If you’re looking for an accounting solution for your Mac based business or are a just sole-proprietor starting out, we’ve taken a look at the very best accounting software for Macs.

We’ve tested a wide range of the best bookkeeping software for Macs suitable for the self-employed, small to medium sized businesses (SME) and sole traders.

All of the accounting tools we reviewed work on every type of Mac including Intel Macs and Apple Silicon Macs with the M-series chips (apart from Account Edge which is Intel only).

Contents

- Why Trust Our Reviews

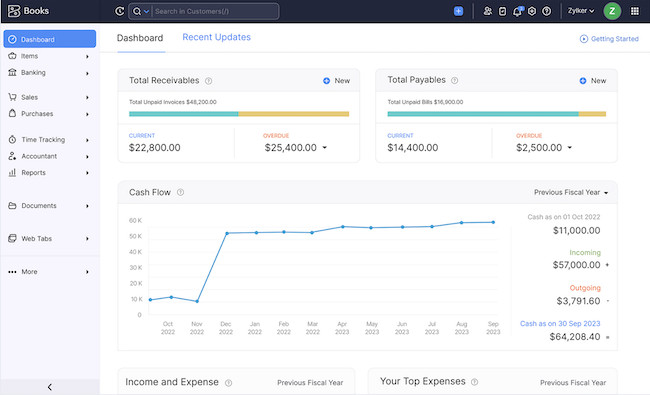

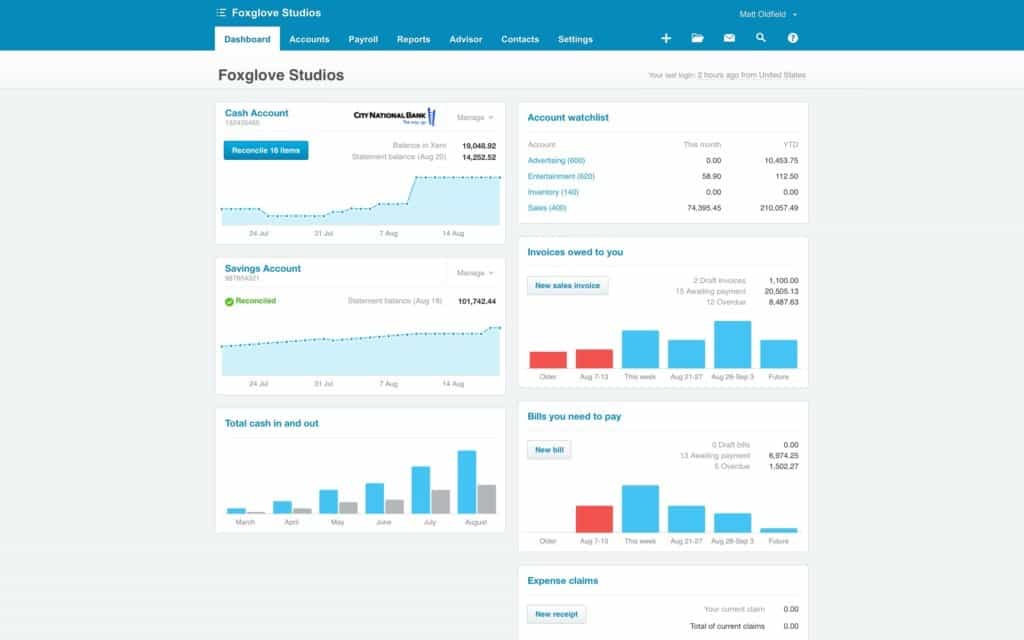

- 1. Xero – Best For Unlimited Users

- 2. QuickBooks Online – Best For Accountants

- 3. FreshBooks – Best For Freelancers

- 4. Zoho Books – Best Free Accounting Software

- 5. Sage – Best for Enterprises

- 6. Melio – Best For Automation

- 7. Patriot Software – Best For Payroll & Accounting

- 8. AccountEdge – Best Offline Accounting App

- 9. Wave Accounting – Best For Startups

- 10. ZipBooks – Best For Unlimited Invoicing

- 11. Puzzle – Best For UK Businesses

- 12. Synder – Best E-commerce & AI Accounting

- Other Mac Compatible Accounting Software to Consider

- Related Software Reviews

- What We Looked For In These Mac Accounting Apps

- What’s New In Mac Accounting Software In 2025?

- FAQ

Why Trust Our Reviews

We’ve been reviewing Mac software since 2013 and have covered thousands of business applications during that time. Our aim is to help you be more informed when taking a decision on which software work best with Macs.

We research and test all of the products we cover and have tested hundreds of different accounting solutions over the years. For more check out how we chose these apps and our software selection process.

Here then are the results of our research into the best accounting software to use on a Mac in 2025.

Below is a comparison table of our top ten followed by reviews for each one.

| Software | Best For | Starting Price | Key Features | Integrations |

|---|---|---|---|---|

| Xero | Unlimited users & mobile access | $1/month | Unlimited users, mobile app, custom invoices | PayPal, Stripe, Square, GoCardless |

| QuickBooks Online | Professional accountants | $3.50/month | Automated invoices, payroll, 750+ integrations | PayPal, Stripe, Square, Shopify, Amazon |

| FreshBooks | Freelancers and solo entrepreneurs | $7.60/month | Invoicing, time tracking, expense management | Apple Pay, Stripe, PayPal, Gusto |

| Zoho Books | Free accounting software & Zoho users | Free/$15/month | Wave import, CRM/Inventory sync, multi-currency support | Razorpay, Stripe, PayPal, Square |

| Sage | Growing teams and enterprises | On request | Custom reports, cash flow tools, 24/7 support | Stripe, PayPal, Paya, GoCardless |

| Melio | Free A/P automation | Free | Bill pay by card/ACH, check sending, unlimited users | QuickBooks, Xero |

| Patriot Software | Payroll + accounting bundle | $20/month | Payroll, double-entry, US support | Stripe, PayPal, QuickBooks Payroll |

| AccountEdge | Offline desktop accounting | $15/month | Local storage, payroll, time billing, audit tracking | AccountEdge Connect, Shopify, Stripe |

| Wave | Freelancers and startups on a budget | Free | Free invoicing, receipts, US/CA payroll | PayPal, Etsy, Stripe, H&R Block |

| ZipBooks | Simple invoicing & bookkeeping | Free/$15/month | Invoicing, time tracking, smart client scoring | Square, PayPal, Gusto, Slack |

| Synder | E-commerce and AI accounting | Starts at $52/month | AI powered e-commerce accounting, detailed tax reports | Shopify, Amazon, Stripe, PayPal, Square, WooCommerce, BigCommerce, QuickBooks, Xero |

1. Xero – Best For Unlimited Users

Best For: Unlimited users and mobile access

Why We Picked It:

Xero delivers a sleek, Apple-like interface and offers unlimited users on all plans. It’s highly customizable, supports PayPal payments, and is especially strong for businesses that need mobile-first invoicing.

Best Features:

- Unlimited users on all plans

- Strong mobile iOS app (Xero Touch)

- Custom invoice templates

- Connects with most major banks (though feeds may break)

- Integrates with over 1,000 third-party tools

Integrations:

- PayPal, Stripe, Square, GoCardless

Pricing: From $1/month (90% off for six months)

Pros:

- User-friendly, intuitive interface

- Unlimited users at no extra cost

- Robust mobile support

- Flexible third-party integrations

Cons:

- Occasional issues with bank feeds

- Not as widely used by accountants as QuickBooks

- No native Mac desktop client

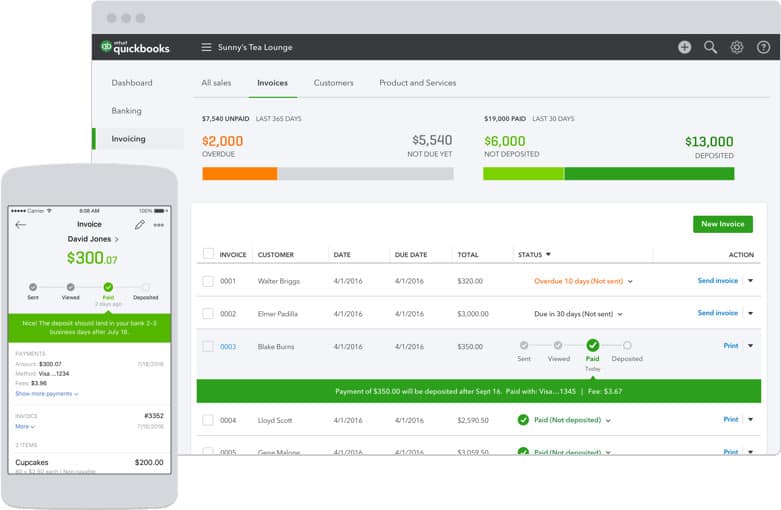

2. QuickBooks Online – Best For Accountants

Best For: Professional accountants and integrations

Why We Picked It:

QuickBooks is one of the most popular tools for a reason. It offers powerful reporting, bank syncing, and is widely used by accountants. While the Mac desktop app has been discontinued, its cloud version works well on any Mac.

Best Features:

- Automatic invoice scheduling and bank syncing

- Seamless Quicken integration

- 750+ app integrations including Shopify

- Built-in payroll (extra cost)

- UK-compliant with MTD and HMRC

Integrations:

- PayPal, Square, Stripe, Shopify, Amazon

Pricing: From $3.50/month (90% off for three months)

Pros:

- Highly trusted and recognized

- Strong ecosystem of integrations

- Easy accountant collaboration

- Built-in payroll support

Cons:

- Desktop version no longer available for Mac

- Some users report bank syncing issues

- Payroll costs extra

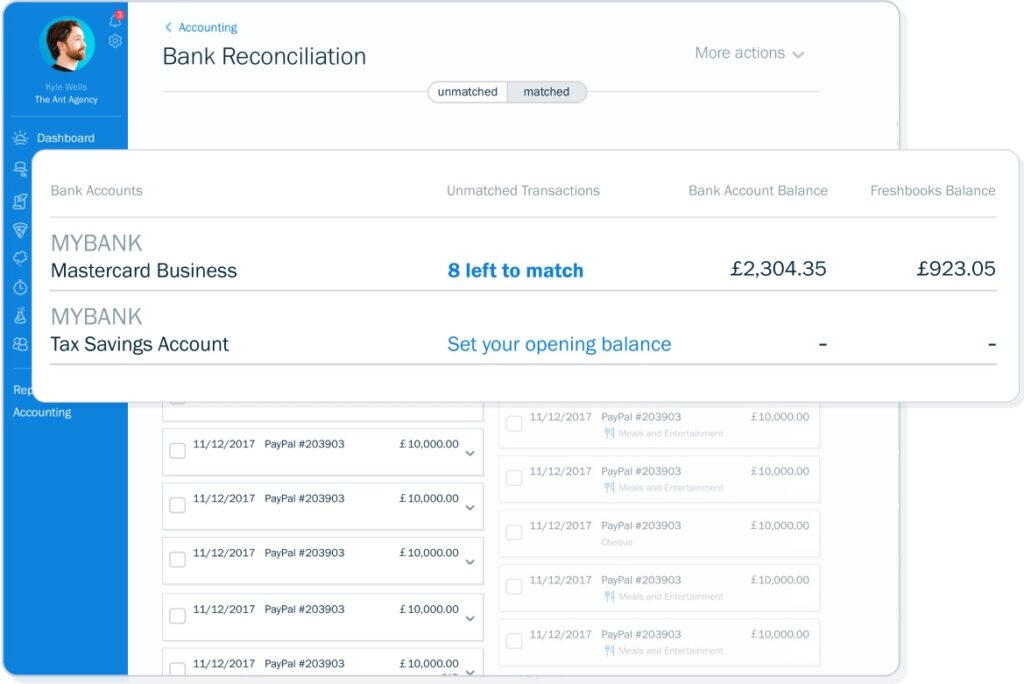

3. FreshBooks – Best For Freelancers

Best For: Freelancers and solo entrepreneurs

Why We Picked It:

FreshBooks is easy to use and handles everything from invoicing to time tracking. It’s ideal for those without a background in finance who still want control over their accounting.

Check our full FreshBooks Review for more.

Best Features:

- Automatic invoicing and payment tracking

- Time tracking for projects and teams

- Expense categorization and team roles

- UK-compliant with MTD and HMRC

Integrations:

- Apple Pay, Stripe, PayPal, Gusto

Pricing: From $7.60/month (50–75% off promotions available)

Pros:

- Extremely beginner-friendly

- Good value for freelancers

- Project-based tracking and invoicing

Cons:

- Additional users cost extra

- Lacks advanced budgeting or forecasting tools

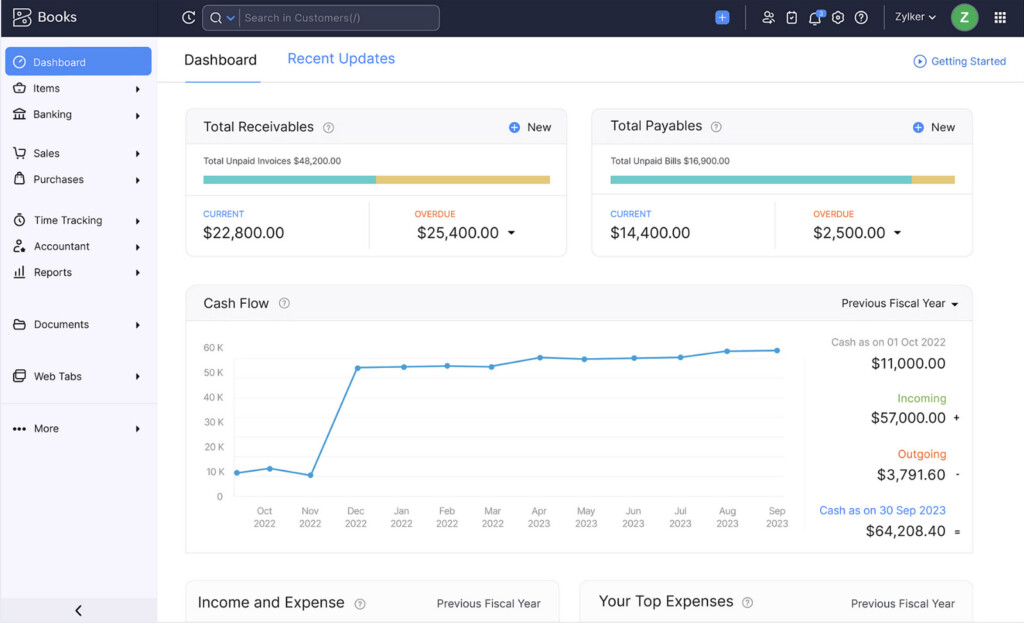

4. Zoho Books – Best Free Accounting Software

Best For: Growing businesses and Zoho users

Why We Picked It:

Zoho Books offers a strong free tier for small businesses and integrates smoothly with the Zoho ecosystem. It’s scalable and easy to use, with automated invoicing and time tracking.

Best Features:

- Free version for solopreneurs

- Imports Wave accounts

- Expense tracking, estimates, and reporting

- Integrated with Zoho CRM, Inventory, and Projects

- Multi-language and multi-currency support

Integrations:

- Razorpay, Stripe, PayPal, Square

Pricing: Free for basic plan; paid plans from $15/month

Pros:

- Excellent for existing Zoho users

- Free plan available

- Highly scalable

Cons:

- Limited third-party integrations outside Zoho

- Extra cost for additional users

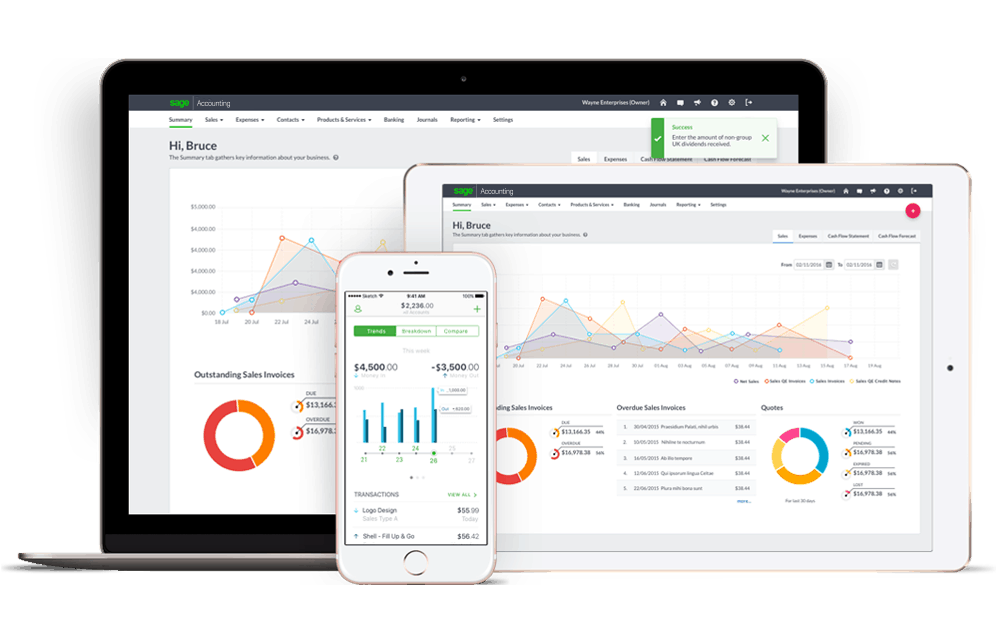

5. Sage – Best for Enterprises

Best For: Growing teams and enterprises

Why We Picked It:

Sage is a well-established accounting solution with robust tools for cash flow, inventory, and payroll. It’s scalable and offers excellent support and training.

Best Features:

- Cloud-based with easy team collaboration

- Clean dashboard and customizable reports

- 24/7 support and expert sessions

- Free bank feeds

Integrations:

- Stripe, PayPal, Paya, GoCardless

Pricing: On request

Pros:

- Trusted by accountants and enterprises

- Great scalability

- Comprehensive training and support

Cons:

- Pricing lacks transparency

- No native Mac app

6. Melio – Best For Automation

Best For: Free accounts payable automation

Why We Picked It:

Melio offers free accounts payable features and allows you to pay bills via bank transfer or credit card—even if your vendors only accept checks.

Best Features:

- Schedule payments for free

- Pay vendors via ACH or card

- Send checks on your behalf

- Unlimited users at no cost

Integrations:

- QuickBooks, Xero

Pricing: Free (fees apply for credit card payments)

Pros:

- Completely free for basic use

- Easy vendor payments

- No user limits

Cons:

- Focused solely on A/P (no full accounting suite)

- Limited integrations

7. Patriot Software – Best For Payroll & Accounting

Best For: Affordable payroll and accounting bundle

Why We Picked It:

Patriot Software is designed for small businesses that need both accounting and payroll. It’s cost-effective and beginner-friendly.

Best Features:

- Double-entry accounting

- Payroll integration with time tracking

- Bank import and reconciliation

- Customizable invoice templates

- Free USA-based support

Integrations:

- Stripe, PayPal, QuickBooks Payroll

Pricing: From $20/month (plus $17/month for payroll)

Pros:

- Great value for payroll + accounting

- Simple interface

- US-based support

Cons:

- Limited feature set compared to larger apps

- No mobile app

8. AccountEdge – Best Offline Accounting App

Best For: Offline desktop accounting

Why We Picked It:

AccountEdge is one of the few full-featured accounting programs still offering a Mac desktop version (Intel Macs only). It’s ideal for those preferring local storage and privacy.

Best Features:

- Desktop software, no internet required

- Payroll, inventory, and time billing tools

- One-time purchase or subscription options

- Detailed reports and audit tracking

- Export to AccountEdge Connect for cloud access

Integrations:

- AccountEdge Connect, Shopify, Stripe

Pricing: From $15/month or $499 one-time license

Pros:

- Works offline

- One-time payment option

- Full-featured desktop tool

Cons:

- No support for Apple Silicon Macs

- Outdated interface

9. Wave Accounting – Best For Startups

Best For: Freelancers and startups on a budget

Why We Picked It:

Wave is completely free and offers essential accounting features for those just getting started. Great for sole proprietors who want simple tools without the cost.

Best Features:

- Free invoicing, accounting, and receipt scanning

- Basic payroll (US and Canada only)

- Simple reports and dashboard

Integrations:

- PayPal, Etsy, Stripe, H&R Block

Pricing: Free (payment and payroll fees apply)

Pros:

- 100% free to use

- User-friendly interface

- Ideal for startups

Cons:

- Limited support

- No UK bank support anymore

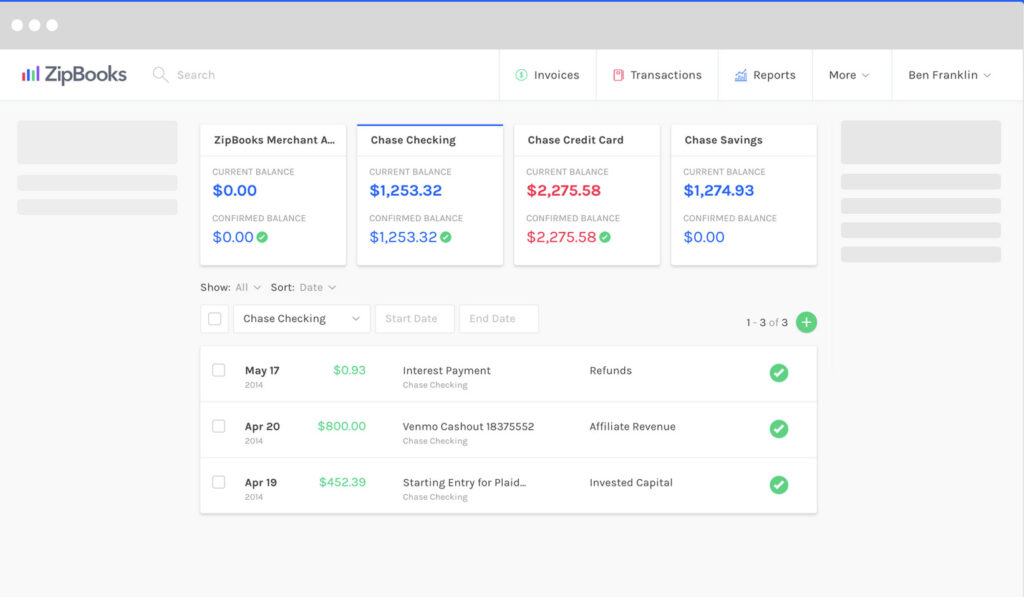

10. ZipBooks – Best For Unlimited Invoicing

Best For: Simple invoicing and bookkeeping

Why We Picked It:

ZipBooks offers a generous free plan and intuitive tools for invoicing, time tracking, and reporting. Ideal for freelancers and service providers.

Best Features:

- Unlimited invoicing and basic reports in free plan

- Time tracking and task management

- Smart tagging and health score for clients

- Accountant access and secure backups

Integrations:

- Square, PayPal, Gusto, Slack

Pricing: Free basic plan; paid plans from $15/month

Pros:

- Free for basic use

- Easy to learn and navigate

- Client insights and reporting tools

Cons:

- Some features require paid plan

- Fewer integrations than competitors

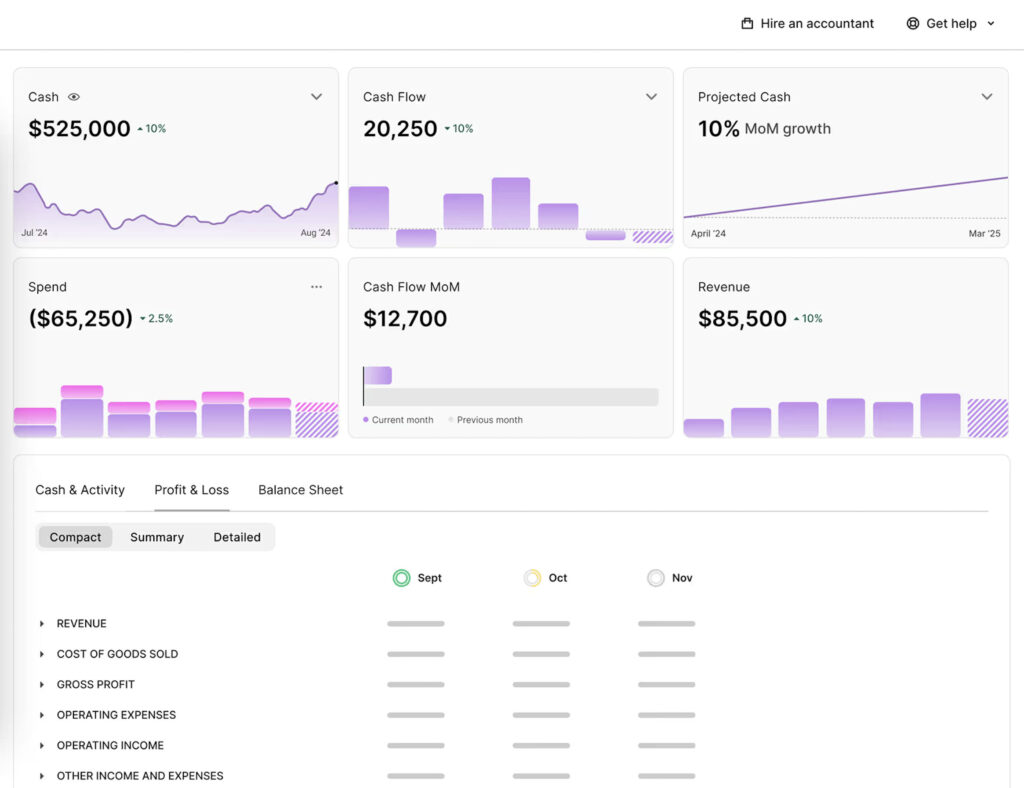

11. Puzzle – Best For UK Businesses

Best For: UK freelancers and small business owners needing Making Tax Digital (MTD) compliance

Why We Picked It:

Puzzle Accounting is a modern, HMRC-recognized accounting platform built specifically for UK businesses. It simplifies bookkeeping and tax compliance with automated bank feeds, intuitive reporting, and full MTD support — without the steep learning curve of traditional accounting tools.

Best Features:

- Fully HMRC-recognized for VAT and Making Tax Digital

- Automatic bank reconciliation and transaction matching

- Real-time profit & loss reporting

- Multi-user access for accountants or partners

- Smart tagging and cash flow insights

Integrations:

Starling Bank, Tide, Revolut, Monzo, and other UK banking APIs

Pricing:

From £20/month, with tiered pricing based on features and number of users

Pros:

- Built specifically for UK MTD and VAT compliance

- Clean, modern UI with simple setup

- No accounting jargon — designed for non-accountants

- UK-based support team

Cons:

- No payroll or inventory features

- Limited third-party integrations compared to Xero or QuickBooks

- Not ideal for businesses with international operations

12. Synder – Best E-commerce & AI Accounting

Best For: E-commerce businesses and automated accounting

Why We Picked It:

Synder is an enterprise level solution designed to make multi-channel e-commerce accounting easy and error-free. It automatically syncs sales, fees, and taxes from payment platforms and marketplaces, helping you keep your books accurate and tax-ready. Its real-time data sync and smart rules make it a good fit for busy online sellers using a Mac.

Best Features:

- Automatic transaction syncing from multiple sales channels

- Real-time reconciliation and duplicate detection

- Detailed financial and tax reporting

- Supports multiple currencies

- Smart rules for customizable workflows

Integrations:

Shopify, Amazon, Stripe, PayPal, Square, WooCommerce, BigCommerce, QuickBooks, Xero

Pricing:

From $11/month (billed annually)

Pros:

- Excellent for multi-channel sellers

- Easy setup and automation

- Accurate, real-time syncing

- Works seamlessly with QuickBooks and Xero

Cons:

- Not a full accounting suite on its own

- Can be pricey for small sellers with low volume

Other Mac Compatible Accounting Software to Consider

If the top options we picked don’t quite meet your needs, here are other Mac-compatible accounting apps worth checking out:

- KashFlow – UK-based accounting software with solid VAT and HMRC integration for small businesses.

- Quicken – A personal finance tool with light business features, ideal for freelancers tracking both personal and business expenses.

- NetSuite – Oracle’s cloud-based ERP solution for large or fast-growing businesses needing advanced accounting, inventory, and CRM tools.

- Kashoo – A simple and affordable option for small businesses and freelancers that want automated bookkeeping.

- FreeAgent – Cloud accounting designed for freelancers and contractors, especially popular in the UK.

- OneUp – Smart automation and inventory management tools for small businesses, with AI-powered bookkeeping.

- Sunrise by Lendio – A free bookkeeping app with invoicing and expense tracking, especially good for sole proprietors.

- Manager.io – A free, downloadable desktop accounting software for Mac with optional cloud hosting.

- GnuCash – A free, open-source accounting program that supports double-entry bookkeeping for small businesses and personal finance.

- Busy – Indian-based accounting software suited for SMEs needing GST support and basic inventory management.

Related Software Reviews

If you found these accounting software reviews useful, you may also be interested in our research into the following:

- Payroll Software for Mac

- Invoicing Software for Mac

- Personal Finance Software For Mac (Quicken Alternatives)

- Time Tracking Software for Mac

- CRM Software for Mac

- Tax Software For Mac

What We Looked For In These Mac Accounting Apps

To choose the best accounting software for Mac users in 2025, we evaluated dozens of platforms using criteria that reflect the latest technology trends, business needs, and macOS compatibility. Here’s what we prioritized:

1. Seamless Bank Account Integration

We favored tools that automatically sync with your bank accounts, credit cards, and payment services. Real-time bank feeds reduce manual entry, help catch errors quickly, and give you a clear picture of your cash flow.

2. Automatic Transaction Reconciliation

The best tools offer smart matching and automated reconciliation, eliminating the need to manually verify every transaction—saving time and improving accuracy.

3. Easy Accountant and Team Access

We looked for platforms that make it simple to invite your accountant, bookkeeper, or business partners to access your data securely. Multi-user support with customizable permissions is essential for growing teams and collaboration.

4. CRM and Workflow Integration

Accounting platforms that integrate with popular Mac compatible CRM tools (like Salesforce, HubSpot, and Zoho CRM) help streamline billing, invoicing, and client management in one unified system.

5. Responsive, Multi-Channel Support

We prioritized solutions with strong customer service—whether that’s via live chat, email, or phone—along with searchable help centers and access to real human support when you need it most.

6. Payroll Integration & Compliance

Payroll support is increasingly built into accounting platforms. We highlighted tools that either offer built-in payroll features or integrate with third-party payroll providers, and are updated to reflect U.S. and UK tax laws. For more, see our guide to the best payroll software for Mac.

7. Invoicing and Payment Processing

Professional-grade invoicing is a must. We looked for software with customizable invoice templates, automated reminders, recurring billing, and integration with payment gateways like Stripe, PayPal, Apple Pay, and Square. For software dedicated to this, check our guide to the best invoicing software for Mac.

8. iOS and Cross-Device Compatibility

We prioritized tools with dedicated iOS apps for iPhone and iPad, as many Mac users operate across multiple Apple devices. Bonus points for apps optimized for Apple Silicon (M1/M2/M3 chips) for improved speed and battery life.

9. Making Tax Digital (MTD) & International Tax Compliance

For UK-based users, we ensured the tools support Making Tax Digital (MTD) and are HMRC-recognized for filing VAT and income tax. For global businesses, we looked for platforms with flexible tax settings for multiple regions and currencies.

10. Cloud-Based with Offline Options

While most users now prefer cloud access, we also considered solutions like AccountEdge that offer offline functionality for those needing local control or working in low-connectivity environments.

11. Value for Money

Finally, we considered pricing transparency, free trial availability, and the features included in each plan. Our list includes both free and paid options to suit a wide range of budgets and business sizes.

What’s New In Mac Accounting Software In 2025?

Accounting tools in 2025 are evolving quickly, especially as cloud computing and AI become essential to modern businesses.

Here are some key trends shaping accounting software for Mac users this year.

1. AI-Powered Bookkeeping and Categorization

More platforms are integrating artificial intelligence to automate transaction categorization, flag anomalies, and offer predictive financial insights. These tools help reduce manual entry and errors, saving time for small business owners and freelancers.

2. Native Apple Silicon Optimization

As Apple continues transitioning to M-series chips, more developers are optimizing their software for Apple Silicon. Expect better performance, lower battery usage, and faster load times from native apps or well-optimized web apps on Macs.

3. Real-Time Financial Dashboards

Users now expect real-time data and visual dashboards. Tools like Xero and QuickBooks are enhancing their UI to provide immediate insights into cash flow, receivables, and tax liabilities at a glance, right from the dashboard.

4. Mobile-First Accounting

With more businesses operating on the go, apps like FreshBooks and Zoho Books are prioritizing mobile features, allowing users to send invoices, track expenses, and get paid directly from iPhone or iPad apps.

5. Embedded Payments and Fintech Features

Accounting tools are becoming more like financial hubs. Services like Melio and Wave now offer embedded payment processing, credit options, and integration with digital wallets (like Apple Pay), reducing the need for third-party gateways.

6. Enhanced Compliance Automation

Global compliance is getting easier. UK-based users benefit from Making Tax Digital (MTD) integrations, and U.S. users are seeing more automated 1099 and W-9 reporting. Expect more region-specific tax automation in mainstream tools.

7. Integration with E-commerce and CRM Tools

With growing e-commerce adoption, accounting software is offering deeper integration with platforms like Shopify, WooCommerce, and CRM tools like Salesforce and HubSpot, helping unify financial and customer data in one system.

FAQ

What is the best accounting software for Mac users?

The best accounting software for Mac depends on your specific needs. For example, Xero is great for unlimited users and mobile access, QuickBooks Online is widely used by accountants, and FreshBooks is ideal for freelancers and solo entrepreneurs.

Do these accounting tools work on Apple Silicon Macs?

Yes, all the software listed in our guide works on both Intel-based and Apple Silicon (M-series) Macs, as most are cloud-based or have web versions compatible with macOS.

Is there any 100% free accounting software for Mac?

Yes there is a limited number of free accounting software for Macs available. Wave, Melio, ZipBooks, and the free tier of Zoho Books offer completely free plans, though they may come with limitations like fewer features or users.

Free accounting platforms can also suddenly stop supporting certain features and regions leaving users stuck as happened with the Wave accounting platform when it suddenly announced it would no longer support users outside of the USA and Canada.

It’s both difficult and stressful to switch accounting solutions later on as your business grows so we recommend going with a free trial of a paid solution from the start and then deciding whether to continue with it.

Which software is best for invoicing clients?

FreshBooks, Xero, and ZipBooks are particularly strong when it comes to invoicing. They offer custom templates, automation, and online payment integration.

Can I manage payroll with these accounting apps?

Yes. QuickBooks, Patriot Software, Sage, and AccountEdge include or integrate with payroll tools. Some offer built-in payroll, while others require add-ons or third-party services.

Do any of these tools offer offline use?

Yes, AccountEdge is a desktop-based accounting tool that can be used offline, making it ideal for those who prefer local storage over cloud access.

Which software offers the most integrations?

QuickBooks Online leads with over 750 integrations. Xero also integrates with more than 1,000 third-party apps, making both excellent for complex business workflows.

Can I use these tools outside the US?

Most of these accounting platforms offer international support, but features like tax filing may vary by country. FreshBooks, QuickBooks, Zoho Books, and Xero have specific versions or settings for countries like the UK, Canada, and Australia. Puzzle is focused on UK businesses.

Can these tools handle multi-currency transactions?

Yes, several tools like Xero, Zoho Books, and QuickBooks Online support multi-currency transactions, which is essential for businesses dealing with international clients or suppliers.

Is accounting software secure to use online?

Yes. Most modern accounting tools use bank-level encryption and two-factor authentication to keep your financial data secure. Always check the provider’s security practices before signing up.

How do I choose the right accounting software for my Mac?

Consider your business size, whether you need features like payroll or inventory, your budget, and whether you want cloud-based or desktop software. Use our comparison table and reviews above to match your needs.

Can you use Tally on a Mac?

If you’re an Indian based user and wondering why the Tally accounting software didn’t make our list, Tally for Mac does not exist. However, there are still ways to run Tally on a Mac if you really need it.

How do I choose the right accounting software plan?

Most accounting platforms charge per user so if you need more one user or accountant to access the accounts, you’ll almost certainly need more than the basic plans.

Other things to consider when choosing which plan to go for are:

- How many clients you need to invoice

- How many bills you need to track

- Whether you need to invoice in multiple currencies

- Do you need expense tracking?

- Do you need project plan based tracking to keep track of how much your project is costing?

- Do you need analysis tools such as cashflow predictions and advanced reports?

Different accounting apps have different tiers which may or may not include these so it’s important to bear in mind your needs so that you can be prepared to pay a higher subscription if necessary.