If you’re using a Mac to run your business, your expense software should feel like its made for macOS.

But too often, Mac users end up forced into interfaces or apps that were clearly built with Windows in mind.

This guide focuses on expense tools that don’t just work on a Mac, they fit into how you already use it.

From smart automation to simple approval tracking, the tools below help teams of all sizes stay on top of spending, without switching between systems, digging through folders, or emailing PDFs back and forth.

Whether you’re running finance for a startup or just want to stop chasing receipts, these apps can help make expense tracking part of the process, not a disruption.

Table of Contents

- Why Trust Our Reviews

- 1. Ramp

- 2. Rippling

- 3. Zoho Expense

- 4. Expensify

- 5. QuickBooks Online

- 6. Emburse Professional

- 7. FreshBooks

- 8. BILL

- 9. SAP Concur

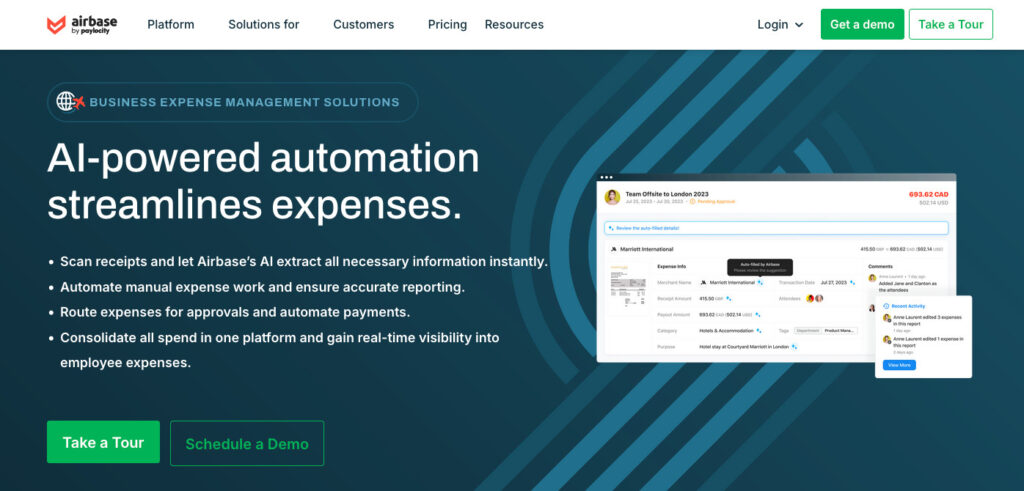

- 10. Airbase

- Other Expense Management Software for Macs

- Related Software

- How We Selected These Mac-Compatible Expense Management Tools

- What’s New in 2025 for Mac Expense Management Software

- FAQ

- Conclusion

Why Trust Our Reviews

We’ve been reviewing Mac software since 2013 and have covered thousands of business applications during that time. Our aim is to help you be more informed when taking a decision on which software work best with Macs and Apple products.

We research and test all of the products we cover and have tested hundreds of expense tracking solutions over the years. For more check out how we chose these apps and our software selection process.

Below is a comparison table of our top ten expense tracking apps followed by reviews for each one, some other selections you may want to consider and a look at what lies ahead in this sector.

| Software | Pricing | Best For |

|---|---|---|

| Ramp | Free corporate card & expense management platform for small businesses | Best for startups & SMBs wanting automated spend control |

| Rippling | Starts around $8/user/month (pricing varies by modules) | Best for growing businesses wanting unified HR, payroll & expenses |

| Zoho Expense | Free plan available for 3 users; paid from $3/user/month | Best for small teams needing affordable, simple expense tracking |

| Expensify | Free for individuals; teams from $5/user/month | Best for freelancers & small businesses who need receipt scanning |

| QuickBooks Online | Starts at $30/month; no free version | Best for small businesses wanting integrated accounting & expenses |

| Emburse Professional | Custom pricing; no free plan | Best for mid-sized to large companies with advanced expense policies |

| FreshBooks | Starts at $19/month; no free plan | Best for freelancers & service-based businesses who invoice a lot |

| BILL | Starts around $45/user/month; no free plan | Best for SMBs needing AP/AR automation plus expense management |

| SAP Concur | Custom pricing; no free plan | Best for enterprises needing global travel & expense compliance |

| Airbase | Custom pricing; no free plan | Best for mid-sized businesses needing spend management & corporate cards |

1. Ramp

Best for: Fast-scaling companies that want a free, automation-first expense tool that works naturally on a Mac

Why We Picked It:

Ramp offers a truly modern approach to expense management, pairing smart corporate cards with automated spend tracking, all designed with speed and clarity in mind.

The UI runs effortlessly in Safari on macOS, and features like automatic receipt matching, real-time alerts, and native Apple Mail parsing help Mac users skip the manual busywork.

Its pricing model is also a big plus as Ramp is completely free to use for small teams, making it especially attractive for growing startups or finance teams on a budget.

Features:

- Automatic receipt collection and policy enforcement

- AI-based spend categorization

- Unlimited virtual and physical cards

- Built-in travel and vendor savings insights

- Approval flows for managers and teams

- Real-time visibility into spending by department or project

Integrations:

Slack, QuickBooks, NetSuite, Xero, Google Workspace, Microsoft 365, Oracle NetSuite, Uber, Lyft, TravelPerk

Mac support: Full browser-based access with native speed in Safari

Free plan: Yes for small teams

Best for: Fast-scaling companies that want a free, automation-first expense tool that works naturally on a Mac

Mac-specific note: Includes native receipt parsing from Apple Mail and fast-loading Mac dashboards

2. Rippling

Best for: Teams looking to manage expenses alongside payroll, IT, and benefits on macOS

Why We Picked It:

Rippling stands out by offering expenses as part of a broader all-in-one finance and HR system. Teams can manage reimbursements, corporate cards, and approvals all from the same place they run payroll and IT provisioning.

Mac users benefit from a clean browser experience that loads quickly and stays responsive, even across large orgs. It’s especially helpful for companies already running Rippling’s HR or device management tools.

Features:

- Smart expense policies and approval chains

- Reimbursement tracking and direct deposit payouts

- Virtual and physical card support

- Automated policy enforcement

- Alerts for out-of-policy spend

- Clean financial reporting interface

Integrations:

Google Workspace, Slack, QuickBooks, Xero, NetSuite, Microsoft 365, Plaid, Brex, Gusto

Mac support: Full browser-based UI with native feel in Safari

Free plan: No, but demo available

Best for: Teams looking to manage expenses alongside payroll, IT, and benefits on macOS

Mac-specific note: Optimized browser app designed with macOS system performance and navigation in mind

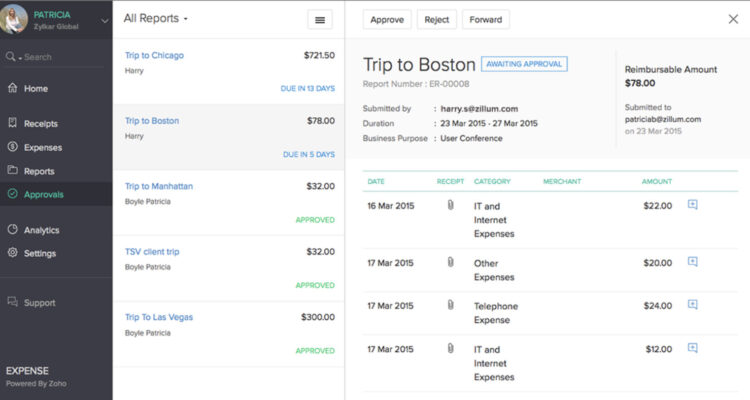

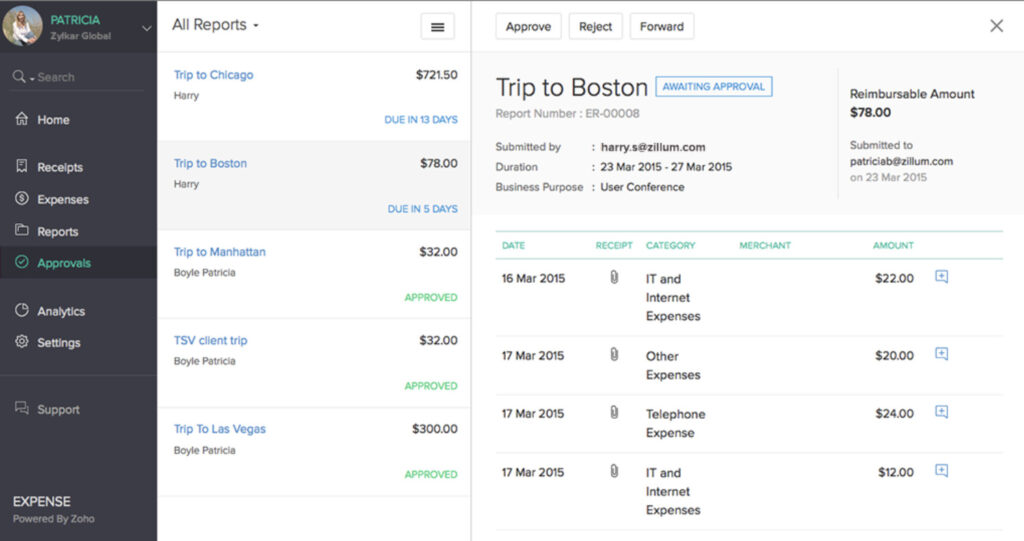

3. Zoho Expense

Best for: Small businesses and freelancers who want low-cost, Mac-friendly expense management

Why We Picked It:

Zoho Expense is a lightweight but capable tool that doesn’t sacrifice core features. It works well for smaller teams that want to keep costs down while gaining access to OCR scanning, automated approvals, and accounting integrations.

Its design is consistent across Safari and the Zoho mobile apps. It fits nicely for businesses that already use other Zoho tools but also works fine on its own.

Features:

- Smart receipt capture and OCR scanning

- Multi-level approval workflows

- Mileage and per diem tracking

- Reimbursement automation

- Budget monitoring

- Custom expense fields

Integrations:

Zoho Books, QuickBooks, Xero, Google Workspace, Slack, Microsoft 365, Zapier

Mac support: Web-based access optimized for Safari, with iOS app support

Free plan: Yes, for up to 3 users

Best for: Small businesses and freelancers who want low-cost, Mac-friendly expense management

Mac-specific note: Lightweight web app with fast OCR and drag-and-drop receipt import on Mac

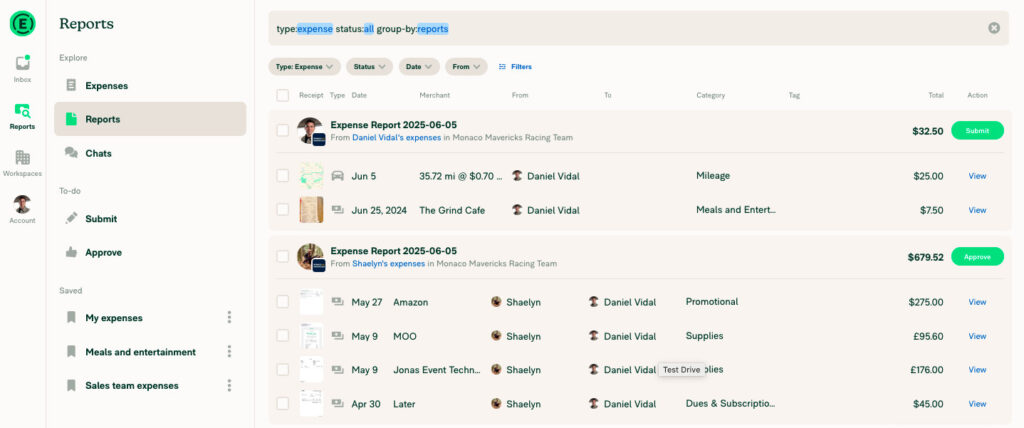

4. Expensify

Best for: Frequent travelers who need fast, mobile-to-Mac receipt syncing

Why We Picked It:

Expensify remains a go-to for individuals or small teams who frequently travel for work. Its SmartScan tech helps capture receipts in seconds, and mileage or per diem entries are simple.

Mac users benefit from smooth syncing between the mobile app and browser dashboard. The Apple Mail integration also helps pull receipts directly from digital confirmations.

Features:

- One-click receipt capture and matching

- Reimbursement via ACH

- Real-time approval routing

- Card import and reconciliation

- Travel booking integrations

- Policy enforcement

Integrations:

QuickBooks, Xero, NetSuite, Uber, Lyft, Gusto, Zenefits, TripActions

Mac support: Browser access with responsive UI in Safari

Free plan: Yes, for individuals

Best for: Frequent travelers who need fast, mobile-to-Mac receipt syncing

Mac-specific note: Receipt parsing from Apple Mail and fast sync between iPhone and Mac dashboard

5. QuickBooks Online

Best for: Businesses already using QuickBooks who want to add expenses without switching tools

Why We Picked It:

QuickBooks Online includes a built-in expense management module that’s ideal for users already in the QuickBooks ecosystem. Expense categories, approvals, and reimbursements integrate directly into your accounting system.

Its web dashboard runs smoothly on any Mac browser, and the mobile app allows for quick receipt uploads that sync across platforms.

Features:

- Receipt scanning and matching

- Auto-categorization and tagging

- Expense approval flows

- Direct connection to banking feeds

- Reimbursement tracking

Integrations:

TurboTax, Gusto, Shopify, Square, PayPal, Expensify, Bill.com

Mac support: Native support via browser and mobile apps

Free plan: No

Best for: Businesses already using QuickBooks who want to add expenses without switching tools

Mac-specific note: Fully compatible with macOS browsers, syncing smoothly with QuickBooks Mac apps

6. Emburse Professional

Best for: Companies with heavy compliance and audit tracking needs

Why We Picked It:

Emburse Professional (formerly known as Certify by Emburse) is geared toward businesses that require strict financial oversight. It provides granular control over spending categories, audit trails, and receipt verification.

While its interface isn’t the most modern, it performs reliably in Safari on a Mac, and integrates well with complex accounting environments.

Features:

- Custom expense policies and routing

- Detailed audit logs

- Travel booking and policy sync

- Auto-generated expense reports

- Real-time alerts and approvals

Integrations:

NetSuite, SAP, QuickBooks, ADP, Oracle, Google Workspace, Microsoft 365

Mac support: Fully browser-based with consistent access across Mac platforms

Free plan: No

Best for: Companies with heavy compliance and audit tracking needs

Mac-specific note: Reliable in macOS environments with strong accounting software integrations

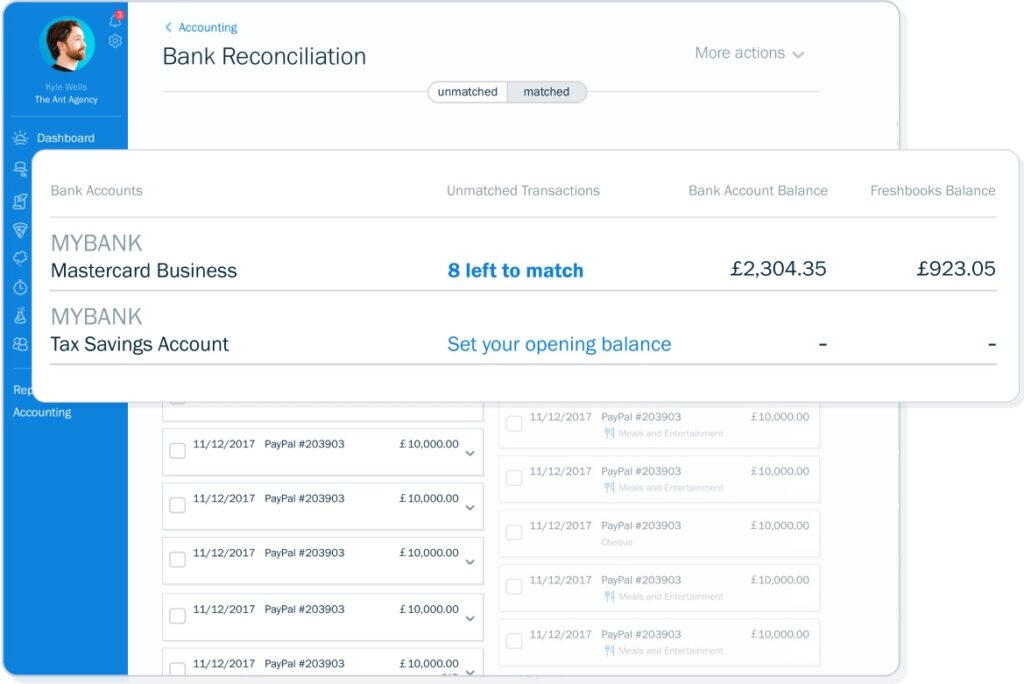

7. FreshBooks

Best for: Freelancers who want simple invoicing and expense tracking in one

Why We Picked It:

FreshBooks combines intuitive invoicing tools with expense tracking, time logging, and basic accounting features. It’s ideal for self-employed professionals and solo business owners who want to handle everything from client billing to expense categorization on their Mac.

The interface is designed to be beginner-friendly, and works cleanly in Safari or Chrome on macOS. It’s a particularly good fit for creative freelancers, consultants, and remote workers using MacBooks or iMacs daily.

Features:

- Automatic expense categorization

- Mobile receipt scanning

- Mileage tracking

- Invoicing and time tracking

- Client estimates and proposals

- Financial reporting

Integrations:

Stripe, PayPal, G Suite, Gusto, Trello, Asana, Shopify, Zoom, HubSpot, Slack

Mac support: Web-based with iOS companion app

Free plan: No, but free trial available

Best for: Freelancers who want simple invoicing and expense tracking in one

Mac-specific note: Clean browser dashboard optimized for macOS users and syncs well with Mac-friendly tools like Apple Mail and Calendar

8. BILL

Best for: Credit-based spend tracking with real-time budgets

Why We Picked It:

Bill (formerly known as Divvy) combines corporate cards with live budget tracking. Teams can issue virtual or physical cards while setting clear limits per department, trip, or event.

The web dashboard loads quickly on Mac browsers, and Apple Wallet compatibility makes it easy to use Divvy cards from a Mac-connected iPhone.

Features:

- Real-time budget enforcement

- Receipt uploads and policy review

- Virtual and physical card issuing

- Automated reimbursement

- Role-based permissions

Integrations:

QuickBooks, NetSuite, Xero, Slack, Google Workspace

Mac support: Fast browser-based UI, plus Apple Wallet support

Free plan: Yes

Best for: Credit-based spend tracking with real-time budgets

Mac-specific note: Works well in Safari; mobile app syncs easily with Mac via cloud

9. SAP Concur

Best for: Large companies with multi-country expense and travel needs

Why We Picked It:

SAP Concur handles expense, travel, and compliance in a single system. While more complex to implement, it suits global companies needing strong audit trails and tax handling.

The web-based version has improved for Mac users, especially in Safari, and mobile-to-desktop syncing helps streamline approvals and bookings.

Features:

- Expense and travel policy alignment

- Receipt capture and mileage logging

- Compliance checks

- Role-based reporting and analytics

- Multi-currency support

Integrations:

SAP, TripIt, Egencia, QuickBooks, Microsoft 365, Salesforce, Oracle

Mac support: Full browser access with mobile sync

Free plan: No

Best for: Large companies with multi-country expense and travel needs

Mac-specific note: Improved Safari compatibility with reliable sync from mobile to Mac

10. Airbase

Best for: Teams looking to combine card, bill, and reimbursement tools in one

Why We Picked It:

Airbase brings all company spend, cards, reimbursements, and bill payments, into one platform. It’s ideal for finance teams looking to simplify their toolset.

Its dashboard runs well in Safari, and the automation features help cut down on time spent chasing receipts or approvals.

Features:

- Corporate card issuing

- Bill payment management

- Multi-level approvals

- Budget controls and audit logs

- Accounting sync

Integrations:

QuickBooks, NetSuite, Slack, Google Workspace, Xero, Oracle

Mac support: Web-based with fast loading times in macOS browsers

Free plan: No, but demo available

Best for: Teams looking to combine card, bill, and reimbursement tools in one

Mac-specific note: Built for browser-based use with minimal lag on modern Macs

Other Expense Management Software for Macs

There were some tools that didn’t quite make our top list but are definitely worth considering if any of the above don’t fit your needs.

Here’s a selection of the best of the rest.

11. Float – Best for Spend Control in Canada and the US

Float offers modern corporate card and spend management tools for companies based in Canada and the US. It’s a strong pick for startups and finance teams looking to control budgets, issue cards, and manage approvals – all with a clean interface that works great on a Mac.

While Float is well-built for browser use, it’s only available to businesses incorporated in Canada or the United States, so teams based elsewhere will need to look at other options.

Mac support: Web-based with fast performance on Safari and Chrome

Free plan: No, but demo available

Best for: Canadian and US companies managing corporate card spend and approvals on Mac

12. Zoho Books – Best for Bookkeeping + Expense Tracking in One

If you’re already using Zoho Expense, Zoho Books gives you more control over accounting and project-based expense management. It’s ideal for small businesses that want invoicing, billing, and expenses under one roof.

Mac support: Web-based with mobile app support

Free plan: Yes, for businesses under a revenue threshold

Best for: Small business owners needing simple accounting and expense tracking

13. Payhawk – Best for International Expense Control

Payhawk is built with global teams in mind, offering multi-currency cards, VAT recovery tools, and localized controls. It’s ideal for companies based in the UK or EU operating across borders.

Mac support: Web-based, mobile companion app

Free plan: No

Best for: Companies managing expenses across multiple countries

14. Pleo – Best for European Startups

Pleo gives teams across Europe smart company cards with tight control over spending. It’s a good option for startups looking to ditch paper receipts and spreadsheets.

Mac support: Web-based and mobile app

Free plan: Yes, with feature limits

Best for: European startups replacing manual expense systems

15. Fyle – Best for Google Workspace Integration

Fyle makes it easy to submit expenses directly from Gmail, which is especially handy for Mac users who rely on Google Workspace. It also offers strong real-time spend analytics.

Mac support: Browser access; Gmail and Slack integration

Free plan: No

Best for: Teams using Gmail and looking for integrated expense capture

16. Teampay – Best for Pre-Approval Before Spending

Teampay focuses on controlling spend before it happens. It routes purchase requests through approvals before any money is spent, ideal for finance teams that want to prevent surprise transactions.

Mac support: Web-based

Free plan: No

Best for: Finance teams that want to enforce budgets proactively

17. Shoeboxed – Best for Scanning and Archiving Paper Receipts

Shoeboxed isn’t a full expense system, but it excels at digitizing and organizing paper receipts. You can even mail in physical receipts to have them scanned and categorized.

Mac support: Web-based + iOS app

Free plan: No

Best for: Small teams or individuals with lots of physical receipts

18. Spendesk – Best for Finance Teams with Growing Headcount

Spendesk provides cards, approvals, budgets, and accounting exports in a clean interface. It’s especially helpful for finance teams trying to scale processes as a company grows.

Mac support: Web-based

Free plan: No

Best for: Growing finance teams building spend controls from scratch

19. Rydoo – Best for Travel and Expense Integration

Rydoo handles both travel booking and expense management. It’s useful for companies that want a single system to manage travel approvals and post-trip reimbursements.

Mac support: Browser-based + mobile apps

Free plan: No

Best for: Travel-heavy companies who want one tool for flights, hotels, and expenses

20. Navan (formerly TripActions) – Best for Travel-First Expense Management

Navan is designed for companies where travel and expenses go hand-in-hand. It handles everything from booking flights to submitting receipts and reconciling spend, all in one place. The browser dashboard works smoothly on Mac, and the iOS app is one of the best for on-the-go approvals and uploads.

Mac support: Web-based + iOS app

Free plan: No

Best for: Companies where travel booking and expense tracking need to live in one tool

Related Software

If you still haven’t found what you were looking for here, you may also find the following useful:

- How To Setup an HR Stack on a Mac

- HR Software For Mac

- Employee Scheduling Software for Mac

- Employee Monitoring Software for Mac

- Time Tracking Software For Mac

- Payroll Software for Mac

- Accounting Software For Mac

- Recruitment Software For Mac

How We Selected These Mac-Compatible Expense Management Tools

To make sure our recommendations actually work well for Mac users, we carried out detailed hands-on testing of each expense management platform included in this guide.

We didn’t just rely on marketing claims or feature lists, we tested these tools in real-world expense scenarios like uploading receipts, managing approvals, syncing card transactions, and reviewing reports on macOS devices.

Here’s the framework we used to choose the best expense management solutions for Mac-based teams:

macOS Compatibility and User Experience

We prioritized expense platforms that perform smoothly on macOS, using browser-based interfaces that respond well in Safari or Chrome. We tested compatibility on the latest versions of macOS, checked for Apple Silicon optimization, and looked at how each tool handles file uploads, drag-and-drop actions, and native system notifications.

Expense Tracking and Approval Features

We looked for platforms that go beyond basic receipt storage – tools that include real-time card syncing, policy enforcement, mobile capture, and automated approvals. Built-in tools for categorization, mileage, per diems, and reimbursements were essential.

Affordability for Small to Mid-Sized Mac Teams

We focused on tools that make sense for startups, agencies, and small businesses running on Macs. That meant evaluating free tiers, usage limits, pricing transparency, and whether features like custom fields or card integration required enterprise plans.

Integration with Apple & Popular Business Tools

We looked at how each tool connects with Gmail, Apple Mail, Slack, accounting software like QuickBooks or Xero, and whether mobile apps worked well on iPhone alongside the desktop Mac experience. The smoother the integration with Apple’s ecosystem, the higher it ranked.

Collaboration & Reporting Capabilities

Expense management is rarely a solo task – so we evaluated how each tool supports collaboration between finance, operations, and leadership. Shared dashboards, multi-level approvals, and exportable reports for accountants all played a role.

Security & Compliance

We reviewed each vendor’s approach to secure data handling, including encryption, permissions, and compliance with standards like GDPR and SOC 2. Expense data often includes sensitive employee and financial information, so this was non-negotiable.

Customer Support & Setup Help

Finally, we looked at onboarding support, live chat availability, and help resources like setup guides and video walkthroughs. Tools with responsive support and clear documentation scored highest, especially for non-technical users on small teams.

What’s New in 2025 for Mac Expense Management Software

In 2025, expense management tools have become faster, more automated, better adapted to Apple’s hardware and software ecosystem and of course, embraced AI.

Optimized Performance for Apple Silicon

Most leading expense tools are now fully optimized for Apple Silicon, offering faster upload speeds, quicker data syncing, and reduced memory usage on MacBooks. Platforms like Ramp and Divvy now open instantly in Safari or Chrome and feel more responsive during bulk uploads or approval flows.

Smarter Receipt Capture with AI

AI has moved from gimmick to utility in expense software. Many platforms now auto-tag receipts, match transactions to vendors, flag policy violations, and even detect duplicate submissions. This saves finance teams hours each month in manual review.

Real-Time Spend Visibility Across Devices

With more teams working remotely or hybrid, real-time spend dashboards are now available across Mac, iPhone, and iPad. Finance admins can approve expenses, freeze cards, or monitor team budgets on the go.

More Control Over Pre-Approval and Limits

Tools like Teampay and Airbase offer advanced pre-approval features that help companies stop overspending before it happens. Expense limits, merchant restrictions, and automated approvals are now easier to manage in-browser on a Mac.

Travel & Expense Integration

Travel-heavy teams can now book flights, track per diems, and submit expenses from a single platform. Tools like Navan and Rydoo offer this dual functionality, helping Mac users eliminate the gap between trip planning and expense reports.

Stronger Compliance and Audit Support

As data privacy rules tighten, expense platforms have doubled down on security. Look for features like role-based permissions, audit logs, and native macOS sandboxing to keep financial data protected.

FAQ

What is expense management software?

Expense management software helps businesses track spending, reimburse employees, manage corporate cards, and stay compliant with financial policies.

Does expense software work on a Mac?

Yes. Most modern platforms are browser-based and work perfectly in Safari or Chrome on a Mac. Some also offer iPhone and iPad apps for on-the-go expense tracking.

What should Mac users look for in an expense tool?

Look for tools that:

- Work fast in Safari

- Support Apple Mail or iCloud Calendar integrations

- Sync with Apple devices

- Offer iOS apps

- Provide strong data security and export options for accountants

Which expense tools integrate with Mac apps?

Popular platforms like Ramp, Rippling, and Zoho Expense integrate with Slack, Gmail, QuickBooks, and even Apple Mail for receipt parsing.

Is there free expense software for Mac?

Yes. Ramp, Zoho Expense (for up to 3 users), and Divvy offer free plans. Some platforms charge based on card usage or features, so read the fine print.

Can I scan receipts from my Mac or iPhone?

Yes. Most tools let you upload from your desktop or scan with your phone. OCR (optical character recognition) turns images into data automatically.

Is expense software secure?

Good platforms offer encrypted storage, SOC 2 compliance, access controls, and GDPR support. Always check their data privacy documentation.

Can I use these tools for reimbursements and corporate cards?

Yes. Many platforms support both. You can issue cards, set spending rules, and reimburse employees directly to their bank accounts.

Conclusion

Managing company expenses from a Mac no longer means relying on spreadsheets or finance tools that weren’t designed for macOS.

The best expense management software of 2025 works perfectly on MacBooks and integrates with tools you already use, from Apple Mail and Slack to QuickBooks and Zoom.

If you want the smartest automation and cleanest Mac interface, go with Ramp.

If your team already uses Rippling for payroll or HR, adding expense management makes total sense.

For small teams or freelancers, Zoho Expense offers a great feature set for the price.

And if none of the top picks are quite right, there are plenty of other strong options in the second list worth exploring, especially if your business has specific travel, compliance, or card control needs.

Pair any of these with the best accounting software for your Mac or any Mac compatible HR software, and you’ll have a complete, modern expense system that works exactly how it should, on your Mac.