Moneydance is a personal finance app for Mac, Windows and Linux that’s proved a popular alternative to Quicken for both Mac and PC.

Moneydance has many satisfied customers that previously used Quicken for budgeting and managing their finances especially because it’s very reliable at connecting with bank accounts.

Although Moneydance now works on both PC and Mac, it was originally designed just for Mac when it was released in 2005 and there are still older versions for Snow Leopard and PPC Macs available.

Since it’s very similar on all platforms, this review will be of interest to both Mac and Windows users.

Here then we take a closer look at what Moneydance can do and give our opinions on it.

Table of Contents

Moneydance Review

Moneydance includes most of the major features of Quicken including online banking and bill payments, bill attachments and has excellent investment tracking and budgeting tools.

One of the big attractions of Moneydance compared to Quicken and other products is that it works offline on Mac desktops so your financial data isn’t hosted in the Cloud.

Another plus is that unlike Quicken, there is no subscription to use Moneydance as it offers a one-off purchase option of $69.99 for Moneydance 2024.

However, this doesn’t include bank syncing for which you have to purchase the subscription version which costs $9 per month.

Moneydance Overview

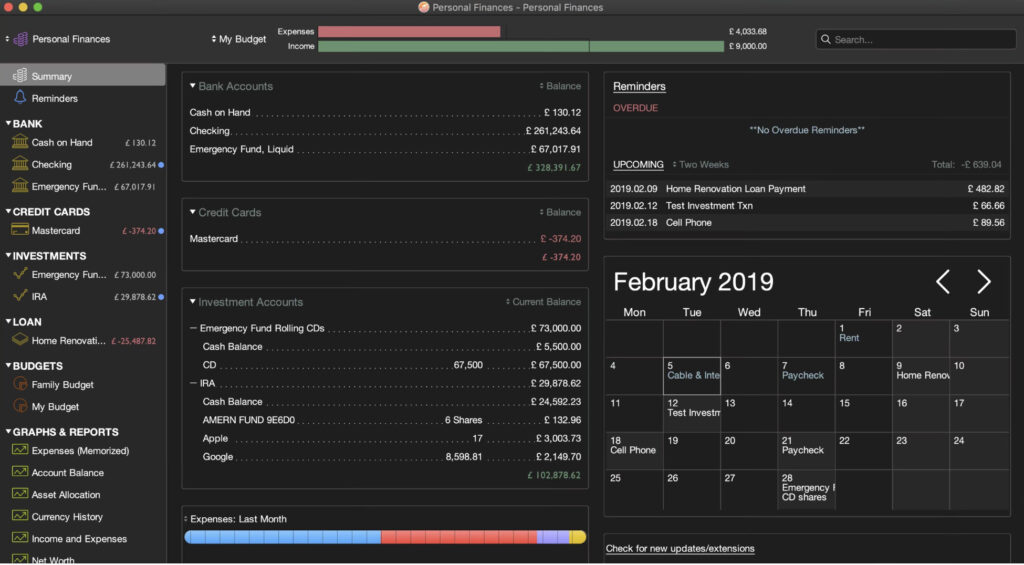

Moneydance provides a very clear overview of your finances. It gives you all the essentials such as account balances, upcoming and overdue transactions and exchange rate information.

The integrated calendar overview is particularly useful for a quick oversight of upcoming credits and debits so you can manage your finances for that month more easily.

To access more details for an account, simply click on it and you can enter transactions or reconcile it against a statement.

Clicking on a transaction reminder will display a window where you can automatically record the transaction.

You can easily setup recurring payment reminders using the calendar too.

Online Banking

One of the main reasons Mac users have switched to Moneydance is the reliable online banking features.

Moneydance will automatically download transactions and make bill payments to hundreds of financial institutions via Direct Connect which is the same system used by Quicken for Mac.

It also intelligently learns how to automatically categorize and sort downloaded transactions so that they are easier to manage.

This is useful when it comes to recognizing ledger history and auto-suggesting similar payee entries.

Note however that as with all personal finance apps, syncing with Direct Connect doesn’t always work. This is often due to security changes on the bank’s side regarding how third party applications access them rather than Moneydance itself.

However, some banks are choosing to drop Direct Connect support completely in favor of using EWC+ to connect to personal finance software like Moneydance.

Unfortunately, Moneydance doesn’t support EWC+ yet and so if your bank doesn’t support Direct Connect, you won’t be able to sync it with Moneydance.

In general though, for those banks that do still support Direct Connect, Moneydance is very reliable when it comes to syncing and downloading online banking and investment house statements.

Investment Features

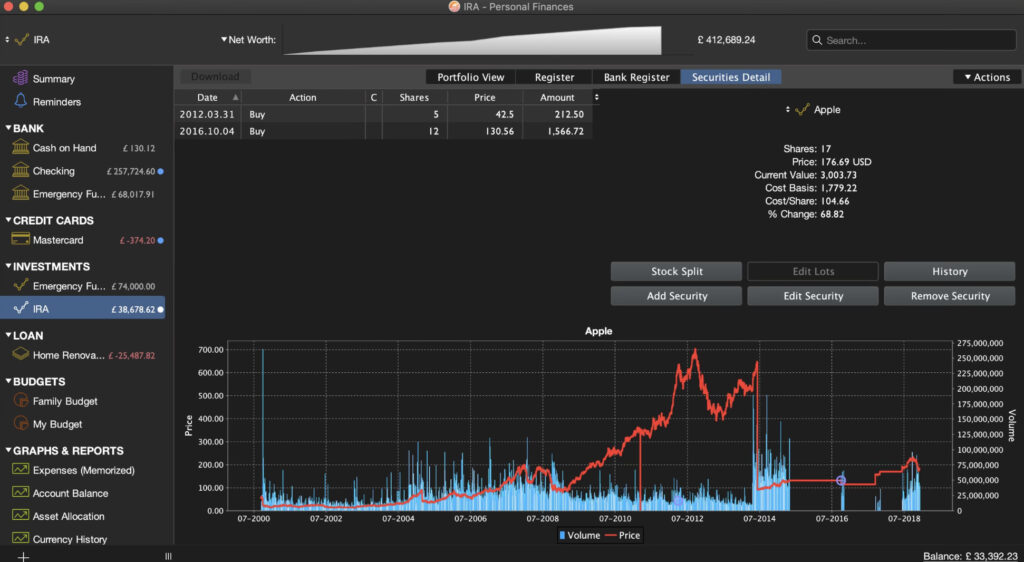

Investment tracking in Moneydance is easier to navigate and more powerful than Quicken, with support for stocks, bonds, CDs and mutual funds among others.

You can see the total value of your investments or the performance of individual stocks and mutual funds over time. Moneydance will also download stock prices automatically in real-time.

Moneydance is particularly good at handling investments and transactions in multiple currencies so is an excellent choice for those that hold investments or make purchases in currencies other than US dollars.

Reporting

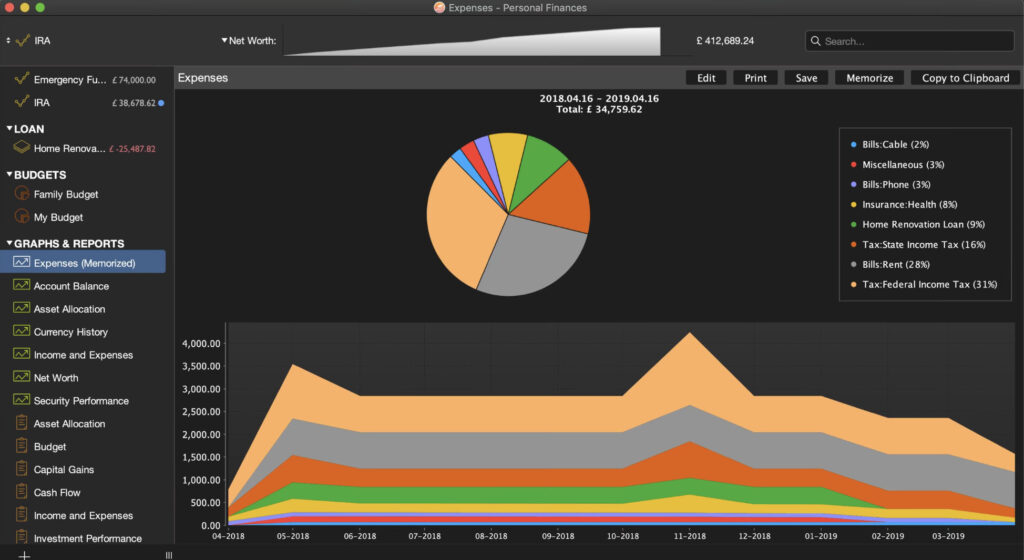

Moneydance has some powerful reporting tools that compare favorably with Quicken and it can generate reports for any of your accounts, savings or investments.

You generate reports for income and expenses, change the graph types and see detailed pop-up data when your cursor floats over them.

You can also save graphs and export them to PNG format for sharing.

Accounts Register

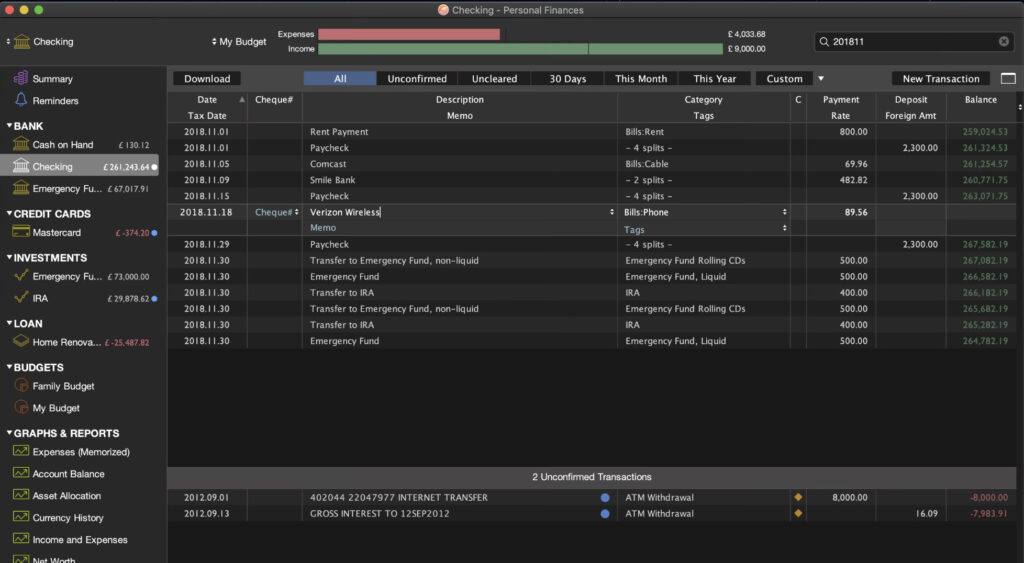

Another popular feature in Moneydance is the accounts register. The accounts register allows you to simply enter, delete and edit transactions in an account.

The calculation of balances and sorting of transactions in automatic. There’s also a payee auto-complete feature that makes it easier to enter and categorize transactions.

Importing Quicken Files Into Moneydance

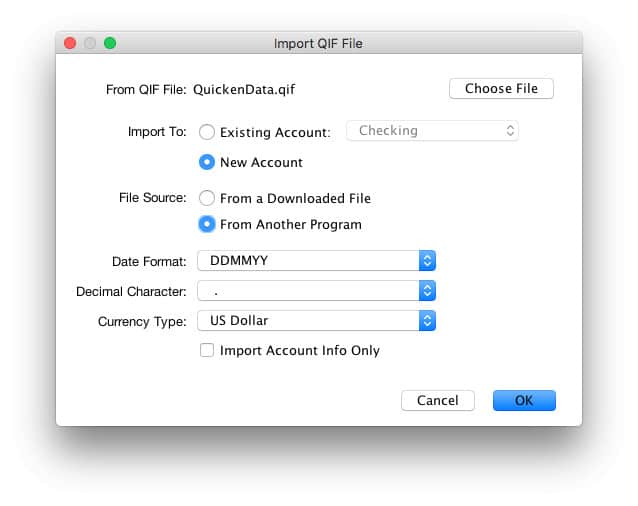

Importing Quicken data is simple enough. All you need to do is export a QIF file from Quicken and then import it into Moneydance.

It’s recommended to import all of your Quicken accounts into one QIF file otherwise the import process can be a bit messy and complicated.

This is particularly true if you want to avoid duplicate transactions which can be tedious to clean-up manually.

This can also be a problem when importing QIF files from banking institutions – you may find that some transactions are duplicated and need to remove them manually.

Note that unfortunately, Quicken 2019 has removed the option to export files in QIF format in the Mac version. It now only exports in QXF which is a proprietary Quicken format that can’t be imported into any program. However, the Windows version of Quicken still exports to QIF so Mac users must open their accounts on a PC and export them if they want to import them to another program.

Moneydance Mobile

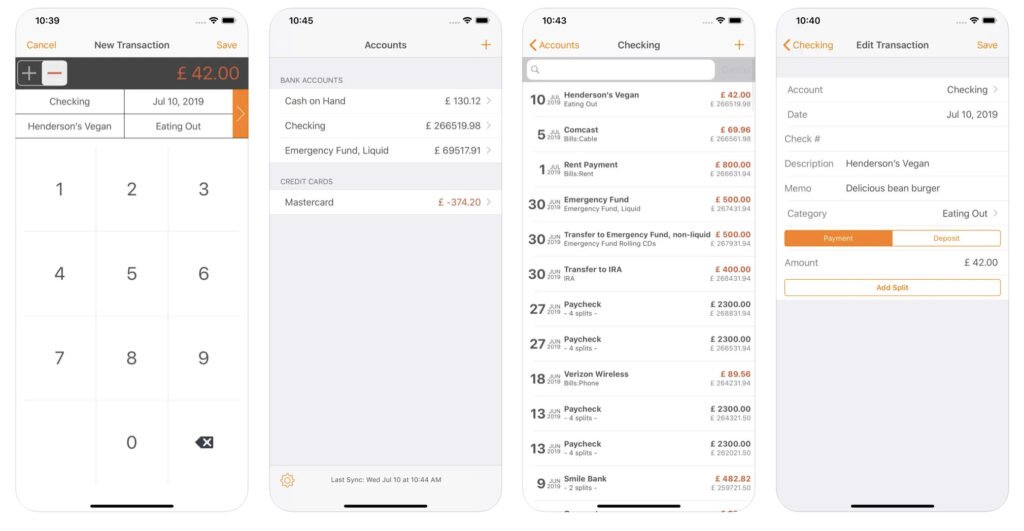

Another nice thing is that the Moneydance iPad and iPhone apps are both free from the Mac App Store so you can manage your budgeting on the move. There’s also an Android app.

However, overall the Moneydance mobile app is quite limited and it’s only really useful for manually inputting transactions on the move.

For example, you can’t search transactions, it can’t hold more than 12 months worth of data and there are no budgeting functions.

Moneydance only syncs the Mac and iOS app via Dropbox too – there’s no iCloud or WiFi syncing available.

Extensions & Add-Ons

Finally, a unique feature of Moneydance is the ability to extend its functionality with add-ons and extensions.

These include such things as Balance Predictor based on previous transactions, Debt Insights and a Find and Replace extension which is useful for removing duplicate transactions from imported Quicken or banking files more easily.

Moneydance extensions are made with the Python programming language so if you’ve got any knowledge of Python, you can make your own or customize them.

New In Moneydance 2024

Moneydance 2024 introduced various enhancements to the app. Some of the highlights include:

- Batch Change Amounts: This feature allows users to modify multiple transaction amounts simultaneously using mathematical expressions. For instance, to reverse selected transaction amounts, you can apply the expression “{value} * -1”.

- Searchable Accounts and Categories: The updated search functionality enables filtering accounts and categories by name, type, currency, or security. This makes it easier to locate specific accounts or investments, such as all bank accounts or particular stocks like Apple shares.

- Enhanced Date Range Customization: Users can now define more precise date ranges for financial analysis. The update includes expanded predefined ranges and the ability to adjust the offset and duration of these ranges, facilitating detailed financial comparisons over time.

- Improved Auto Backup Settings: To safeguard financial data, Moneydance 2024 offers enhanced backup functionality, allowing multiple automatic backups per day. This ensures data integrity and provides peace of mind against potential data loss.

- Expanded Context Menus: Moneydance now features more comprehensive context menus accessible via right-click (or control-click on Mac). These menus provide quick access to options such as adding or removing accounts from the sidebar, editing details, reconciling transactions, adjusting balances, or opening accounts in new windows.

Moneydance Drawbacks

Moneydance definitely feels a little friendlier than Quicken to use although at the same time, it also feels a bit lightweight.

There’s no basic things like budgeting goals, retirement planning and support for multiple accounts or profiles either so it’s not as suitable for families or organizations that want to create accounts for multiple users.

You can though install Moneydance on as many computers as you want at home if for example, a husband and wife want to have separate accounts.

Business users must purchase separate licenses for each computer they install Moneydance on however.

Moneydance Support

In terms of support, Moneydance is definitely limited compared to most budgeting apps.

There’s not even a direct email address to contact the developer Infinite Kind or a telephone number for support.

However, it does have an extensive Knowledge Base where the developer is very responsive to customer queries and problems.

From going through the knowledge base, it seems that most users questions or problems are rapidly resolved by the team behind Moneydance.

Moneydance Pricing

You can purchase Moneydance 2024 for $69.99 from the Mac App Store or direct from the developer for the same price with a 90 day money back guarantee.

You can also purchase Moneydance as a one-off purchase from the developer for $65 but this does not include MoneyDance+ for connecting to banks.

There is also a free fully functional Moneydance demo for up to 100 transactions.

Major updates are usually discounted by 50% for existing users.

If you’ve got a very old Mac, there’s even legacy versions available.