If you’re running a business of any size, managing your payroll can be an administrative and bureaucratic nightmare.

Although Employee Management Software can take the pain out of HR, Payroll requires specialist software to do it accurately, efficiently and legally.

We’ve looked at the best payroll software for Mac for small to medium-sized businesses to help take the stress out of payroll management.

All of the applications rated here are suitable for anything from just one employee up to several hundred so no matter the size of your business, you’ll find something here to solve your problem.

Table of Contents

- What We Looked For In The Best Payroll Software

- 1. Bamboo Payroll

- 2. HiBob Payroll

- 3. OnPay

- 4. OnTheClock Payroll

- 5. Rippling Payroll

- 6. Paychex

- 7. Patriot Payroll

- 8. QuickBooks Payroll

- 9. Multiplier

- 10. Papaya Payroll

- 11. Gusto

- 12. Sage

- 13. BrightPay

- 14. CheckMark

- 15. Xero

- 16. Aatrix

- 17. Lightning

- Desktop vs Cloud Payroll Software

- Why Use Payroll Software?

- Trends in Payroll Software for Mac in 2025

What We Looked For In The Best Payroll Software

Ultimately, the task of good payroll software is to simplify the process of paying your employees correctly, on time and make sure the right income tax rate is applied depending on the State they are in.

However, some features to consider when choosing a payroll solution for your business include:

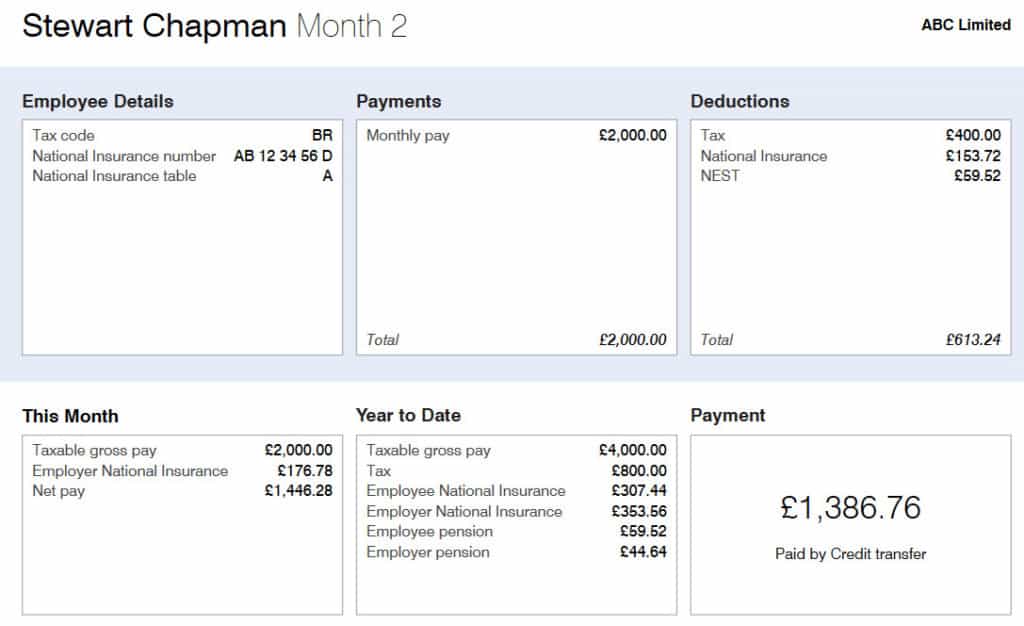

- Creating payslips

- Calculating deductions

- Calculate employee benefits

- Calculating or filing taxes both state and federal in accordance with current regulations (although we generally recommend using dedicated tax software for this).

- Processing (and voiding) direct deposit payments to staff bank accounts

- Ability to differentiate between salaried employees and those contracted by the hour

- Ability to share your accounts or payroll with accountants and other financial professionals

- Track employee holidays, public holidays and birthdays

- Complying with national, state and international payroll regulations

- Producing reports

- Printing checks (although you may be better using specialized check printing software for this)

- Printing IRS forms

- Creating employee profiles to quickly see data such as pay rate, salaried status, time off, tax band etc.

- Mobile or online access for when you can’t be in the office – very useful for running payrolls on the move

- Integration with accounting software for more convenient processing of payrolls

With this in mind, here is the best Mac compatible payroll software of 2025.

1. Bamboo Payroll

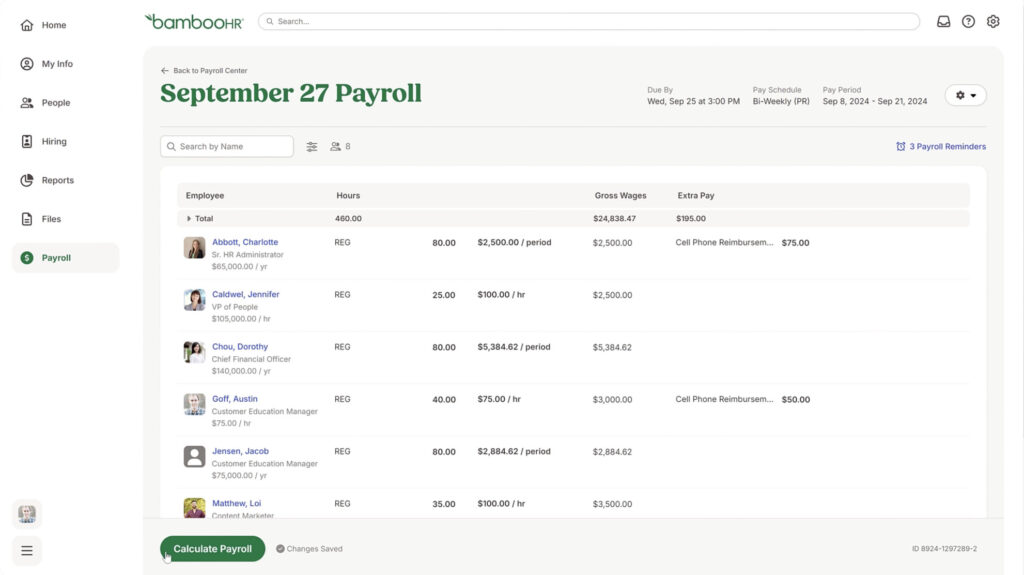

Bamboo Payroll is a modern cloud-based payroll solution designed for small to medium-sized businesses that integrates seamlessly with BambooHR’s human resources platform.

You can run payroll quickly and accurately while automatically syncing employee data such as hours worked, benefits, and deductions from BambooHR. This eliminates the need for manual data entry and reduces the risk of errors.

Bamboo Payroll supports full-service tax filing, including federal, state, and local taxes, along with automatic updates for compliance and tax rate changes. It also generates and files W2s and 1099s for employees and contractors.

The system allows for unlimited payroll runs, custom pay schedules, and direct deposit payments. Employees can log into the BambooHR self-service portal to view their pay history, update details, and download payslips.

Bamboo Payroll currently supports businesses operating in the United States and is particularly suited for those already using BambooHR for HR management, making the two tools an all-in-one HR and payroll solution.

Since it’s cloud-based, Bamboo Payroll works smoothly on Mac, iPhone, and iPad, allowing you to manage payroll anytime and anywhere.

If you’re already using BambooHR, adding Bamboo Payroll provides a smooth, efficient, and integrated payroll experience on any Mac.

Pricing: Free trial / starting from $6 per employee/month plus a base fee (available upon quote request).

2. HiBob Payroll

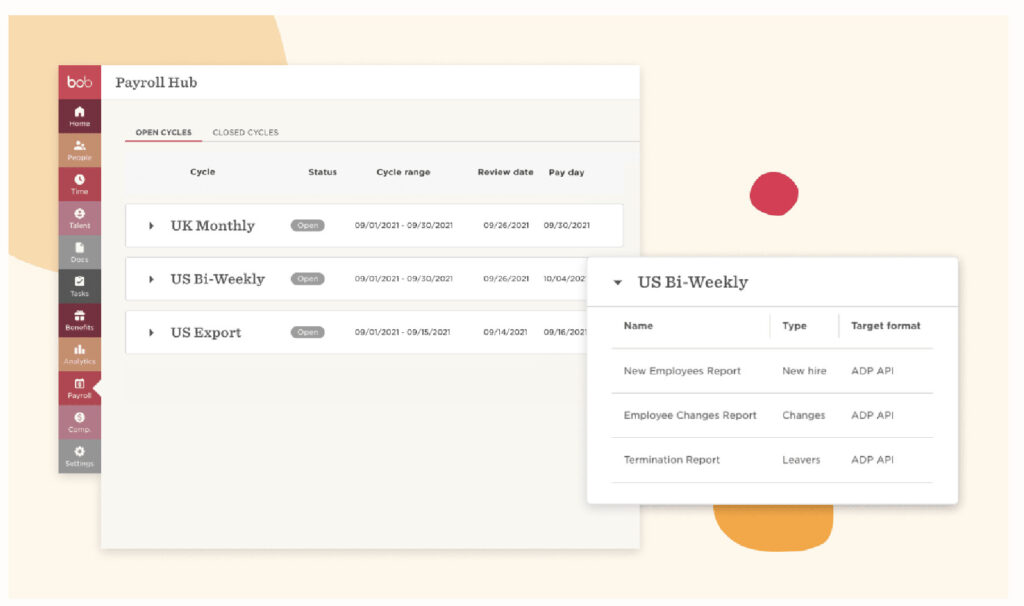

HiBob Payroll (Payroll Hub) is a modern payroll-solution module from HiBob (also known as “Bob”), designed to integrate seamlessly with its HR platform for small to mid-sized and globally distributed teams.

You can automate payroll data flows by using the Payroll Hub, which centralizes payroll details, supports payroll cycle setup (weekly, bi-weekly, monthly, bi-monthly), and syncs HR changes (new hires, terminations, address/title changes) in real time.

For UK-based operations, HiBob offers a fully native UK Payroll solution that calculates pay, National Insurance, student loan deductions, handles P45/P60/P11D, and keeps you compliant with HMRC regulations.

The platform is cloud-based, works across Mac, PC, mobile devices, and offers a unified user experience for HR, payroll, and employee self-service.

If you’re looking for a payroll tool that is deeply integrated with HR, supports multi-cycle payroll, and is suited for teams with global/UK workforce needs, HiBob Payroll (Payroll Hub) is a strong option.

Pricing: HiBob uses a custom-quoted model rather than fixed published pricing. Typical prices from roughly US$8–12 per employee per month for smaller teams.

3. OnPay

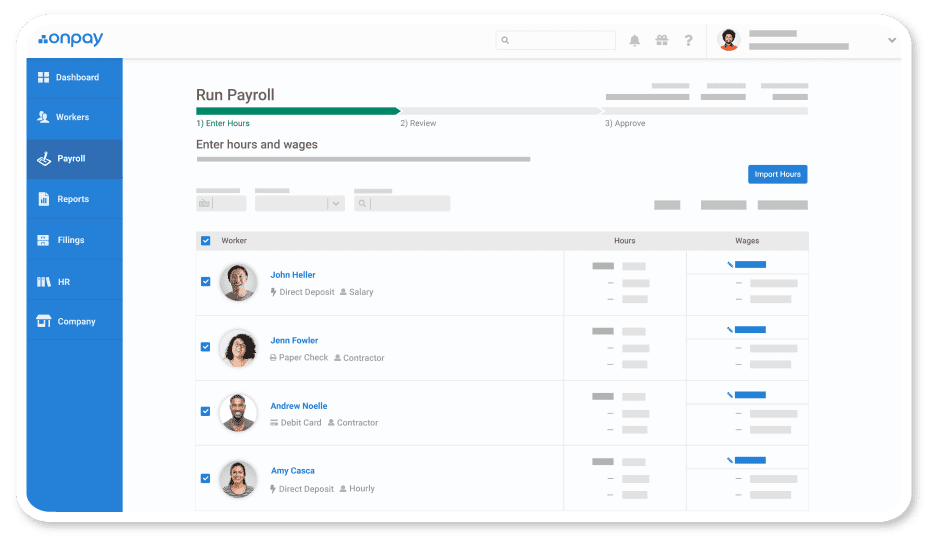

OnPay is a value for money yet powerful payroll and HR solution that’s simple enough to use for anyone that’s new to Payroll processing.

OnPay offers a full service payroll including unlimited monthly pay runs, automatic tax filing, health insurance payments and multi-state payroll processing.

OnPay allows employees to login and self-onboard, run reports on new hires and make automated payroll taxations.

OnPay also offers phone support with trained experts in case of problems or any payroll related processing issues.

OnPay is excellent value for money compared to other small business payroll solutions with the base fee starting at $40 per month and then $6 per user.

Unlike many payroll software there are no add-ons or additional fees either apart from mailing workers W-2/1099 forms and penalties if there are insufficient funds to run a payroll.

OnPay will also automatically transfer your payroll processing from an existing provider including from ADP, Paychex, Intuit and most other payroll solutions.

OnPay offers a no risk free trial to see if it’s the righ solution for your business before you have to subscribe.

Pricing: Plans starting from $40/month + $6 per employee/month.

4. OnTheClock Payroll

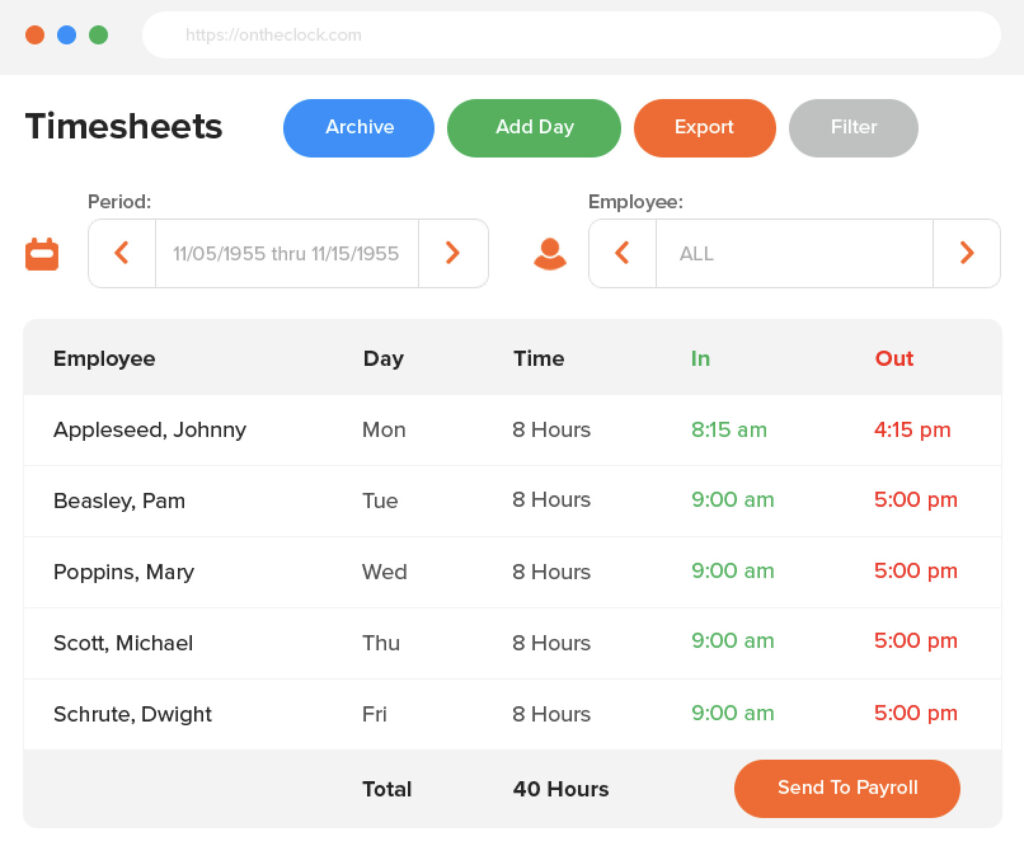

OnTheClock Payroll is an add-on payroll service from the time-tracking and workforce management provider OnTheClock, designed primarily for US-based companies that already use OnTheClock for time tracking, scheduling and attendance.

You can set up payroll that feeds directly from time-cards tracked in OnTheClock, automating direct deposits, tax calculations, federal/state/local tax filings (where supported), and payroll run workflows.

Important limitations:

- The payroll add-on is only available for businesses operating in the United States.

- Some withholding types (e.g., contractor payment deductions, state-mandated IRA/retirement plans, certain local taxes) are not supported.

- Because OnTheClock’s strong core is time-tracking and scheduling rather than full HR/Payroll suites, companies with more complex payroll compliance needs may find the limitations restrictive.

Since it’s cloud-based and supports Mac/Windows web browsers (via OnTheClock’s core platform) it can work for Mac-based users, though the payroll module is more of a US-centric payroll bolt-on rather than a purpose-built Mac-native payroll solution.

If you’re looking for a simple extension from time-tracking into payroll within the same platform, OnTheClock Payroll offers a straightforward option – but if you need international payroll, advanced tax compliance or global workforce coverage, you might need to consider alternatives.

Pricing: there is a one-time enrolment fee of US$ 250 at sign-up. After that the service costs a base fee of US$ 40 per month plus US$ 6 per employee per month.

5. Rippling Payroll

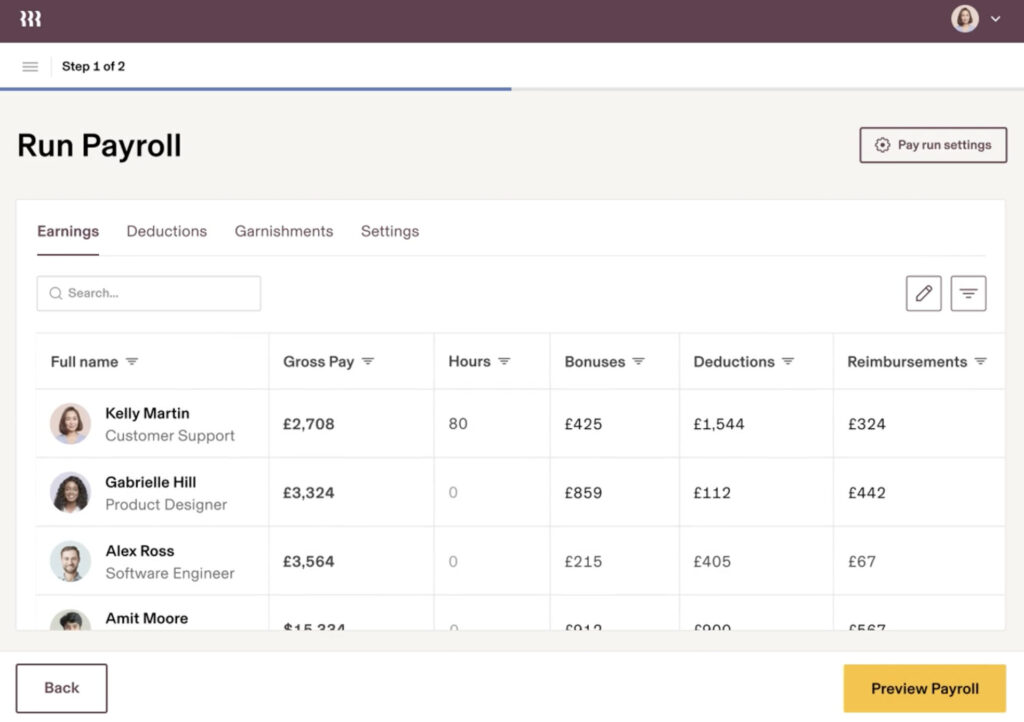

Rippling Payroll is part of the all-in-one workforce platform Rippling (covering HR, IT, finance and payroll) designed to centralise employee data and automate the entire payroll process.

You can process payroll for employees and contractors (including multi-state and global payroll) in a connected system where HR changes (hires, terminations, salary adjustments) propagate automatically, and tax filings, direct deposits, W-2/1099 generation, and currency conversions are handled seamlessly.

If you operate a business with multi-country workforce, complex pay schedules, or want unified HR + payroll + IT/asset management in one system, Rippling Payroll is a strong contender—though the modular setup means you’ll want to review how many add-ons you’ll need and whether the total cost remains manageable.

Pricing: Rippling pricing is modular and starts at approximately US $8 per employee per month for the core platform and around US $35 per month for the payroll module (note: custom quotes apply).

6. Paychex

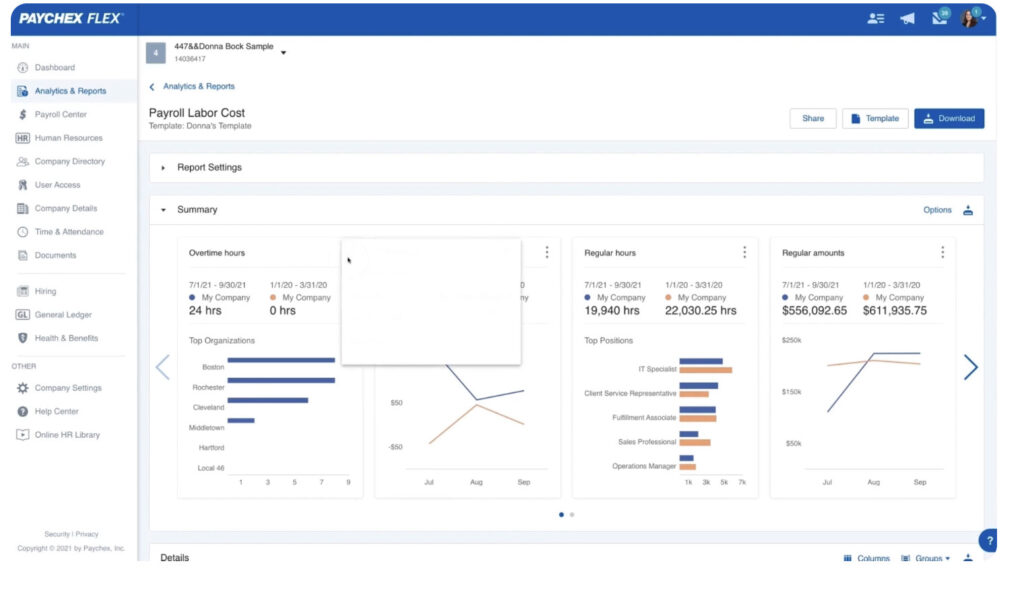

Paychex Payroll (via the Paychex Flex platform) is a comprehensive cloud-based payroll and HR solution primarily designed for US-based businesses of all sizes and offers support for payroll, taxes, HR and associated services.

You can process payroll runs online or via mobile, handle direct deposit, pay checks, manage garnishments, and the system automatically calculates, withholds and files federal, state and local payroll taxes.

Employee self-service is included: staff can view payslips, W-2/1099 forms and update direct-deposit and personal info via the mobile app or browser.

Because Paychex is very feature-rich and supports mid-sized businesses with complex payroll and compliance needs (especially in the US), it is well suited for businesses scaling up – but for very small firms or those with only simple payroll requirements it might be more cost and feature heavy than necessary.

Pricing: Starts at US $39 per month plus US $5 per employee for the Essentials plan. For larger or more complex enterprises you’ll need to request custom quotes for the Select and Pro plans.

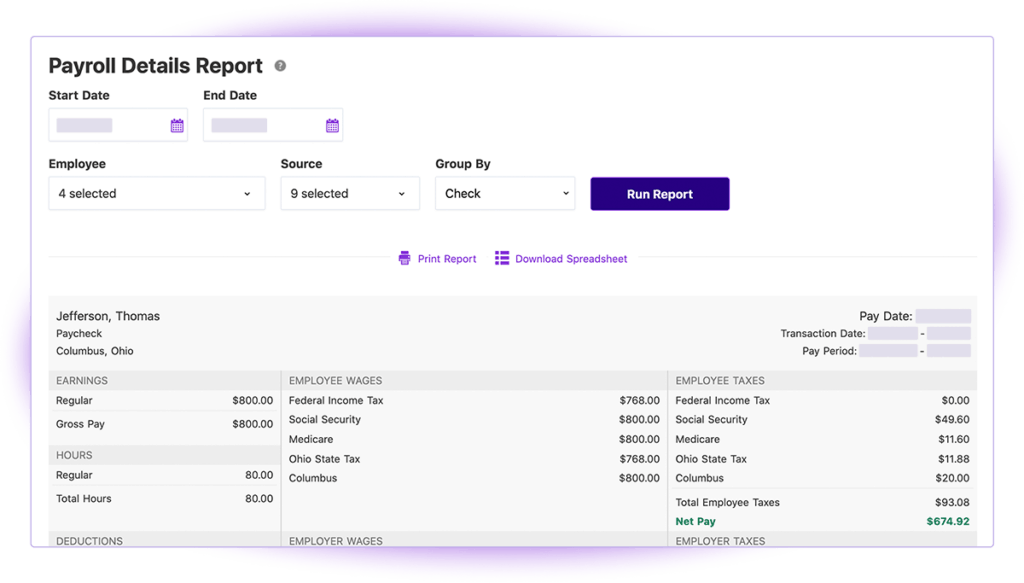

7. Patriot Payroll

Patriot Payroll software is an easy to use accounting and payroll solution for US businesses that works online.

You can choose to either run payroll yourself with the Patriot Payroll Basic solution or let Patriot handle everything from tax filing to payments with Full Service Payroll.

The Basic Payroll service is very reasonably priced at $17 per month although there’s a $4 per employee charge on top. This includes, payroll setup, check printing, unlimited payroll runs, flexible pay schedules and printable W2s.

The Full Payroll service costs $37 per month plus $4 per employee but includes all tax filing including W2, W3, federal, state and local taxes.

If you’re based in one State but have employees in another State, Patriot Payroll can also handle that although it costs an extra $12 per month.

Employees can also check their payments and payslips by logging into the Patrot Payroll employee portal.

Since Patriot Payroll runs on any device, it can easily be used on iPhone and iPad too.

If you want an easy to use online payroll tool, Patriot Payroll is extremely straightforward. It’s ideal for small businesses although since billing is done per employee, medium-sized firms may find that the cost adds up.

You can sign-up for a free trial of Patriot Payroll to test it for yourself.

Pricing: Starting from $17 + $4 per employee/month. For a limited period you’ll get the first 30 days for free and then 50% off the next 3 months ($8.50/month)

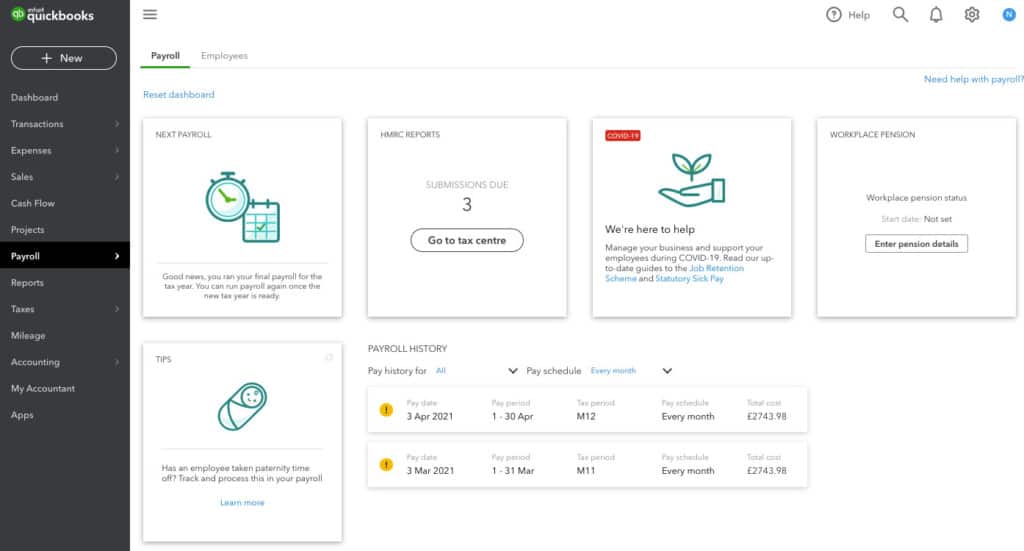

8. QuickBooks Payroll

QuickBooks Payroll is the best payroll software on the market thanks to its incredible ease of use and integration with a wide range of accounting packages.

QuickBook is the best payroll software for both US and UK businesses as it has been customized for both 1099 E-file and Pay in the USA and HMRC in the UK.

QuickBooks accounting software is one of the most widely used and respected in the industry, so much so that almost all the other payroll solutions featured here offer optional integration with it.

Although there’s no QuickBooks Payroll desktop app, it can be used via the QuickBooks Desktop Mac 2021 accounting software desktop as an added module if you subscribe to it.

However, we recommend subscribing to QuickBooks Payroll online as Intuit is slowly discontinuing the desktop versions of its products.

You also get the useful QuickBooks Payroll mobile app which gives you the power to run payrolls, pay taxes, file forms and view your employee’s salary history.

The ability to execute payroll runs away from your Mac in particular is really useful if you can’t be in the office or at your desk for any reason.

Other nice touches include integrated time tracking so it can be used as a billing tool too, employee access so they can check pay stubs and automatic tax liability calculations.

There are 3 different versions of QuickBooks Payroll: Core, Premium and Elite (formerly known as Basic, Enhanced and Assisted Payroll).

- Core ($25 + $6 per employee/month) which is suitable for small teams but only pays taxes for employees in one state, not multiple states.

- Premium ($42.50 + $9 per employee/month) which is aimed at small to medium sized businesses that also need HR support and same day deposits. It also provides access to the HR Support Center which includes onboarding tools, state and federal overtime laws, job descriptions etc.

- Elite ($65 + $11 per employee/month) which is aimed at large businesses also seeking tax penalty protection and a personal HR advisor. It also supports payments to employees in multiple states.

If you want an easy to use payroll software that integrates with a wide range of accounting software and takes care of everything from tax filing to salary payments, QuickBooks Payroll is the perfect solution.

You can also try QuickBooks Payroll for free to judge for yourself.

You can also check out our full review of QuickBooks Payroll.

Pricing: Plans starting from $8.50 per employee/month with 50% off for a limited period

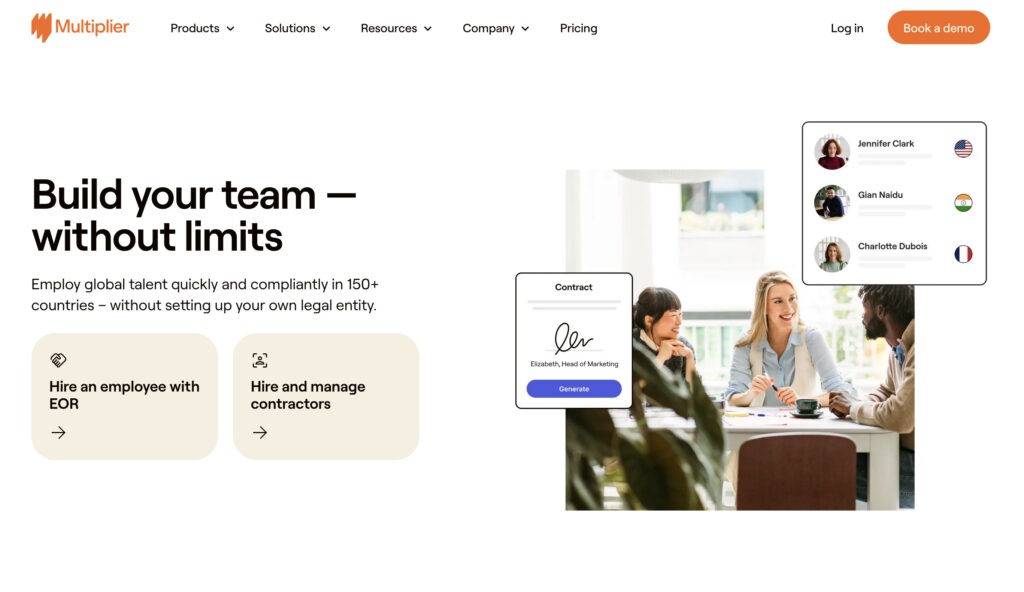

9. Multiplier

Multiplier is a powerful yet straightforward global payroll and compliance platform designed to help businesses manage international teams with ease.

Multiplier provides a full-service international payroll solution that includes compliant hiring in over 150 countries, automatic local tax filings, benefits administration and contractor payments.

With Multiplier, companies can onboard employees or contractors anywhere in the world without setting up local entities, issue locally compliant contracts, and ensure adherence to regional labor laws.

Multiplier also offers 24/7 support with local HR and legal experts to help navigate cross-border employment complexities and resolve payroll issues quickly.

Multiplier stands out for its transparent pricing and ease of use compared to hiring through traditional Employer of Record (EOR) firms.

Businesses pay a simple monthly fee per employee or contractor, with no hidden fees or surprise charges for international compliance.

Multiplier will even handle switching from your current global payroll or EOR provider to their system at no extra cost.

Multiplier offers a free demo so you can see if it’s the right global payroll solution for your team before committing.

Pricing: Demo Available. Plans starting from $400/month per employee or $40/month per contractor.

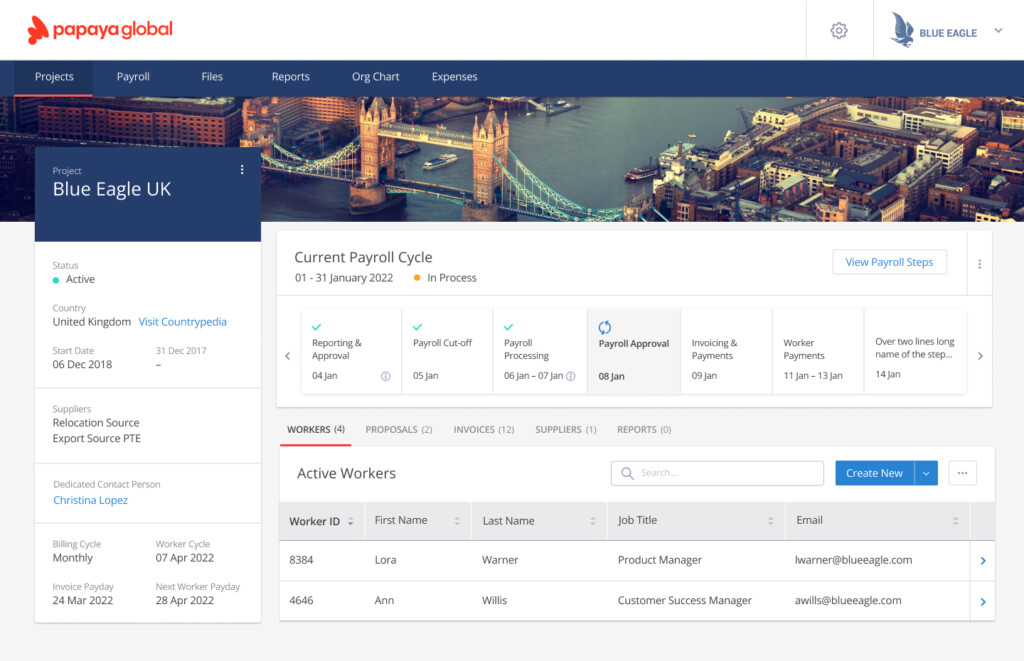

10. Papaya Payroll

Papaya Payroll is an enterprise level Payroll system that allows you to pay employees’ net salaries, tax liabilities, benefits and pensions in over 100 countries.

It recently acquired Azimo global cross border payments to support global payroll processing on any platform, including Macs.

Some of the highlights of Papaya include guaranteed payroll payments in 72 hours which Papaya claims is the fastest payroll delivery on the market.

Papaya also guarantees compliance with payment licenses across the world and is subject to reporting and auditing in each market.

It also gives you a clear overview of Payroll and payments in one platform so that you have visbility of employee onboarding to payroll payment.

Papaya payroll also provides 24/7 support for clients if anything goes wrong with payroll processing and real time alerts for payment processing.

You can request a demo of Papaya Payroll to see it in action for yourself.

Pricing: Starting from $5 per employee/month.

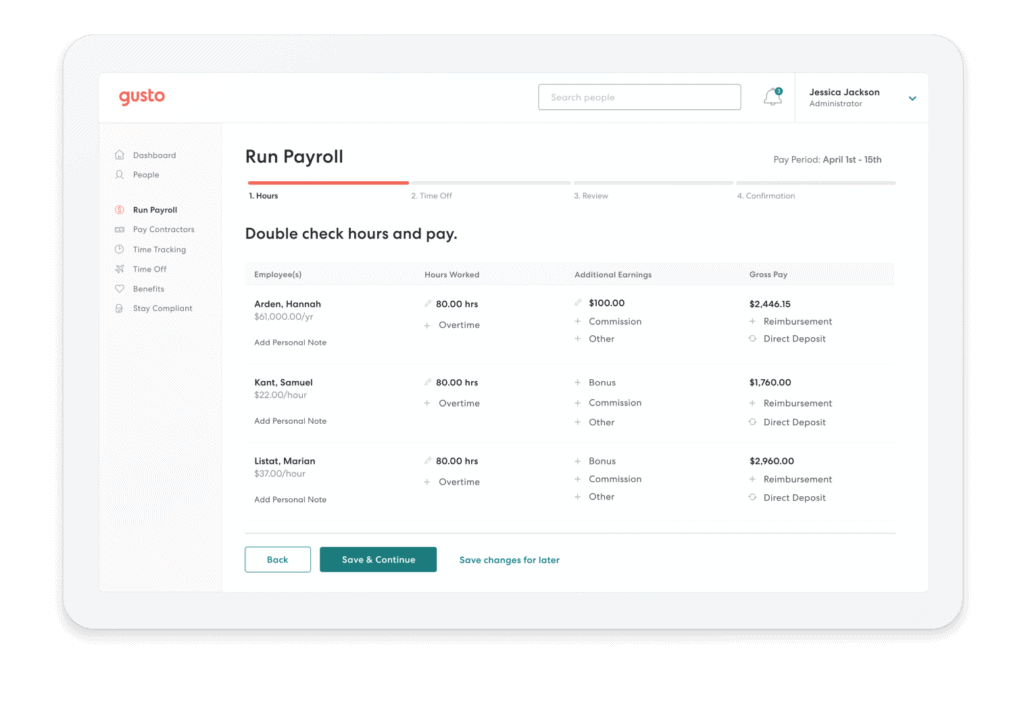

11. Gusto

If you’re looking for something that can handle Payroll and HR but make it extremely easy, look no further than Gusto.

Gusto is used by over 60,000 companies to run their business and it’s easy to see why it’s become such an attractive solution to small and medium-sized organizations struggling to keep on top of things as they grow.

Gusto cleverly simplifies the complexities of running a small business and makes it incredibly easy to keep things under control.

Gusto covers everything from running pay runs and keeping up to date with payroll legislation to automatically filing taxes and even onboarding new employees into the system.

What we like most about Gusto is the modern, streamlined approach it takes to Payroll. In fact if Google made some kind of Payroll solution (and in fact Gusto is backed in part by Google Capital), Gusto is probably what it would look and feel like.

Even those with no experience in Payroll should be able to set up Gusto to manage payrolls quickly and the average pay run takes no more than 10 minutes.

You can ask Gusto to do pay runs manually or automatically. Manually allows you to administer the system yourself while AutoPayroll does everything for you from executing pay runs at a specific time to filing taxes.

It will even automatically report new-hires to government, calculate child support garnishments and automatically adjust wages to comply with the FLSA Tip Credit minimum wage requirement.

Gusto is constantly updated with payroll tax laws and regulations for 50 States including federal and local taxes. You can run unlimited pay runs, it automatically files W-2s and 1099s and there’s an employee portal to allow staff to check pay stubs and pay history.

The added HR features are something that stand out in Gusto compared to solutions like QuickBooks. Gusto even takes care of online onboarding when you recruit new employees.

This not only reduces paperwork but also time spent integrating new staff members into your payroll system. Once in the system, employees are also notified by mobile when they are paid.

There are 3 Gusto plans: Simple, Plus and Premium starting at $49 per month.

All plans include full service payroll, employee self-service, health benefits and workers comp administration and support for paid off time policies. You can also customize plans with things like 401(k)s and FSA.

You can get started now for free with Gusto to judge for yourself.

Pricing: Plans starting from $49/month + $6 per employee/month.

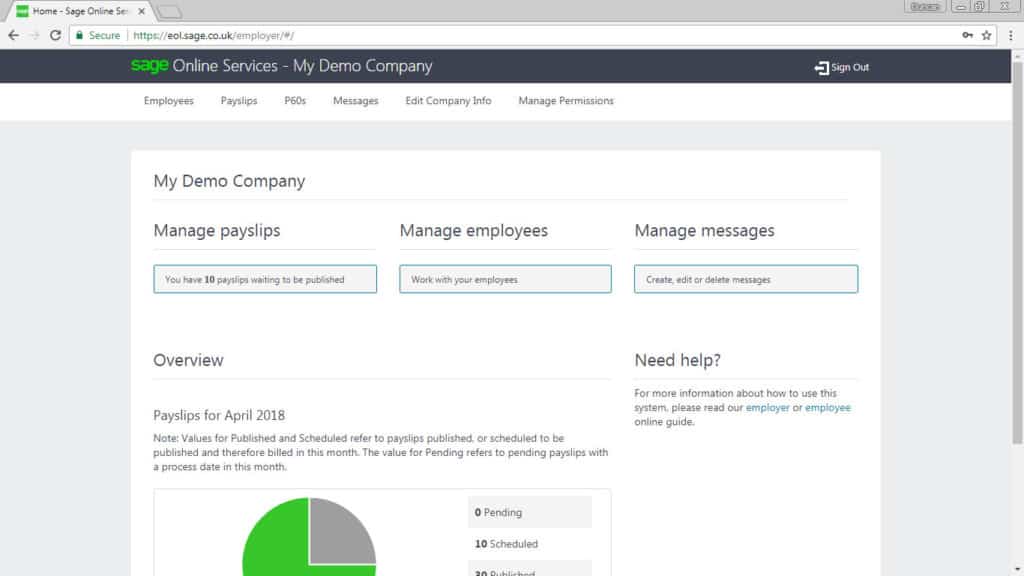

12. Sage

Sage is an all round accounting solution with a Business Cloud Payroll solution suitable for small, medium and large businesses. Since it’s Cloud based, it can be used on any platform including Mac, Windows and mobile.

Sage Payroll can be used as a standalone product or alongside its own accounting solution Sage Cloud. Alternatively, you an also use it with QuickBooks accounting software.

Sage Payroll automatically files local, state and federal taxes and even takes care of any notifications from government for you. Sage has professional staff certified by the American Payroll Association (FPC) that can give professional advice on any payroll issues you may have.

Sage Business Cloud Payroll includes free 24 hour support and is automatically updated each year for changes in payroll legislation so it’s always up to date. There are no limits on the number of transactions or pay runs you can make either.

Because it’s based online, Sage works on all platforms including Mac, Windows and mobile. Sage also offers a desktop payroll application but its Windows only.

You can request a free demo of Sage to try before you buy.

Note that users in the UK must go to the Sage UK site to try its payroll solution.

Pricing: On Request.

13. BrightPay

BrightPay is an award winning UK based desktop payroll software that works on both macOS and Windows.

BrightPay officially endorsed by HMRC, supports all RTI submission types and includes auto enrollment. This mean however that BrightPay is only suitable for UK small businesses – it does not work in the USA or other countries.

BrightPay now integrates with a most major accounting software and even allows you to to batch process multiple employers at the same time.

BrightPay also has a Cloud version called BrightPay Connect which syncs with both the desktop client and can be used in any browser.

BrightPay Plans start at 84 pounds for up to 3 employees going up to 339 pounds for unlimited employees.

BrightPay offers a generous 60 day free trial so you can fully test it out before purchasing.

Pricing: Plans starting from £84.

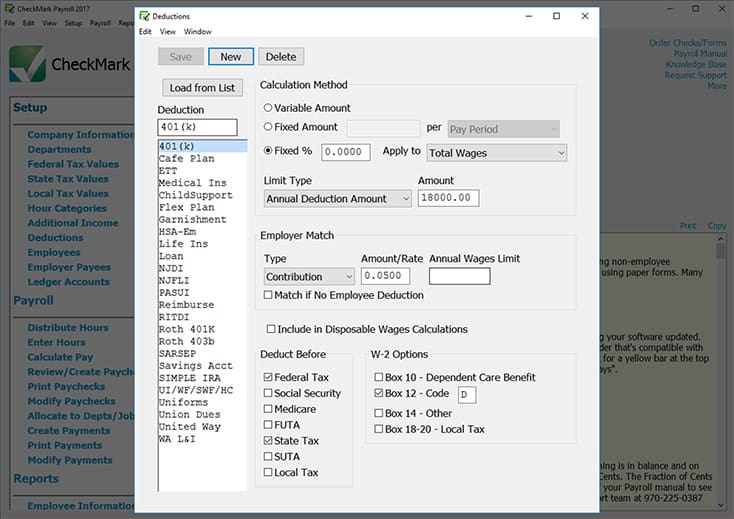

14. CheckMark

CheckMark is one of the few payroll solutions that offers both a Mac and PC desktop download.

It has also just launched their Online Payroll, meaning you can use it directly in your browser, making it perfect to use on the go as well.

CheckMark has been in the accounting and payroll business since 1984 so it’s an extremely solid product with a good track record.

What we like about CheckMark Payroll is that it integrates not only with its own accounting package MultiLedger but also with QuickBooks (see review above) and many other popular accounting systems so it doesn’t try to lock you in.

Some of the best features of CheckMark Payroll are:

- Unlimited Payroll run processing

- Unlimited employee processing

- Printing and E-filing of W2s, W3s and more to the SSA

- Direct Deposit payments to employees

- Emailing of pay stubs to employees

- MICR encoded check printing

- Back-up your Payroll to the Cloud (costs extra)

Another big plus is that if subscription based software isn’t for you, CheckMark doesn’t require any monthly payments although it doesn’t come cheap at $549 for CheckMark Payroll Pro and $609 for the Pro+ version.

The online version however comes with a monthly cost of $20/month plus $6 per employee.

If you want a purely desktop payroll solution for both Mac and PC, CheckMark Payroll is an excellent choice although the price will put off many small businesses.

Note that the current version of CheckMark Payroll Desktop only works on 32-bit versions of macOS which means it does not work on Catalina, Big Sur or Monterey which are all 64-bit.

However, there are still ways to run 32-bit apps on the latest versions of macOS so you can use CheckMark Payroll on Catalina, Big Sur and Monterey.

You can try it free for 60 days before deciding whether it’s the right tool for you.

Pricing: Starting from $549

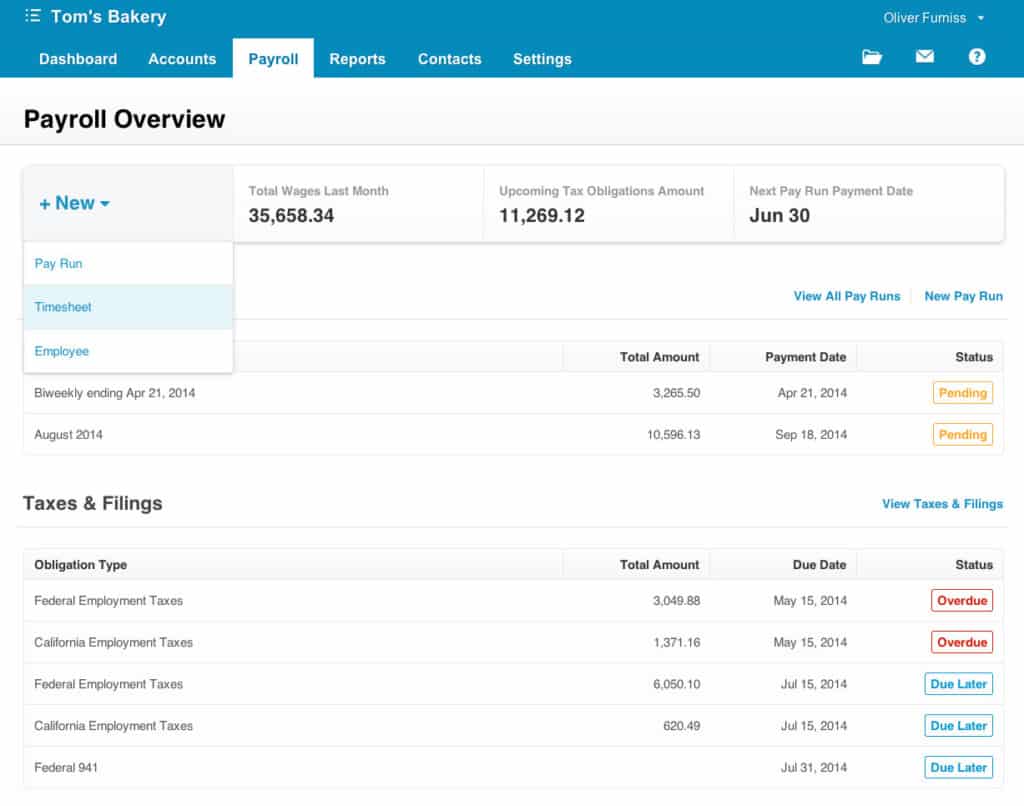

15. Xero

Xero is a complete accounting and payroll solution designed specifically for Apple devices. Xero is actually Cloud based but the look and feel is very much of an iOS/macOS oriented product.

It is a complete accounting package and payroll is just one aspect of it. Xero doesn’t have all the features you’ll find in dedicated payroll software like QuickBooks and CheckMark Payroll but it’s extremely slick, clean, easy to use and works on any platform.

You can perform pay runs, generate payroll reports and create payroll journals using Xero.

However, it’s more focused on providing an overall accounting solution including reports, invoicing, payment processing, inventory management and more.

If you want a complete accounting package that has simple payroll support and looks great on any platform, Xero is worth checking out.

Pricing for Xero starts at $2 (90% for the first 3 months) for the Early Plan although this puts limited on the number if invoices you can issue, bills you can pay and transactions you can reconcile.

You can also try Xero for free to decide whether it’s for you.

Pricing: Plans starting from $2/month (normally $20 per month)

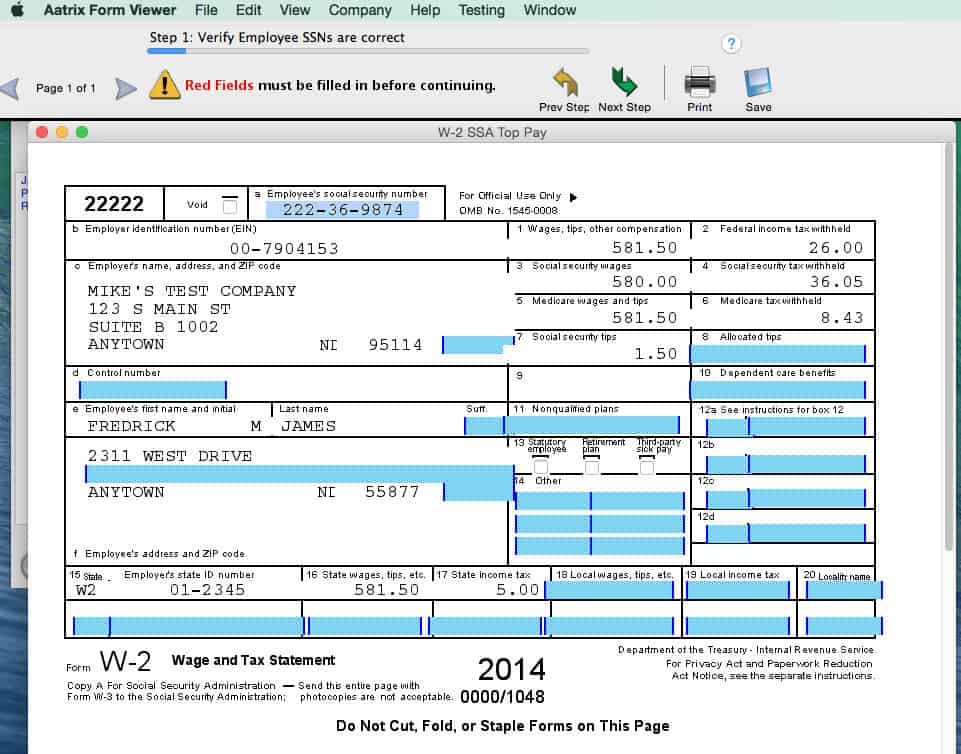

16. Aatrix

Aatrix Payroll solutions are aimed at small to medium-sized businesses and the company offers two different apps depending on the size of your company.

Aatrix Top Pay is aimed at small businesses but only tracks deductions, employee contributions, vacation, sick time and holiday time. For pay runs, it requires QuickBooks which it can automatically post pay run data to.

Aatrix Ultimate Payroll is designed for larger businesses and handles all payroll itself. Aatrix also offers a useful eFile service which allows users your customers to eFile payroll reports for processing.

You can request a free demo of Aatrix to try first but you’ll need QuickBooks already installed to use Aatrix Top Pay.

17. Lightning

If you’re based in Australia, the options are even more limited but you can try Lightning Payroll which has both a Mac and Windows desktop client.

Lightening is ATO and Fair Work compliant, includes free support and costs $299 with a free 30 day trial.

We hope this guide to pay roll solutions for Mac users have been helpful. If you’re just get started out in doing payrolls for your business, we also recommend CheckMarks’s useful guide to Payroll for beginners.

If you need something to manage your customers or client base on your Mac, you may also find our guide to the top CRM solutions for small business owners on Mac useful too.

If you have any other questions, suggestions or experiences regarding the software featured here, let us know in the comments below.

Pricing: Plans starting from $299/year.

Desktop vs Cloud Payroll Software

Payroll software usually falls into two types:

- Desktop standalone apps or “on premise” solutions which you can download onto your Mac or Windows PC

- SaaS (Software as a Solution) Cloud based apps which work online on any platform in any browser.

Whichever you choose, almost all payroll apps use a monthly subscription model.

This is increasingly common in the software industry and although it may seem inconvenient, it avoids the need for costly upgrades further down the line.

Be aware too that most payroll apps do pricing per employee or per how many payroll runs you do.

Keeping up to date with the latest payroll laws at local, state and federal level is a big job alone and payroll software is one of those areas where a subscription makes particular sense.

Note that most payroll software is aimed at US-based businesses and therefore only comply with US payroll laws and regulations.

However, in these reviews we’ve also highlighted the best payroll tools for UK small businesses and Australian payroll software.

Why Use Payroll Software?

To do payrolls properly, you need dedicated software.

Most tax filing software don’t deal with payrolls and even many of the best accounting software stay away from payroll completely.

One of the biggest reasons for this is because payroll administration is notoriously complex due to ever changing payroll tax laws which make it very easy to get caught out.

And getting your payroll wrong can be extremely costly.

Advantages to using your own in-house Payroll solution include:

- Doing payroll yourself is much cheaper than outsourcing

- You’re less likely to make mistakes calculating state taxes using Payroll software

- It’s much quicker – pay schedule templates and payroll runs can be executed instantly with payroll software

- It gives you full control of your payroll including the ability to fix payment problems quicker.

- You’ll make far fewer errors than doing things via spreadsheet

- It’s more secure than doing things via Excel or other spreadsheet apps

- Most payroll tools can be accessed on mobile via apps or browsers which allow you to execute pay runs anywhere

- Payroll software allows you to go paperless in your office

Trends in Payroll Software for Mac in 2025

The payroll software market continues to evolve rapidly, and for Mac users in 2025, the shift is clearer than ever: modern payroll solutions are becoming more cloud-native, more integrated, and far more automation-driven than before. Here’s what’s shaping the best payroll software for Mac this year:

Cloud-First and Cross-Device Flexibility

Gone are the days when payroll tools needed to be tied to on-premise servers or Windows-only desktop apps. In 2025, virtually all top payroll platforms for Mac – like Gusto, OnPay, QuickBooks Payroll, and Rippling – are fully cloud-based and accessible through any modern web browser. This means Mac users get the same full feature set as PC users, with no compatibility workarounds needed.

Deeper Integration With Macs & Apple Devices

Payroll providers know their users run Macs for a reason: they want seamless, elegant tools. Many services now offer native Mac or iOS integrations, from single sign-on with Apple ID to tight connections with macOS Contacts, Calendar, and even Siri shortcuts for basic tasks like approving timesheets or running reports.

AI-Powered Automation

AI is now front and center. Many payroll solutions use AI to handle payroll compliance, flag anomalies in pay runs, suggest tax-saving optimizations, and even automate employee onboarding. Small business owners benefit most, as they can reduce errors and manual checks with minimal payroll knowledge.

Global Payroll and EOR Expansion

As remote and hybrid work continues to thrive, Mac-friendly payroll tools increasingly bundle international payroll, contractor management, and Employer of Record (EOR) services into one. Providers like Multiplier, Deel, and Remote have gained traction for allowing Mac-using companies to hire, pay, and stay compliant with global teams without extra local setups.

Employee Self-Service Portals on Mobile

Employees expect control. Nearly every top payroll app now has polished self-service portals optimized for Mac, iPhone, and iPad. Workers can check payslips, update tax details, manage benefits, or request time off from anywhere, which reduces admin time for payroll teams.

Compliance Automation and Real-Time Updates

With tax laws changing fast, compliance remains a top priority. Modern payroll tools auto-update for state, federal, or international tax changes and alert users instantly, minimizing the risk of penalties. Expect this to become even more robust, with auto-filing for multi-state taxes, real-time error checks, and instant e-filing of forms like W-2s and 1099s.

Transparent Pricing, Fewer Hidden Fees

Small businesses have pushed back on opaque pricing. In 2025, Mac-friendly payroll platforms are more transparent about monthly base fees, per-employee charges, and what’s included (or not). Many are ditching hidden add-ons for year-end filings or direct deposits, offering straightforward, predictable costs.