If you’re one of the many people disappointed by Intuit’s decision to close down Mint, here we’ve looked at the best free and paid Mint replacements to use on a Mac.

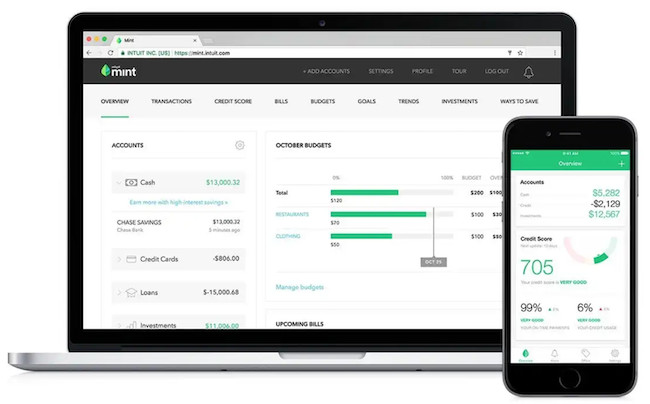

Launched in 2007, Mint was one of the most popular personal finance software out there, not least because it was completely free to use.

However, as of 1st January 2024, it was officially discontinued by Intuit although it was operational until March 24th 2024.

After this date, there was a forced migration to Credit Karma until May 3rd 2024.

Not all Mint fans were happy about this – and understandably so.

Whereas Mint was more of a pure budgeting software, Credit Karma focuses more using your finances (and data) to recommend alternative credit and debit cards that offer a better rate of interest than the ones you are using.

In fact, there are very few budgeting features in Credit Karma at all.

The good news is, there are some excellent alternatives to Mint on Macs that can be used instead.

Table of Contents

What We Looked For In These Mint Alternatives

We used a very simple formula to evaluate which apps make a good replacement for Mint on a Mac.

- They are either FREE or reasonably priced.

- They have a Mac desktop app or if not, can at least be used in a browser on both Intel and Apple Silicon Macs.

- Ideally they have a Mint migration tool to help you import your accounts.

- They are easy to use and effective at managing your finances.

With this in mind, here’s our selection of the best ones that fulfilled our criteria in order of ranking.

1. Money Manager Ex (Free)

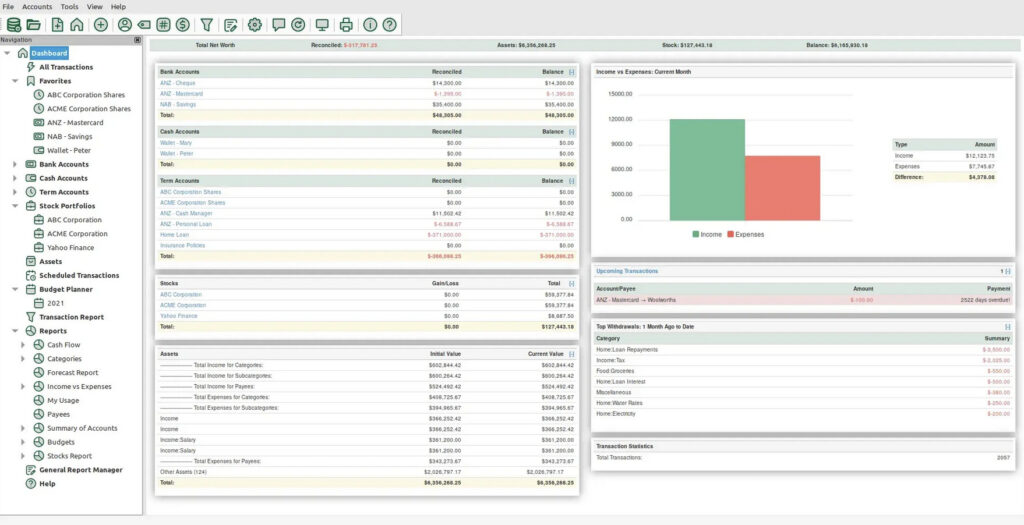

Money Manager Ex (MMEX) offers a free, open source replacement to Mint for users who value privacy and control over their finances.

MMEX offers budgeting, investment tracking and reporting financial tools without relying on cloud storage or automated bank connections.

Here’s how it compares to Mint:

Key Features

- Data Privacy: All data is stored locally, offering enhanced security compared to Mint’s cloud-based system.

- Expense Tracking & Budgeting: Allows manual entry of transactions with customizable categories and budget planning.

- Reporting & Analysis: Generates detailed reports, including cash flow and spending summaries.

- Investment Tracking: Supports basic investment management without automated price updates.

- Platform Compatibility: Available for macOS, Windows, Linux, and Android (no iOS support).

- Multi-Currency Support: Ideal for international users with manual exchange rate entry.

- Cost: Completely free and open-source.

MMEX is ideal for those who don’t want their finances stored online but don’t mind manual data entry.

While it lacks Mint’s automation, its offline app and zero cost make it a good personal finance app for those on a budget.

Check our full Money Manager Ex review for more.

Pricing: Free

2. Empower (Free)

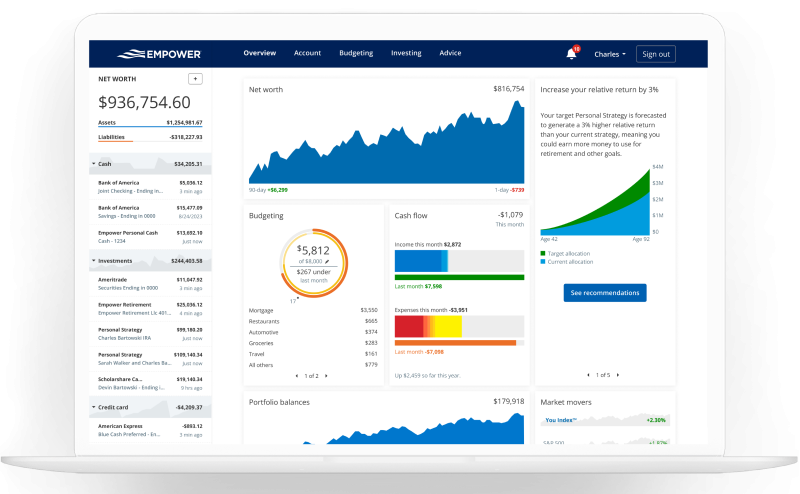

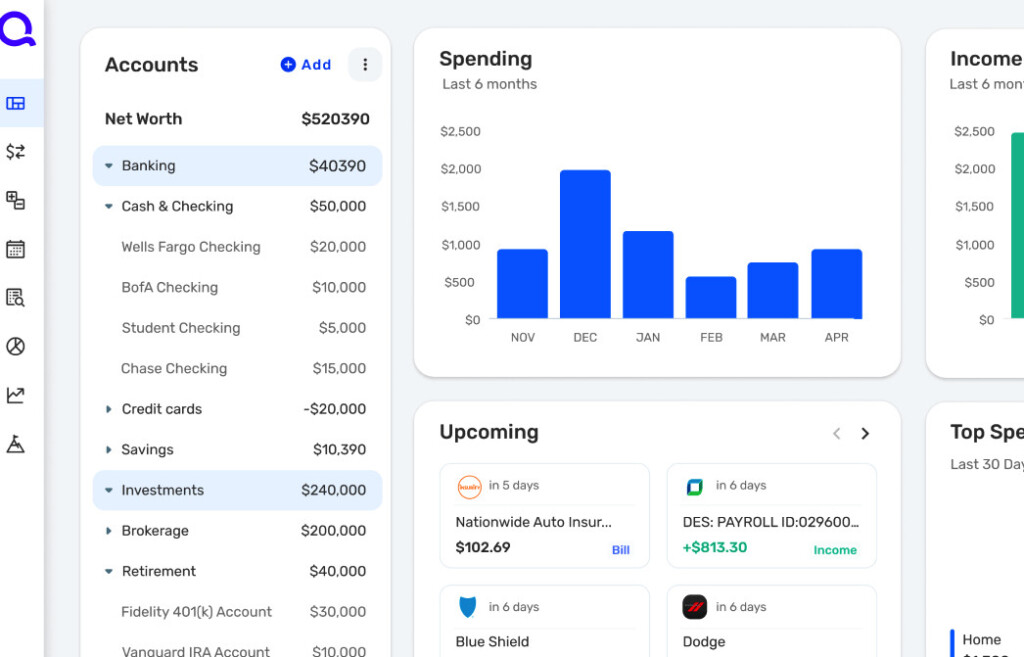

If it’s investment management you need, we found that Empower (formerly Personal Capital) ticks all the right boxes as the best alternative to Mint on a Mac.

It’s free to use, easy to use, effective at managing your finances best of all, has an excellent Mac desktop app.

Empower used to be Personal Capital until recently but unlike Mint’s switch to Credit Karma, it retained all of the features that made Personal Capital so popular.

Here are some of the other reasons Empower is the best replacement for Mint on a Mac

- It’s free to use with no limitations. You can even get a free consultation with an Empower financial advisor (more on how this works here). Unlike Mint, there are no annoying ads in the free version either.

- It syncs accounts from all major financial institutions seamlessly in one place – and it does it better than Mint. If you experienced frequent account syncing issues with Mint, then you’ll be pleasantly surprised by Empower as it uses Plaid which is far superior to Direct Connect.

- You can track spending by category or account type.

- You can easily see your Net Worth.

- There’s an effective Retirement Planner for 401k management

- It analyzes where banking and investment management fees are eating into your profits.

- It will send you alerts when bills are due (although it doesn’t support Bill Pay but then again, neither did Mint).

- It can track cryptocurrencies such as Bitcoin, Ethereum and many others (without requiring accessing to your crypto wallet either).

- You can get customer support from real humans – which seemed impossible with Mint.

On the downside:

- There’s no data import tool for Mint accounts although you can export your accounts in CSV format and upload them to Empower.

- It only supports US based financial institutions.

Check out our full Empower review for more.

Pricing: Free

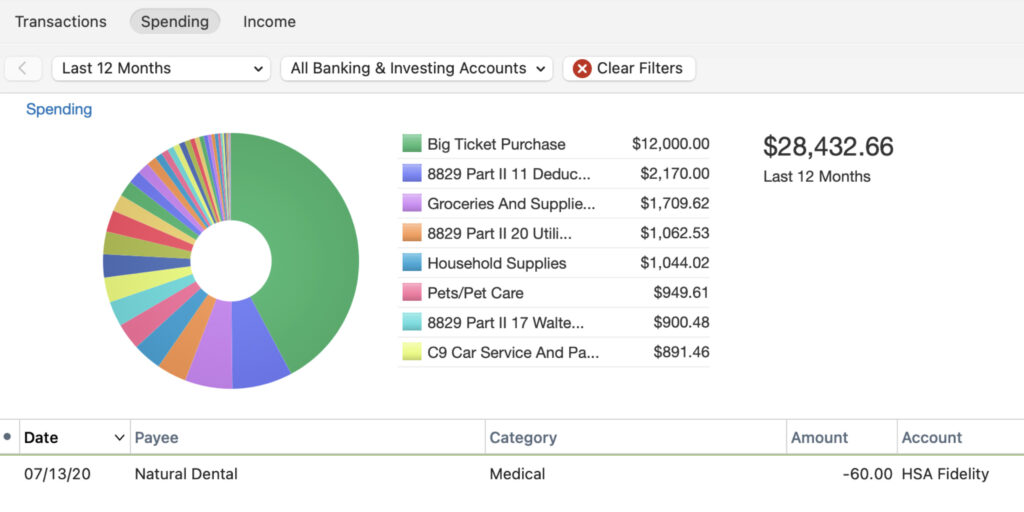

3. Copilot

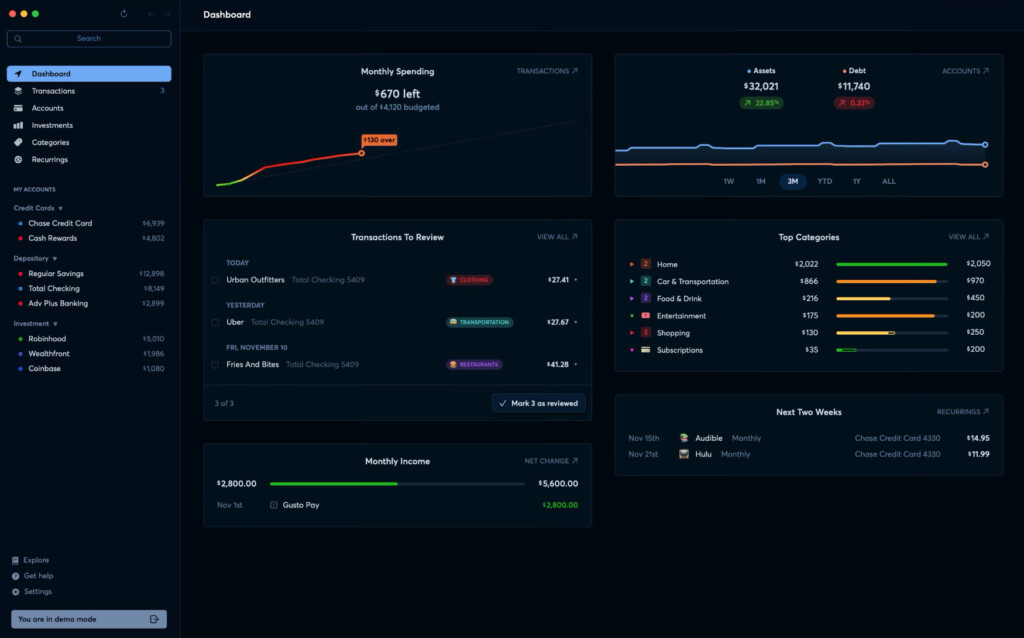

If you’re looking for a slick Mac desktop alternative to Mint, then Copilot is an ideal replacement.

Copilot is designed specifically for Apple devices and has both an incredibly slick macOS and iOS app.

Copilot tracks spending, budgets, investments and net worth.

Some of the things we really like Copilot as an alternative to Mint are:

- Copilot has a Mint data importer tool so that you can easily import your Mint accounts into it.

- It gives you useful daily snapshots so you get a quick up-to-date overview of your finances on any date you choose.

- It syncs with most major banks and financial institutions.

- There are bill reminders for upcoming payments.

- Copilot has a really useful spending by category report to see where your money is going.

- If you spend less than your budget allows, Copilot can also carry-over unspent budgets into the following months.

- It has a really good looking Mac desktop app compared to other Mint replacements

On the downside:

- Copilot is USA only but there are plans to release it Canada and other countries soon.

- Account syncing can be unreliable depending on which bank you have.

You can read our full Copilot for Mac review for more.

Pricing: $13/month or $95/year

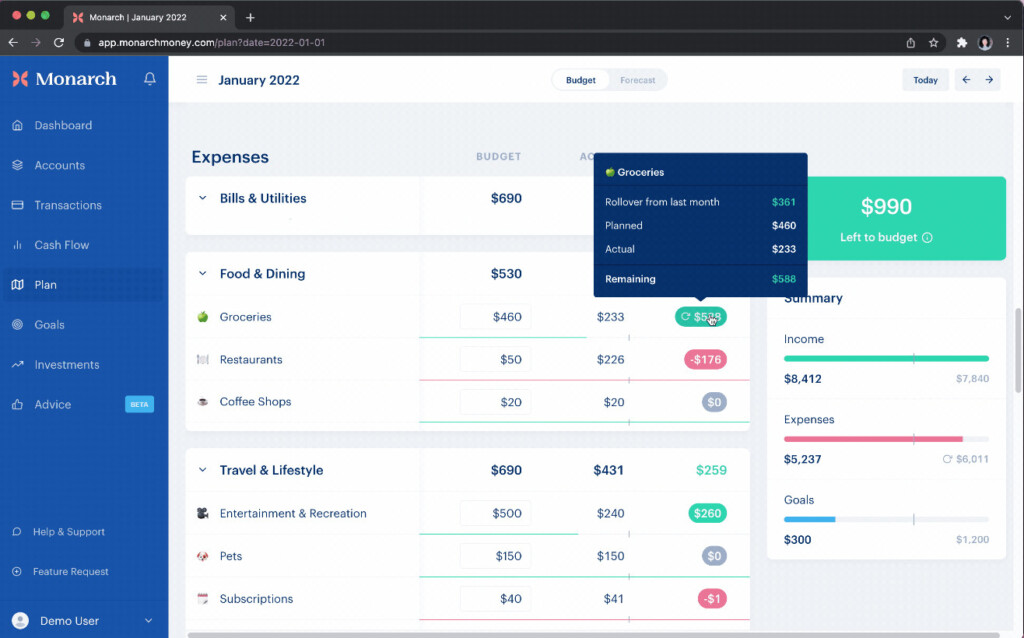

4. Monarch Money

What we like about Monarch Money is not only is it a simple and effective budgeting app, but its also one of the few apps that already makes it easy to migrate from Mint.

In fact, one of the founders of Monarch was one of the minds behind Mint so the basics of what made Mint so effective have gone into it.

Monarch was also the first personal finance app to include a Mint Data Exporter to make it as painless as possible to switch to Monarch.

The Mint data exporter only works in Google Chrome but if you’ve got years of Mint data to migrate, it’s definitely worth using.

Once installed, it simply detects when you are logged-into Mint while in Chrome and then downloads your transactions in CSV format

Some of the features we really liked in Monarch are:

- The Monarch user interface is strikingly elegant and easy to use from the minute you open it.

- It gives you a clear overview including recent transactions, income and expense comparison and net worth.

- It connects and syncs with banks seamlessly thanks to Plaid.

- It’s really good at tracking spending right down to specific merchants such as Amazon and McDonald’s.

- It has excellent shared budgeting features for couples and families making it easy to add other members. Unlike with Mint, you don’t have to share your username and password for others to use it.

- Excellent customer support by humans

On the downside:

- There’s no Mac desktop app but you can use it in any browser

- There’s no way of monitoring your credit score in Monarch

Monarch isn’t cheap at $99.99 annually but you can try it for free.

Pricing: $99.99/year

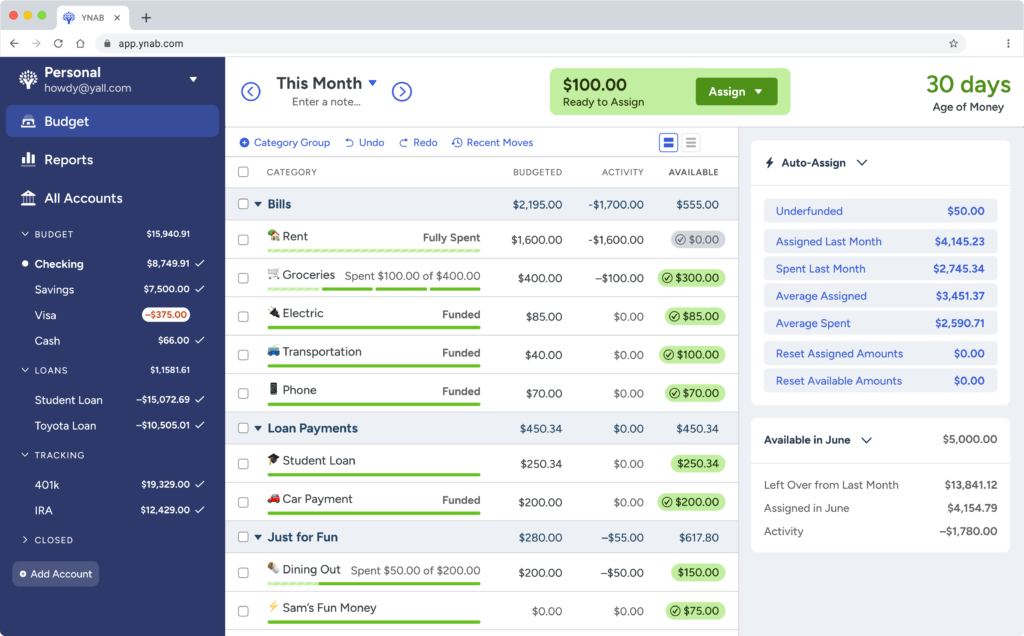

5. YNAB

If it’s budgeting that you really miss from Mint, then as the name suggests, You Need a Budget (YNAB) is 100% focused on helping you create and stick to a budget.

YNAB uses a zero-budget approach which is a method of budgeting where all expenses must be justified for a specific period.

This means that every cent must be justified so it’s a pretty strict system – but extremely effective if you can stick to it.

The interface of YNAB is like a glorified spreadsheet so it will appeal to those that like spreadsheet budgeting but presented in a more glossy, presentable way.

What we like about YNAB is:

- It’s very effective at helping you create and stick to a budget

- It syncs accounts and transactions

- It can also connect to banks outside of the USA including UK and EU

- It has some clear and effective charts and graphs to track your progress

- It includes a Mint data import tool to help you switch easily

Some of the drawbacks however are:

- It uses Direct Connect to sync which can be very unreliable

- There’s a lot of configuration required at the beginning to setup your budgets.

YNAB isn’t free but you can try it free for 34 days. After that it’s either $14.99 a month or $99 per year.

Pricing: $14.99/month or $99/year

6. Rocket Money (Free)

Rocket Money (formerly known as Truebill) is a simple budgeting app which has a free version that anyone can use.

It has a very similar interface to Mint and you can up and running very quickly with a budget. It also features a Mint import tool to get you started.

Rocket Money connects and syncs to your accounts in minutes and gives you an instant overview of your checking, card, savings and investment accounts.

One of the things that Rocket Money does well is identify subscriptions and regular monthly payments that you may be be able to cut out or save on.

In fact, it claims that 80% of its customers save money to identify and cancel unwanted subscriptions.

Rocket Money is free to use but there is also a paid version starting at a very modest $4 a month although this is also free if you’re a Rocket Mortgage Customers

Pricing: Free / Plans start at $6/month

7. Quicken Simplifi (50% Off)

Quicken Simplifi is a lighter version of Quicken for Mac launched by Quicken Inc and offers tailored spending plans to help you stick to a budget.

Simplifi is very mobile focused but can be used in any browser on a Mac.

Simplifi actively helps you create a spending plan by analyzing your net income and expenses.

Some of things we like about Quicken Simplifi are:

- Clear overview of your accounts including checking, saving, credit cards and loans.

- Automatic categorization of spending and transactions.

- Bill overview so you can easily see when bills are due.

- Allows you to identify recurring subscriptions so that you can eliminate or get rid off all those you no longer need.

- It includes an import option for Mint accounts although there have been some issues with this.

On the downside:

- Simplifi can be very unreliable at importing accounts depending on the bank and financial institution.

- No free plan or free trial.

Quicken is currently offering 50% off Simplifi for a limited period.

Pricing: $2.99/m for a limited period (50% off) normally $5.99/m

8. Quicken Classic Deluxe

If you want a desktop alternative to Mint then the Deluxe version of Quicken Classic may be your best option.

Quicken Classic Deluxe is from the same company that makes Simplifi but offers desktop app and more features.

The Deluxe version offers essential budgeting features such as expense tracking, customizable budgets, and bill reminders.

It also syncs with the Quicken mobile app so you can manage and track spending on the go.

It tracks your bills although if you want it to pay them automatically, you have to pay extra for Quicken Bill Management (formerly Quicken Bill Pay).

Bill Management is provided for free in the Premier version of Quicken although the subscription fee is also higher.

If you don’t require complex financial tools but want a desktop replacement for Mint, Quicken Classic Deluxe for Mac is definitely worth trying.

Pricing: $5.99/month or $71.88/year

Mac Mint Alternatives: Comparison Table

| App | Price | Mint Import Support | Bank Syncing | Budgeting Tools | Investing Tracking | Platform Support |

|---|

| Money Manager Ex | Free | Yes (via CSV/QIF) | No | Yes | Yes (manual only) | macOS, Windows, Linux |

| Empower | Free | No | Yes | No | Yes | Web, iOS, Android |

| Copilot | $95.00/year | No | Yes | Yes | No | macOS, iOS |

| Monarch Money | $99.99/year | Yes | Yes | Yes | Yes | Web, iOS, Android |

| YNAB | $99/year | No | No | Yes | No | macOS, iOS, Android |

| Rocket Money | Free (Basic), $6+/month | No | Yes | Limited | No | Web, iOS, Android |

| Quicken Simplifi | $5.99/m | Yes (via CSV) | Yes | Yes | Limited | Web, iOS, Android |

| Quicken Classic Deluxe | $5.99/m | Yes (via CSV/QIF) | Yes | Yes | No (only available in Quicken Premier edition) | macOS, Windows, iOS, Android |

Conclusion

Copilot is the slickest alternative to Mint and the handy Mint importing tool makes switching easy.

Empower remains the best alternative to Mint for those that need investment tracking. It’s free, incredibly easy to use and has a Mac desktop app.

There are also other Mac personal finance apps such as Moneydance, Money Pro, Banktivity and Moneyspire that didn’t quite make the cut when looking for like-for-like alternatives to Mint.

If you’re interested in these and even more options, check out our full guide to the best personal finance software for Mac.

FAQ

Which personal finance app is the best for budgeting?

Copilot for Mac is the best Mac desktop app for budgeting. YNAB is also an excellent option especially if you want to follow a proactive zero-based budgeting method. It encourages strong financial habits by giving each dollar a job.

Do these apps support syncing with Mac and iOS devices?

Yes, all the apps listed here work on macOS and either have mobile apps for iOS or allow you to use them on the web on mobile.

Which app is best for investment tracking?

Empower easily offers the most robust investment tracking features, making them ideal for users who need to monitor their portfolios.

Are there free alternatives to Mint for Mac users?

Yes, Empower and Rocket Money offer a completely free version. Money Manager Ex offers an offline, free and open source desktop alternative.

Can I use these apps without connecting to my bank accounts?

Most of these apps allow you to manually input transactions without connecting directly to your bank accounts. However, we strongly recommend using bank syncing to keep accounts updated.