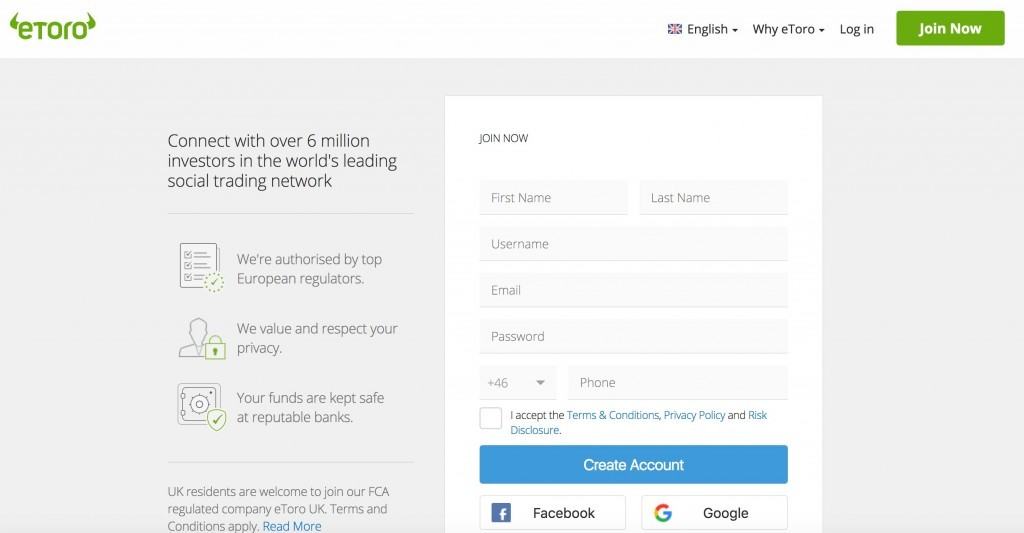

To sign-up for an eToro account, go to the eToro home page and fill in the sign-up form with your name, create a username, create a password and enter your telephone number. Note that when you create your username, you don’t have to use your real name.

However, if you plan on trying to become a top trader yourself, it may be wise to as it’s more likely to ensure that other traders trust and copy you. If other traders copy you, you also earn a share of their profits in what eToro calls the Popular Investor program.

Your phone number is used to verify your account if you intend to trade for real. If you just want to use the demo account for now, you don’t need to verify your account but you still need to enter a phone number anyway.

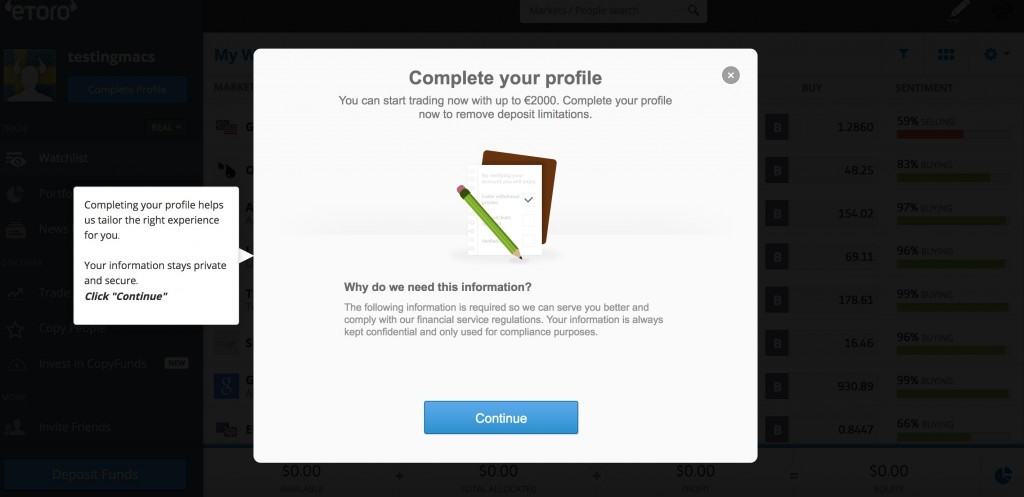

As soon as you signup, you’re taken straight into the main eToro dashboard. You will immediately be prompted to “complete your profile” but you can dismiss this as it’s only necessary if you’re planning to start trading cash for real straight away.

If you’re just going to try a demo account first, you can dismiss it. To activate the demo account, you simply go to the Menu on the left and change “Real” to “Virtual”.

You’ll then be prompted to confirm that you want to switch to a Virtual Portfolio:

If you do intend to take the plunge straight away (which we don’t recommend before at least trying the demo) and trade for real, you will need to fill in a profile and prove your identity via a national ID card or passport.

This is because eToro is regulated by financial service authorities in the country that your trading from and just like a bank that deals with people’s money, it has to adhere to certain rules and regulations. This is good in terms of peace of mind that eToro is a reputable financial organization but it does add the extra hassle of needing to scan and send in some form of ID.

Once sent and verified, your ID should be verified pretty quickly but it’s important to provide the correct information. It’s important you provide the right documents as any delay will result in a delay on any payouts you want to take from eToro.

The failure to provide the right information, especially regarding addresses, has led to some people claiming “eToro is a scam” because eToro will not payout until all information has been verified.

You can still trade while awaiting verification though but if your verification fails for any reason, you won’t be able to withdraw any profit you’ve made.

Information required in the profile includes your address (which is not displayed publicly), trading experience, attitude towards risk, financial status and finally, phone verification via SMS or call.

You can transfer money into your eToro account via several different methods including wire transfer, credit card, PayPal, Skrill, Neteller, WebMoney and MoneyBookers.

How to choose the best eToro traders to copy

Once you’ve activated the eToro demo, you’ll magically see $100,000 of currency appear in your Virtual Equity in the bottom right corner of your screen. You can do whatever you want with this and not lose a penny of real money which is where the fun really starts.

For most people who have opened an eToro account, the CopyTrader system is the biggest attraction and starting point. Just copy the top traders and watch the dollars roll in right? Like anything that sounds too good to be true, it’s not quite that simple.

There are some serious pitfalls and things to be aware of before you trust another trader. The main thing is to be very careful which traders you choose to copy. Here we show you how to systematically avoid these pitfalls, so that you’ve got a much greater chance of making consistent gains with eToro.

We also highlight a few essential identification requirements that are necessary before you can even start trading on eToro.

Here’s how to start copying the best traders on eToro in little more than few clicks:

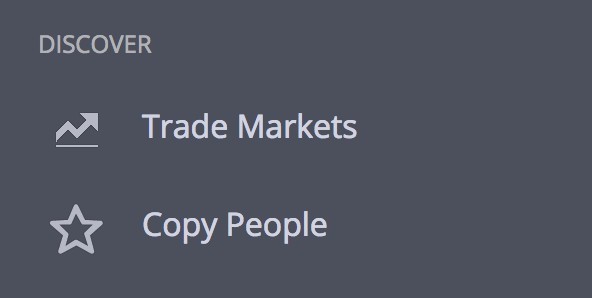

- Go to the left hand menu and select Copy People:

You’ll now see profiles of hundreds of successful traders on eToro. The criteria you choose for the traders you choose to copy is the most crucial aspect of your trading.

Don’t just choose the traders that eToro recommends or highlights on in the main window. The apparent massive gains that accompany their profile pictures don’t always tell the full story.

You’re looking for stable, regularly active traders that have a track record of making steady returns for at least 12 months. Traders that have made spectacular gains of more than 50% in the last 7 days may be using high risk trading strategies that are not viable long-term.

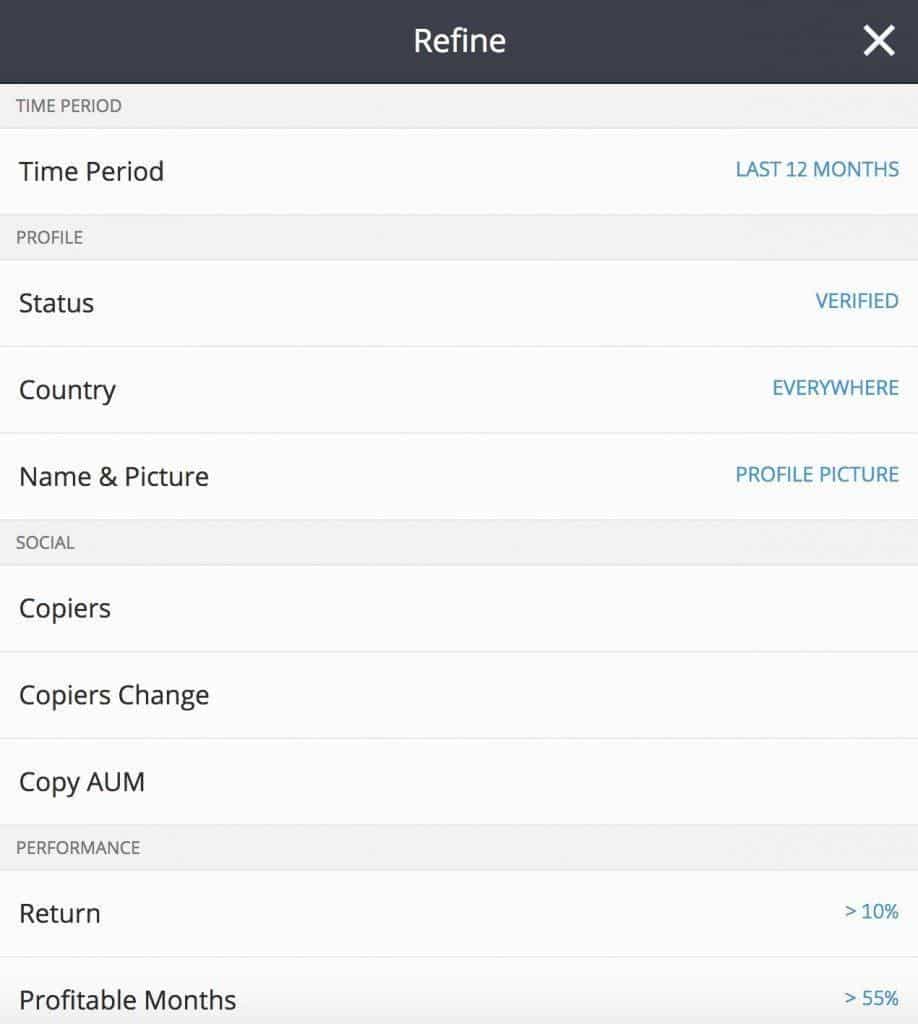

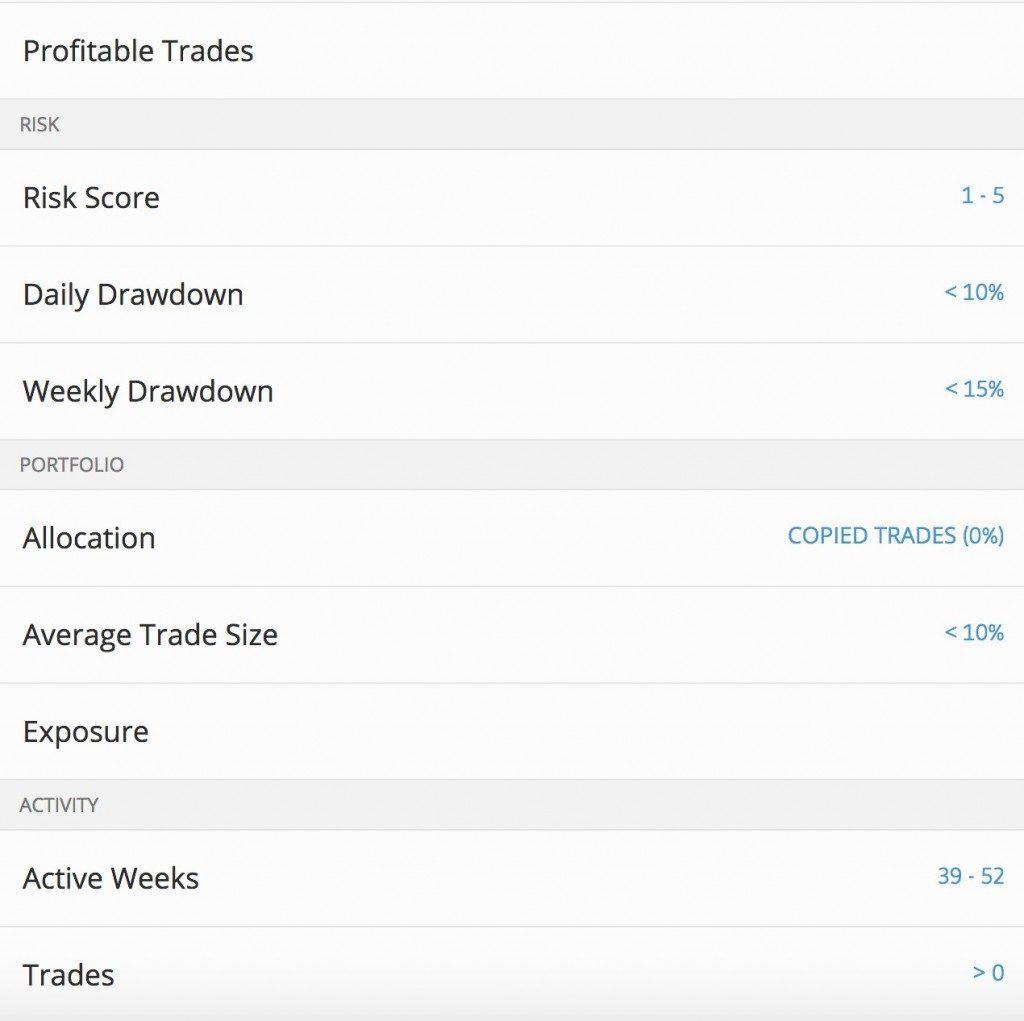

- To narrow it down to the kind of reliable, steady traders that are worth copying, click on the Filter button in the Menu Bar across the middle.

There are several different parameters and settings you can configure here. You don’t have to understand each one of these and you can just copy the settings that we’ve used below. Most of them are self-explanatory relating to how active the traders are.

You’ll notice that under “Status” some traders are labelled as “Verified”. This simply means that they are using their real name and photo in their eToro profile. Although this is meant to give you more confidence that they are trustworthy traders to copy, it really isn’t essential.

There are some good traders who prefer not to use their real name or photos who still make good money. The important thing you should be looking for is their performance, rather than theur identity.

The cool thing about CopyTrader is that if you choose who to copy wisely and start making serious money, you will also be recognized as a Popular Investor and attract other users to copy you. As a result, you will earn a commission on any profits they make which compounds any profit you’ve made by copying others yourself.

The cut you get depends on how many people follow you but a top trader can expect to get 2% annually of any amounts that others copy them with. Some top traders manage more than $300,000 of other people’s money – so 2% is not to be sniffed at.

Once your money is traded, you’ll immediately see your money working for you in real-time. The most interesting view is the Portfolio view which shows how your money is performing in real-time. This gives a clear overview of which of your CopyTraders are performing the best.

What are CopyPortfolios?

CopyPortfolios are a unique feature of eToro that consists of a collection of stocks that spread risk.

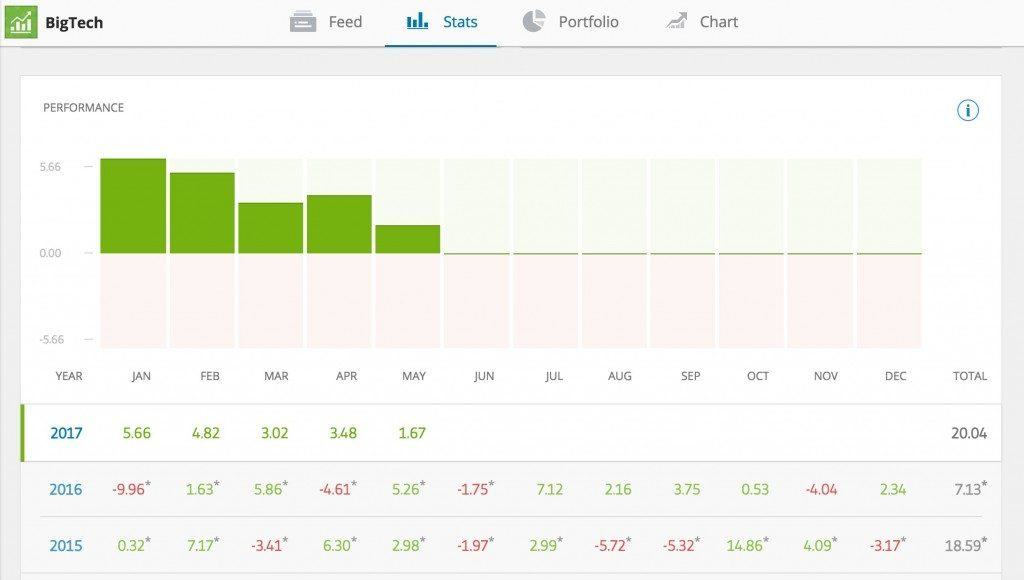

So for example, the BigTech CopyPortfolio includes Microsoft, Google, Apple etc. If one company performs badly but others perform better than it balances out the risk of putting your assets in just one company.

The basket is selected by the what eToro calls its “Investment Committee” which are basically portfolio managers.

eToro also provides alternative ways of trading such as via the Trending R7 where eToro automatically selects the most copied traders on a monthly basis and aggregates them into one lot.

This is quite an exciting development in eToro as portfolios are generally one of the most reliable financial instruments you can use over the long-term. Harnessing the copy trading power of eToro with the earning potential of CopyPortfolios is therefore potentially very potent indeed. In our tests, we found that CopyPortfolios were more successful compared to copying individual traders but they were also more volatile.

Like most mutual stocks, CopyPortfolios are a meant to be long-term vehicles that you leave alone over time to grow and you will notice a lot of volatility on a daily basis. As you can see from the performance BigTech in 2017, the performance was up 20%.

Note however that the minimum trade in a CopyPortfolio is $500 so if you don’t have the kind of capital, you can’t participate in one.

What’s the downside?

eToro is generally an excellent starting point for anyone interested in getting into stock trading. However, it’s definitely not for everyone. One of the biggest and most obvious problems is that not all stock trading on eToro is available in the US yet although cryptocurrency trading is now

For experienced traders, eToro will also feel quite basic and limited, especially when it comes to technical analysis. There are no advanced services such as DMA, STP, ECN or VPS for example. For more detailed technical analysis of stocks, you’ll definitely need some third-party technical analysis software to help you drill-down data.

If you actively monitor the CopyTrader and CopyPortfolio system however and use it cautiously, eToro is a far better idea than jumping into the stock market for the first time and trying to trade on your own.

Don’t Trade With More Than You Can Afford To Lose

Finally, it should go without saying that you should never trade more in eToro than you can afford to lose. Financial markets can be very volatile turning suddenly or unexpectedly and even the best traders lose money. You need a strong stomach to ride out the peaks and troughs of trading and you can even end up losing everything if the market turns on you.

One way you can protect yourself from this is by using stop-outs so that your trades are stopped once the market falls below a certain value. Another is to approach trading with a long term view. Traders rarely make big gains over the short haul but are rewarded for persevering over the long term.

However, the best advice of all is to only risk capital than you can afford to lose. We would never recommend using eToro as your main source of income. If you trade only what you can afford to lose and see eToro as a bit of fun, you can’t go too far wrong.

Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.