While a lot of the best personal finance software are great for managing budgets, they’re not always great at tracking your net worth.

Effectively tracking and optimizing your portfolio can be tricky but there are some excellent investment management apps that make things easier.

We’ve tested and reviewed a range of powerful Mac desktop and Cloud based investment software for all budgets and assets, including those that track stock trading and crypto trading, that do the hard work for you.

Note that most of these tools are aimed at the US market and support connecting to banks and financial institutions in the USA so won’t be available to users in other countries.

Here then are the best Mac apps to manage and balance your financial portfolio starting with the reviews followed by a comparison table so you can see how they match-up side-by-side.

Table of Contents

- 1. Empower (Free)

- 2. Delta Investment Tracker

- 3. Quicken Classic Premier

- 4. Tiller

- 5. Wealthfolio

- 6. Kubera

- 7. SigFig (Free)

- 8. Morningstar Investor

- 9. M1 Finance (Free)

- 10. Portfolio Performance (Free)

- 11. Axos Invest (Free)

- 12. Sharesight (Free)

- 13. Fidelity Full View (Free)

- Comparison Table

- Mac Portfolio Management Software For Advisors

- Running Windows Investment Tools On Macs

- Trends in Investment Portfolio Tracking Software

- FAQ

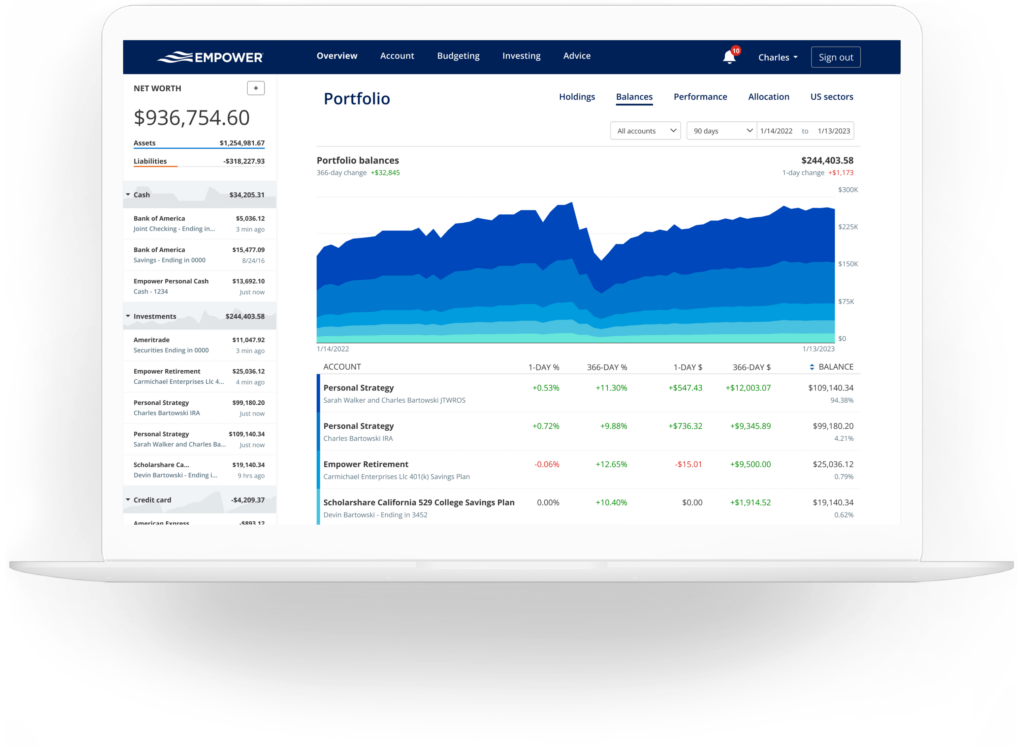

1. Empower (Free)

When it comes to investment tracking, few apps cover more angles than Empower (formerly known as Personal Capital).

Empower is 100% focused on investment management and does it extremely effectively for FREE.

What’s the catch?

Empower uses a unique business model that only charges you a commission if you choose to go with a personalized investment strategy after a free personal strategy meeting with one of its financial advisors.

The app itself is completely free to use for as long as you want and can instantly optimize investments.

Here’s some of the things that we liked the most about Empower:

- It supports investment accounts of all types and brings them into one place.

- It doesn’t actually touch your assets – it merely syncs with your investment institutions

- It instantly reveals insights into spending, saving and retirement goals

- You can run useful “what-if” scenarios based on investment decisions or life changes

- You can analyze fees to see where brokers and fund management commissions are eating into your investments

- If you need guidance, you can choose to consult an Empower financial advisor for free. What we really like about this is that their advisors are fiduciaries which means they have a legal and ethical responsibility to advise you in your best interests – not those of a fund manager or investment house.

You can also check out our complete Empower review for a more in-depth look.

Pricing: Free

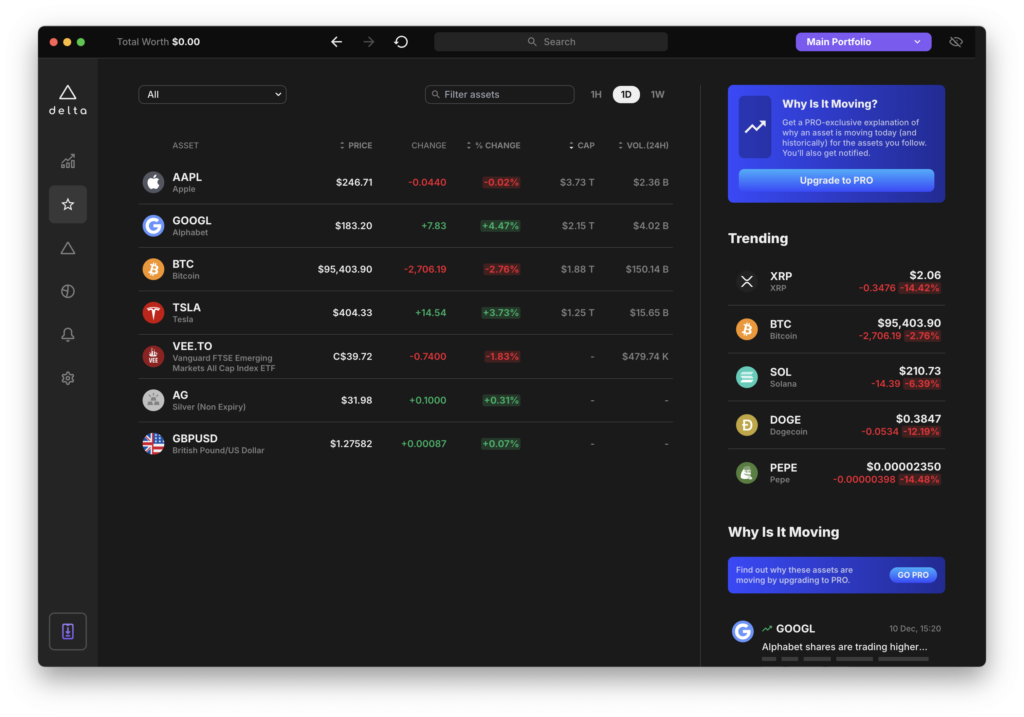

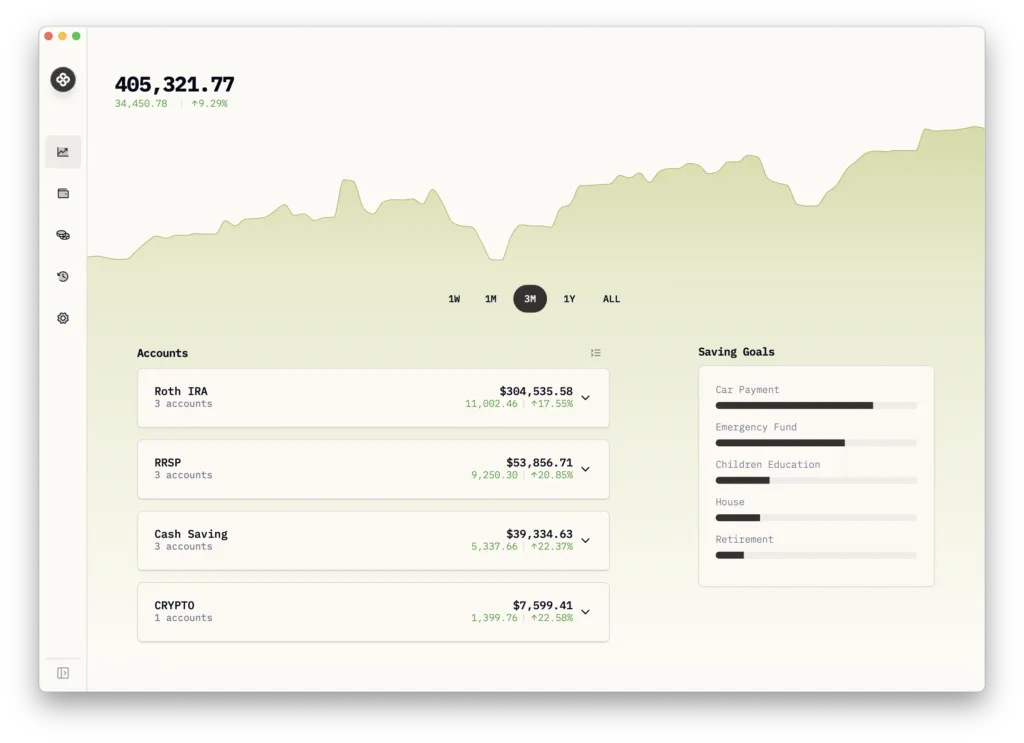

2. Delta Investment Tracker

If you use eToro for stock trading on a Mac, then you may like Delta Investment Tracker which is made by eToro.

Although the mobile version has been around for a while, it now offers a slick Mac desktop app which not only tracks your eToro investments, but also connects with up to 1,600 brokerages.

Delta offers a user-friendly way to monitor your stock, cryptocurrency, ETF, and other investment portfolios in real time.

The app centers around the Portfolio Tracker that consolidates all your investments, including stocks, crypto, funds, and currencies, into one dashboard for a comprehensive view.

It also provides live price tracking and alerts, ensuring you’re up to date with market changes.

Others useful tools include a profit/loss analysis, asset diversification, and portfolio growth over time.

At the moment, you can only link brokerage and add transactions via the mobile app although hopefully that will be added to the Mac app soon.

Check out our full Delta Investment Tracker review for more.

Pricing: Free

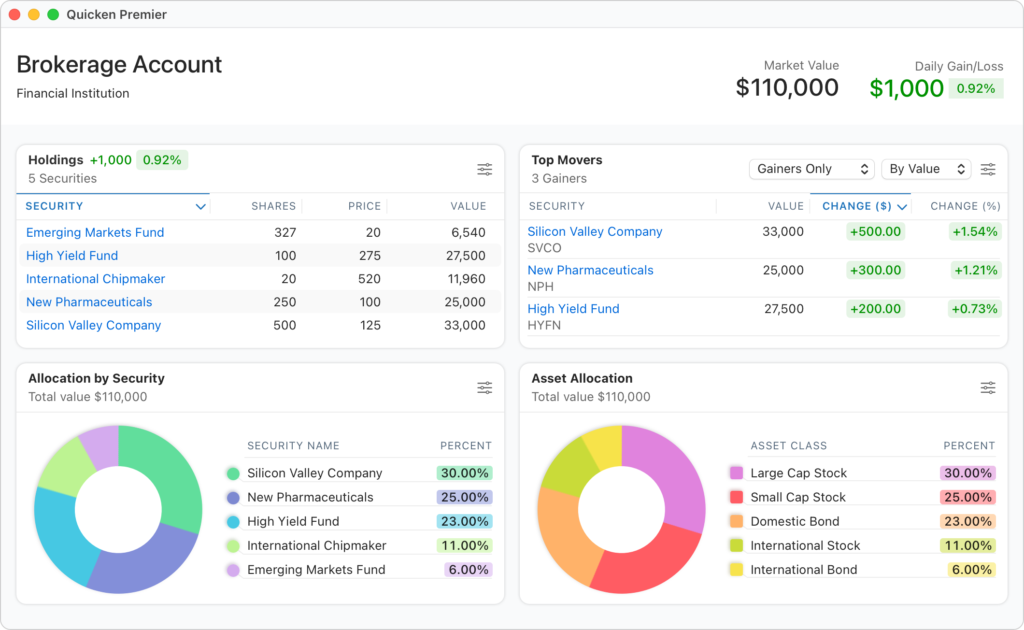

3. Quicken Classic Premier

Quicken is one of the most well-known personal finance software out there and Quicken Classic Premier is the most complete version of it.

Quicken Classic Premier For Mac includes specific focus on investment and is the only version of Quicken you should be looking it at if you need investment tracking features.

In our opinion, some of the strengths of Quicken Classic Premier are:

- It allows you to see how investments are performing with informed buy/sell decisions

- We like the Portfolio X-Ray tool from Morningstar which drills down into your portfolio diversification

- You can quickly see realized and unrealized gains with updated quotes

- It gives recommendations to minimize tax on investments

- There are customizable investment portfolio views with IRR & ROI

- Investment Lot tracking

However, it’s considerably behind the other investment tools featured here because ultimately that’s not the main focus of Quicken products.

Quicken Premier is primarily for those that want a budgeting tool and investment tracker rolled into one.

However, if you’re already a Quicken user, the Classic Premier version could be ideal for you.

You can check out our full Quicken for Mac review for more.

Pricing: $95.88/year

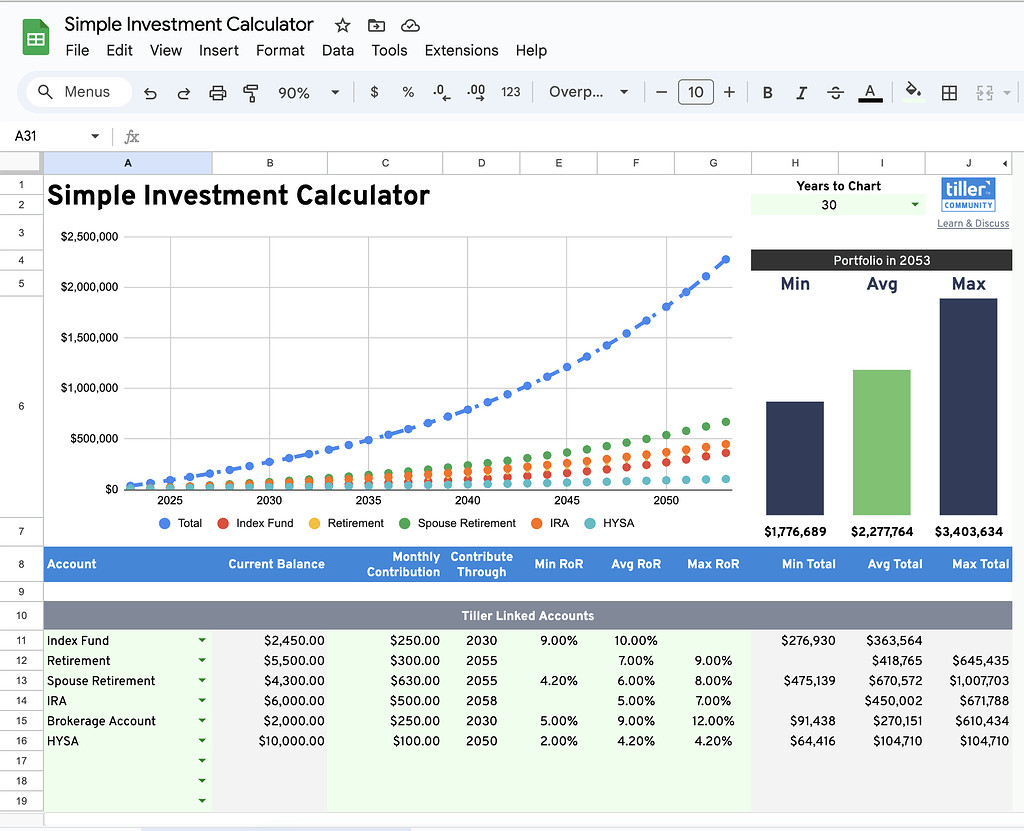

4. Tiller

If you’re an old school fan of spreadsheets, then Tiller may be perfect for you.

Tiller is a powerful spreadsheet-based financial tool designed to help users manage and track their finances through customizable Google Sheets or Excel templates.

While Tiller covers a range of financial tasks such as budgeting, expense tracking, and cash flow management, it’s excellent for investment management and tracking.

Tiller works on any Mac as it is cloud-based and accessible through Google Sheets or Microsoft Excel.

Tiller allows you to track investments by integrating data feeds from financial accounts such as brokerages, retirement accounts, and personal investment platforms.

It automatically updates your investment portfolio with real-time data, including stock performance, account balances, and transaction histories.

There are various investment templates that you can use to monitor portfolio performance, asset allocation, and even compare actual returns to target allocations.

Tiller’s automated categorization tools also help organize dividends, capital gains, and other investment income into a spreadsheet format.

You can create custom reports for portfolios and track progress over time so that you can tweak investment strategies or rebalance portfolios.

For more checkout out our Tiller review.

Pricing: $79/year or $6.58/month

5. Wealthfolio

If you don’t want to store your financial data in the Cloud and want it all on your Mac desktop, then Wealthfolio may be best for you.

Wealthfolio is a new open source portfolio management software that doesn’t cost a cent and doesn’t charge any subscriptions.

It was a built by a software engineers that was frustrated by the plethora of Cloud and subscription based financial management tool.

The Mac desktop app can organize financial assets in a simple, clean interface which provides insights into performance, risk, and asset allocation.

Wealthfolio supports multiple account types, including brokerage and retirement accounts with real time tracking.

It can also import spreadsheet data and export in CSV format.

Pricing: Free

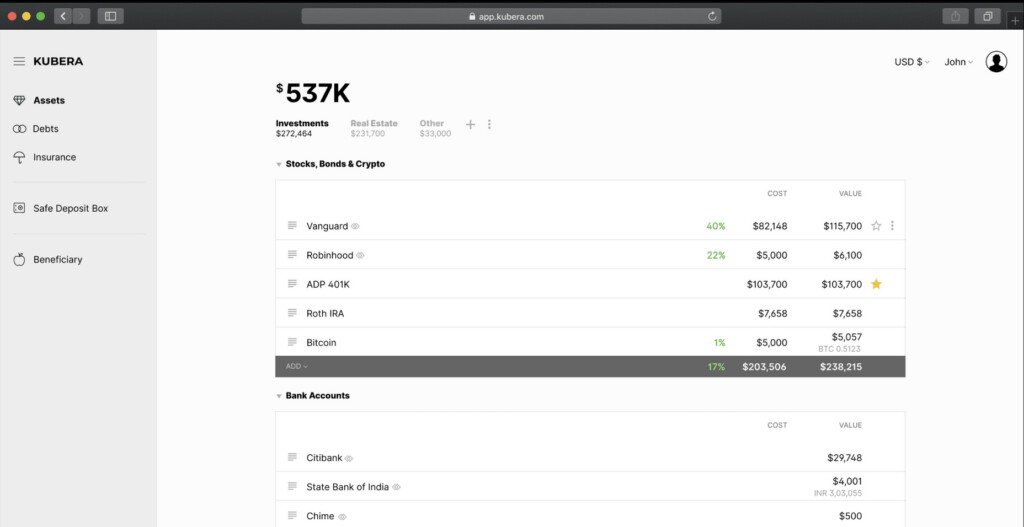

6. Kubera

If you’re looking for a Mac desktop app that can track pretty much any asset, then Kubera could be for you.

Kubera can track all assets, both traditional and crypto including automatic connections to brokerage and bank accounts.

You can connect brokerage accounts such as Robinhood, Fidelity and Vanguard accounts. Kubera also supports Stock Exchanges worldwide including in the US, Canada, UK, Australia, Europe and New Zealand.

For cryptos, it supports all major exchanges including Coinbase, Binance and Kraken. You can also connect your own crypto wallet to it.

Kubera is also the only investment tracker we’ve seen that tracks the value of Non Fungible Tokens (NFTs) too.

Apart from all this, you can also track the value of your home via integration with Zillow, Cars, Metals and even Domains.

In the event of your death or inability to administer your investments, Kubera also has a “Dead-mans switch” feature which will automatically alert named beneficiaries if there hasn’t been any activity on the account for a long time.

Kubera is a bit more expensive than other portfolio trackers but if you need something that covers every asset you own, its well worth it.

Pricing: Starts at $199/year.

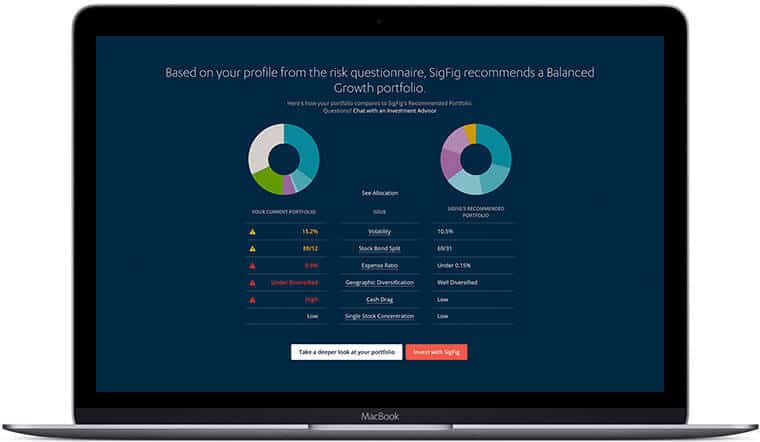

7. SigFig (Free)

SigFig is an excellent robo-advisor tool for minimizing your tax liability as it constantly reinvests and re-balances your portfolio.

You can use it for free up to the first $10,000 managed but after that it charges an annual 0.25% fee. You also need a minimum of $2000 to open a SigFig account.

It only works with certain institutions but you can configure SigFig to automatically transfer funds from your accounts to TD Ameritrade, Charles Schwab and Fidelity.

SigFig configures your portfolio based on answers you give it regarding your risk tolerance, investment time scale and financial goals.

However, if you want to speak to an actual financial advisor, it also offers a “Concierge Service” which is basically a personal investment advisor.

A consultation with a SigFig financial advisor is free but unlike Empower, be aware that they’re not a fiduciary so the advice may not be as impartial.

Pricing: Free up to first $10,000 managed, after that 0.25% annual fee.

8. Morningstar Investor

Morningstar is one of the most well known investment journals in the world so it was only a matter of time before it launched its own investment tracker.

Morningstar is famous for the “X-Ray” analysis report and the Morningstar Investor tool integrates all this information into analyzing your assets and stocks in-depth.

It can then offer detailed comparison and optimization suggestions based on a wealth of information that few other platforms can provide.

What we like about it is that the uncomplicated, easy to digest interpretation of data that Morningstar is known for has also gone into the tool with Analyst Ratings and value barometers making it easy to understand.

You can automatically link your portfolio’s banking institutions and investment accounts to Morningstar Investor which uses over 20 different indicators to analyze them including fundamentals and profitability ratios by sector.

Detailed reports include fees and expenses, global holdings breakdowns and asset allocation.

Morningstar is also suitable for bond investors and can create multiple portfolios based on profiles, risk and sectors.

Pricing: $34.95/month or $249/year

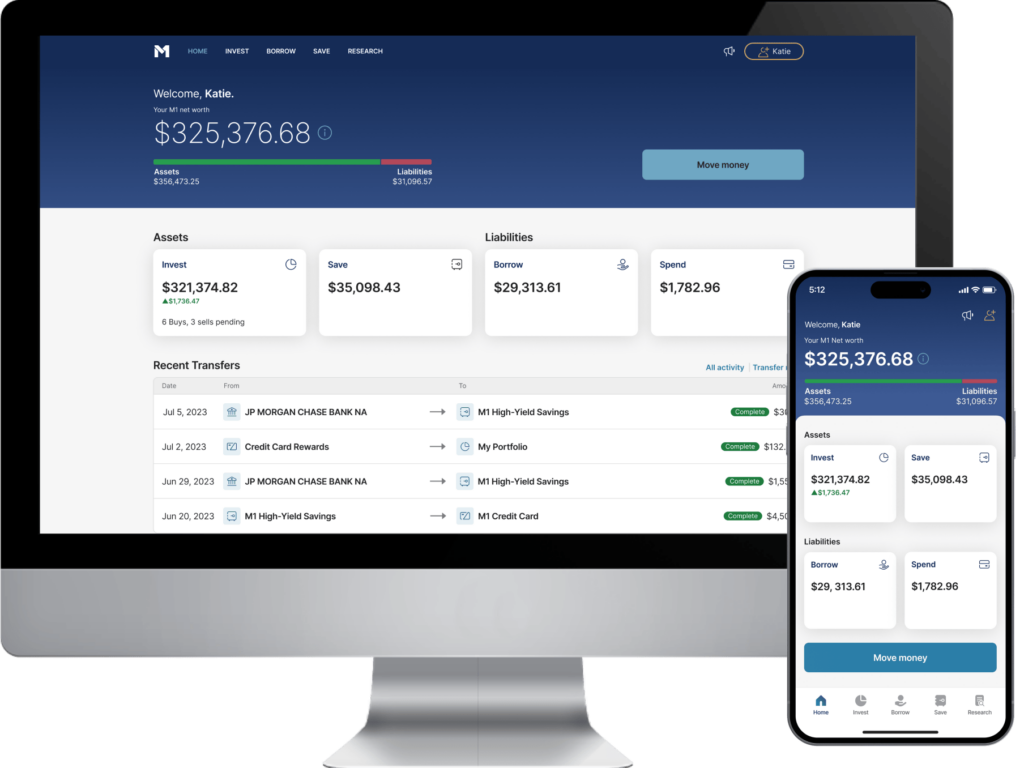

9. M1 Finance (Free)

When it comes to intelligent investment tracking, M1 Finance is all about growing your money fast. M1 Finance not only balances your portfolio but can automatically invest in stocks and ETFs for you.

Some of the things that make M1 Finance stand out for tracking portfolios are:

- No investment management fees, highly customizable portfolios and rock solid security

- It makes investing understandable for anyone and optimizes your investing for the long term so that you can retire earlier.

- M1 Finance spreads your portfolios into themed pies based around specific industries and works on the principle of fractional shares and intelligent automation to invest your funds.

- M1 is also unusual in that it allows you to borrow from a margin account based on your portfolio with some very attractive borrowing rates compared to major lenders. In fact you can borrow up to $10,000 from M1 with no extra paperwork or admin required based on your portfolio.

We also like the fact that you can setup direct deposits and even spend with an M1 debit card so you don’t have to transfer everything to your checking account if you don’t want to.

More recently M1 Finance has added the ability to track cryptocurrency investments within the app if you trade cryptos on your Mac.

If you’ve been using Robinhood to manage your investments up until now, you’ll find M1 Finance a refreshing change with many former Robinhood users happy they switched.

Pricing: $3/month or free for over $10,000 invested

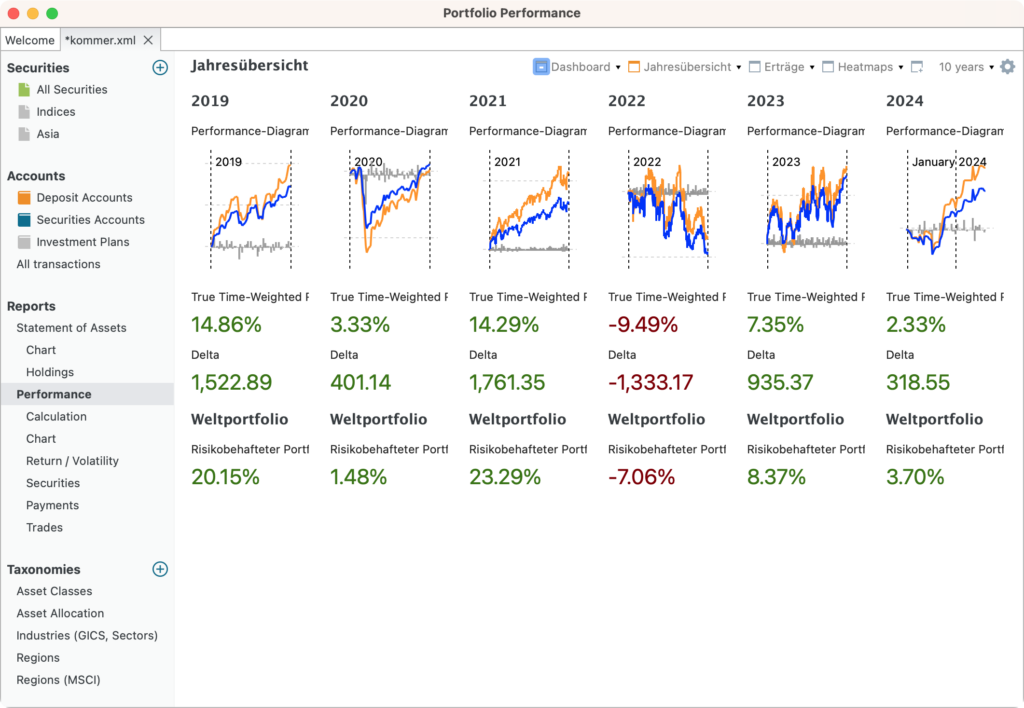

10. Portfolio Performance (Free)

If you want a free open source investment tracking app, then Portfolio Performance may be for you.

Portfolio Performance supports various asset types and offers detailed insights, such as performance metrics, asset allocation, and dividends tracking.

The dashboard allows for extensive customization through reports and visualizations, making it suitable for both beginners and advanced users.

The app is cross-platform, meaning it works on macOS, Windows and mobile and there’s a native app for Apple Silicon Macs too.

There’s not much support if you have any problems however and since its a German based app, the user forum is mainly in German.

Pricing: Free

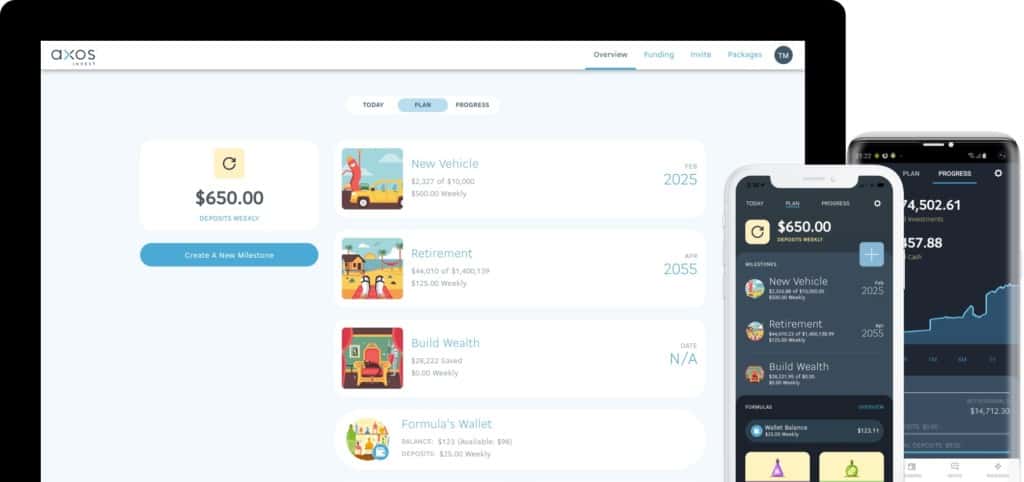

11. Axos Invest (Free)

Axos Invest (formerly WiseBanyan) is a free portfolio management software that doesn’t charge any investment management, trading or re-balancing fees.

Axos Invest is a mix between a robo-advisor and traditional financial advice service with a particular focus on small time investors with no minimum investment fee required to use it.

The company mainly makes money from its tax harvesting tools which amount to 0.25% of assets being managed.

Like many rob-advisors, it works by asking you a few simple questions about your investment needs and then creating a customized portfolio of exchange traded funds based on your risk tolerance.

It’s important to be aware that whereas tools like Empower never actually touch your cash (it only links to your accounts) – Axos Invest handles your investments directly.

However, all cash and securities held in its accounts are protected by SIPC up to $500,000, with a limit of $250,000 for cash but it’s something to bear in mind before opening an account.

Although it’s free to use, there are also add-ons that cost a few dollars which enable you to track clusters of stocks such as Blockchain Stocks, Internet Innovator Stocks and Socially Minded Stocks.

There are also Axos Invest mobile apps for iPhone, Android and even iWatch to track how your assets are performing.

Withdrawals can take up to 7 business days and while it’s not unusual for transfers to require clearance from investment services, this is longer than the average.

Nevertheless, if you’re a small investor, Axos Invest is one of the few investment tracking tools that’s free, whatever your balance.

Pricing: Free

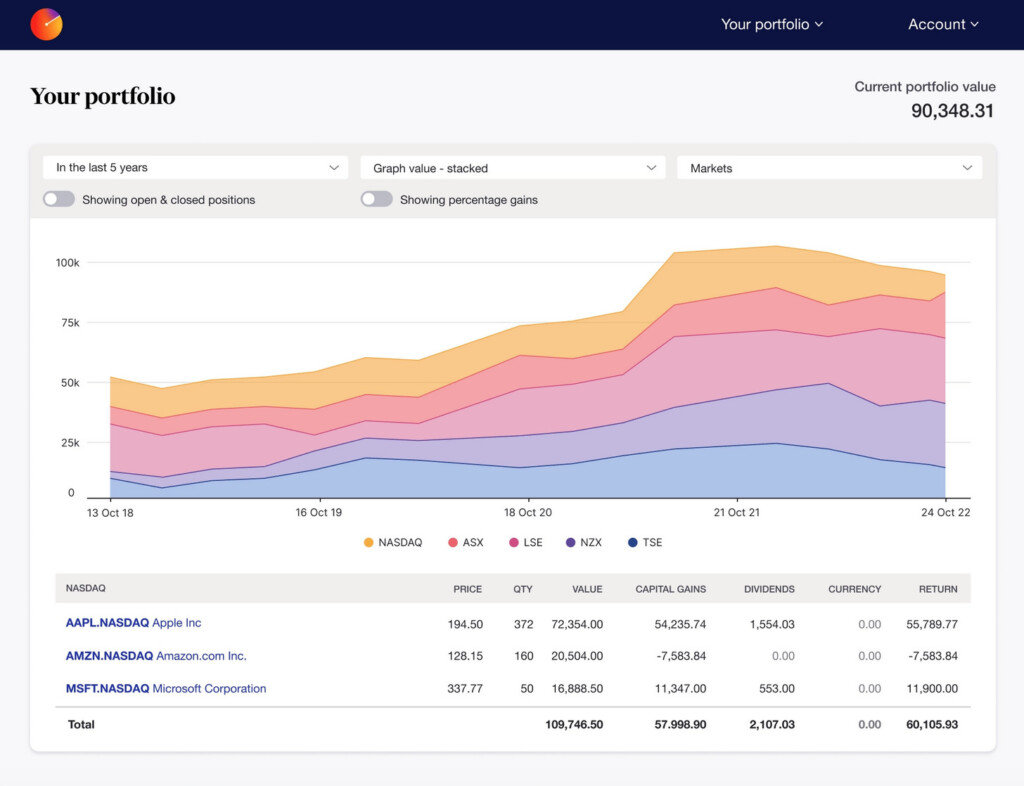

Sharesight is a global portfolio management tool that works in the US, Canada, UK, Australia and New Zealand.

Its one of the few investment apps we’ve seen that apart from portfolio tracking, also tracks dividend payments and tax liabilities.

The software connects to around 200 major brokers worldwide including in the UK Trading 212, Hargreaves Lansdown and Interactive Brokers.

If it’s not supported, Sharesight also support manually uploading investments such as real estate, vehicles, artworks and other investments.

Sharesight can track corporate actions such as dividend payments, DRPs and share splits but also global stocks, cryptos, ETFs and funds.

Its also one of the few investment apps that can track multiple currencies, expected value from dividends and benchmarking of portfolios.

There’s a range of pricing plans for the service starting at Free for up to 10 holdings and one portfolio with plans for more holdings starting at $7 per month.

Pricing: Free / Plans starting at $7 per month

13. Fidelity Full View (Free)

If you’re a Fidelity customer, then the company offers its own impressive financial tracking software Fidelity Full View.

The tool is free for Fidelity customers and links with your Fidelity accounts to provide a clean, simplified basic overview of your investments.

If you’re already a Fidelity customer, your accounts have been migrated to Full View but you’ll have to manually re-sync them for it to update your data.

There’s no actual analysis or robo-advisor in Fidelity Full View and investment data is limited to details of your Holdings and Net worth history.

This is partly because Fidelity Full View is also designed as a personal finance budgeting tool so it also shows you your income and expenses alongside portfolio data.

This includes debts related to credit cards, loans, mortgages and insurance.

You can also link it to the Fidelity Retirement Planner to give you a holistic view of finances.

Fidelity Full View is the most basic investment portfolio tracker we’ve seen but if you’re already a Fidelity customer and want an overview of your Net Worth, it’s worth checking-out.

Pricing: Free for Fidelity customers

Comparison Table

| Software | Pricing | Assets | Portfolio Tracking | Bank/Broker Syncing | Tax Reports | Platform Support | Special Features |

|---|

| Em-power | Free | Stocks, Bonds, Crypto, Real Estate | Yes | Yes | Yes | Web, iOS, Android | 401K planning tools |

| Delta Invest-ment Tracker | Free; $60/year for Pro | Stocks, Crypto, ETFs | Yes | Limited | No | iOS, Android | Crypto-focused alerts |

| Quicken Classic Premier | $95.88/year | Stocks, Bonds, Mutual Funds | Yes | Yes | Yes | macOS, Windows | Advanced reports and tax tools |

| Tiller | $79/year | Stocks, Bonds | Yes (via Google Sheets) | Yes | Yes | Web, Google Sheets | Spread-sheet-based customization |

| Wealth-folio | Free | Stocks, ETFs | Yes | No | Limited | macOS, Windows, Linux | Perfor-mance analysis |

| Kubera | $199/year | Stocks, Real Estate, Crypto | Yes | Yes | Limited | Web | Estate planning and net worth tracking |

| SigFig | Free | Stocks, ETFs | Yes | Yes | No | Web, iOS, Android | Investing re-balancing advice |

| Morning-star Investor | $249/year or $34.95/month | Stocks, Mutual Funds | Yes | No | Yes | Web | In-depth investing research |

| M1 Finance | $3/month or free for over $10,000 invested | Stocks, ETFs | Yes | Yes | No | Web, iOS, Android | Robo- investing with “pies” model |

| Portfolio Perfor-mance | Free (Open-source) | Stocks, ETFs, Bonds | Yes | No | Yes | macOS, Windows, Linux | Detailed charts and analysis |

| Axos Invest | Free | Stocks, ETFs | Yes | Yes | No | Web, iOS, Android | Auto re-balancing |

| Share-sight | Free/Plans start at $7/month | Stocks, ETFs, Bonds | Yes | Yes | Yes | Web | Dividend tracking and tax reports |

| Fidelity Full View | Free | Stocks, Bonds, Mutual Funds | Yes | Yes | No | Web | Fidelity invest-ment tracking |

Mac Portfolio Management Software For Advisors

So far we’ve only looked at investment apps for individuals on Mac.

The following tools are aimed more at investment professionals, investment houses or small businesses that want an integrated investment and accounting software solution.

These private equity deal software are aimed mainly at institutions or businesses. Although these services are all Cloud based, they can easily be used on Mac.

Here then is a quick overview of some popular software programs for investment managers that work on Mac.

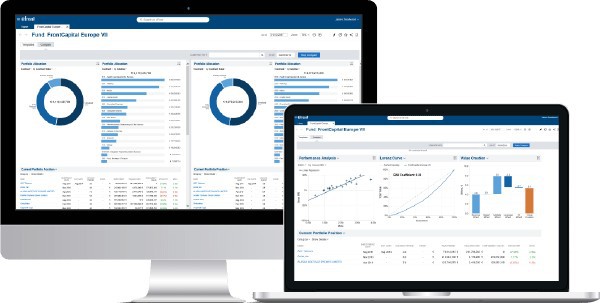

eFront

eFront is for professionals looking to invest in private equity, real-estate, infrastructure, Private Debt and Funds of Hedge Funds. The company provides solutions by asset class, investor type or need. It specializes in alternative investments and works with 850 clients across 48 countries.

FundCount

Need something that combines accounting with investment analysis? FundCount is a powerful solution for accounting and investment analysis aimed mainly at investment management professionals. Its designed for small businesses, family offices, hedge funds, fund administrators and private equity firms to optimize efficiency and integrate accounting processes. The tool is ideal for organizations looking for a portfolio partnership, general ledger accounting and reporting.

Running Windows Investment Tools On Macs

There are still some Windows only desktop investment apps that aren’t available on Mac.

Notable examples include programs like Investment Account Manager and Fund Manager.

In these cases, the only option is to run Windows on your Mac using virtualization software such as Parallels.

Virtual machines allow you to run Windows and macOS simultaneously so that you can switch between Windows and your Mac whenever you want.

However, running Windows on a Mac is not without problems.

For one it takes a lot of your Mac’s memory and hard drive to run Windows and can end up slowing down the rest of the applications you’re using.

It also doesn’t always give you the same features that PC users enjoy anyway, so you have to settle for certain features not working.

The latest Apple Silicon Macs with the M-series chips can also only run the ARM version of Windows which many financial planning software are not compatible with anyway.

Our strong advice is to use one of the investment apps for Mac we’ve reviewed here rather than go down this route.

Trends in Investment Portfolio Tracking Software

Investment portfolio tracking software has evolved dramatically over the past few years and 2025 shows no signs of slowing down. Investors now expect more than just a static dashboard: they want live insights, automation, and tools that help them act, not just observe.

Here are some key trends shaping portfolio tracking tools this year:

📈 Real-Time Data & Integrations

Modern investors expect their dashboards to reflect real-time changes, not end-of-day summaries. Leading tools like Empower and Delta Investment Tracker now pull live market prices, crypto holdings, and even alternative asset valuations to provide a truly up-to-the-minute view.

🤖 AI-Powered Insights & Automation

AI is no longer a novelty, it’s becoming standard. Apps like Quicken and Kubera are integrating machine learning to detect spending patterns, flag portfolio drift, and even suggest rebalancing or tax-loss harvesting opportunities automatically.

🌍 Support for Global & Alternative Assets

Investors aren’t sticking to U.S. stocks and mutual funds anymore. Tools like Sharesight and Kubera lead the way in supporting global equities, crypto wallets, real estate, collectibles, and private investments, all under one umbrella.

🔗 Open Banking & Seamless Connectivity

Modern portfolio trackers use open banking APIs to automatically sync transactions and balances across banks, brokers, crypto exchanges, and even retirement accounts. This trend removes the hassle of manual data entry and keeps net worth snapshots truly up to date.

🏦 Tax Optimization & Reporting

With stricter tax rules for capital gains and crypto, built-in tax tools are in high demand. Some apps now generate country-specific capital gains reports, track dividend income, and help investors export data to TurboTax or accountants with a click.

🤝 Hybrid Advisor Integration

Some portfolio trackers, such as like Empower and SigFig, go beyond DIY dashboards by offering access to real financial advisors for tailored advice. This hybrid trend bridges robo-advice with the human touch for investors who want more than algorithms.

📱 Mobile-First, With Elegant UX

Today’s investors want to check portfolios on the go. Whether it’s M1 Finance’s simple rebalancing or Delta’s beautifully designed mobile app, clean interfaces and intuitive workflows are no longer optional, they’re expected by investors.

In 2025, portfolio tracking software is all about automation, inclusivity for alternative assets, and AI-enhanced personalization. The days of spreadsheets are gone, modern investors want effortless, intelligent tools that give them a real edge.

FAQ

What is the best portfolio tracker for Mac users right now?

Empower (formerly Personal Capital) is consistently rated as one of the best all-round portfolio trackers for Mac users. It links all your accounts in one dashboard, tracks investments, analyzes fees, and even helps plan for retirement — all with a generous free plan.

Is there a free investment tracker for crypto and stocks?

Delta Investment Tracker is great for tracking both traditional investments and crypto in one place. It has a free plan with multi-asset support, price alerts, and watchlists – all available on Mac through its desktop app, web version or mobile app.

Does Quicken still work well for investment tracking on Mac?

Quicken Classic Premier is still one of the most popular choices for detailed portfolio tracking, budgeting, and reporting. The Mac version has improved a lot, though some advanced features are still Windows-only.

What about spreadsheet-based tracking for Mac?

Tiller is ideal for people who prefer spreadsheets. It automatically pulls in transactions and balances into Google Sheets or Excel on Mac, so you can customize reports, track investments, and see your net worth however you like.

Is there a portfolio tracker just for UK investors?

Wealthfolio is designed for UK investors, especially those with ISAs and pensions. It helps track goals, risk levels, and portfolio performance. It’s all based online, so it works perfectly on Mac

Is there a simple, privacy-focused portfolio tracker for Mac?

Kubera is a modern portfolio tracker with a clean design and strong privacy features. It supports global assets, crypto, DeFi, and even home and vehicle values, so you get your true net worth in one dashboard.

What’s the best automated portfolio tracker with robo-advising?

SigFig combines portfolio tracking with automated investing. It analyzes your existing portfolios for hidden fees and inefficiencies, then offers low-cost robo-investing if you want to automate your strategy.

Are there any tools with in-depth stock research as well?

Morningstar Investor goes beyond tracking. It’s a trusted platform for deep stock research, fund ratings, portfolio X-ray analysis, and risk assessments. It works on Mac through its online portal.

Can I track and invest commission-free on a Mac?

M1 Finance combines portfolio tracking with free investing in stocks and ETFs. It’s more hands-on than a traditional robo-advisor but still automates portfolio rebalancing. Its web app works smoothly on Mac.

Is there an open-source portfolio tracker for Mac?

Portfolio Performance is a free, open-source tool that runs on macOS. It’s powerful for DIY investors who want custom charts, performance analysis, and dividend tracking without paying for a subscription.

What if I want an all-in-one brokerage and tracker?

Axos Invest and Fidelity both offer easy portfolio tracking alongside commission-free investing, retirement accounts, and automated advice. Both work on Mac through their secure web platforms.

Do any of these trackers handle international shares well?

Sharesight is excellent for tracking global portfolios, dividends, and tax reporting. It supports over 40 stock exchanges worldwide and runs entirely online, so it’s fully Mac-friendly.

Final Tip:

Many investors use two tools: one to track everything in one place (like with Empower or Kubera) and another for deep research or hands-on trading (like Fidelity or M1 Finance). Mixing the right combo often works better than looking for just one tool to do it all.