Any advantage you can get in Forex trading counts so we’ve looked at the top forex trading platforms for Mac of 2025.

While Windows users can use just about any forex platform, forex trading on a Mac is a little more complicated due to the lack of platforms and software that support macOS.

While there is plenty of excellent stock trading software for Macs that support Forex, there are less Mac compatible Forex only tools available.

However, here we’ve shortlisted the best ones including those that offer generous free versions.

Most of them now not only allow you perform technical analysis, but also connect to brokers so you can trade instantly from them.

Table of Contents

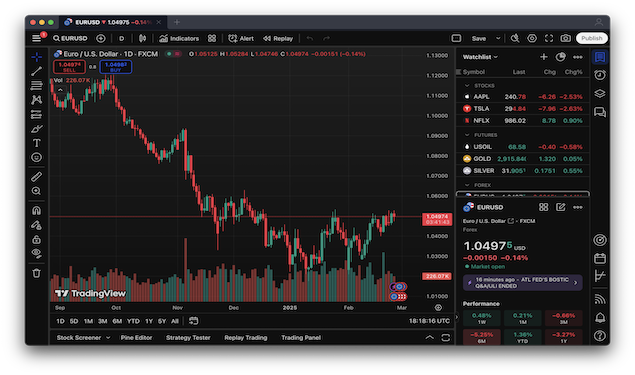

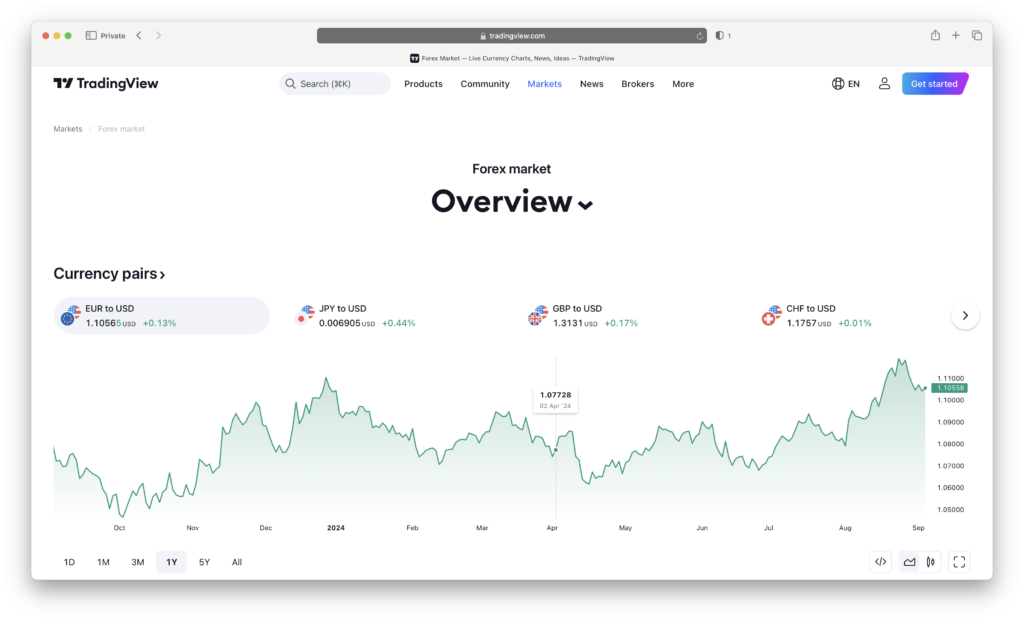

1. TradingView (FREE)

When it comes to forex charting and technical analysis, nothing beats TradingView in our opinion.

The platform has the most active community of day traders of any platform partly because many of its features are FREE to use.

TradingView has a slick Mac desktop app that allows you to connect it to major brokers such as Oanda, TradeStation and FXCM.

For those seeking an alternative to MT4 on Mac, TradingView is the ideal replacement.

The TradingView Forex page provides a clear overview of the most important global developments in the currency markets with the real-time value of major currencies.

There’s also a convenient Economic Calendar of important events and news feed for the latest currency news.

The community feed provides a constant stream of commentary from top traders giving advice and tips on currency movements making TradingView a very accessible tool too.

The paid plans of TradingView provide faster real time data, a wider range of real-time stats, more intraday reports and you can have more charts per tab open.

You also get feeds for NASDAQ, NYSE and NYMEX.

You can read our full TradingView for Mac review for more.

Pricing: Free, paid plans start from $12.95

Pros:

- Free to use

- Amazing range of charts

- Integrated with broker platforms so you can trade the market

- Active community of traders

- Customizable time frames

- Mac desktop app

Cons:

- Doesn’t work with all forex broker platforms

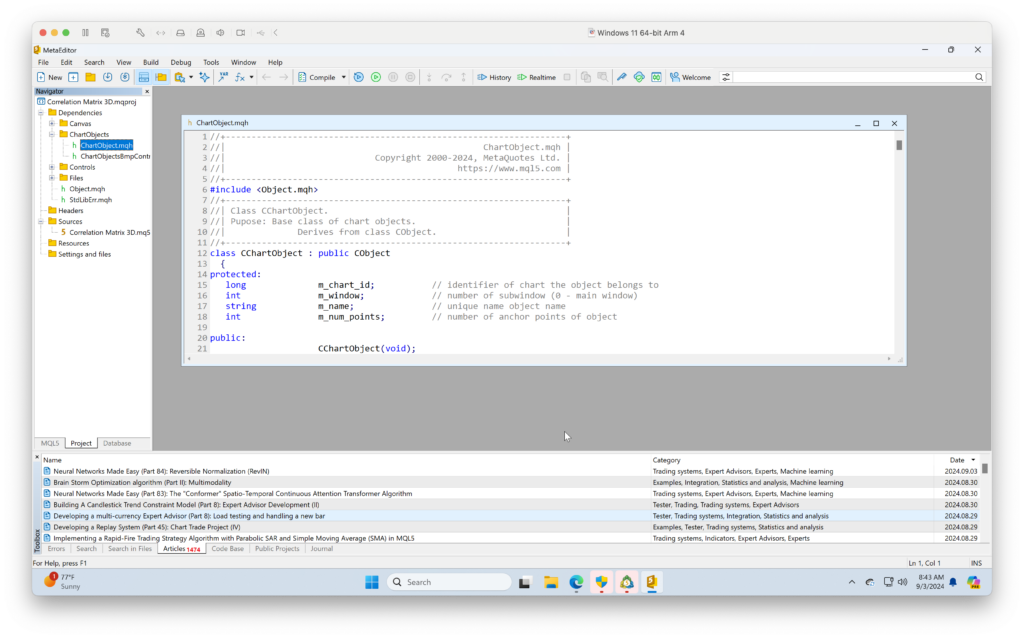

2. MetaTrader (MT4 & MT5)

MetaTrader is the most widely used Forex trading software in the World but it unfortunately, it isn’t available for Macs.

However, the good news is that you can install MT4 and MT5 on a Mac using a virtual machine.

A virtual machine enables you to run Windows alongside macOS so that you can use PC only apps such as MetaTrader.

You can connect MetaTrader to most major brokers so once installed, you can trade directly from it too.

Many brokers such as IG, XM, Milton Prime and IC Markets also do the hard work for you by creating a ready-made version of MT4 or MT5 for Mac if you open an account with them.

You can read our full guide on how to install MT4/MT5 on a Mac for more.

Pricing: Free

Pros:

- The most widely used Forex technical analysis app

- Connects to major brokers for trading

- Choose from either MT4 or MT5

Cons:

- Requires some technical experience

- Requires third party software to run on Macs

3. NinjaTrader

NinjaTrader is a powerful trading platform which is extremely popular with Forex traders due to its advanced charting, technical analysis tools, and wide range of features.

Unfortuntely, it’s not available for Mac but you can also run NinjaTrader on a Mac with a Virtual Machine.

Although this requires third party software, it’s well worth it due to NinjaTrader’s real-time data analysis, customizable charting tools, and comprehensive market indicators.

NinjaTrader allows you to observe price movements through multiple chart types (e.g., candlestick, line, bar charts), as well as leverage automated trading strategies through custom or pre-built algorithms.

The platform’s robust backtesting feature also enables you to test trading strategies using historical market data.

You can also trade directly ftom NinjaTrader by integrating it with Forex brokers such as FXCM and FOREX.com.

Other pro features include custom orders, limit, stop, and conditional orders to manage risk.

Pricing: Free to use but $60 for broker integration

Pros:

- Advanced Charting

- Automated Trading

- Backtesting and Simulated Trading

- Lots of Third-Party Add-Ons

Cons:

- No Mac desktop version

- Requires a virtual machine to run on a Mac

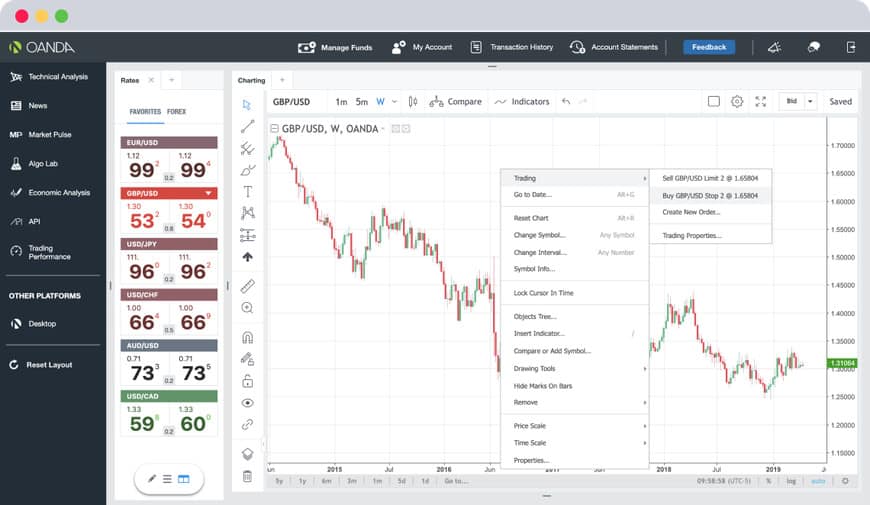

4. Oanda FX Trading

Oanda (formerly known as Currensee) is an award-winning currency trading platform with no minimum trade size and no minimum deposit.

You can trade on over 100 different instruments including currency pairs (Forex), indices, commodities, bonds and metals.

Oanda is also one of the few Forex trading platforms to offer a Mac desktop app, although all it effectively does is retrieve the web version without using the browser.

It’s also integrated with TradingView meaning if you sign-up for a TradingView account, you can link it to Oanda to trade the FX market in real time.

One of the ways Oanda sells itself on its pricing transparency meaning there are no added commissions on your trades and unlike many Forex trading platforms, no minimum trading amounts.

There are some useful tools in Oanda such as the Currency Strength Heatmap and Historical Forex Position Ratios.

Oanda doesn’t offer much in the way of advice when it comes to Forex trading but it does have a some very good free Forex training tutorials via the Oanda Academy.

Oanda puts a strong emphasis on being transparent with customers and adhering to regulations specific to each global area.

We recommend trying a few paper trades first via an Oanda demo account to get a feel for it.

Pricing: Free app, trading commissions vary

Pros:

- Looks slick on macOS

- Mac desktop app

- Forex training academy

- Transparent pricing

Cons:

- Desktop client is basically web version

- Not many forex specific tools

5. cTrader

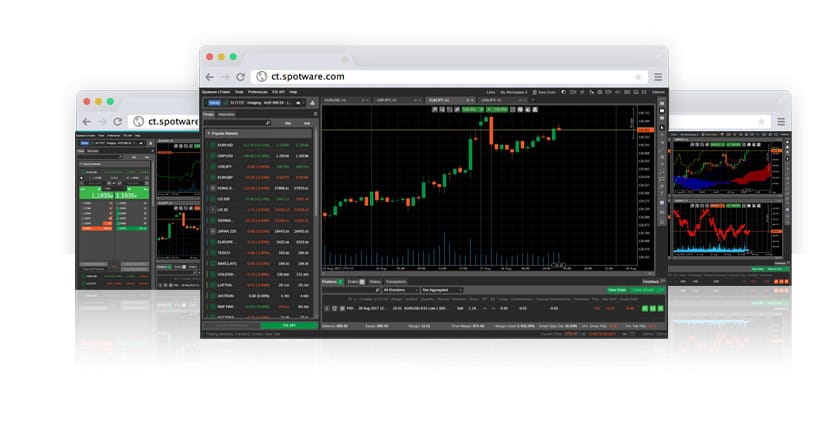

cTrader has rapidly developed to become one of the major Forex trading rivals to MT4 and this has grown due to incompatibility problems between macOS and MetaTrader.

cTrader only has a desktop client for Windows but Mac users can now use the free cTrader web client which offers all the functionality of the desktop client.

The cTrader platform looks and feels a bit slicker than MT4, it’s easier to navigate and it supports more order types. However, in terms of overall features, there’s not much to choose between them, especially for beginners.

The same features such as charts, trade logging, account management tools, back testing and technical indicators are all available in both.

For those that are already accustomed to MT4 and want something very similar on their Mac, the cTrader web platform is certainly worth a closer look.

Pricing: Free

Pros:

- Web version can be used on any Mac in a browser

- Similar tools to MT4 and MT5

- Lots of back testing tools

Cons:

- Desktop version only available for Windows

- Mac users can only use the web client

Forex Trading Software Tips

Here’s a few things we discovered when investigating Forex trading options for Mac users that it’s worth being aware of.

Instant Forex Trade Execution

One thing you should always check is how the forex platform you’ve chosen executes trades.

Believe it or not, some brokers don’t actually execute forex trades immediately the moment you buy or sell.

Rather, once you’ve made your trade, it is sent to an Execution Desk or Dealing Desk (DD) for processing.

This creates delays and therefore potential losses in the time between trade and execution which in the fast-moving world of currencies, can be significant.

Fortunately, most brokers now offer instant trade execution but it’s always worth making sure before signing-up as there’s nothing worse than finding out your trades aren’t in real-time.

Margin and Leverage

One of the good things about forex is that most brokers don’t charge commission on trades like they do with stock market trading.

Most forex brokers make money by capturing part of the spread i.e. the difference between what you can buy and sell currency on each trade although some brokers have specific revenue models that differ from this.

The other attractive thing about forex trading and the international currency market is that you can buy and sell with far more than you have in your account.

This is called your Margin or Leverage and differs from broker to broker.

So for example, with just a small deposit of $100 and a broker offering leverage of 1:100, you can make currency transactions up to $10,000 even if you don’t have that much in your account.

However, it’s very important to be aware that the reverse is also true.

Your losses can also be equal to any potential gains and brokers require a deposit to cover any potential losses based on their leverage rate.

Many forex brokers offer a rate of leverage or margin which is typically 1:50 although it can be much more than this depending on the broker.

Some Forex trading platforms also offer PAMM Services (Percentage Allocation Money Management) which is when traders pool money together to trade.

This means that you can take advantage of more experienced brokers to trade money for you although not all platforms offer this feature.

Demo Accounts vs Real Trading

Most forex platforms provide free demo accounts, usually with several thousand dollars worth of pretend currency.

This is a great way to get familiar with forex trading in general if you’re new to it.

However, it’s very easy to get a false sense of security with demo forex accounts and there’s a few things to be aware of when using them.

Demo accounts operate in a simulated market environment and therefore don’t always reflect real-time market liquidity.

Although they are based on current market conditions, in some demo accounts, there may be a delay between live and simulated pricing.

In a real world trading environment, you may also experience rejected orders and slippage with Forex trades.

This usually doesn’t happen with demo accounts so be prepared for such things if you open a live account.

The margin requirements may not be the same in demo accounts as they are in live accounts as brokers often update live margins but demo accounts may not always coincide with those of real accounts.

Finally, don’t underestimate the psychological difference between trading pretend currency and real currency either

The pressure when trading large volumes of hard cash can be significant and a simulated environment can’t replicate this.

Some products or features may not be available on demo accounts so you may not be getting the full platform experience.

Profit Withdrawals

Different brokers have different policies on profit withdrawals.

It usually takes a few business days but some take longer than others depending on the payment method chosen such as Wire, PayPal, Check etc.

Global Availability

Some Forex trading platforms are not available worldwide.

Those that are based in the US are always available in the USA but many platforms based in other countries don’t accept customers from the US.

All of the Forex trading platforms reviewed here are available to users in the USA and its dependencies.

Trade With Caution

Finally, probably the best advice we can give when forex trading on your Mac is simply to trade with caution.

Forex trading in particular is high risk due to leveraged trading which allows you to risk far more than you actually trade with.

The most important rule in trading is you must only trade using your risk capital.

Chasing losses or risking other capital is extremely risky and can end in financial ruin if left unchecked.

Fortunately, almost all Forex brokers allow you to set a minimum margin requirement so that a margin closeout will occur if the market turns suddenly.