If you’re looking for a free personal finance software for your Mac, Money Manager Ex (MMEX) is a simple free desktop app that stores your data offline.

If you’re someone who prefers local data storage over your accounts being stored in the Cloud, Money Manager Ex may be for you.

It will also appeal to those that want an alternative to using spreadsheet software to manage their finances.

Or if you’re looking for a free alternative to Mint or Microsoft Money for Mac after they were discontinued, MMEX is a very basic offline replacement for it.

I took a quick look at it to see how it stacks-up against the best personal finance apps for Macs.

Table of Contents

Overview

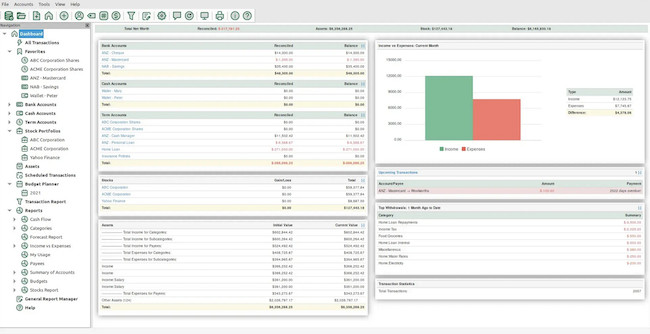

Money Manager Ex has been developed over several years and has added many features over that time.

Here’s an overview of exactly what you do and don’t get in the software.

| Feature | Support |

|---|

| Platform Support | macOS, Windows, Linux, Android |

| Data Privacy | Local data storage with encryption support |

| File Import/Export | Supports QIF, CSV, and XML for data import/export |

| Expense Tracking | Manual transaction entry with category and sub-category support |

| Budgeting | Monthly budget tracking and customizable spending categories |

| Reporting | Income vs. expense reports, category breakdowns, and cash flow analysis |

| Investment Tracking | Manual input for stocks and securities, no automatic price updates |

| Bank Syncing | Not available (manual import only) |

| Currency Support | Multi-currency with real-time exchange rate manual entry |

| User Interface | Simple and functional, though somewhat outdated in design |

| Cloud Synchronization | Not available, requires manual backup and file sharing |

| Mobile App | Limited functionality for Android, no seamless sync with desktop |

| Customization | Fully customizable categories, accounts, and reports |

| Cost | Free (Open-source) |

| Backup Options | Database backup and restore options |

Getting Started

Firstly, I strongly recommend reading through the documentation for Money Manager Ex before starting.

You can fumble your way through but the software does take some fathoming and although there are some in-app tips to get you started, they’re very basic.

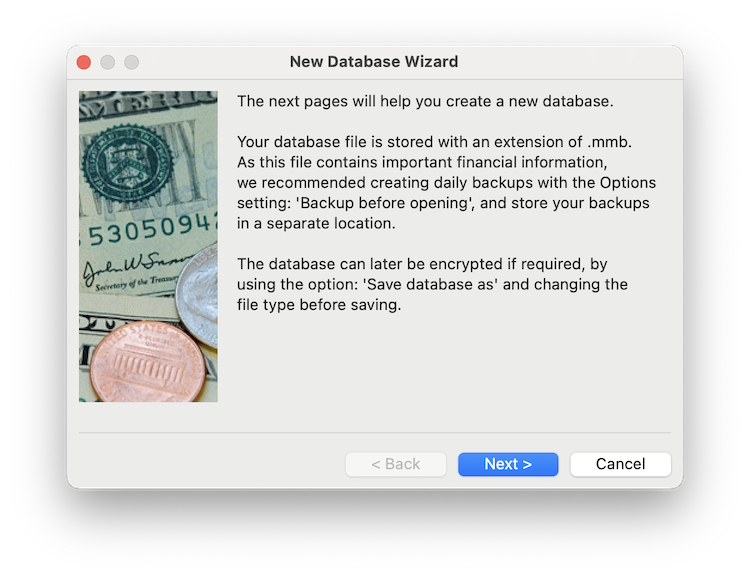

When you open Money Manager Ex for the first time, it gives you various options including importing a CSV file or starting a new database of accounts.

You can also import Quicken files in QIF format which makes it a possible alternative for anyone looking for a free alternative to Quicken for Mac.

However, I didn’t try this and my guess is that you’ll end up having to do a lot of reformatting and correcting of Quicken accounts if you do.

Money Manager Ex advises activating the “Backups before opening” option and then storing those backups in a different location such as an SSD external drive.

This is in case your Mac hard drive dies in which case, you’ll lose all of your data as there’s no Cloud backup so we strongly recommend this.

It also advises that you can encrypt the database later by using the encryption save option.

This encrypts your data with AES encryption in an SQLite database to prevent unauthorized access to your personal finance data.

Installation of Money Manager Ex on macOS is simple and straightforward although immediately, it’s striking how outdated the interface is.

However, this is a completely free and open source finance app so we can’t be too fussy.

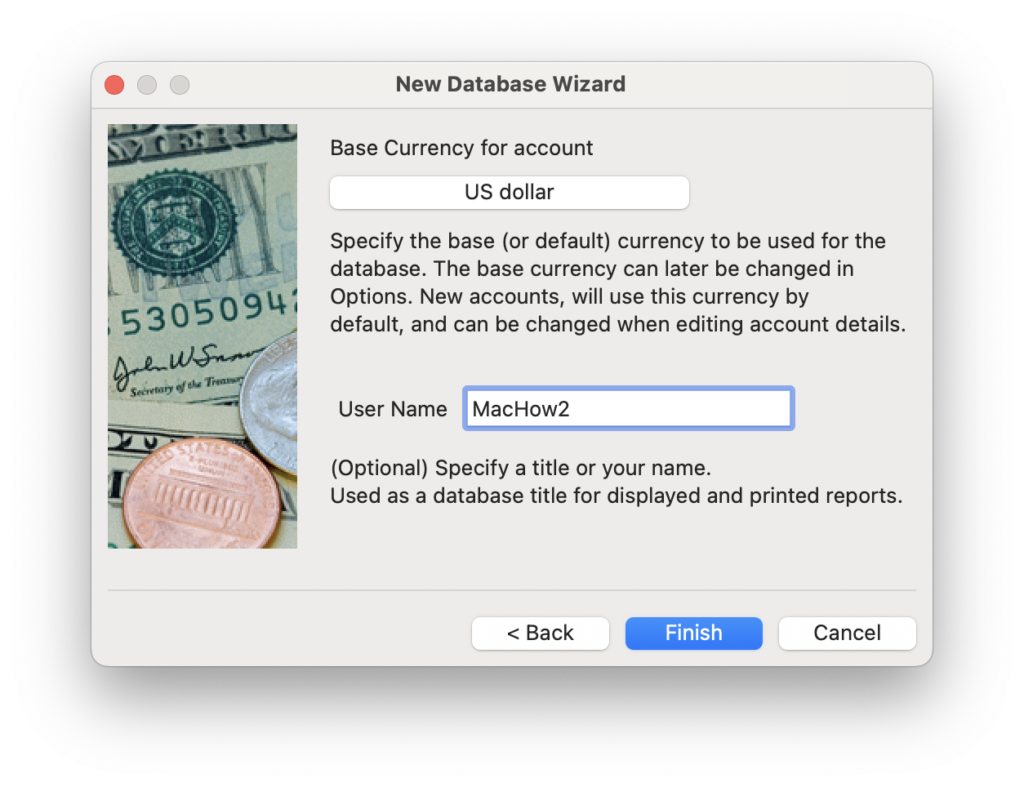

The new database wizard asks you give a name to your accounts and select the currency.

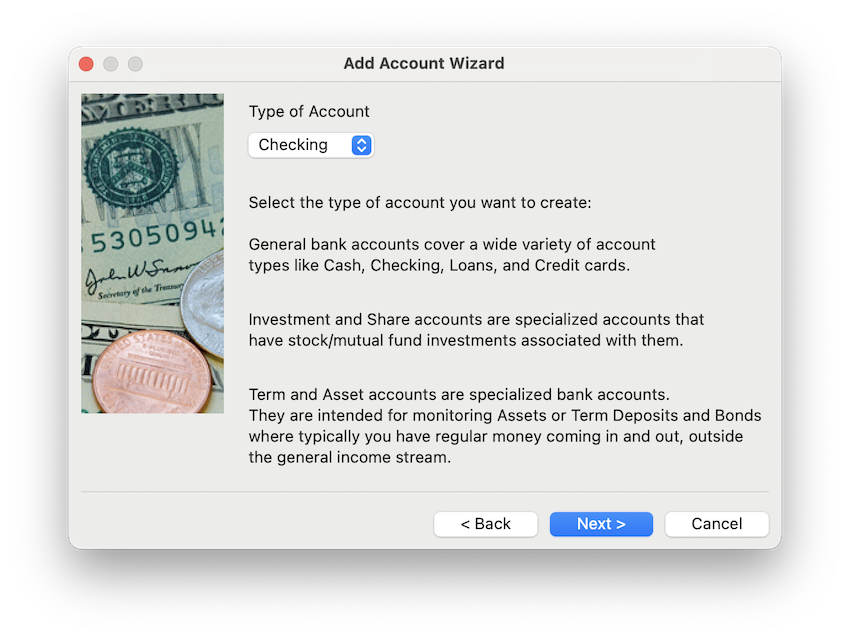

You can add multiple types of accounts, including checking, savings, and investment accounts.

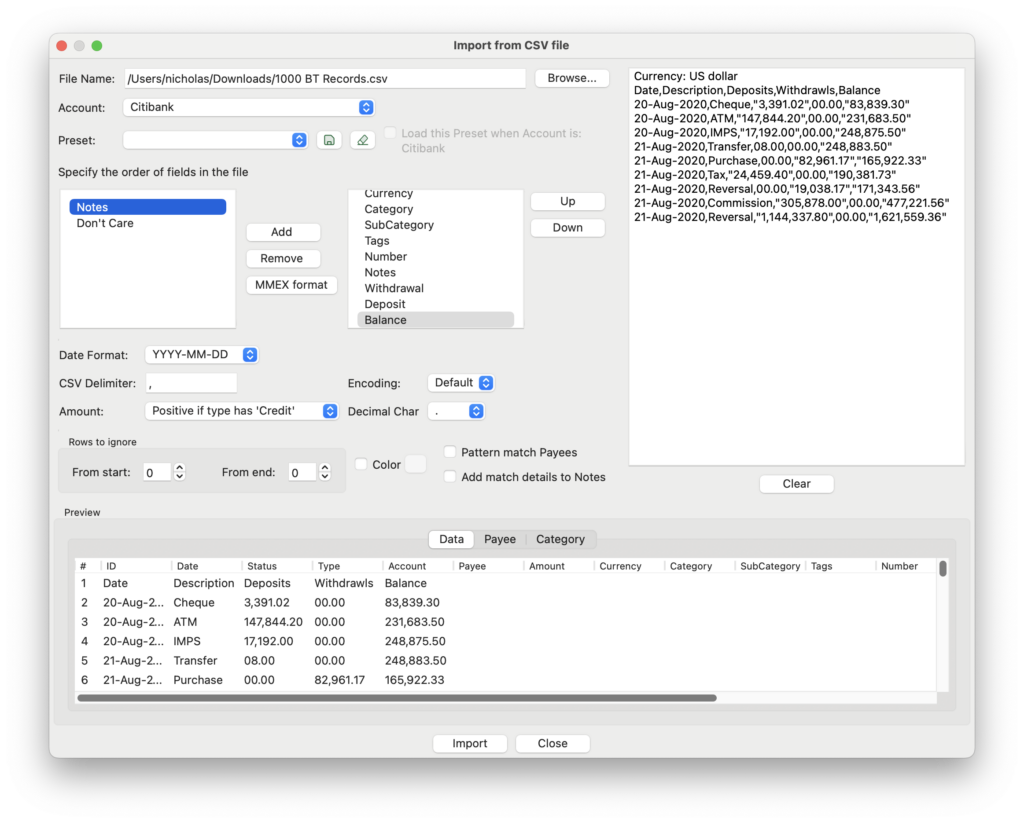

I tried both manually entering transactions and importing a CSV file. Importing is fast and simply requires you to specify the order of fields you want to display.

However, this obviously requires that the CSV file you import has these fields otherwise it won’t work.

The app offers different categories for expenses and income, which are fully customizable.

There’s also the option to group categories (e.g., under “Home Expenses”) for more detailed financial tracking.

Key Features

- Expense Tracking:

Entering expenses was straightforward, but the manual nature of the process is definitely tedious if you’re used to bank syncing and automatic imports. However, I liked that I could split transactions across multiple categories, which is useful for shared expenses. - Budget Management:

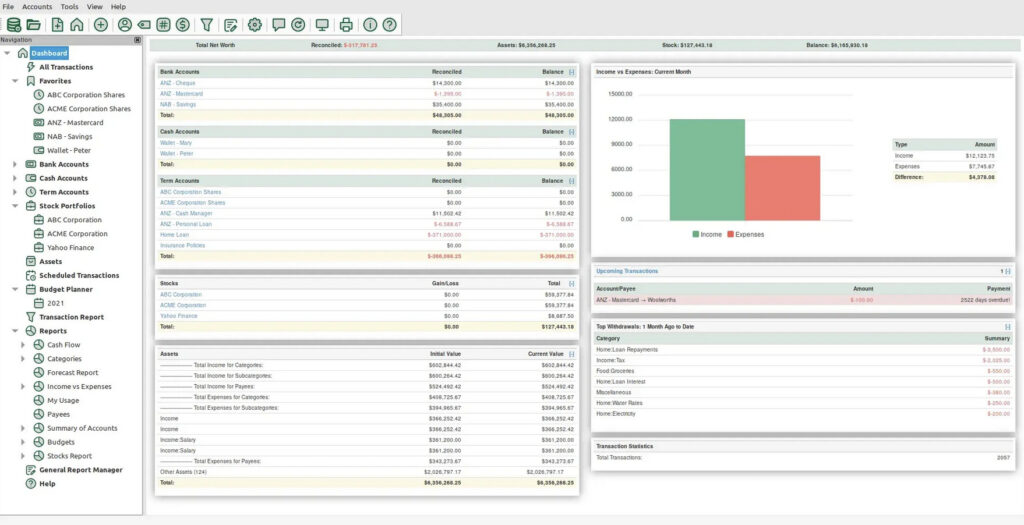

The budget feature is simple but effective for basic budgeting. I could set monthly spending limits for different categories and track my remaining budget in real time. You can’t actually see a graphical representation of this although you can generate reports on it (see below). - Reports and Charts:

MMEX provides detailed reports, including expense summaries, income vs. expense charts, and cash flow analysis. The reports generate quickly, and I could easily export them as PDFs. However, the graphics are very basic compared to most modern personal finance apps. - Investment Tracking:

This was one of the more advanced features. I was able to input stocks and track their value over time. However, there’s no automatic price update feature – you need to manually input the latest market values which isn’t exactly fun. There are far better investment tracking apps for Macs to do this.

Performance

MMEX performed quickly and didn’t crash or freeze during use on an Apple Silicon Mac. It seems to tick-over smoothly even with a large database.

Obviously since there’s no Cloud backup, it’s important to either backup your Mac (such as with Time Machine) or backup your accounts on an external drive as advised by MMEX during the setup process.

What I Liked

- Free and Open Source: No subscription fees or hidden costs.

- Data Privacy: Since all data is stored locally, there’s no concern about third-party data breaches or your financial data being handled by anyone else.

- Customizable Categories: I liked the flexibility in setting up categories that fit my exact spending.

- Fast Performance: No lags or crashes, even with detailed reporting.

What Could Be Improved

- User Interface: The interface looks like something from the 1990’s. A major design overhaul for MMEX is long overdue.

- Automatic Bank Sync: The lack of bank integration may be a big issue for users with multiple accounts. Manually entering transactions is painful.

- Mobile Integration: There’s no way to access the app on mobile devices.

- Investment Tracking: Automatic updates for stock prices would make this far more useful rather than having to enter it yourself.

- Retirement Forecasts: There’s no feature for retirement planning or 401k tracking so we recommend using one of these retirement software for Macs if you need this too.

FAQ

Is Money Manager Ex compatible with the latest versions of macOS version?

Yes, it worked fine with macOS Sequoia and the developer claims the most recent versions works with macOS 10.12 Sierra onwards. The older version also works with macOS 10 and 11.

Does it support automatic bank synchronization?

No, MMEX does not support direct bank connections. All transactions must be entered manually or imported from CSV or QIF files.

Is my financial data safe with Money Manager Ex?

Yes, all data is stored locally on your device, which enhances privacy but requires you to manage backups yourself.

Can I use Money Manager Ex on my iPhone or iPad?

There is a mobile version for Android and iOS available, but it doesn’t sync with the desktop app. Manual file transfers are required.

How does it compare to paid alternatives?

MMEX is a great choice if you value privacy and don’t mind (a lot of) manual data entry. However, if you need bank synchronization, cloud storage, or a more modern interface, there are many better options.