DEGIRO is a European based trading platform founded in 2013 that offers some of the lowest fees in the stock trading industry.

With over 600,000 customers in 18 different countries, it’s one of the biggest pan-European trading platforms out there but also allows you to trade on stock markets in North America and Asia.

DEGIRO’s low fees and policy of no platform fees make it ideal for both frequent day traders and buy-and-hold investors.

In this review, we take a closer look at what it offers.

You May Also Like:

Table of Contents

- DEGIRO Quick Overview

- Regulation of DEGIRO and Investor Protection Scheme

- What are DEGIRO’s fees?

- Who Can Open a DEGIRO Account?

- DEGIRO Accounts

- What Can You Trade On DEGIRO?

- Which Stock Exchanges Can You Use On DEGIRO?

- DEGIRO Platform Features

- Is DEGIRO Any Good?

- Is DEGIRO Good For Long Term Investing?

- Is DEGIRO good for beginners?

- Is DEGIRO good for day trading?

- How do I withdraw money from Degiro?

- Training Resources

- Does DEGIRO Offer SIPP and ISA Accounts?

- DEGIRO Downsides

- DEGIRO Customer Support

DEGIRO Quick Overview

- Based and regulated in Holland

- Low trading fees

- No inactivity fee

- No minimum deposit

- Supports 9 different currencies

- Trade Stocks, ETF, Funds, Bonds, Options, Futures, Cryptos

Regulation of DEGIRO and Investor Protection Scheme

Your funds placed in DEGIRO are insured. DEGIRO is considered an investment firm and so you are covered by the €20,000 Dutch Investor Protection Scheme (Beleggerscompensatiestelsel) as it is authorized by the Netherlands Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB).

In addition, DEGIRO was recently acquired by German broker Flatex which is one of the leading online brokerages in Europe and will only enhance DEGIRO’s stability.

So basically, DEGIRO is subject to the same regulations as any Dutch bank so your funds are protected in the same way.

What are DEGIRO’s fees?

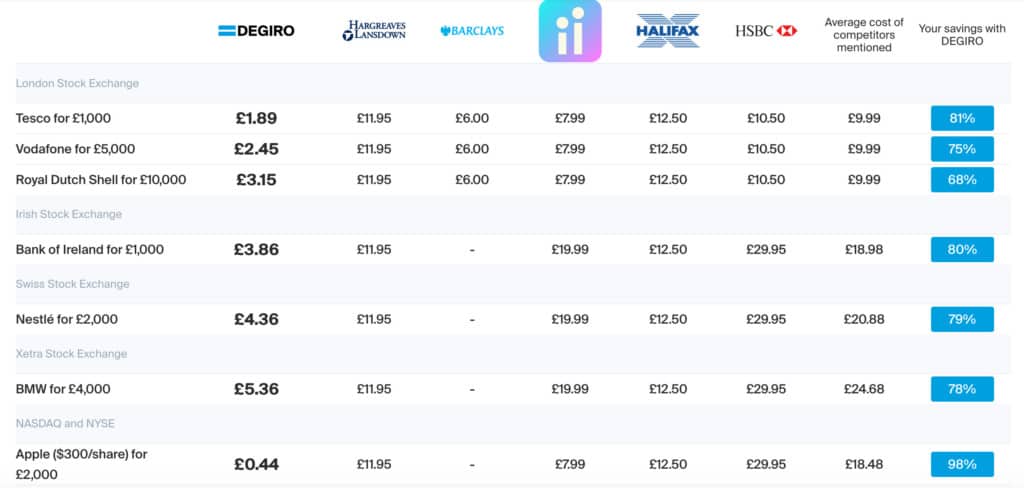

DEGIRO’s low fees are easily one of it’s biggest attractions. In the UK, it costs just £1.75 + 0.014% per trade for individual shares with a maximum charge of £5 per trade.

Other countries charge similar rates such as:

- Austria, Belgium, Denmark, Finland, France, Ireland, Italy, The Netherlands, Norway, Portugal Spain, Sweden, Switzerland – 4.00 EUR + 0.05%

- Canada – 2.00 EUR + CAD 0.01 per share

- Australia, Hong Kong, Japan, Singapore – 10.00 EUR + 0.06%

Note however that if you’re in the UK and trade outside of the London Stock Exchange, there is an extra €2.50 per year charge. DEGIRO offers real-time for free among the Euronext exchanges and US markets with BATS.

In Europe, fees for trading funds start at €7.50 plus 0.10% for exchange-listed investment funds but this can go up to €75.00 plus 0.10% for non exchange funds. Note that there is also a holding charge of 0.2% per year.

Who Can Open a DEGIRO Account?

You need to be resident in one of the 18 countries that DEGIRO serves in order to open a DEGIRO account. That includes:

- Austria

- Belgium

- Czech Republic

- Denmark

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Netherlands

- Norway

- Poland

- Portugal

- Spain

- Sweden

- Switzerland

- United Kingdom

You also need an EU, Norwegian or Swiss bank account in your own name to open a DEGIRO account.

DEGIRO Accounts

DEGIRO offers five account types:

- Basic (No leveraged products, no extra fees)

- Custody (DEGIRO cannot lend your stocks to a third party)

There are three account types that offer leveraged products that you can switch to from a Basic account.

- Active

- Trader

- Day Trader

Note that you can’t switch to these accounts from a Custody account.

It can take up to 3 working days while DEGIRO verifies your account as you have to provide ID documents which is standard with all financial organizations as part of the KYC (Know Your Customer) requirements to prevent money laundering.

The minimum deposit is £0.01 but it must be made by bank transfer. DEGIRO does not accept funding or withdrawing from your account via credit or debit card.

Note that if you switch accounts, you have to setup a whole new profile – you can’t just switch between them seamlessly.

What Can You Trade On DEGIRO?

DEGIRO allows you to trade a wide range of instruments and assets including:

- Shares

- Investment funds

- Exchange-traded funds (ETFs)

- Futures

- Leveraged products

- Bonds

- Options

- Warrants

You cannot trade Forex however on Degiro.

Which Stock Exchanges Can You Use On DEGIRO?

One of DEGIRO’s biggest attractions is the number of stock exchanges that it allows you to trade on. Even though it’s Dutch based, you can trade on almost any major stock exchange.

European Stock Exchanges:

Euronext Amsterdam

Euronext Brussel

Euronext Paris

Xetra

Borse Frankfurt

London Stock Exchange

Vienna Stock Exchange

SIX Swiss Exchange

OMX Copenhagen

BOlsa de Madrid

OMX Helsinki

Athens Stock Exchange

Budapest Stock Exchange

Euronext Dublin

Borsa Italian S.p.A.

Oslo Stock Exchange

Warsaw Stock Exchange

Euronext Lisbon

OMX Stockholm

Prague Stock Exchange

Istanbul Stock Exchange

North America Exchanges:

NASDAQ

NYSE

NYSE MKT

NYSA Arca

Currenex

Toronto Stock Exchange

Toronto Ventures Exchange

Asia and Oceania Exchanges:

Australian Securities Exchange

Hong Kong Exchange

Tokyo Stock Exchange

Singapore Exchange

DEGIRO Platform Features

DEGIRO’s main trading platform is called WebTrader which works via a browser and via the DEGIRO mobile app. Via WebTrader you can see your portfolio, order capabilities, real-time streaming quotes and market news.

There’s a QuickOrder button at the top of the platform to place trades quickly and you can place orders by value or number of stocks.

You can add your most traded assets or stocks to a favorites list for quicker trading.

DEGIRO WebTrader also offers financial reports, upcoming dividends and earnings notifications and analyst ratings.

DEGIRO has pop-out interactive charts with 13 different indicators, drawing tools and multiple chart types. You can save chart templates although overall, the TA tools are not DEGIRO’s strongest point.

The mobile app has been improved a lot and now allows you to do pretty much everything you can on desktop including place orders and create watchlists.

You can also use face recognition and touch ID to login into the DEGIRO iOS and Android app.

Is DEGIRO Any Good?

It’s impossible to say that DEGIRO is “good” for everyone but if you’re looking for a no-frills low cost broker, then DEGIRO offers some of the lowest rates in the industry.

You can trade on multiple stock exchanges worldwide and the WebTrader platform is very easy to use with no bloated, confusing features.

If you’re looking for something with lots of technical analysis tools and professional training tips, then DEGIRO might not be for you however.

DEGIRO manages to offer such low trading fees by cutting down on all the extras you get with many other trading platforms.

Is DEGIRO Good For Long Term Investing?

DEGIRO is a very good choice for long term investors since there’s no account opening fee, no inactivity fee and it offers free withdrawals.

This is quite unusual for trading platforms and so it’s popular with long-term investors that don’t trade very frequently.

Is DEGIRO good for beginners?

DEGIRO is an excellent platform for beginners. It’s one of the simplest we’ve seen and the platform doesn’t overwhelm you with lots of unnecessary tools or features.

However, it may not be the best platform to develop you as a trader as the training materials are limited.

DEGIRO is however slowly expanding its stock market training and educational resources so this is changing.

Experienced traders may also feel the technical analysis tools in DEGIRO are lacking although we recommend also using stock trading software alongside any stock trading platform for technical analysis anyway.

Is DEGIRO good for day trading?

DEGIRO’s low fees meant that it’s a very good option for day traders that trade frequently.

DEGIRO also allows scalping or hedging but shorting has certain limitations depending on the product being traded.

How do I withdraw money from Degiro?

You can withdraw funds from DEGIRO simply by logging into WebTrader and clicking on the ‘Deposit/Withdraw Funds’ button.

Simply select the option ‘Transfer funds from your investment account to your nominated bank account’ with the amount you would like to transfer.

Typically funds are transferred to your bank account within 2 to 4 working days.

Training Resources

DEGIRO doesn’t have extensive training or learning materials because it’s generally self explanatory and aimed at beginners to trading.

There is however an Investors Academy which is an online training course for those new to trading. These are in video format with text transcripts.

There’s very little on technical analysis or charting though so we recommend you check out some of these stock charting tools to assist with your trading.

However, considering the low fees that DEGIRO offers, it’s understandable that the training materials are limited.

Does DEGIRO Offer SIPP and ISA Accounts?

For UK users, there are no Self Invested Pension Products (SIPP) or Individual Saver Accounts (ISA) with DEGIRO. This is mainly because it is a Dutch based rather than UK based trading platform.

DEGIRO Downsides

As already mentioned, DEGIRO lacks extensive training materials for those that want to become professional traders.

DEGIRO is firmly aimed at those new traders and as such is definitely one of the best trading platforms for beginners we’ve seen.

One thing we’d really like to see in DEGIRO is a practice trading account.

A paper trading or virtual trading account is a safe way to test a platform without losing real cash and it’s hard to understand why DEGIRO doesn’t have one.

For UK users, the lack of SIPP and ISA accounts also means that there aren’t any tax advantages to using DEGIRO.

However, the incredibly low trading fees may well offset any tax savings anyway and it all depends on how active you plan to be as a trader.

DEGIRO Customer Support

You can contact DEGIRO by phone and email and it supports 18 different languages which is unusual for any trading platform to support so many nationalities.

Phone support is between 07:00-21:00 CET weekdays.

You can open a DEGIRO account here to try it for yourself.

Disclaimer: Investing Involves Risk Of Loss