While we can’t promise to turn you into the Wolf Of Wall Street overnight, we can show you the best trading software for Macs of 2025 to get you off to the right start.

I’ve had years of experience trading on macOS and while I might be biased, I think Macs are actually better than PCs for trading.

However, there’s no denying that there’s definitely less Mac based trading software than there is for Windows PCs.

I therefore tried and tested a range of trading software, screeners and platforms including those with Mac desktop apps aimed at everything from beginners to seasoned professional traders.

In my research, I covered a wide range of apps that allow you to trade everything from stocks and cryptos to options and forex.

After extensive testing, I found that TradingView for Mac (FREE) was the best trading software of 2025 thanks to its amazing charting, broker integration and excellent Mac desktop app.

Table of Contents

- Trading Software vs. Trading Platforms

- 1. TradingView (Free)

- 2. MotiveWave

- 3. Charles Schwab (thinkorswim)

- 4. TC2000

- 5. Interactive Brokers (IBKR)

- 6. Tastytrade

- 7. Power ETrade

- 8. Robinhood

- 9. Market Gear

- 10. MooMoo

- 11. MetaTrader

- 12. ProTA

- 13. Latinum

- 14. Apple Stocks

- 15. IG (UK)

- 16. SaxoTrader (Europe)

- 17. Interactive Investor (UK)

- The Broker Small Print

- What I Looked For In These Trading Apps

- Using iPad Trading Apps on Macs

- Running Windows Trading Software on Macs

Trading Software vs. Trading Platforms

The distinction between trading software and trading platforms is becoming less clear, as many tools now combine both functions. However, there are still key differences:

- Trading Software: Primarily used for market analysis, these tools help traders study trends using indicators like moving averages, trendlines, and oscillators. They are often called stock charting software, stock screeners, or day trading apps. Some can also execute trades by integrating with brokerage accounts.

- Trading Platforms: Provided by licensed brokers, these platforms allow you to buy and sell stocks and other assets. While they often include basic charting tools and fundamental analysis features, they may not be as advanced as dedicated trading software. Many also integrate news feeds, automated trading, and copy trading.

Today, many trading platforms include built-in analysis tools, and many trading software solutions now support direct trade execution, making the lines between them increasingly blurred.

With this in mind, here’s my selection of the best tools for trading on a Mac.

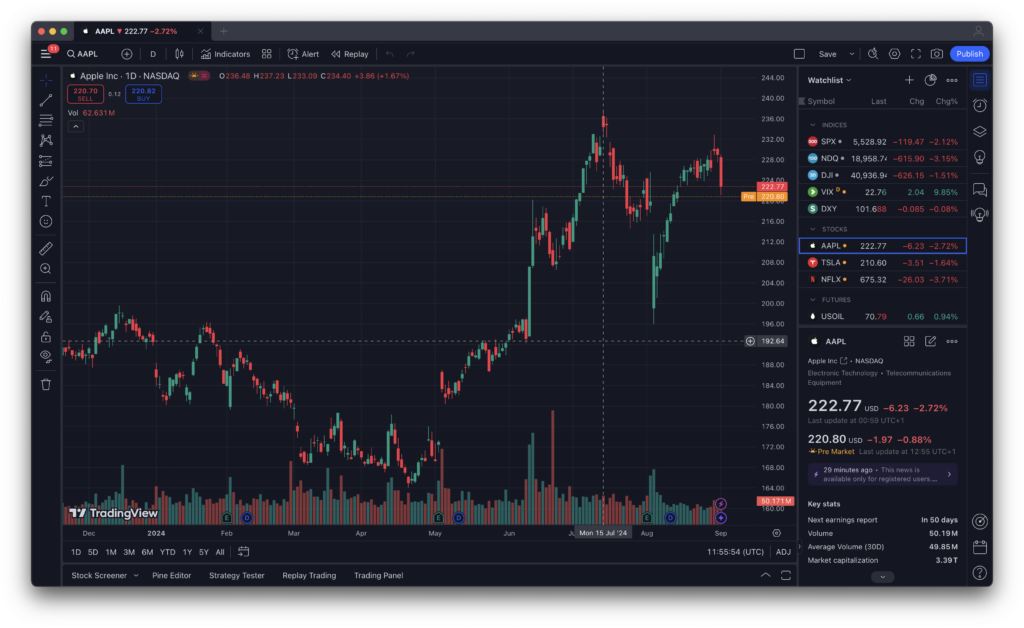

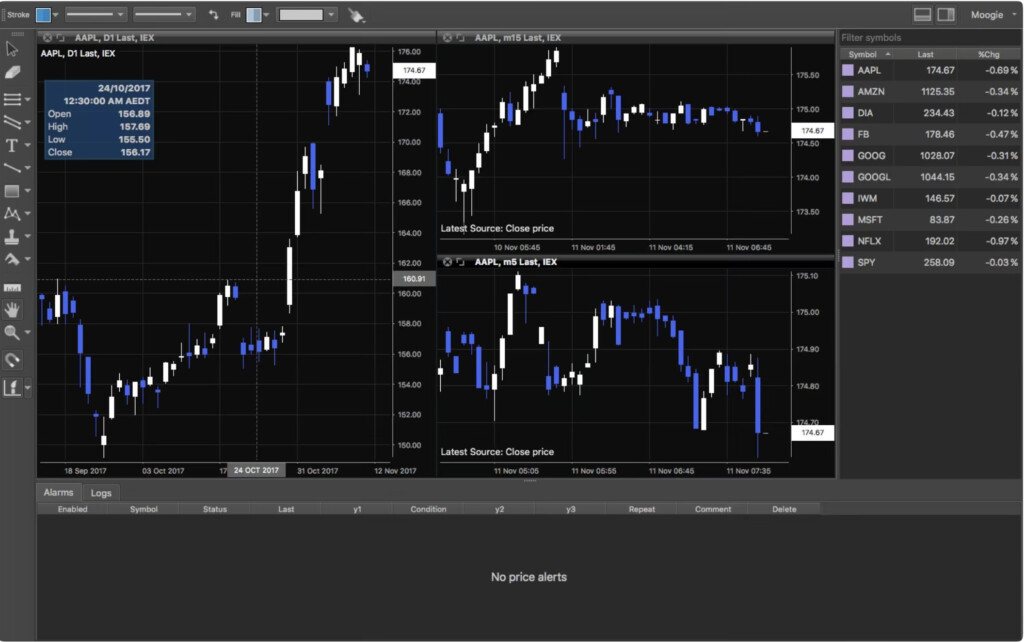

1. TradingView (Free)

TradingView is an amazingly powerful yet easy to use community driven charting and trading software that combines user knowledge with sophisticated analysis to make you a better trader.

It’s ideal for beginners with a thriving, helpful trading community that makes it more accessible than most other tools although millions of professionals use it due to its incredible range of features.

It has an excellent FREE native Mac desktop app for both Intel and Apple Silicon Macs so it works flawlessly on any type of Mac.

The great thing about TradingView is that you can use all the main features for FREE.

You only have to upgrade to the paid plans if you want to remove some time frame limitations, use multiple indicators, get faster, real-time information and remove ads.

These are highly recommended if you’re going to trade seriously but you can use the free version for as long as you want.

TradingView also allows you to trade on the stock market in real time by connecting it to selected brokers.

These include Oanda, TradeStation, Gemini, FXCM, Cannon Trading, GAIN, GFX Brokers, Interactive Brokers, Meintrade and even Indian trading platforms such as Dhan.

You can check out our full TradingView review for more on why we rate it so highly.

Pricing: Free for one chart and indicator, Paid plans start at $12.95/month with 16% off

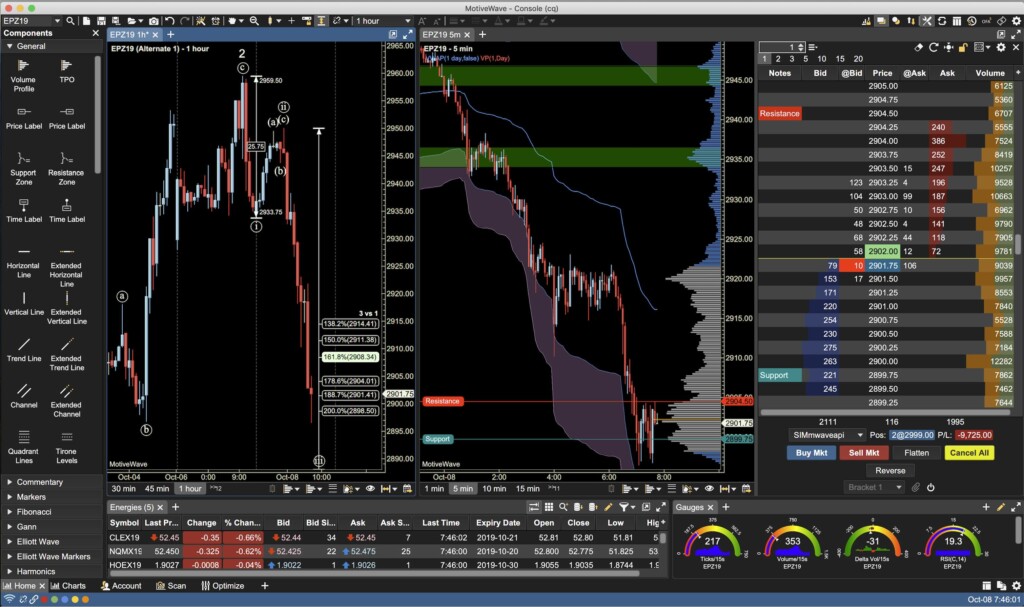

2. MotiveWave

MotiveWave is a professional multi-asset desktop trading software for Macs.

It not only allows users to do powerful technical analysis but is integrated with multiple brokers and financial data delivery services.

Brokers that you can connect to MotiveWave include Oanda, TD Ameritrade, Forex.com, Cannon Trading, GAIN, GFX Brokers, Interactive Brokers and Meintrade.

If your broker isn’t supported, it may also be possible to connect it via a Gateway Connector such as Rithmic or CQG.

MotiveWave automatically looks for complex patterns such as Elliott Wave Patterns and Gartley Harmonic Shapes in order to identify trading opportunities.

You can also connect it to Rithmic Level 2 data which gives you incredible insight into a stock’s price action.

Other advanced features include Replay Mode, Advanced Alerts based on multiple market signals, Component Alerts and Multiple Monitor Support.

You can also sign-up for a free trial of MotiveWave and when it expires, you can still use the limited Community Edition for free.

You can check out our full MotiveWave review for more.

Pricing: Limited free community edition, Paid plans start at $24/month.

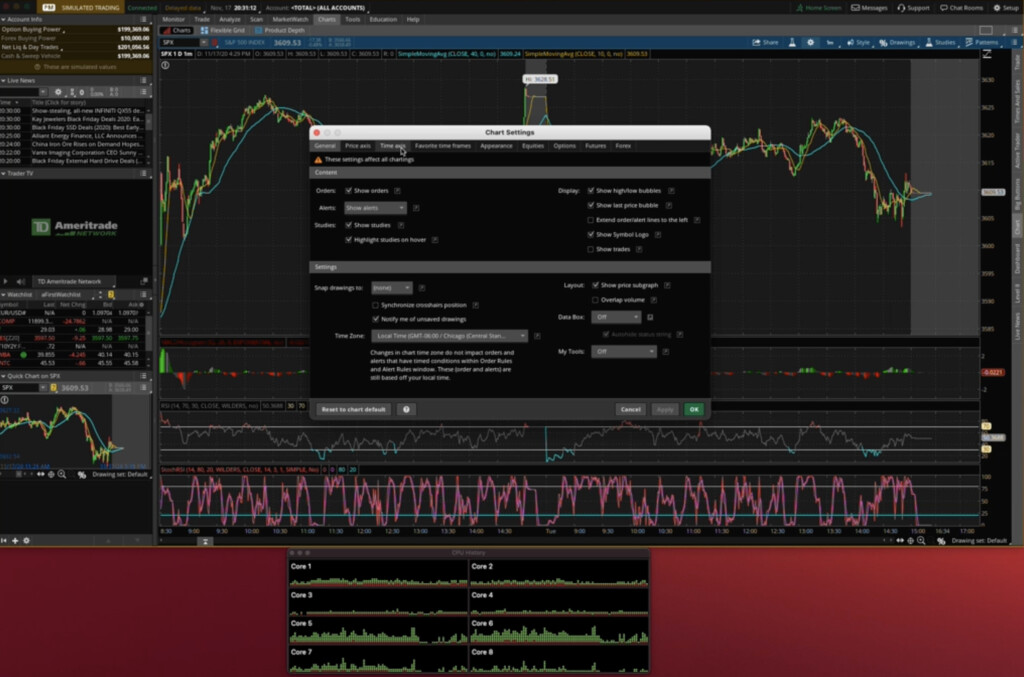

3. Charles Schwab (thinkorswim)

Charles Schwab acquired TD Ameritrade in 2019 but it retained the TD Ameritrade thinkorswim (TOS) trading platform that has been popular on Windows and Mac for many years.

Thankfully, it also retained the TOS Mac desktop app too as well as the user friendliness that made thinkorswim popular with beginners with extensive how to guides, live training seminars and specific lessons on areas such as Options trading.

thinkorswim uses data from various sources including Morningstar and the Federal Reserve Economic Database giving you a wide range data to work with.

There’s also a paper trading account with Charles Schwab ThinkorSwim to test the water first.

Note that if you’re looking for Schwab’s optionsExpress, Schwab acquired it back in 2011 and has now retired it in favor of focusing on TOS instead.

Pricing: 0% commission, $0.65 per options contract

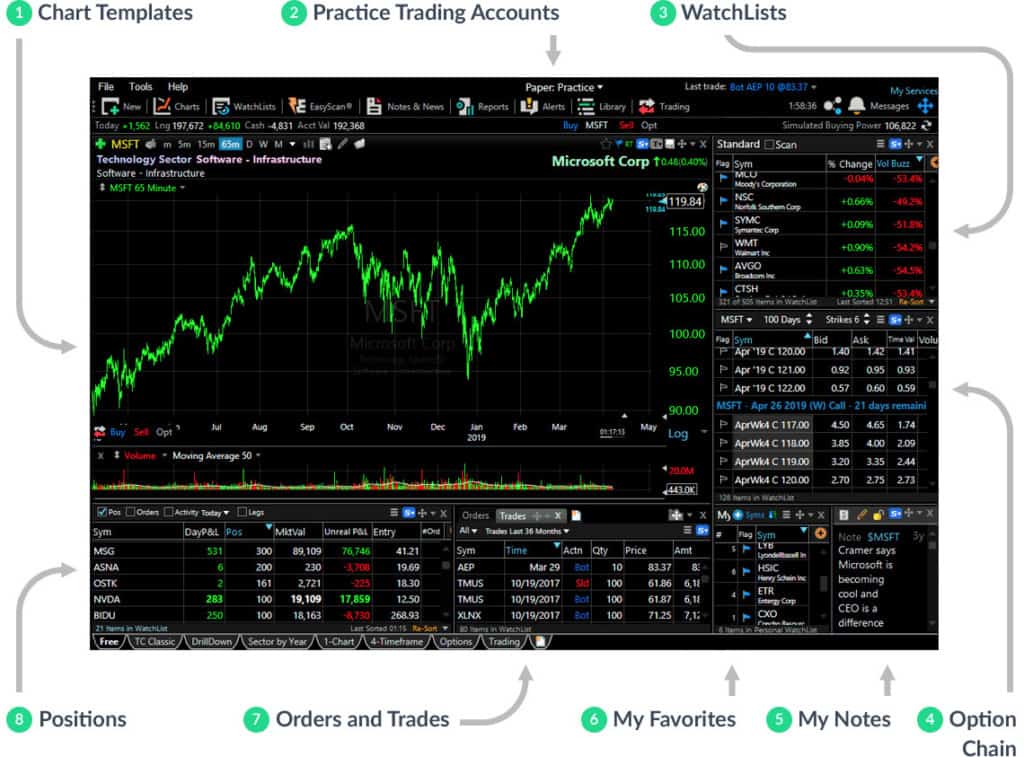

4. TC2000

For a long time the popular TC2000 trading software and platform was only available for Windows but you can now use TC2000 on Macs too.

TC2000 allows you to connect to it remotely or you can now use TC2000 in any web browser on a Mac.

The comprehensive dashboard gives you charts, all US stocks & options, indicators, streaming data, option chains, trading windows, notepad and favorites watchlist.

Although you can’t connect TC2000 to external brokers, it offers its own brokerage account which it charges a commission for although the margin rates are reasonable.

If you’re looking for an all-in-one stocks/options trading and broker platform on your Mac, TC2000 is well established and trusted although it’s one of the more expensive tools we looked at.

Pricing: Starts at $9.99/month

5. Interactive Brokers (IBKR)

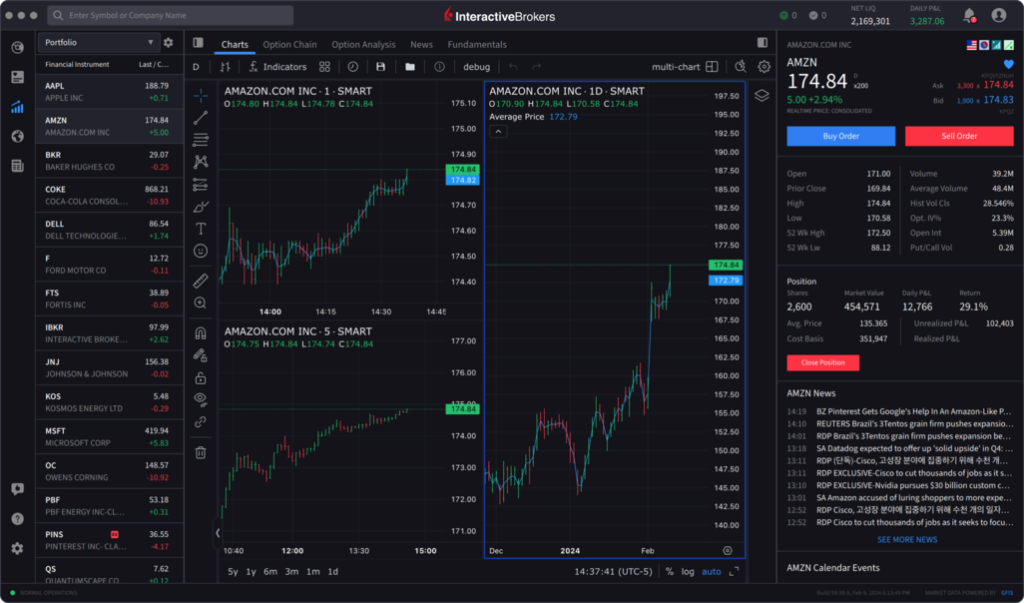

Interactive Brokers (known more commonly as IBKR) is aimed at experienced traders with its Trader Workstation platform.

IBKR Trader Workstation is complex with advanced Options analytics and portfolio management tools that take some time to find your way around at first.

IBKR also offers one of the best mobile apps for Options trading for those that want to trade on the move.

We wouldn’t recommend IBKR for beginners but for those that are already experienced traders, its a powerful platform with some of the most advanced algorithmic trading capabilities around.

Pricing: Variable commission and margins depending on asset class

6. Tastytrade

Tastytrade (formerly Tastyworks) is a Chicago based online brokerage firm from the makers of the Tastylive stock market news network.

Tastytrade is actually the US branding of the UK based IG (see review further down) and covers stocks, options, ETFs, and futures.

What we like about Tastytrade is that not only is it fresh and original, but it’s also got a Mac desktop client.

Tastytrade is also known for its extremely competitive pricing compared to most platforms and its own lively rolling news network.

Tastytrade is a very accessible trading platform that’s ideal for those new to trading because of its lack of jargon.

Pricing: Variable commission and margins depending on asset class

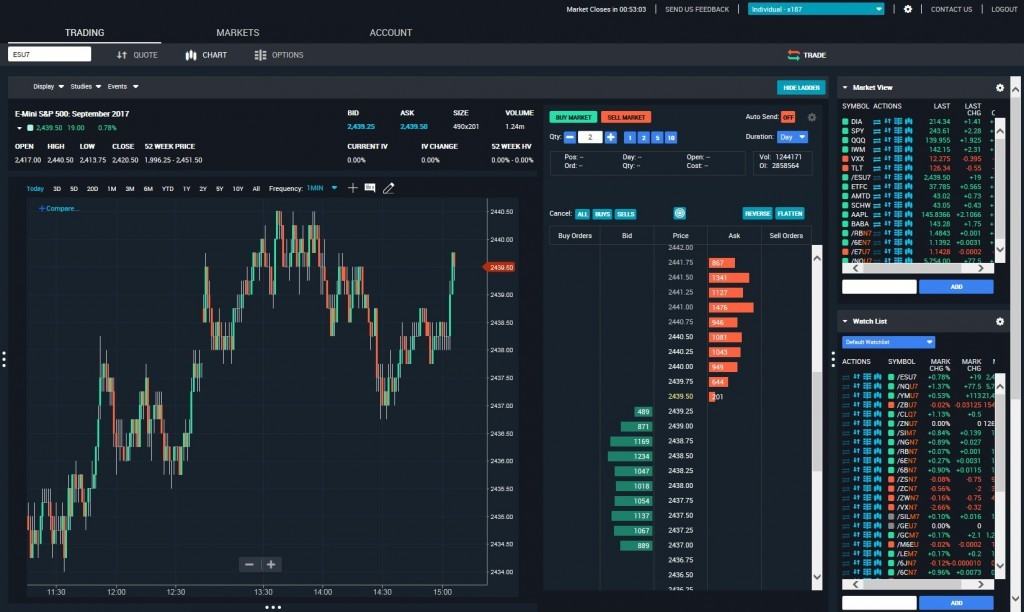

7. Power ETrade

ETrade is one of the biggest names in online trading and is a powerful online stocks, options and futures trading platform.

The main selling point of the Power ETrade platform is that it covers a huge range of assets, it’s well presented and designed and is easy to use for beginners.

The range of trading possible with Power ETrade is impressive covering Stocks, Options, Mutual Funds, ETFs and Bonds.

It also includes Futures trading with the ability to see Futures contract prices in real-time, depth of market and working orders.

Power ETrade can also evaluate risk vs reward, show you different outcomes based on different market scenarios and alert you to potential profitable trades.

Pricing: Variable commission and margins depending on asset class

8. Robinhood

Robinhood is a commission-free trading platform that has become popular with beginners.

The platform has a simple and clean interface, making it easy for new traders to buy and sell stocks, options, and cryptocurrencies.

While Robinhood doesn’t have a dedicated Mac app, its web platform and iOS apps are optimized for Apple devices.

It lacks advanced charting tools though, so it’s more suited for long-term investors and casual traders than for those relying on technical analysis.

Pricing: Commission free but other fees apply depending on trade

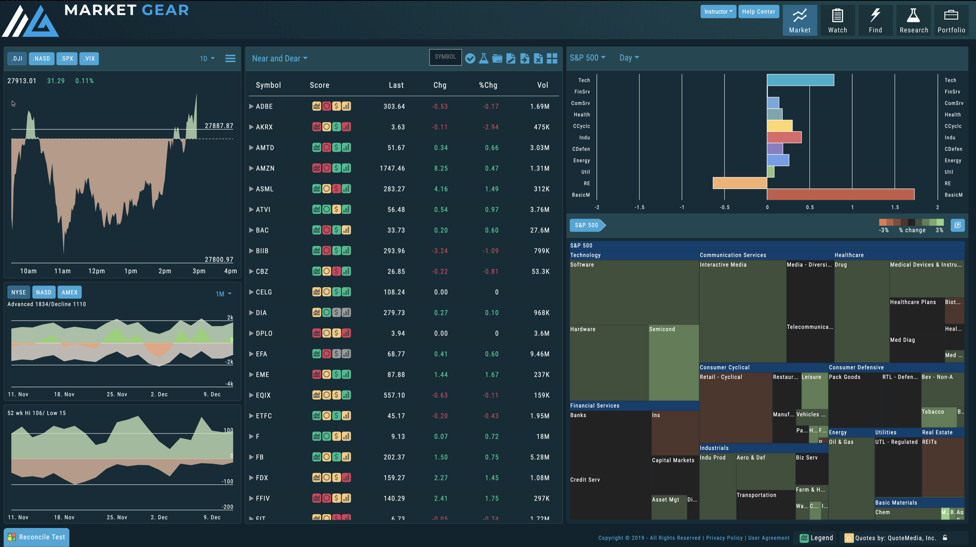

9. Market Gear

Market Gear is a powerful and comprehensive options trading tool aimed at professional traders.

Market Gear is made by iVest+ which is a big player in the world of trading platforms for educators and retail investors.

In particular, the Options trading features in Market Gear are some of the most advanced we’ve seen on any trading app.

For example, if you want to put on a bull call spread, Market Gear can analyze where you will make and lose money and make quick changes, but you can’t break the concept of the bull call spread.

It also allows you to connect to multiple brokers at the same time so if you’re experiencing problems with one account, you can switch to another trading account instantly.

Market Gear might be a bit overwhelming for beginners to trading but it’s powerful enough to impress any seasoned stock trader that has multiple brokerage accounts.

You can also read our full Market Gear review for more.

Pricing: $75/month

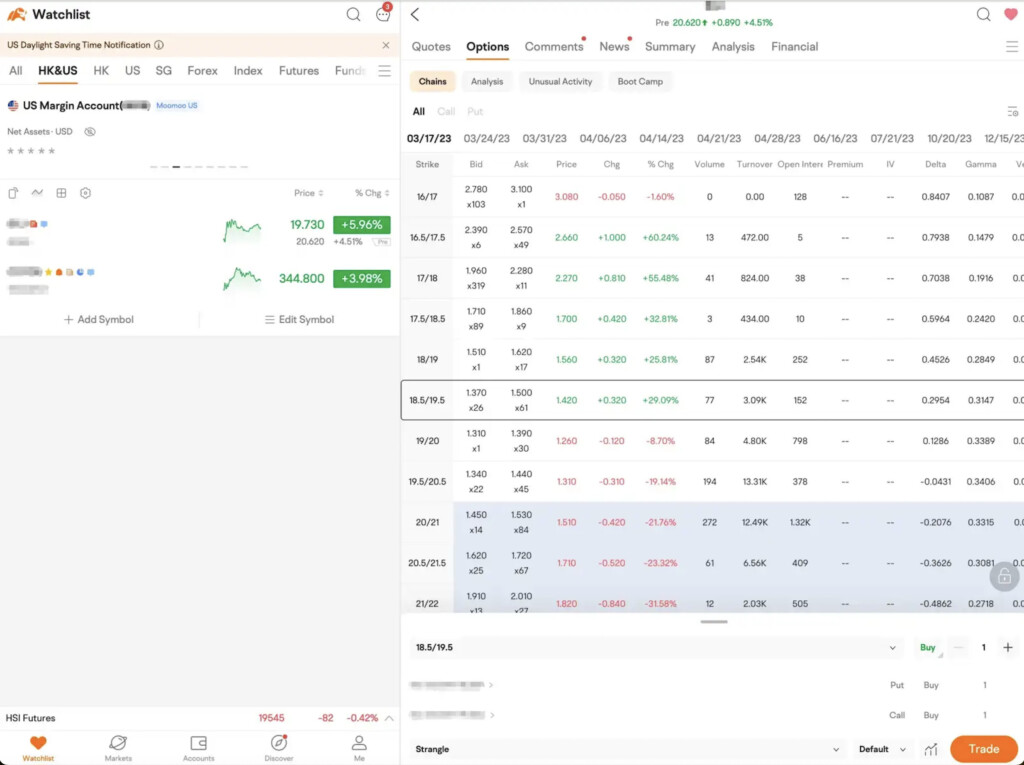

10. MooMoo

If you want a slick Mac desktop app with zero commission trading, then MooMoo stands out as one of the best value trading apps we’ve seen.

MooMoo drills down data thanks to access to Level 2 NYSE market data including real time bid and ask feeds.

Usually only professional traders have access to this level of data so it already gives you a big advantage over most other trading apps.

It also analyzes trades before you place them to estimate what the result will be.

We also like the fact that MooMoo offers a free paper trading account so that you can place practice trades before using real money.

We’d say that MooMoo is an excellent trading starting point for beginners but the Level 2 NYSE data will also attract professionals too.

Pricing: 0% commission, variable Margin Rate

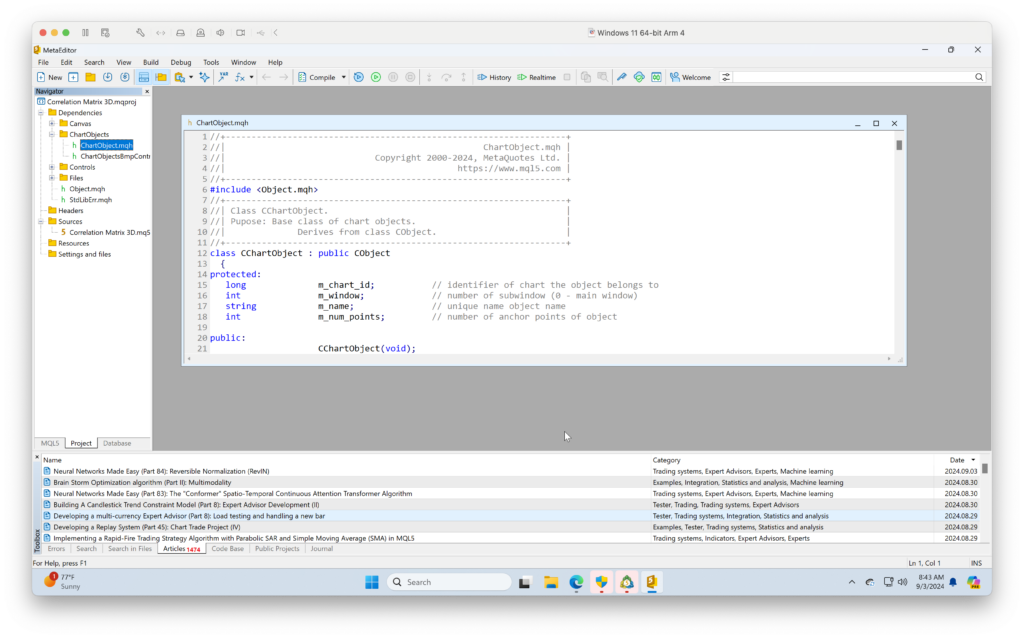

11. MetaTrader

MetaTrader (both versions 4 and 5) is one of the most widely used platforms for forex and CFD trading, but it’s also suitable for stock traders looking for robust charting and technical analysis tools.

While MetaTrader doesn’t offer a native Mac app, many you can still run it on a Mac using a virtual machine.

Some brokers also offer customized Mac versions of MetaTrader.

However, we think that TradingView is much better than MetaTrader anyway and you’d be much better off going with it instead.

MetaTrader is ideal for traders who need algorithmic trading capabilities or who prefer to develop their own indicators and trading systems.

MetaTrader is available worldwide and through brokers.

Pricing: Free

12. ProTA

ProTA is one of the most established technical analysis software packages for Mac and has been around for over 20 years.

The software is designed specifically for Macs and aimed both at beginners and seasoned traders.

Among the many features are more than 100 indicators, line studies, smartlists, chart templates and trading systems.

ProTA uses Yahoo Finance to extract end of day financial data and continuously updates data automatically to make sure you’re making trading decisions based on the latest figures.

It also allows you to import your own Excel data, drill-down tickers to analyze market data and create your own rules for data tracking.

Pricing: $99/year

13. Latinum

Latinum is a slick, professional trading and technical analysis software for Mac and PC.

If you’re going to be trading Stocks, Cryptocurrencies Forex and CFDs (Contract for Difference) then Latinum is a good choice as it supports streaming quotes for Forex and CFDs.

Latinum is designed for discretionary (non-automated) traders and quickly enables you to determine risk, make orders quickly via a Mini Order Ticket feature and more easily manage order and positions with a Mini Blotter.

You can even trade Forex on Latinum by linking it to FXCM Trading Station and Marketscope broker accounts although it no longer supports OANDA.

Latinum also has a trading simulator which you can practice paper trades on.

Pricing: Starts at $99.99/year

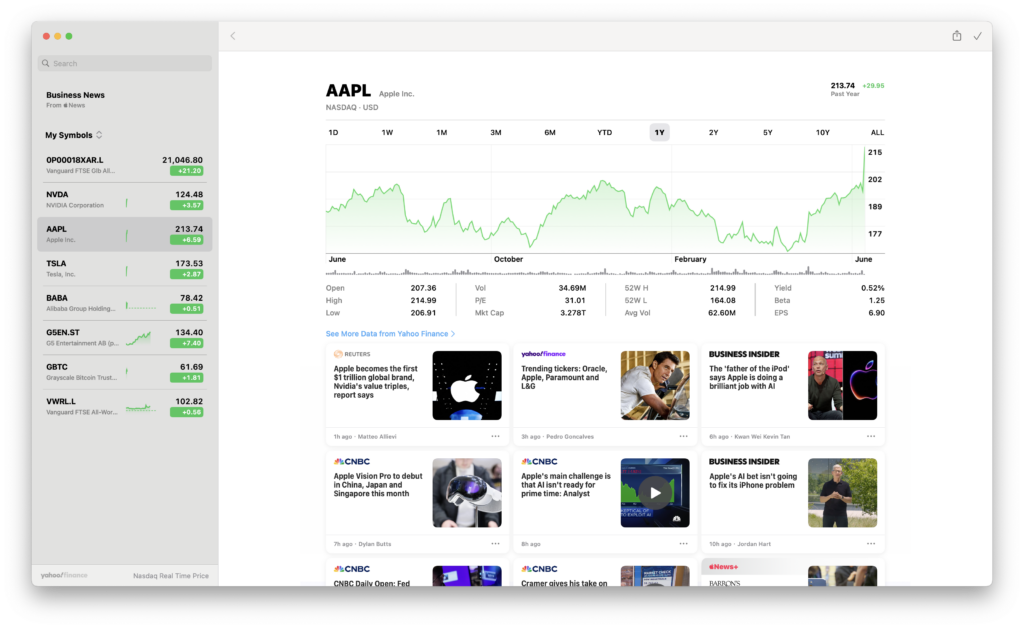

14. Apple Stocks

Finally, no roundup of Mac compatible stock screeners would be complete without a mention of Apple Stocks in macOS.

The Stocks app is free in macOS and although you can’t trade from it, it’s very slick and aggregates multiple stock news sources in one place.

To access Stocks on your Mac, simply go to Finder > Applications and select Stocks or search for “Stocks” in Spotlight on your Mac.

Pricing: Free in macOS

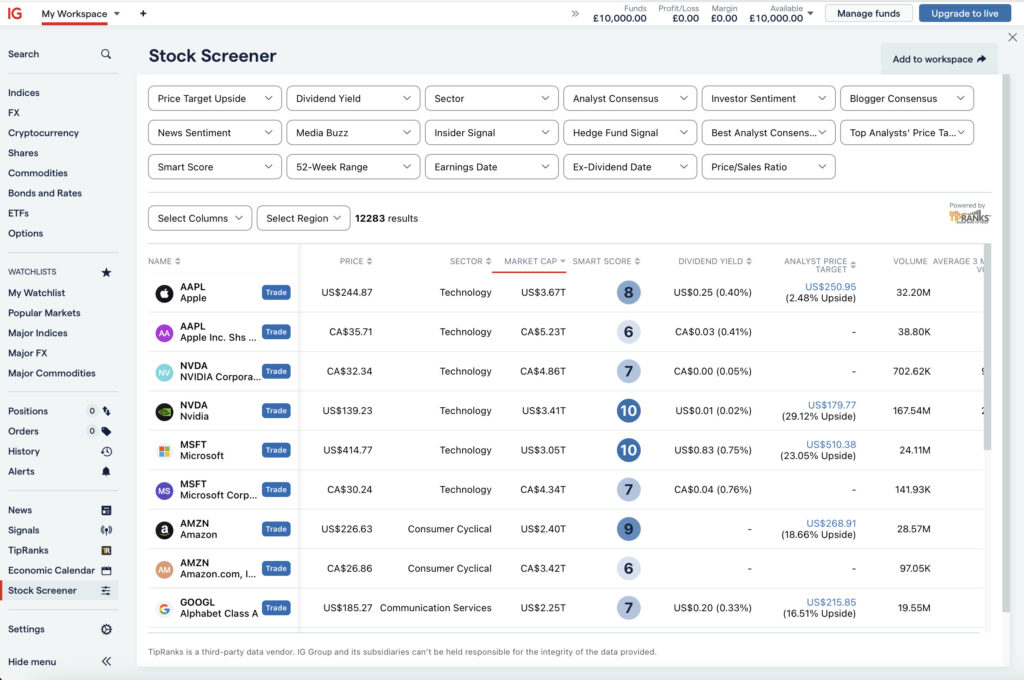

15. IG (UK)

For British based Mac users, IG is one of the best and most established trading platforms with access to over 17,000 markets.

This includes forex, stocks, indices, commodities, and cryptocurrencies. It also offers CFD trading, spread betting (UK only), and share dealing.

The platform has a clean, easy to navigate interface and has some of the best educational resources of any platform we’ve used.

It also offers risk management tools like guaranteed stop-loss orders (GSLOs) to help you control exposure.

Although there’s no Mac desktop app, you can use it via MT4’s own version of MT4 for Mac.

The platform is regulated by the FCA (UK), ASIC (Australia), and NFA (U.S.), although financial guarantees differ in each country.

Note that although IG may accept customers in the USA and other countries, they will not offer the full range of features or trading possibilities as it’s mainly aimed at the UK market.

Check out our full IG trading platform review for more.

During these volatile times of trade tariffs, IG also has some excellent Market News and Analysis to help base your trades ob.

Pricing: Free Demo Account. Spreads starting from 0.6 pips on forex and commission-free trading on U.S. shares

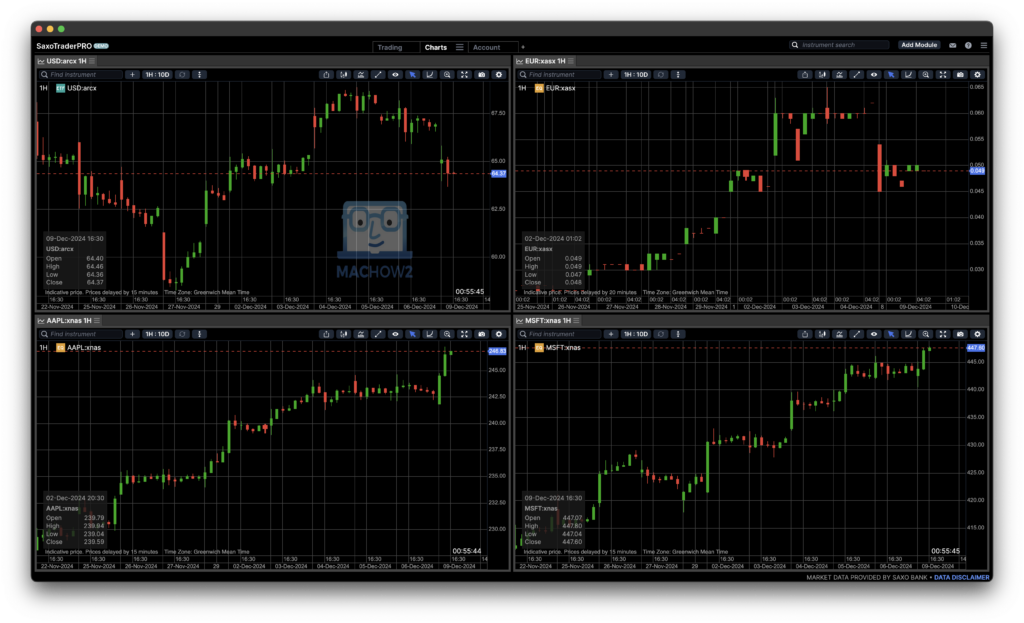

16. SaxoTrader (Europe)

SaxoTrader is Saxo Bank’s trading platform which is a popular choice with traders in Europe.

SaxoTrader Pro is the Mac desktop app which is mainly aimed at professionals although there is an easier to use web version available.

The platform gives you access to over 70,000 financial instruments including forex, stocks, ETFs, bonds, options, futures, and cryptocurrencies.

There are over 50 technical indicators available including annotation tools for in-depth technical analysis.

Some of the best features in Saxo are the risk management tools which include an Account Shield to put a stop loss on your entire account which closes all of your positions when triggered.

The SaxoTrader Pro Mac app is a bit complex for beginners but for professionals that want an advanced desktop trading platform, it’s an excellent choice.

Check out our full Saxo Trader review for more.

Pricing: Free with a Saxo trading account

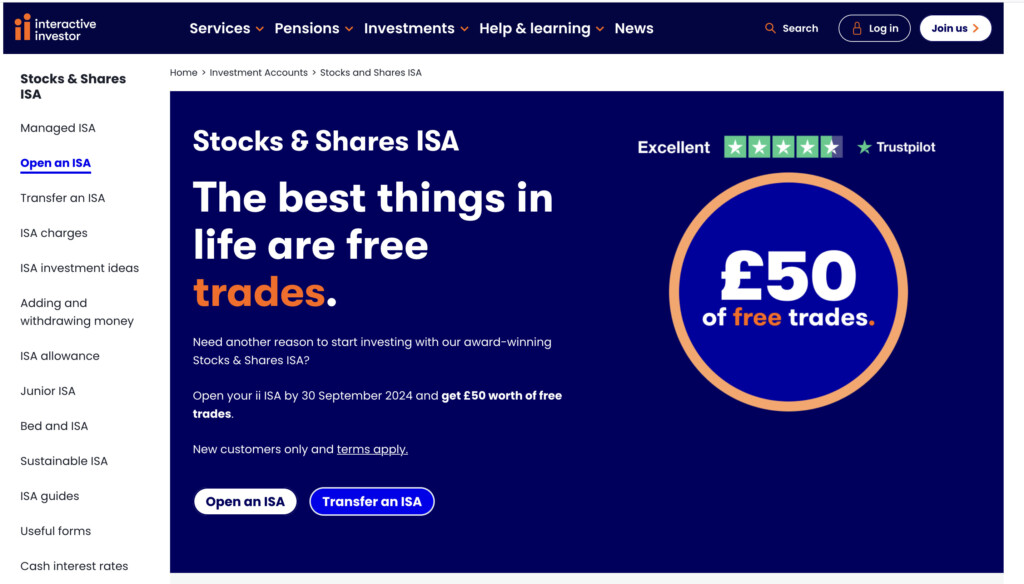

17. Interactive Investor (UK)

If you’re a UK based trader then Interactive Investor is an award winning online investment platform and only open to UK residents.

It does however allow you to buy shares in other foreign exchanges including the US.

If you trade frequently, Interactive Investor works out extremely good value although IG (see review above) also gives it a run for its money.

Interactive Investor also has some excellent charting tools and there are plenty of useful education resources for becoming a better trader.

You can start trading immediately with Interactive Investor as long as you have a UK address, debit card and National Insurance number.

Pricing: Starts from £4.99 per month. Plans for SIPPs. ISA, Ethical and General Investment Accounts (GIAs) also available.

The Broker Small Print

If you sign-up with one of the brokers featured in this roundup, there’s a few useful things to be aware of.

- Almost all trading platforms are free to sign-up for but require a minimum deposit before you can trade. This is usually anything from around $50 upwards. Some may periodically offer incentives of free trades if you open an account with large deposits although since 2018, platforms based in the EU are now prohibited from offering bonus incentives to open accounts. This is because of MiFID legislation (known as Directive 2014) which is aimed at creating more transparency and protection for traders.

- Online trading platforms make money either by setting commissions for trades or more commonly via what’s known as the spread. If a broker claims to offer “commission free trades”, they’re usually making money by widening the spread on trades. Some online brokers also allow you to open a margin account which allows you to borrow from the broker. The lower the margin rate, the better and you’ll find that this rate will decrease the more you borrow.

- Most broker platforms offer demo accounts where you can trade virtual currency in a stock trading simulator on your Mac before trading with real cash. We recommend using these paper trading accounts to get to grips with a platform before trading for real.

- Some trading platforms based outside of the US are not available to users in the USA due to strict laws on CFDs (Contract For Difference) and the Dodd-Frank Act. Likewise, trading platforms based in the USA are also not available to users outside of the US.

What I Looked For In These Trading Apps

In shortlisting these apps and platforms, I gave preference to tools that offered the following features:

- Mac Desktop App: Naturally, I gave preference to those platforms that offered a native Mac desktop for stock trading and analysis. Bonus points went to those that offered a native app for both Apple Silicon and Intel Macs (which were few and far between by the way).

- Chart Trading: The ability to place trades directly from charts is vital for day traders both for speed and trade execution

- Data Replay: This allows you to replay historical market data for backtesting strategies. Without it, evaluating or refining your trading approach becomes difficult..

- Stop-Loss Entries: Automatically attaching stop-losses and take-profit targets to your orders is very important, especially for beginners, to minimize risk and lock-in profits.

- Execution Speed: Fast trade execution is critical in day trading. Slow or laggy software can result in missed opportunities, so I looked for platforms that are snappy and reliable.

- Paper Trading: The best stock trading apps allow you to simulate trades first to get to grips with the software before you start trading with real cash.

- Availability in the USA: All of the following apps and platforms are available to users in the USA. Those based in the UK can also use some of these platforms.

- Investment Tracking Software: I gave preference to those platforms and app that enabled you to link them in some way with either personal finance software or investment tracking software to track your portfolio’s net worth.

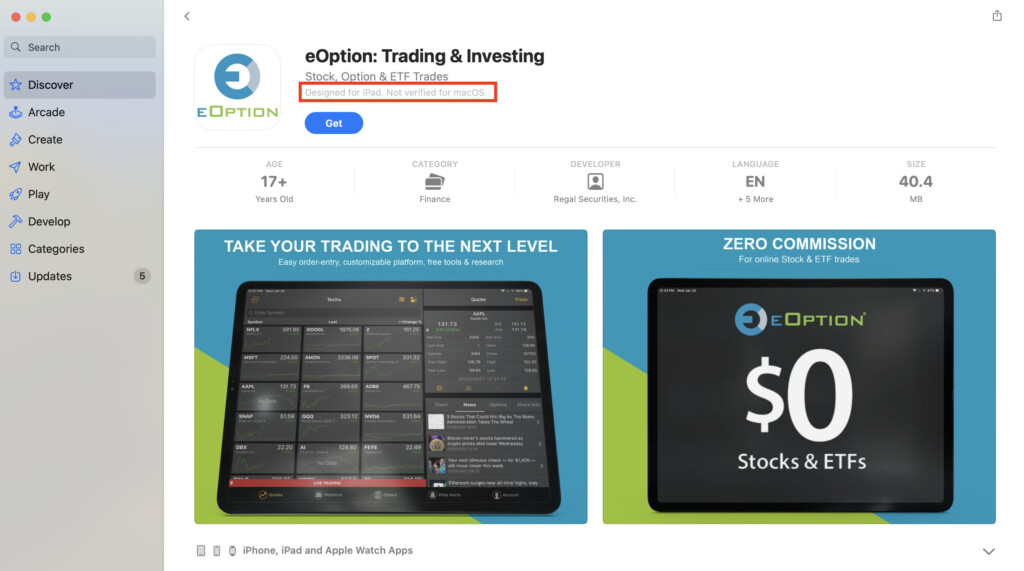

Using iPad Trading Apps on Macs

There are some trading apps for iPad that may run on Macs via the Mac App Store but they aren’t necessarily optimized for it.

One example is the eOption iPad app which is available for download in the Mac App Store but is labelled as “not verified for macOS” which means that it may not work well on a Mac as it’s designed for touch screens.

Running Windows Trading Software on Macs

If none of the apps reviewed here meet your trading needs and you want to run a popular PC or Windows-based software such as NinjaTrader or X-TRADER on your Mac, you can do so using a virtual machine.

This is also the only way to run MetaTrader on a Mac as it’s only available for Windows.

This isn’t an ideal solution because it requires running third party software and sometimes doesn’t offer all the functionality of the Windows version of the software anyway.

However, if really you can’t live without your Windows trading software, it’s the best solution.