Moneyspire 2024 is a well-organized and effective personal finance application for Mac and PC. If you’re looking for a desktop alternative to Quicken for Mac, it’s an excellent choice.

Even better, you can currently get 25% off Moneyspire for Mac for a limited period.

Unlike Quicken, Moneyspire doesn’t require any subscription fees.

Moneyspire also doesn’t host any of your financial data in the Cloud – everything is stored on your Mac desktop if you prefer that.

In this review, we take a closer look at what Moneyspire can do and give you our thoughts on it. Since the Moneyspire app is the same on both Mac and PC, this review will be of interest to both Mac and Windows users.

Table of Contents

Moneyspire Review

If you’re looking for a simple but effective desktop personal finance software for your Mac, then Moneyspire is easily one of the best options out there.

Some of the main reasons we like Moneyspire so much are:

- It’s desktop based. Moneyspire doesn’t host any of your financial data in the Cloud. You can choose to use Moneyspire Cloud (for free) which syncs data between your Mac and mobile device but this is optional.

- It’s got both a Mac & PC desktop client.

- There’s no subscription. Moneyspire is a one-off purchase fee of $59.99 which is currently 25% off off the full price of $79.99 and very reasonable compared to other Mac personal finance software.

- Moneyspire is very easy to use with no bloated features that you don’t need.

- The online banking integration comes at no additional cost. There’s no extra cost for using Moneyspire Connect (although it no longer supports Direct Connect).

- Moneyspire allows you to do essential budgeting tasks such as reconciling accounts, manual transaction entries, split transactions, automatic bill payments/reminders etc.

Here we take a look at Moneyspire for Mac in more detail.

Moneyspire Features & Functionality

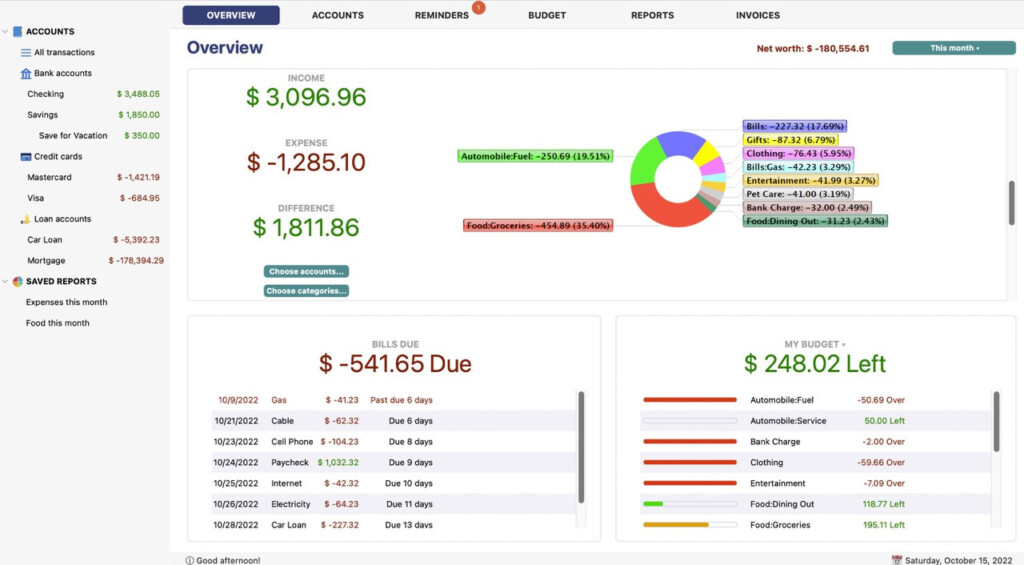

The first thing to look for in any decent personal finance tool is whether it gives you a good overview of your finances. Moneyspire certainly does this with an easy to read, no fuss dashboard.

You can link an unlimited number of checking, credit card and loan accounts to Moneyspire and some investment houses too.

Investment account support used to be limited in older versions of Moneyspire using Moneyspire Connect but this has now been improved considerably in Moneyspire 2024 and includes linking of Vanguard accounts and many others.

However, if you need better investment tracking support we strongly recommend Empower instead (formerly known as Personal Capital) which is our top rated portfolio management software for Mac.

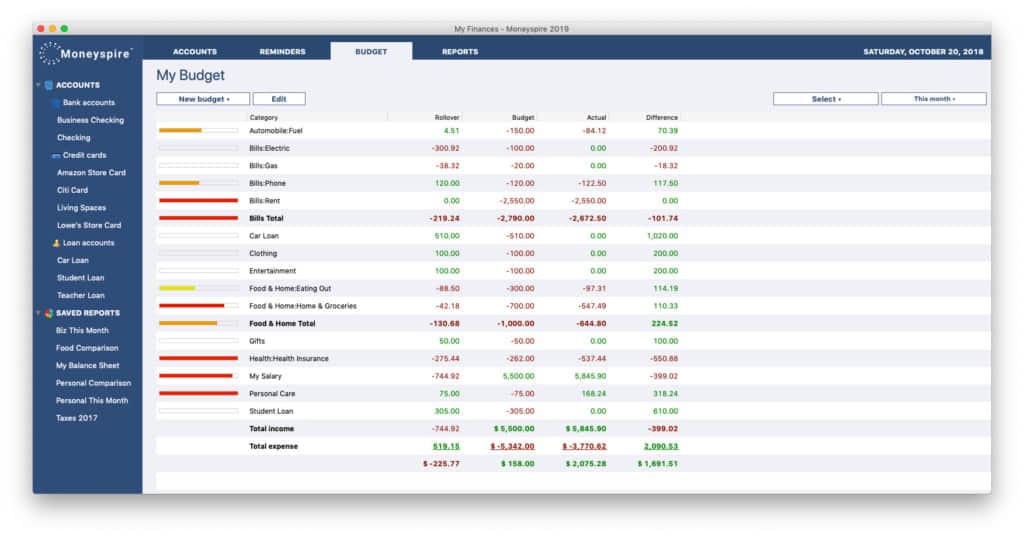

Along the top of the Moneyspire dashboard are four main tabs with all the essentials – Accounts, Reminders, Budget and Reports.

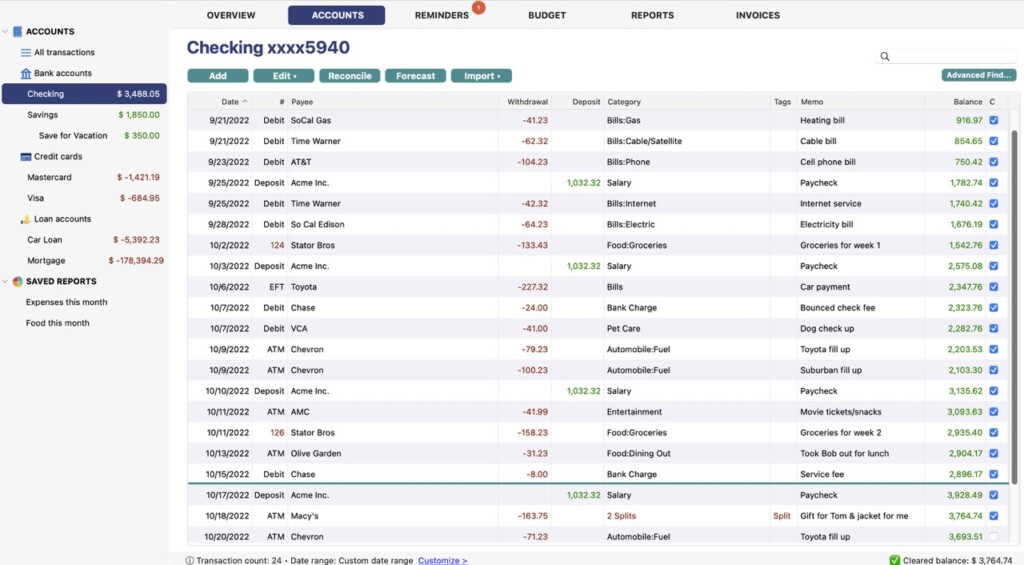

The Accounts view gives you a very good overview of your overall balance and transactions in one place. You can easily search transactions and assets by name, amount, number, payee, memo, category or tags.

You can also add useful attachments to transactions in Word format, images and PDF files.

This is extremely useful when searching for receipts and guarantees or if you want to go paperless on your Mac at home or in the office.

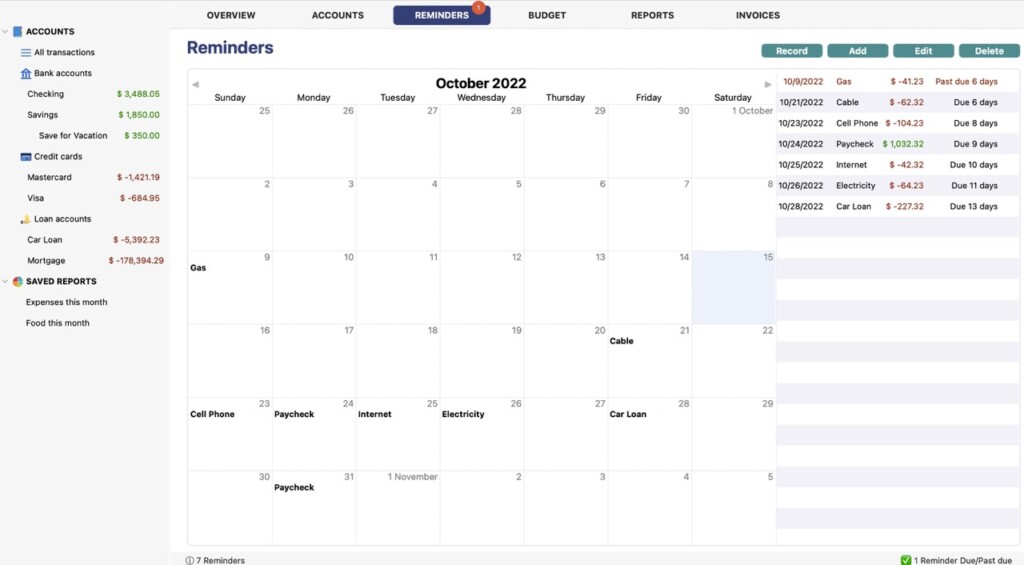

In the Reminders tab, Moneyspire has a useful calendar view to keep on top of bills and makes it clear to see when they’re due.

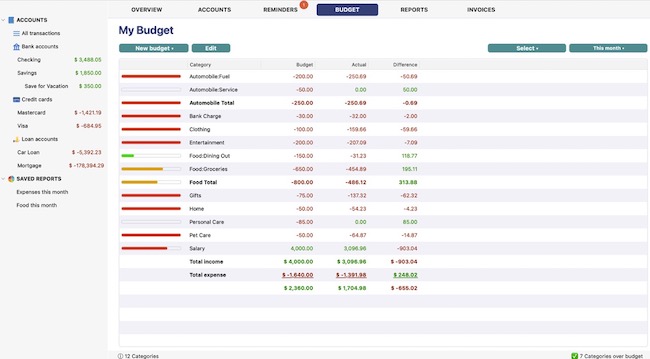

The Budget tab shows you how on target you are for various categories with figures for current rollover, budget target, actual spending and total difference.

Under the Reports tab, there are various options including:

- Income vs expense summary

- Income vs expense detail

- Monthly comparison

- Transaction history

- Balance sheet

- Expenses chart

- Net worth trend chart

- Subtotal by accounts, categories, payees and tags

- Export to spreadsheet (CSV)

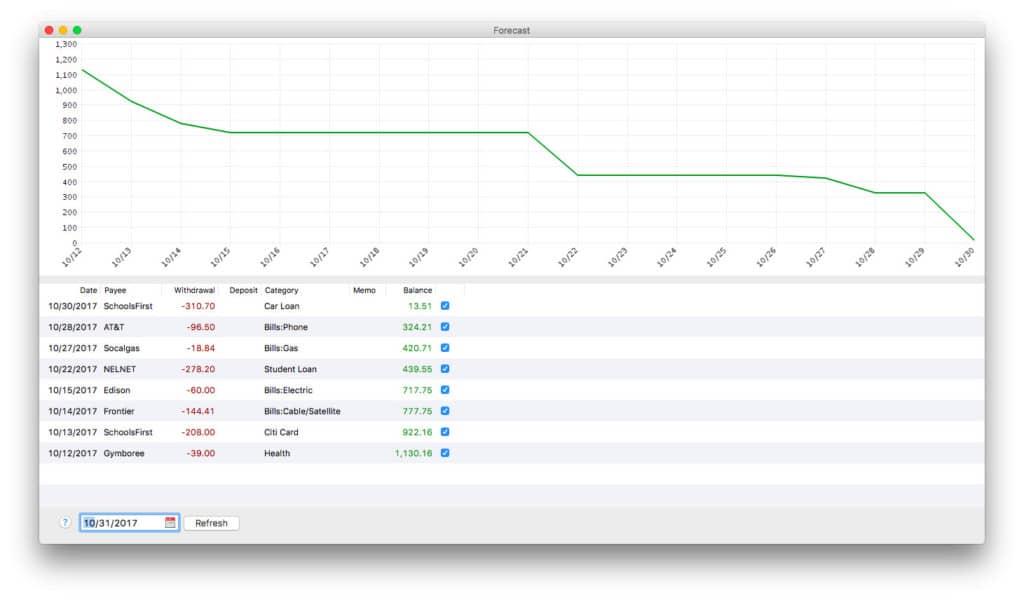

There’s also a useful Forecast view to help you avoid unexpected overdraft fees and bounced payments.

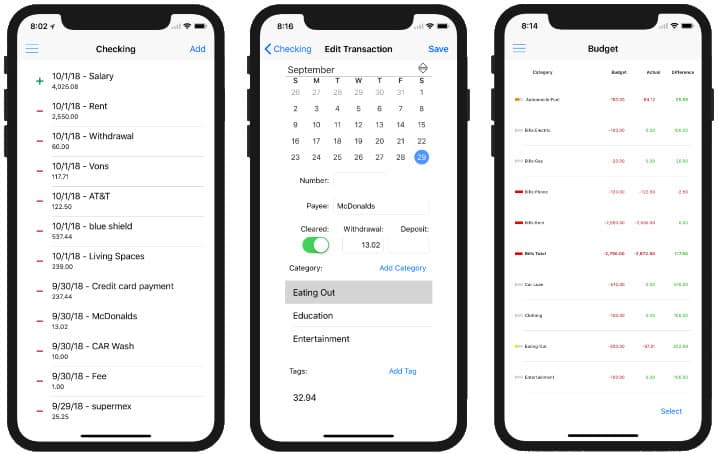

Another thing we appreciate about Moneyspire is the mobile app for iPhone and iPad is free.

It’s also pretty good compared to many personal finance apps allowing you to edit transactions on the move, check your budget and view all your checking accounts at once.

Overall, Moneyspire is highly customizable including everything from font colors and size to register columns and column order.

Other nice touches to Moneyspire include:

- Bulk-edit transactions

- Copy and duplicate transactions

- Cut and paste transactions between accounts

- Learns how to automatically categorize transactions (feature can be turned off)

- Keeps track of cleared and uncleared transactions and balances

- Multi-currency support so Moneyspire can be used in any country not just the USA. This includes downloading of exchange rates and transferring of money between foreign accounts.

- Moneyspire is also available in multiple languages including English, Spanish, French, Portuguese, German and Italian

- Check printing (including payee address) and calibration of check stocks. Read more on other check printing software for Mac here.

- Ability to separate personal and business accounts

Importing Quicken Files Into Moneyspire

Many Quicken users have switched to Moneyspire after being disillusioned with Quicken For Mac, especially after it moved to a subscription only model.

Moneyspire can import Quicken (and Mint files) although as with most personal finance apps that offer this feature, this isn’t without its problems.

The issue is that Quicken files are usually complex and inevitably, you’ll find that there are import errors, duplicate transactions and other things that need cleaning up.

It really depends on the complexity and extent of your Quicken accounts, whether there are attachments etc.

So basically, Moneyspire can import Quicken files although you may find transactions missing or have to do a lot of cleaning up.

In some cases, it may work better exporting your Quicken accounts in CSV format and then importing that into Moneyspire.

Our advice is to start your accounts from scratch with Moneyspire and keep your Quicken accounts for legacy purposes.

The other problem is that since Quicken 2019, the Mac version no longer exports to QIF format.

However, the Windows version of Quicken still exports to QIF so Mac users must open their accounts on a PC and export them if they want to import them to another program.

Online Banking & Moneyspire

Moneyspire offers one of the most generous online banking deals of any personal finance tool on Mac.

There’s no extra cost for Moneyspire Connect which allows you to automatically download transactions for 15,000 institutions worldwide.

This avoids the painstaking need to manually enter accounts and transactions from your accounts.

However, Moneyspire no longer works with the standard Direct Connect service offered by most financial institutions which you can use to pay bills.

However, some banks such as Wells Fargo charge for using services such as Moneyspire Connect and Direct Connect so check with your financial institution first.

You can also import OFX, QFX, QIF and CSV files or drag and drop files from your bank into Moneyspire.

You can export to QIF and CSV which you can import into other financial tools if you choose to switch from Moneyspire at any time.

Moneyspire Security

One of the big attractions of Moneyspire is that it doesn’t store your financial data in the Cloud. Everything is kept on your Mac desktop.

If you choose to use Moneyspire Connect to sync to the Moneyspire Mac and Mobile apps you have two options, one of which does go through the Cloud.

You can either sync through the Cloud based Dropbox service or you can choose to sync manually through your iTunes account (which does not go through the Cloud).

Whichever method you choose, all financial data is stored in a single file which is encrypted by military grade 128-bit encryption. You can configure automatic data backup to a customizable location.

What’s New In Moneyspire 2024?

Minor updates to Moneyspire are free but major updates usually cost. Currently if you upgrade from an older version of Moneyspire to Moneyspire 2024 you can get $40 off.

There are various changes and improvements in the latest versions of Moneyspire, but the most notable are:

- A much improved user interface

- Streamlined reports for more efficient report generation

- More date timeline comparisons possible

- New weekly and and yearly budget overview

- New optimized app for Apple Silicon M1/M2/M3 chips Macs

- Now individual accounts can be excluded from budgets to give you even finer control over your budget

- Added additional world currency support

- Improved user interface design for a more delightful user experience

There have been various improvements to the mobile app too including:

- Multi currency support

- More transaction history

- Face ID/ Touch ID support

Moneyspire Pricing

Moneyspire 2024 Standard is currently 25% off at just $79.99 compared to the full price of $99.99 which is excellent value for a one-off payment personal finance software.

Moneyspire 2024 Pro which also includes invoicing is currently 25% off at $99.99 compared to the full price of $119.99.

There are no additional charges for Moneyspire Connect or mobile apps like with many other personal finance apps although your bank may levy charges for using these.

Licenses are valid for a lifetime and one license is valid on both Mac and PC. Minor updates are free although major updates are offered at a discount to users.

Customer Support is free and available online via email. Most users report that Moneyspire response times are fast and helpful.

If you’re looking for a simpler alternative to Quicken without a subscription, then Moneyspire is an excellent option.

It’s not as complete or advanced as Quicken but it’s much cheaper and easier to use.