Disclaimer: Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1519299) and is not FDIC or SIPC insured. Investing involves risk

Table of Contents

eToro USA Review

eToro started over 10 years ago but it’s only been in the past few years that it’s finally available in the USA.

It’s important to be aware from the start that the US version of eToro is only available for cryptocurrency trading – eToro USA does not offer CFDs.

The global version of eToro already has 10 million users worldwide in 140 different countries and has been in fintech since way back in 2007.

eToro also launched a cryptocurrency trading platform and offers long-only cryptocurrency trading in 15 major currencies (and counting) in 40 different states.

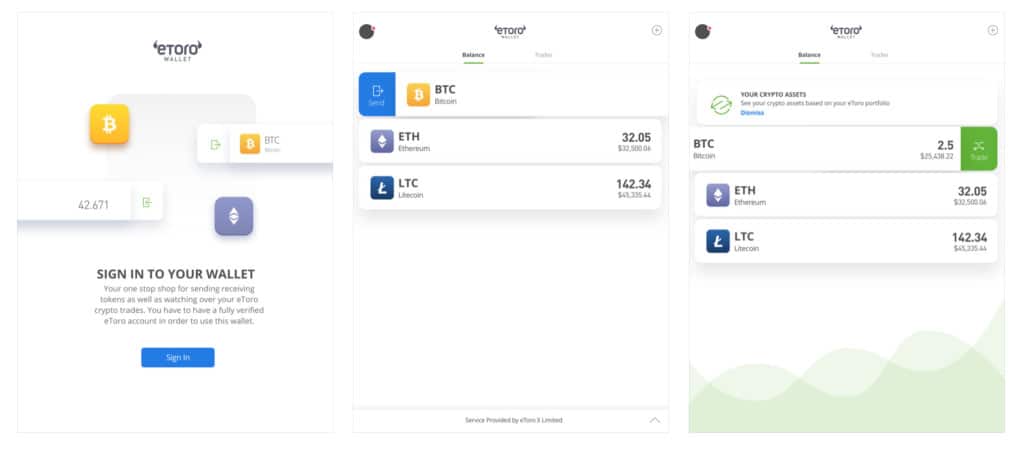

It also conveniently has its own secure cryptocurrency wallet which means you can trade and save your funds on the same platform.

In this review of eToro USA, we look at what it currently offers to users in the US.

Note that if you’re interested in trading on Mac, you’ll also find our guide to top trading software on Mac useful too.

Is eToro Legit?

Because it’s very accessible, even to those without trading experience, one of the first questions people ask about eToro is whether it’s a scam or not?

Quite simply, eToro is trustworthy because it’s subject to all the strict financial regulations that other financial services are.

eToro is legit and is fully licensed in multiple US States.

eToro USA is operated by eToro USA LLC, which is registered with FinCEN as a Money Services Business.

In other parts of the world, it is regulated in Europe by the Cyprus Securities and Exchange Commission (CySec) and in the UK by the Financial Conduct Authority (FCA).

eToro has even been featured by the Financial Times as one of its Top 10 Financial Companies to watch so it’s safe to say, that eToro is definitely legit and trading with it is as secure as any other trading platform.

However, it’s also important to be aware that in the specific world of cryptos, there is still no regulatory framework although that may eventually change as cryptos become more mainstream.

It’s also true that eToro won’t allow you to withdraw funds until your identity has been fully verified. This requires sending copies of your ID and other information and it may take some time before your identity is checked.

Which Parts Of eToro Are Available In The USA?

In the USA, eToro only offers crypto-currency trading.

This might sound surprising in the home of Wall Street but its due to strict regulations on what’s known as “CFDs” (Contract For Difference) in the US.

This applies to all trading and gambling platforms in the US like eToro that use spreads and you can read more about why it affects US users only in this Forbes article.

For the moment, you’ll also see that certain features are disabled. Some buttons are grayed out (such as the option to open SELL trades) and you can’t comment on the News Feed for example.

Please note however that eToro is not available in all US States yet.

Specifically, it’s currently available in Massachusetts, Pennsylvania, Utah, Wisconsin, Indiana, Missouri, Maryland, Michigan, Colorado, New Jersey, South Carolina, Washington, Virgina, Arizona, Ohio, Georgia, Iowa, Mississippi, Alaska, New Mexico, North Dakota, South Dakota, Arkansas, Maine, Oklahoma, Rhode Island, Kentucky, Montana, Wyoming, California, Oregon, Vermont, Alabama, Kansas, Connecticut, Washington DC, Florida, Texas, Idaho and the US Minor Is.

What Are The Highlights Of eToro?

Some of the benefits of using eToro for crypto-trading include:

- Ability to use eToro’s own crypto wallet. This is much more convenient than having to use an external crypto currency wallet.

- The worldwide version of eToro has been in the crypto-currency trading business since 2013 so the US version has benefited from that experience and know how.

- The eToro platform is secure and has never been subject to hacks or security breaches.

- Crypto trading is very easy to understand on eToro compared to other crypto trading sites and services.

- There’s a 15 major crypto currencies available to trade with with more being added.

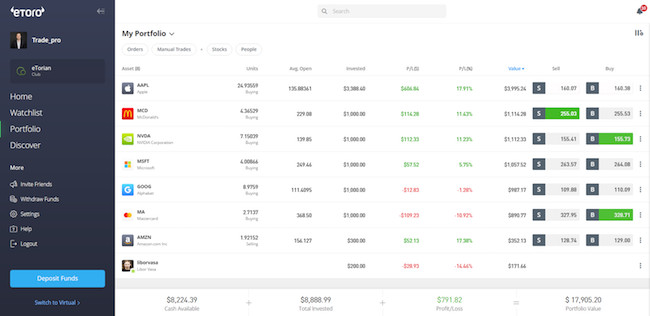

- eToro will automatically diversify your crypto basket to make sure you’re getting a balanced portfolio – especially important in the volatile world of cryptos.

- eToro doesn’t allow you to leverage trades to prevent you losing more than you’ve invested.

- Hedging trades is not possible

- You can test trade on eToro with a $100,000 virtual currency account.

- You only need to make a minimum deposit of $100

- You can trade with a minimum position for any single trade fixed at $25

- Limits are imposed on maximum position taken to reduce systemic risk

How Much Does eToro Cost?

You can sign-up to trade with eToro and you only need a minimum deposit of $100 to start trading with.

Disclaimer: Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. MacHow2 is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

eToro makes its money through spreads.

The spreads in general are slightly higher on eToro than many other platforms although they are still competitive and on the upside, there are no other hidden fees.

Cryptocurrency trading spreads start at 1.00% of trade value for Bitcoin/USD pair but different crypto currencies have different spreads.

What Can You Trade On eToro USA?

The US version of eToro only allows you to trade cryptos.

At the moment you can trade the following cryptocurrencies: Bitcoin, Ethereum, Bitcoin Cash, Dash, Ethereum Classic, Litecoin, IOTA, Stellar, EOS, NEO, Tezos, and ZCASH.

As the number of crypto currencies increases, eToro will gradually add the most popular ones.

eToro has its own cryptocurrency wallet which makes it easy to store and transfer profits from trading. You can convert between two currencies on the fly and receive transfers from other wallets.

You can withdraw and add funds easily into any bank account via wire transfer and the minimum withdrawal is $50.

eToro’s crypto wallet is also regulated by the Gibraltar Financial Services Commission for extra security and is securely encrypted.

eToro CopyTrader

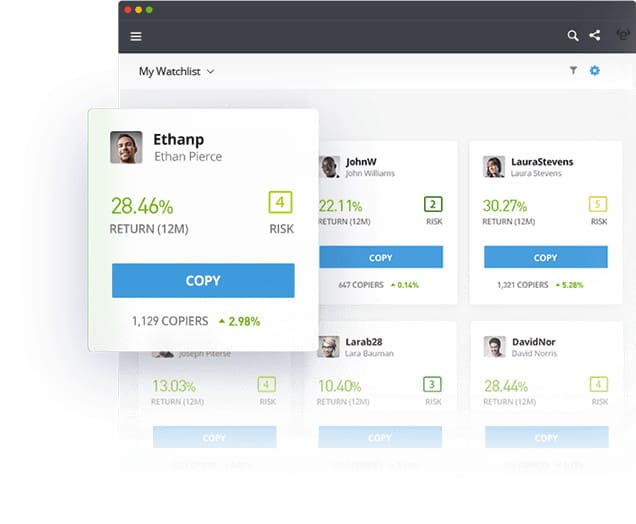

One of the best features of eToro is the CopyTrader system which allows you to copy successful traders without needing any trading knowledge.

In the global version of eToro, you can copy traders from anywhere in the world although in the USA version, you can only copy traders in the USA.

eToro also has mobile apps for iOS and Android which allow you to copy trade anywhere or just keep and eye on your investments.

If you have any problems, eToro customer support is available via live chat or ticketing 24 hours a day but only Monday to Friday.

For a more in-depth look at the fully functioning global platform, check out our other eToro review to get an idea of what’s coming to eToro USA soon.

You can sign-up for an eToro USA account here to try it for yourself.

Disclaimer:

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. MacHow2 is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.