Update: Quicken 2018 for Mac has now been released and Quicken 2016 is no longer available. Check out our review of Quicken 2018 for Mac for more.

Quicken For Mac 2016 has been released today despite it taking 7 years for Intuit to release the last big update to Quicken last year.

This is probably the last ever version we’ll see from Intuit because in March 2016, the company announced that it has sold Quicken to private investment firm HIG Capital.

The big question is, does this final throw of the dice by Intuit disappoint as much Quicken 2015 or has Intuit finally made peace with Mac users?

We took a closer look and reviewed Quicken 2016 on Mac although the results were quite disappointing and we’re recommending switching to one of these alternatives to Quicken on Mac.

Table of Contents

Bill Pay Returns

You might have guessed it from the headline but the big addition to Quicken For Mac 2016 is finally – yes finally – Bill Pay online payments.

8 years after it first appeared in Quicken 2007 for Mac only for Intuit to bizarrely Kill Bill (Pay) in Quicken 2015 last year, Quicken 2016 now supports Direct Connect Bill Pay from over 450 banks and it also allows you to transfer funds between accounts at the same financial institution.

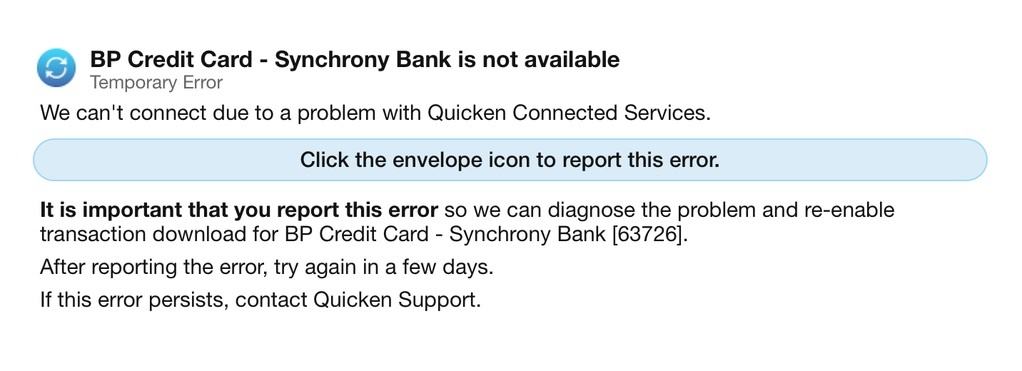

Of course, this is still limited to banks that support Direct Connect Bill Pay and as many Quicken users will tell you on Mac, it doesn’t sometimes work as well as it should.

Intuit don’t seem to have provided any official list of banks that work with Direct Connect on Mac so you have to contact your bank in order to check whether it’s supported or not.

Note that confusingly, Quicken 2016 for Mac does not support Quicken Bill Pay for direct bill payments from your account.

Direct Connect Bill Pay is a completely different service to Quicken Bill Pay which only works in Quicken 2007 for Mac and the Windows version of Quicken.

If you’re thinking that you’ll just buy Quicken 2007 instead then, you’re out of luck. Quicken 2007 for Mac does not officially support anything higher than OS X Lion and Intuit don’t even sell it anymore although you can buy it from resellers on Amazon still.

Quite why Intuit decided to not include this essential feature in Quicken 2016 is a mystery but a good example of why Mac users are continually frustrated with the way Intuit does business on OS X.

This is extremely confusing for customers and our advice is make sure that your bank supports Direct Connect Bill Pay before upgrading because Quicken Bill Pay simply won’t work with it.

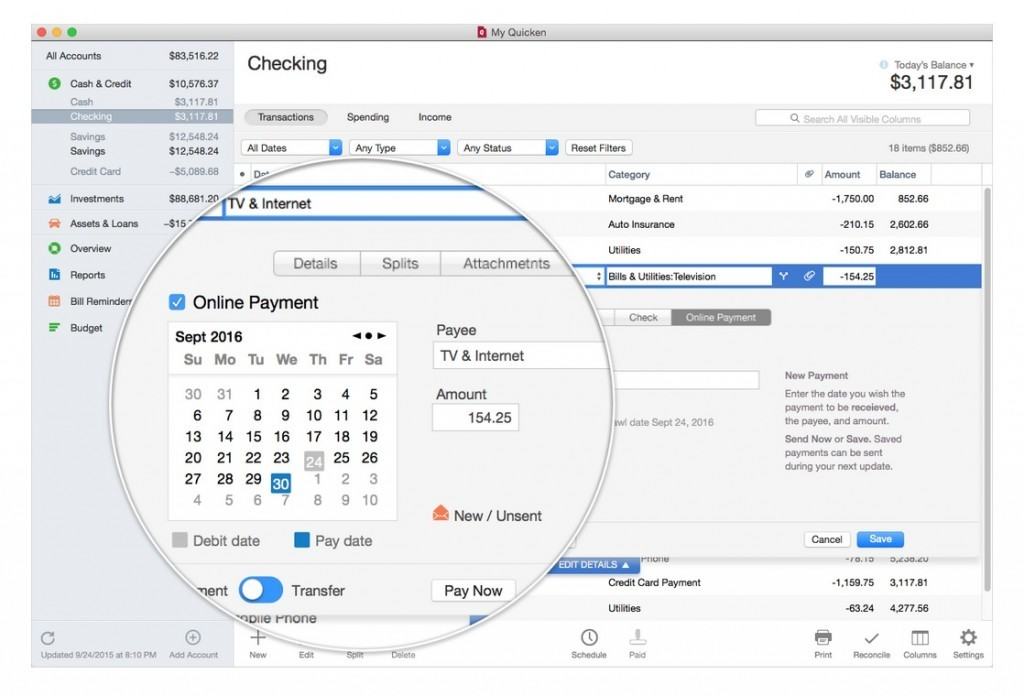

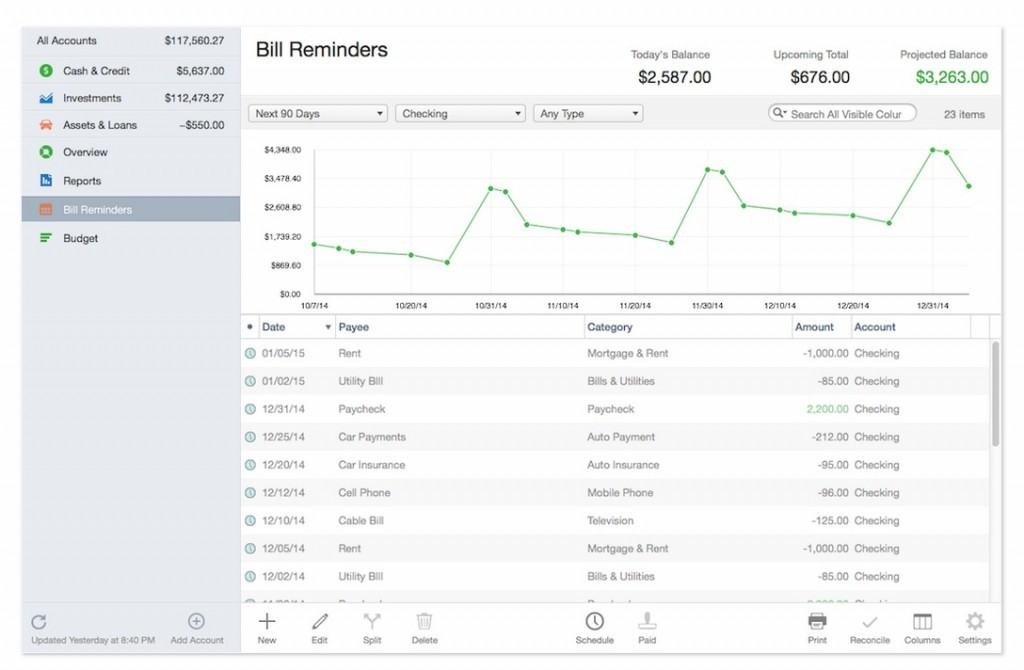

If you’re one of the lucky ones and Direct Connect Bill Pay is supported by your bank, Quicken 2016 makes things a bit easier with a useful calendar for tracking and reviewing transactions by Bill Pay as well as scheduling future payments.  The problem with Quicken 2016, as with Quicken 2015, is that Bill Pay and Direct Connect sometimes simply do not work giving you “temporary error” messages such as the one below.

The problem with Quicken 2016, as with Quicken 2015, is that Bill Pay and Direct Connect sometimes simply do not work giving you “temporary error” messages such as the one below.

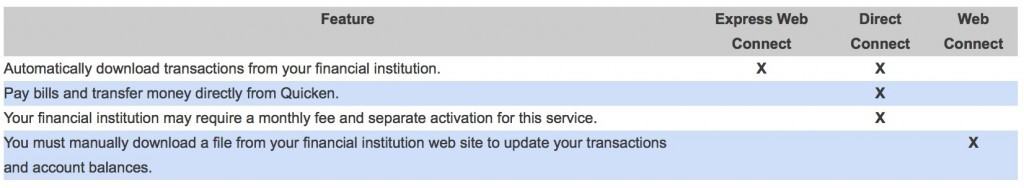

It very much depends on what system your bank supports because Quicken uses three different ways to connect to your bank account – Quicken Connect, Direct Connect and Web Connect.

We strongly recommend you verify which of these your bank supports but you can see on overview of the differences between the 3 different ways of connecting here.

Direct Connect is the most important feature to check for because it offers the most complete service and is included in Quicken 2016 for Mac.

New Features

But are there really any new Quicken for Mac 2016 features other than Bill Pay? Well there are two but one of them isn’t actually “new” anymore:

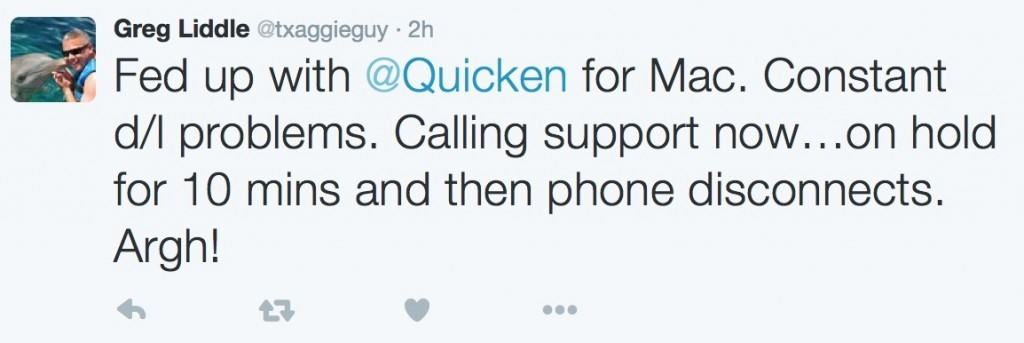

- Free Phone Support: Free phone support is now available to Quicken 2016 for Mac customers between 5AM to 5PM PST. However, this has already been introduced in Quicken 2007 and 2015 since earlier this year. Whether this is any better than the painful Live Chat online support remains to be seen although early experiences from some users already are that it’s not much better.

- Transfer Money Between Accounts: You can now transfer money between bank accounts at the same bank that are connected to Quicken via Direct Connect.

So apart from Bill Pay, Quicken 2016 is a small upgrade from 2015. However, there have been some subtle changes to features and the interface compared to Quicken 2015 for Mac.

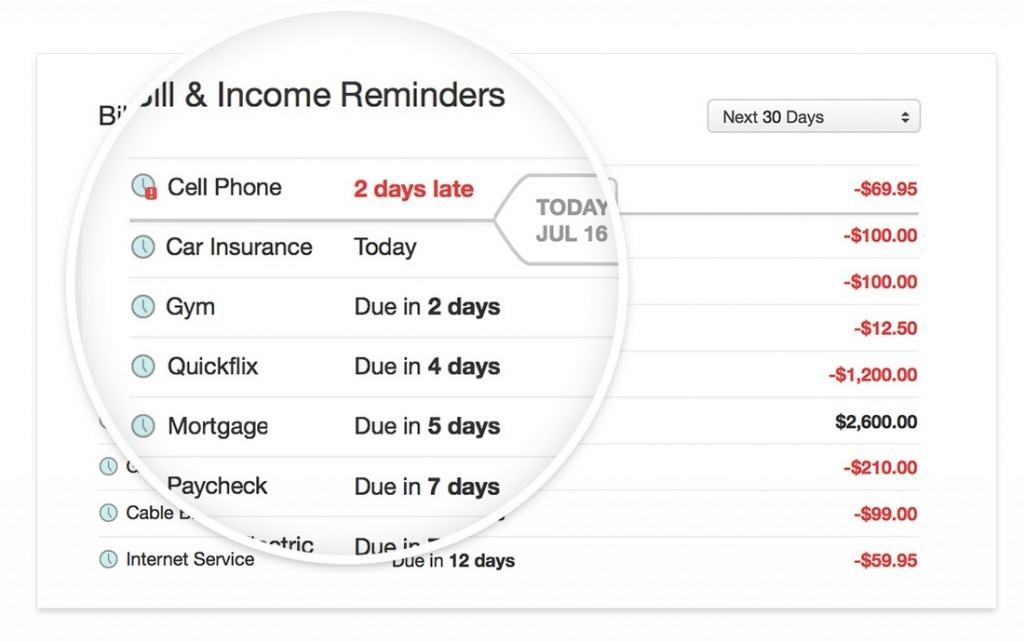

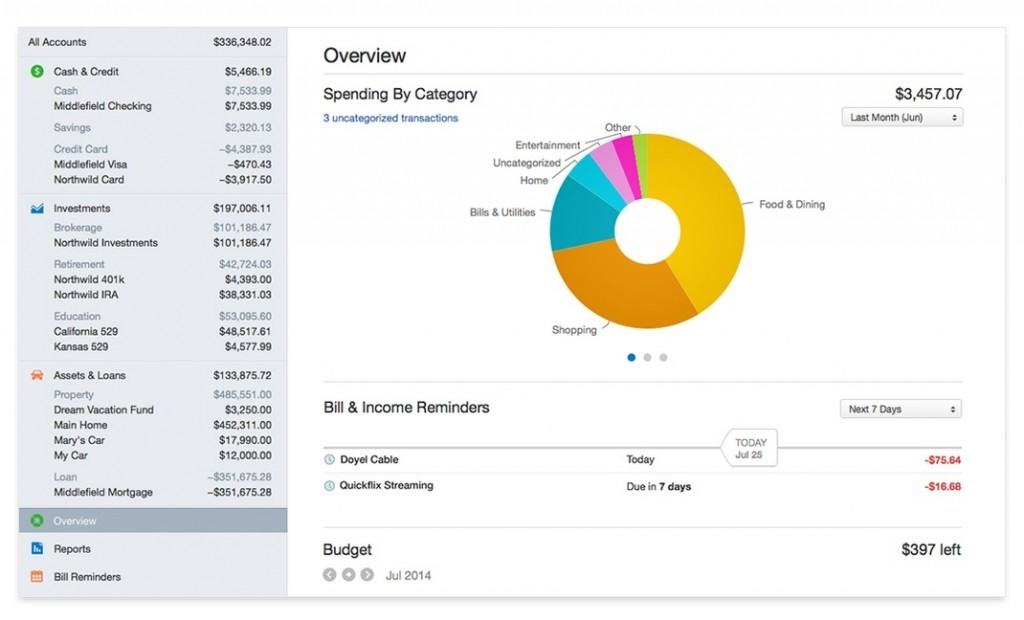

For example, Scheduled Transactions has now changed name to Bill & Income Reminders and now allows you to have a better overview of the impact of upcoming paychecks and bills on your account balance to avoid overdrafts or slipping into the red.

However, there’s no calendar view of these transactions so you can’t get an overview of what’s coming up over the year ahead which is a bit frustrating.

In addition, Quicken 2016 for Mac can automatically download transactions from more financial institutions – around 14,500 according to Intuit.

Note that this can be extremely unreliable however. We experienced various duplicated transactions which are a nightmare to remove manually if you have years of accounts.

We also found that Quicken For Mac doesn’t always categorize them correctly and you may find you have to spend a lot of time manually categorizing transactions yourself.

Quicken 2016 for Mac at least supports manual bill reconciliation so you can reconcile transactions against your bank statements.

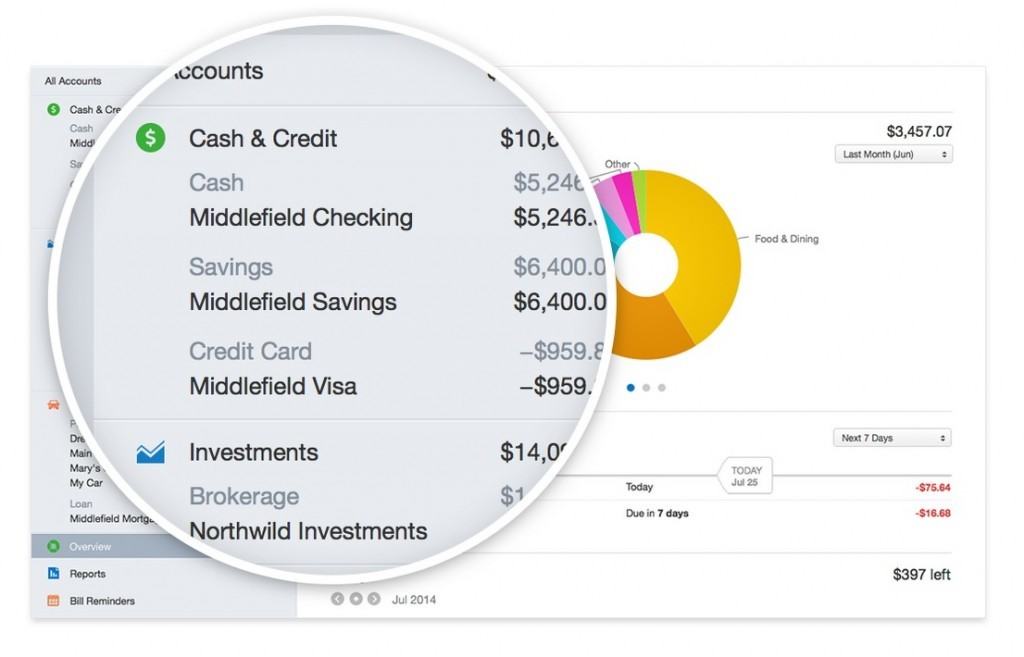

Investment Tracking has been slightly improved in Quicken For Mac 2016 showing you realized and unrealized gains, continuous updates, Schedule D tax reports for capital gains and tax deduction tracking for when you have to file taxes.

However some investment reports and views are missing such as performance (IRR) and allocation by investment.

Of course, Quicken can’t actually manage investments such as stocks and shares but there’s plenty of excellent stock trading software for Mac which we looked at in depth here.

Investment tracking in Quicken for Mac in general is still behind Quicken for Windows as it provides far less detail on how investments are performing.

You’ll also find that if you import investment data, you’ll end up having to manually correct quite a lot of it. You can also just add investment data manually too.

In general, Quicken for Mac isn’t like Quicken For Business i.e. it’s not suitable for small business management but for that we’d recommend reading our article on the best accounting software for Mac.

![]()

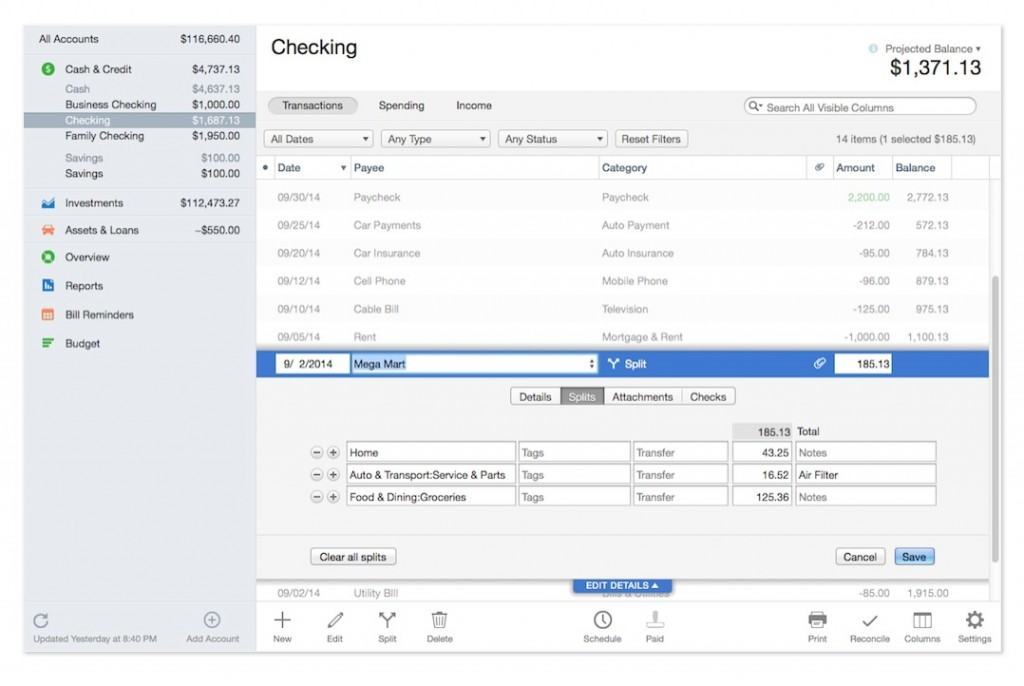

There’s a redesigned account register which makes it easier to manage transactions.

This includes quicker searches, more filters and customizable columns and row heights.

Things like categories, splits, tags, attachments, check printing remain the same. Rather bizarrely though, Quicken 2016 does not track paychecks – a feature that used to be available in Quicken 2007 but has disapeared down the Intuit memory hole.

The reporting interface has been streamlined slightly and allows more customization including a cash flow graph to show you income and outgoings, bill reminders and net worth over time to help plan your future. There’s also a few other useful reports in Quicken 2016 such as a category summary and tax schedule.

There’s also a few other useful reports in Quicken 2016 such as a category summary and tax schedule.

Quicken 2016 For Mac vs Other Versions Of Quicken

This is all very nice but the question for all those that shelled out for Quicken 2015 little more than a year ago is is it really worth upgrading to Quicken 2016 For Mac just for Bill Pay?

As we’ve seen, Intuit are trying to tempt users with a few “extra” goodies and enhancements but the truth is Bill Pay remains the only compelling feature worth upgrading for.

If you do rely on Bill Pay, upgrading is a no-brainer – it’s definitely worth upgrading for the convenience of it.

However if you don’t need Bill Pay, there aren’t really many compelling reasons to upgrade from Quicken 2015.

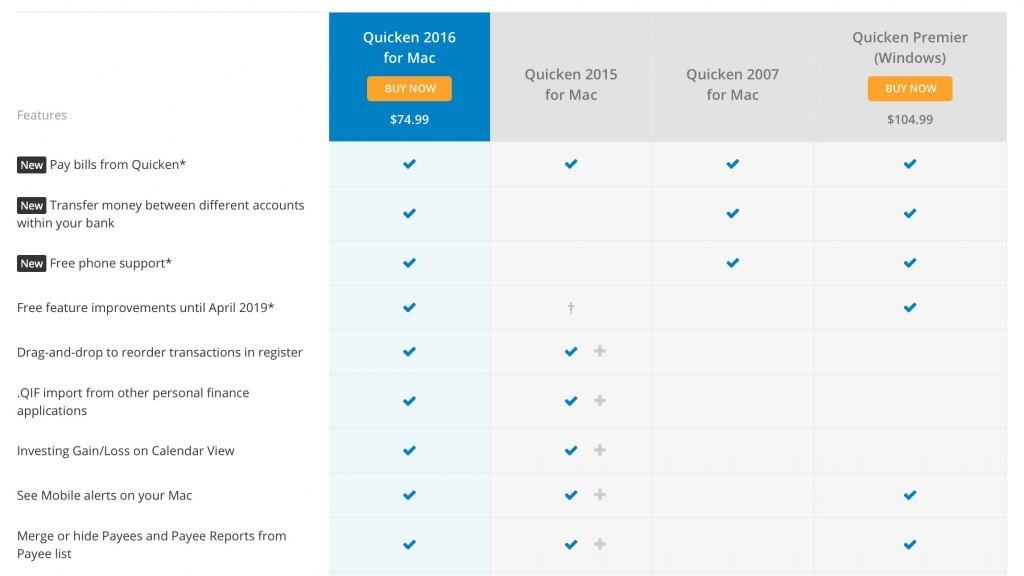

This comparison chart shows you at a glance what you’re missing out on (or not) including how Quicken 2015, Quicken 2007 for Mac and Quicken Premier on Windows compared to Quicken 2016 and as you can see, it’s hard to make an argument in favor of upgrading:

The most important differences are at the top of the chart above i.e. Bill Pay, the ability to transfer money between accounts and free phone support.

To its credit, Intuit has been allowing Mac users to provide feedback and also vote on features they want to see in new versions of Quicken since the release of Quicken 2015 and the idea is that until 2019, the most requested features will be added for free.

It’s hard to discern whether this means whether Mac users will or won’t have to upgrade to another version of Quicken until 2019 but if it’s free updates for the next 4 years, then it’s definitely progress.

Considering that Intuit are in the process of selling Quicken, it’s hard to see how they can commit the new owners to offering free updates to Mac users until 2019 so it remains to be seen.

Quicken For Mac vs Quicken For Windows

When it comes to Windows, whichever way you look at it, Quicken for Mac is still miles behind Quicken for Windows and if you need the Windows version, you’re better off installing Windows on your Mac than buying the Mac version.

There are several important features missing from the Windows version but one of the most critical for many people is the failure to support multiple foreign currencies.

Quicken for Mac still cannot download currency exchange rates and you can’t transfer money between accounts in different currencies.

Budgeting is also sorely lacking in Quicken for Mac compared to windows.

The best you can get is a 3 month trend but trying to create a 12 month budget is simply not possible which seems like a major oversight in a personal accounting application

Other notable missing features in the Mac version are the Debt Reduction Planner, a Customizable Portfolio View and Portfolio X-Ray.

The ability to automatically link online bills to Quicken to see the due date and amount due that has just been introduced into Quicken 2016 for Windows is also missing.

Migrating To Quicken 2016 From Another Version Of Quicken

If you’re moving from Quicken 2015 for Mac to Quicken 2016 then you should have no problems. If you’re a Windows user using Quicken 2010 and have switched to Mac, you can transfer all of your data to Quicken 2016 except budget and transaction attachments.

Note that you must first install the conversion utility on your PC to convert into a file that Quicken for Mac can read.

We found that there were several errors during this transfer but in general, migrating data from Quicken for Windows to Quicken for Mac worked relatively well.

Moving from Quicken 2007 For Mac or an earlier version of Quicken on Windows to Quicken 2016 For Mac is another story though.

Accounts, Transactions, Categories, Tags (classes) and scheduled transactions and bill pay transactions should transfer successfully. However, budgets, transaction attachments and passwords will not transfer.

In addition, loan amortization schedules, home inventory and emergency records data, explicit lot assignments and securities watch lists features that were in Quicken 2007 are not in Quicken 2016 For Mac – so be very careful about deciding to upgrade if you have a lot of data stored in them.

Note as well that you’ll also have to go through and reestablish all of your online banking Bill Pay connections again by going to Accounts > Setup transaction download.

Last but not least, you’ll also need to be running OS X 10.10 Yosemite or OS X 10.11 El Capitan or higher to use Quicken 2016.

Quicken 2015 worked on OS X 10.7+ but Quicken 2016 no longer supports anything earlier than Yosemite.

In March 2016, Intuit announced that it had found a buyer for Quicken, HIG Capital.

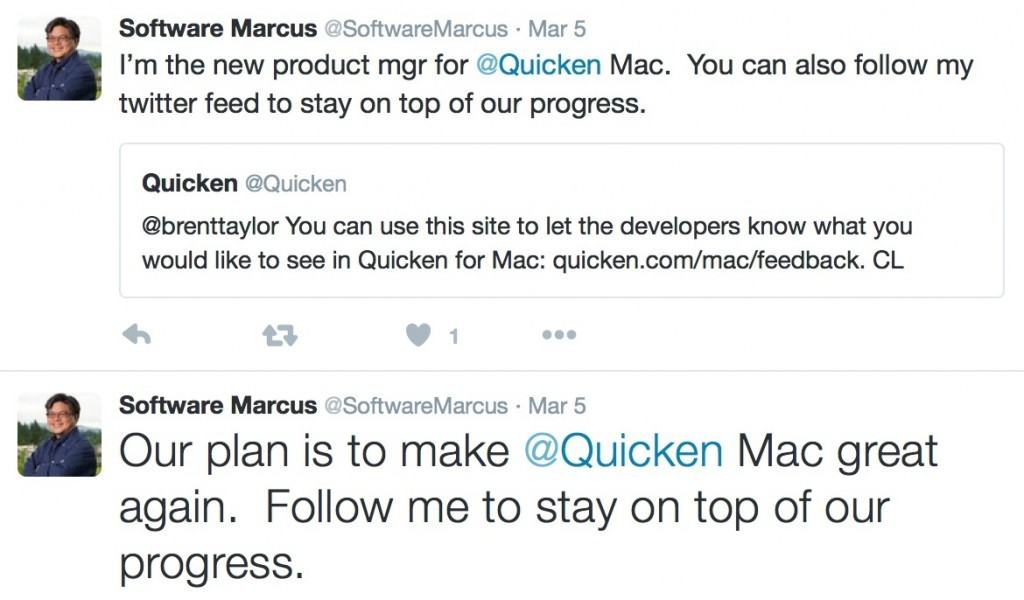

The good news for Mac users is that the Head of Quicken Eric Dunn, claims that many of the complaints made by Mac users have been noted and that Intuit has brought in Marcus Aiu as the a new product manager for Quicken for Mac: Aiu previously worked as Senior Product Manager for Quicken before leaving the company but has now rejoined it to focus on improving the Mac product.

Aiu previously worked as Senior Product Manager for Quicken before leaving the company but has now rejoined it to focus on improving the Mac product.

Intuit has also pledged that the engineering team will be doubled with the aim of bringing the Mac version “closer to the feature set of Windows over the next Quarter and Years”.

Initial evidence is that Quicken is making good on its promise and is rapidly updating Quicken 2016 for Mac based on customer feedback.

In May 2016 Quicken released a version 3.4 update for Quicken 2016 for Mac which finally included full 12 month budgeting.

This includes a new Stacked view which stacks actual values above budgeted ones, a detailed pop-up on total values in the summary column and ability to export and copy budgets to Excel or Numbers.