Copilot is one of the best personal finance apps we’ve used on a Mac and in this review, we take a closer look at the pros and cons of this impressive budgeting app.

If you’re looking for an alternative to Mint on a Mac which has been discontinued, then Copilot is up there with one of the best budgeting tools out there for Macs.

Copilot (not to be confused with Microsoft’s AI assistant Copilot) has been around since 2019 and until recently, used to be only available on iOS but now has a Mac desktop app that’s rapidly gaining in popularity.

Copliot was founded by a former Google employee Andres Ugarte and is easily the best looking budgeting app we’ve seen on a Mac and as we found, it’s not just a pretty face.

Table of Contents

First Impressions: It’s pretty

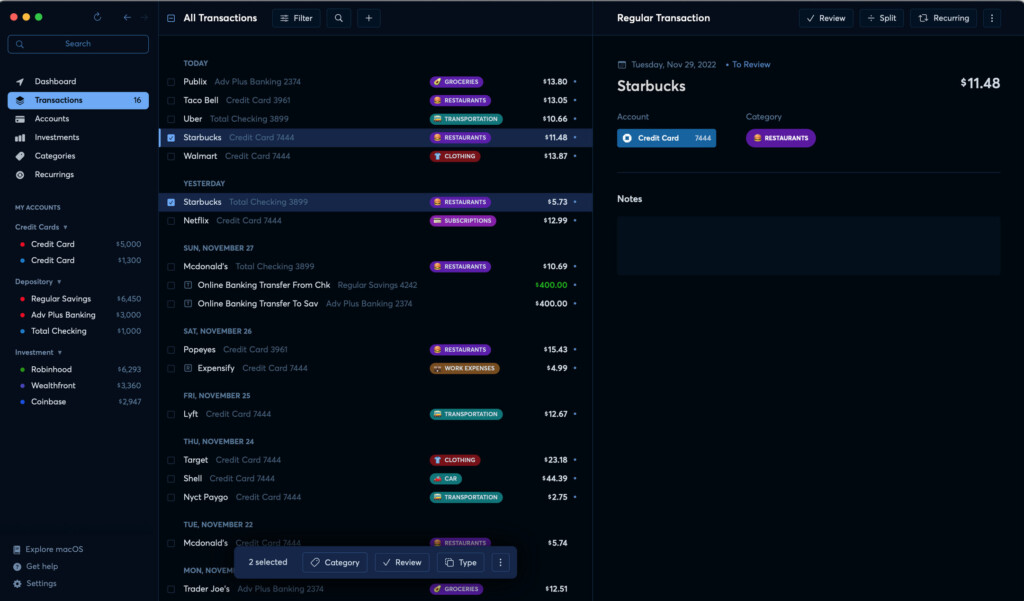

The first thing that immediately strikes you about Copilot is that it’s a very good looking app.

Copilot looks great on macOS whether its for tracking spending, budgets, investments and net worth – all the basics you want in a budgeting app without all the unnecessary bloat of products like Quicken.

Since its designed exclusively for the Apple ecosystem, it can also be used in macOS Dark Mode.

Setting-up Copilot

The first thing to do when you start Copilot is to sync your bank accounts with it.

Depending on how many accounts you’re syncing, the amount of data imported can be overwhelming at first but don’t panic as Copilot does a remarkably intelligent job of sifting through it all.

Copilot uses Plaid to sync your bank accounts with it which in our opinion, is the most reliable way to sync accounts with any personal finance software.

The best personal finance software we’ve used Empower also uses Plaid for this reason because it eliminates many of the problems with Direct Connect.

Although most major financial institutions are supported by Copilot, not all are. In particular, linking of credit cards such as the Apple Card has to be done manually.

Apple Card support is also dependent on Apple cooperating with Copilot so this might not happen anytime soon.

Once synced, Copilot will immediately make budget estimates based on your financial data but you’ll find yourself having to manually correct a lot of this.

If you’re a Venmo user, this is a particular issue with Venmo refunds as Copilot obviously has no way of estimating any refunds you might be due to receive from friends, family or colleagues as it depends on how you’ve split it.

You therefore may have to manually assign some transactions to the right categories.

You can however setup rules for Venmo charges and Copilot will then estimate more accurately what you’re owed for future transactions.

Venmo integration is something that Copilot has really tried to integrate though and definitely sets it apart from other budgeting apps.

The investment tracking in Copilot is also updated in real time so you can follow minute-by-minute changes to your investments.

You can also benchmark investments against popular indexes like the Vanguard S&P 500 ETF to better visualize how they are performing.

Copilot also supports tracking your crypto investments and can retrieve staking and exchange pool data from the Coinbase and Binance exchanges amongst others.

![]()

Spending & Budgeting

Maintaining control of your spending is key to any decent budgeting software and Copilot does this very well indeed.

Copilot gives you useful daily snapshots to give you an instant overview of how your spending was on any particular day.

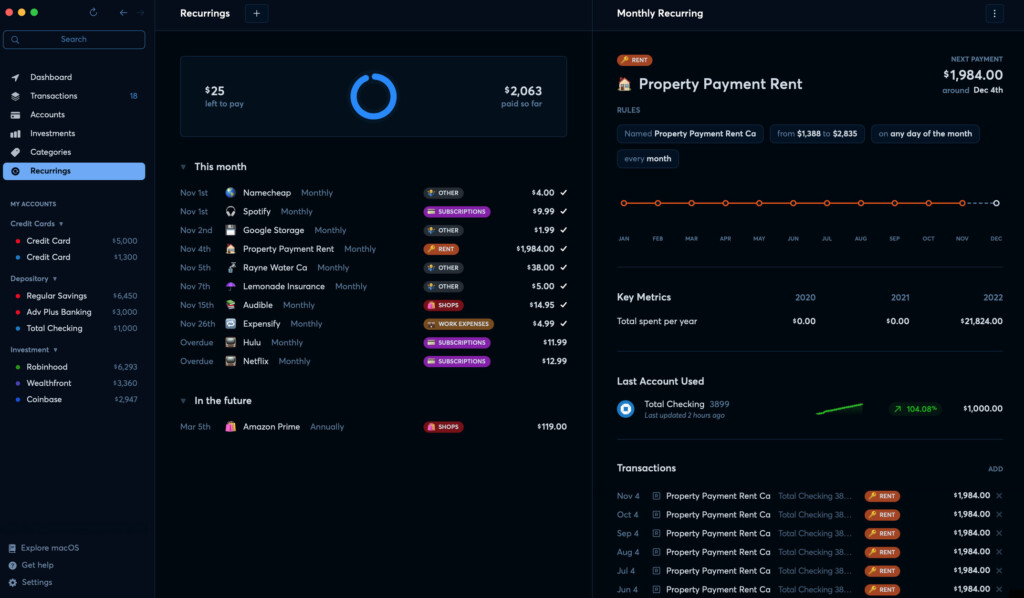

There are also bill reminders for upcoming payments and a well organized spending by category summary.

If you fall within your budget, you can also set Copilot to carry-over your budget into the following months too.

The “Upcoming” feature is a really useful way to see which expenses are coming out of your account soon, especially subscriptions that you may have either forgot about or have forgotten to cancel.

One really cool feature in Copilot is its ability to automatically suggest a way to balance budgets.

The “Rebalance Budgets” tool will examine your spending and then suggest alternative ways of allocating your spending while staying within the same budgets.

While this sometimes misses the mark in real life because of unexpected and spontaneous spending, its a really nice feature that helps you rethink how to adjust your spending.

You can of course also manually adjust budgets for certain categories so if you spot that you’re spending way too much on Ubers, you can lower the budget (and then hopefully try to stick to it).

You can also choose to receive notifications when money has been spent although this is more useful on the mobile app than on your Mac desktop.

Categorizing

One of the things we liked the most in Copilot is the way it can automatically categorize data.

This includes things like subscriptions and recurring charges so that you identify subscriptions and monthly charges that you may not need or use anymore.

Recurring transactions are intelligently tracked and understood by Copilot saving you a lot of time manually reconciling them.

One neat touch is the way Copilot categorizes Amazon purchases.

Whereas many budgeting apps would categorize these generically under “shopping”, you can actually link Copilot to your Amazon account and lists your purchases by name and category.

This can be glitchy at times and may require manual correction of transactions but it gives you a surprisingly clear overview of how much you’re actually spending on Amazon alone.

Another smart aspect to Copilot bank syncing is that it immediately understands which entries are internal transfers between accounts (marked with a “T”) so that it keeps everything perfectly balanced and understood at a glance.

In general Copilot’s ability to understand and categorize transactions is uncannily accurate and partly down to the apps use of Copilot Intelligence AI which makes it remarkably smart compared to many personal finance tools.

You can customize a lot of how Copilot displays category data too including category names, colors and even emojis.

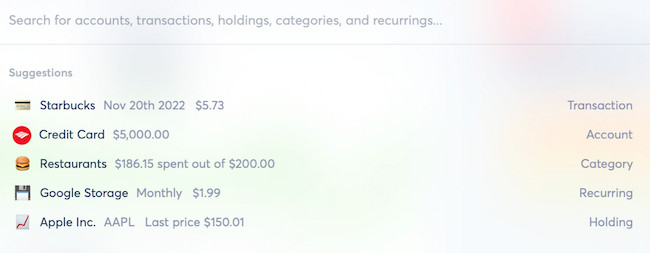

If you can’t find a specific transaction in a category, the search tool in Copilot for Mac is smart and very quick to find them either by company name or amount.

Although you can bulk change categories, review status and transaction type, there is however no way to bulk rename or auto rename or tag transactions in Copilot which we’d like to see in future versions.

Importing Mint Data

If you’re one of the many Mac users looking for an alternative to Mint, then Copilot is working on a data import tool that will allow Mint users ti import their data into it.

You can join the wait-list to be informed when its ready.

How Secure Is Copliot?

Copilot publishes an extensive policy on its Privacy and Security measures and its clear they take this issue seriously, as they should.

No personal finance app is immune from hacking but as with most of them, no one can actually touch your money (including Copilot staff) if they manage to hack Copilot as it only uses Plaid for read-only access to your accounts.

In terms of security, Copilot’s policy is quite clear on this:

Your personal Copilot financial account data, such as budgets and transactions, is only accessed by the Copilot team when necessary to provide the Copilot services, like when you request support for a data issue. We use aggregated and anonymized data for internal analytics and business purposes – you can read our Privacy Policy for more information.

We employ a number of security measures to help keep your data safe, including 256-bit encryption to protect it at rest and Transport Layer Security (TLS) to protect it in transit. In other words, your data is encrypted while it is being stored and while interacting with our servers. And we do not see or store your bank login credentials because we partner with trusted data aggregators, like Plaid and Finicity, to connect to your financial institutions. Copilot works with third party vendors who adhere to industry security standards. You can read more about Plaid and Finicity’s security policies on their websites.

Copilot’s direct OAuth integrations for Capital One and Coinbase meet the same data security requirements. OAuth allows us to connect directly with your bank rather than importing your account and transaction data via an aggregator. We do not see or store your OAuth login credentials either.

In terms of privacy, Copilot assures that it does not sell your data to third parties:

What you do in Copilot, stays in Copilot

Our only focus is on building tools that help you improve your finances. We respect your privacy, so we give you transparency and control over your data and keep it private. We don’t like it when we start seeing online ads for things we recently bought, so we do not sell your personal data to third parties so that they can advertise products to you.

The impression we got from Copilot is that it’s quite transparent on this issue. The business model uses the subscription fee to develop the product rather then sell data to third parties in order to raise revenue.

You can read the full Copilot Privacy Policy for more on this.

Downsides

The biggest downside of Copilot for users outside of the U.S. is that it’s only available in the USA. Copilot is not available in other countries including Canada, the UK and Australia.

The Copilot website states that there are plans to roll it out in other countries soon but nothing more concrete than that.

You can request that your country is added to the waitlist here and see the current leaderboard which is currently headed by Canada, UK and Germany.

On switching to Copilot, there’s also no easy way to import financial data from other apps into Copilot.

You can’t even import CSV files into Copilot which you’d expect as standard in any personal finance app.

As mentioned earlier, Copilot is working on a tool for importing Mint data but the inability to see your historical financial data before switching to Copilot is frustrating.

We’d also like to see more reports in future updates to Copilot. At the moment, there aren’t many analytical reporting tools in Copilot to help summarize things for you over specific time periods.

Finally, there’s no multi-currency support in Copilot so if you use Wise, there’s no way to integrate it.

Despite these drawbacks, one thing we really like about Copilot however is that it publishes its roadmap so you can see which features will be added to the program soon.

Copilot Pricing

Copilot costs $13/month or if you pay annually up-front its $95/year which works out at $7.92/month. This gives you access to both the iOS and macOS app.

You can try a one month free trial of Copilot on your Mac too after you download and install it.

Some may balk at paying this much for a personal finance app but Copilot doesn’t partner with any banks or credit brokerages and unlike Mint, it doesn’t plague you with ads either.

Considering all the benefits of the app, we think it’s a price worth paying as it should pay itself back by helping you get your finances in order.

How To Get Copilot For Mac

You can download the Copilot app from the Mac App Store for both Intel and Apple Silicon apps and also get it from the Copilot website.

The Copilot app is native for both Intel and Apple Silicon Macs – it does not use Electron to wrap a web version of it in.

Alternatives To Copilot

If you’re looking for a free alternative to Copilot on a Mac then the best alternative by far is Empower especially for investment tracking.

For a simpler, cheaper alternative, Money Pro is also an option.

For a more spreadsheet based alternative then take a look at Tiller.

Or if you’re thinking of switching to Copilot from Mint then we recommend reading our look Mint alternatives for Mac.

You can also find a wider range of options in our comprehensive look at the best personal finance software for Mac too.