If you’ve recently made the switch to Mac, you might have already realized that Microsoft Money is not available on macOS.

Microsoft actually replaced Money in 2010 with a free version called Money Sunset Deluxe although there’s no Mac version of that either.

There is a way to run Microsoft Money on a Mac but its not easy to setup and its getting harder with each update to macOS.

However, in our research and testing we found plenty of other options for Mac users to manage finances, from free Cloud based and one time purchase apps to free open source apps.

If none of these fit your needs, you might also want to check out our guide to the best personal finance software for Mac for some broader options too.

| Price | Microsoft Money Import Support | Bank Syncing | Budgeting Tools | Investing Tracking | Platform Support |

|---|

| Empower | Free | No | Yes | No | Yes | Web, iOS, Android |

| Money-spire | $59.99 one-time purchase (normally $99.99) | Yes (via QIF/CSV) | No | Yes | Yes | macOS, Windows |

| Banktivity | Starts at $4.99/m | No | Yes | Yes | Yes | macOS |

| Quicken Classic for Mac | Starts at $5.99/m | Yes (via QIF) | Yes | Yes | Yes | macOS, Windows |

| Tiller | $6.58/m | Yes (via CSV) | Yes (via Sheets) | Yes | Yes | Web, Sheets-based |

| Money Manager Ex | Free | Yes (via QIF/CSV) | No | Yes | Yes (manual only) | macOS, Windows, Linux |

Here then is our list of the best replacements for Microsoft Money on Mac in order of ranking.

Table of Contents

1. Empower (Free)

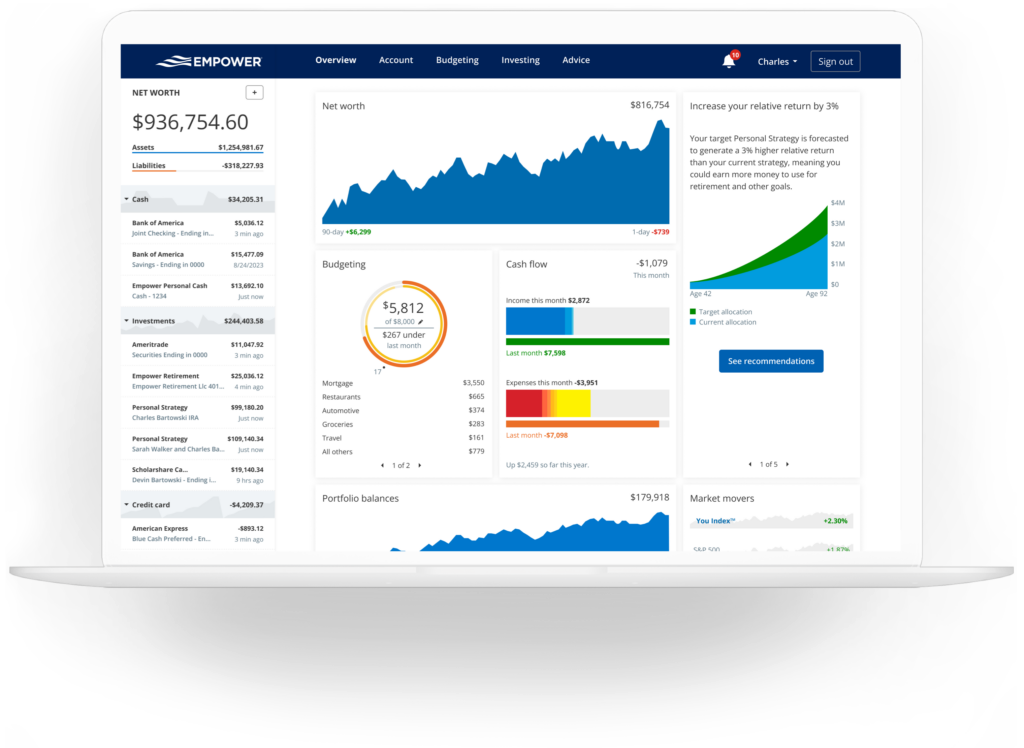

Empower is more than just a free way to manage your money – it actually advises you on how to maximize your capital and investments.

It won our award as the best personal finance software for Mac with the best investment tracking of any software we’ve used.

Empower is 100% free to use and you only get charged if you use an optional personal strategy meeting.

It also has reliable syncing with banks, credit card, credit union and other financial institutions so that it can automatically download transactions.

It can also import Microsoft Money files from Windows if they’re in CSV format.

The Investment Checkup Tool is one of the best things about Empower as it immediately identifies areas where you should diversify investments without increasing the risk.

Other useful features we really like about Empower include automatic bill reminders, stock value updates and 401K updates.

Although there’s no native Mac client, the web interface works extremely well and Empower looks like an application that’s built for macOS.

There is however an official Empower iOS app which looks great on both iPhone and iPads and gives you most of the same features as the desktop version.

If you’re looking for an alternative to MS Money on Mac that not only helps you manage finances but optimize them too, Empower is an excellent free replacement.

You can get started with Empower for free to see for yourself.

You can read our full review of Empower for a more in depth look.

Pricing: Free

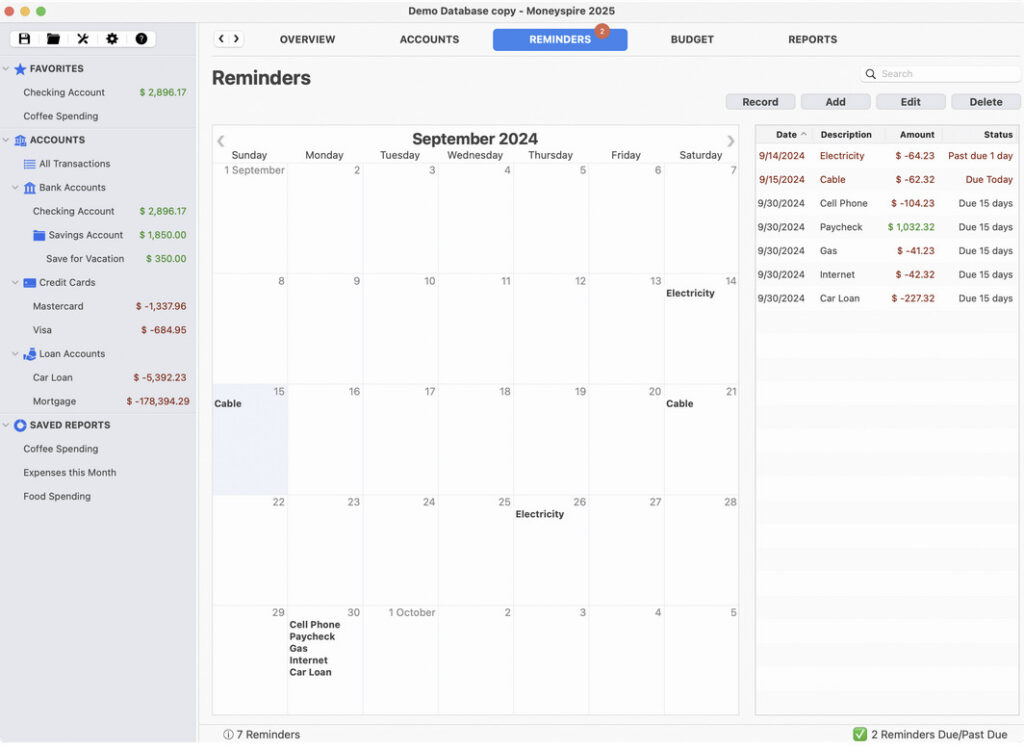

2. Moneyspire

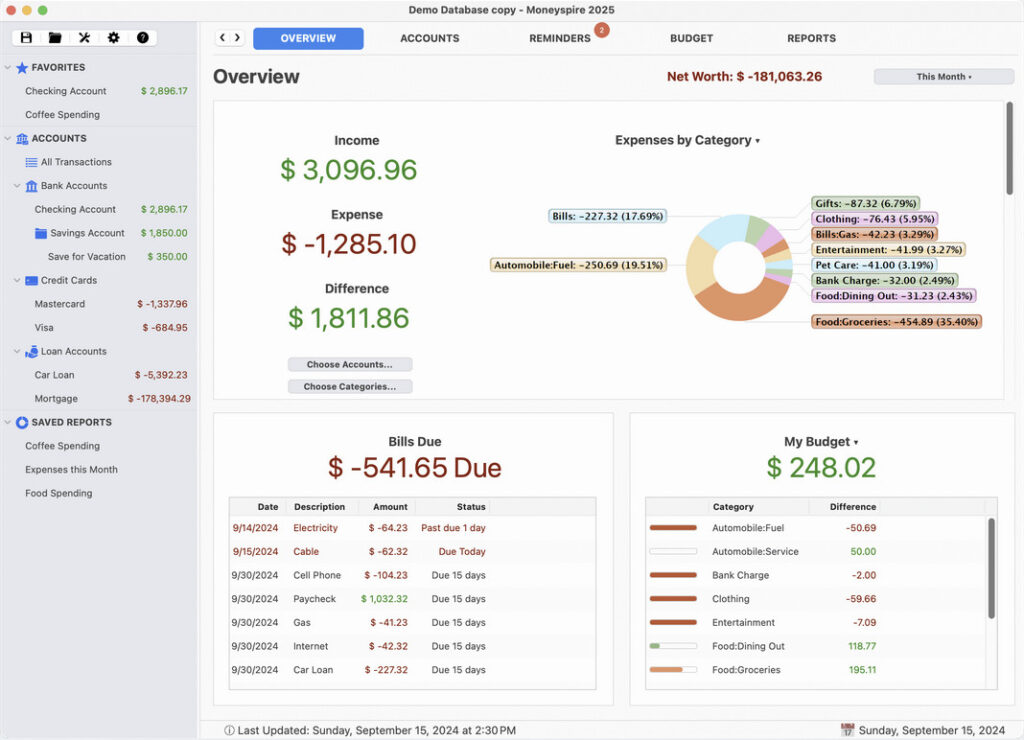

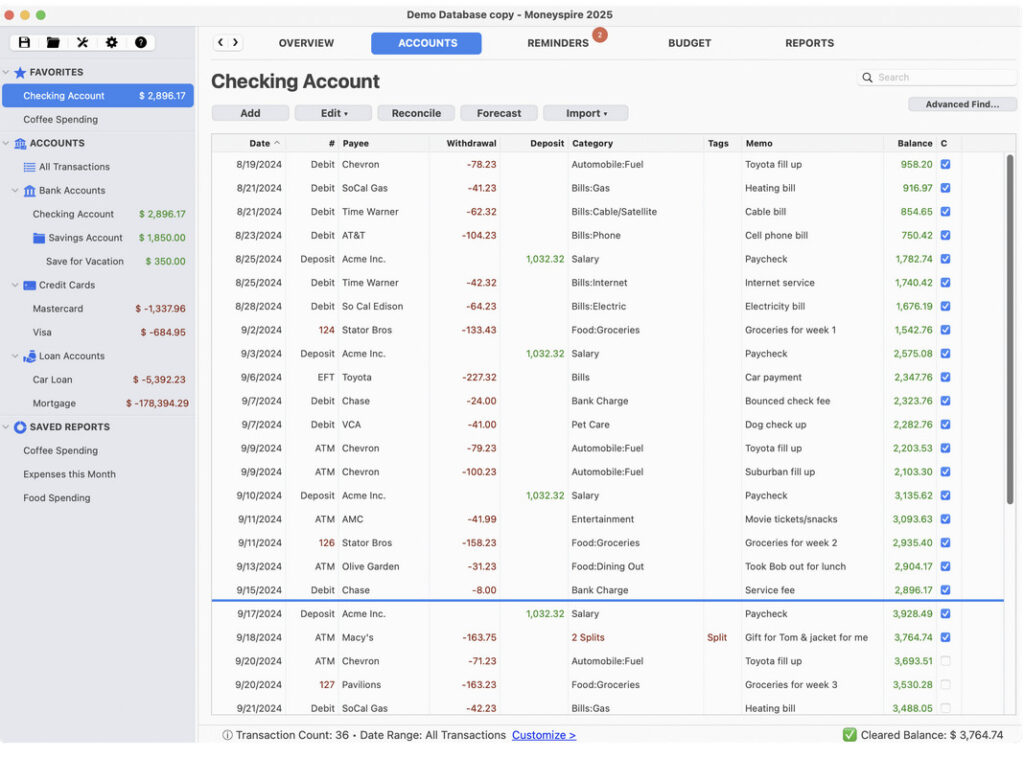

Moneyspire (formerly Fortera Fresh Finance) is an extremely well put together personal finance software that has a native Mac desktop client.

Moneyspire is focused more on managing your day-to-day finances in a straightforward no-nonsense way.

One of the big attractions of Moneyspire is that it doesn’t force you to store your financial data online or in the Cloud although you can if you want to enjoy syncing with iOS devices.

Unlike personal finance software such as Quicken for Mac, it also doesn’t tie you into any annual subscriptions to keep using it although again, you can choose that model if you want.

You can also import MS Money files in CSV format into Moneyspire very easily.

The interface of Moneyspire keeps things very simple by not overwhelming you with information – it’s basic but informative with all essential financial data at your fingertips.

Moneyspire can pay bills automatically with the Direct Connect service, generate reports, forecast balances and reconcile accounts.

Note however that Direct Connect is increasingly being phased-out by banks in favor of Express Web Conect+ (EWC+) which Moneyspire does not support.

If your bank does not support Direct Connect anymore, you may still however be able to connect to your bank via Moneyspire Connect which is a free syncing tool included with Moneyspire.

It does not however support Bill Pay or transferring funds between accounts within it though.

What we like most about Moneyspire is that it feels like it puts the user first, giving you control over both the storage of your finances and the payment model you prefer. It also doesn’t complicate things unnecessarily with features you’ll probably never need.

For a limited period too, Moneyspire 2025 is currently 40% off for $59.99 or $79.99 for Moneyspire Pro with invoicing included.

You can check out our review of Moneyspire for more.

Pricing: Starting from $59.99 (50% off)

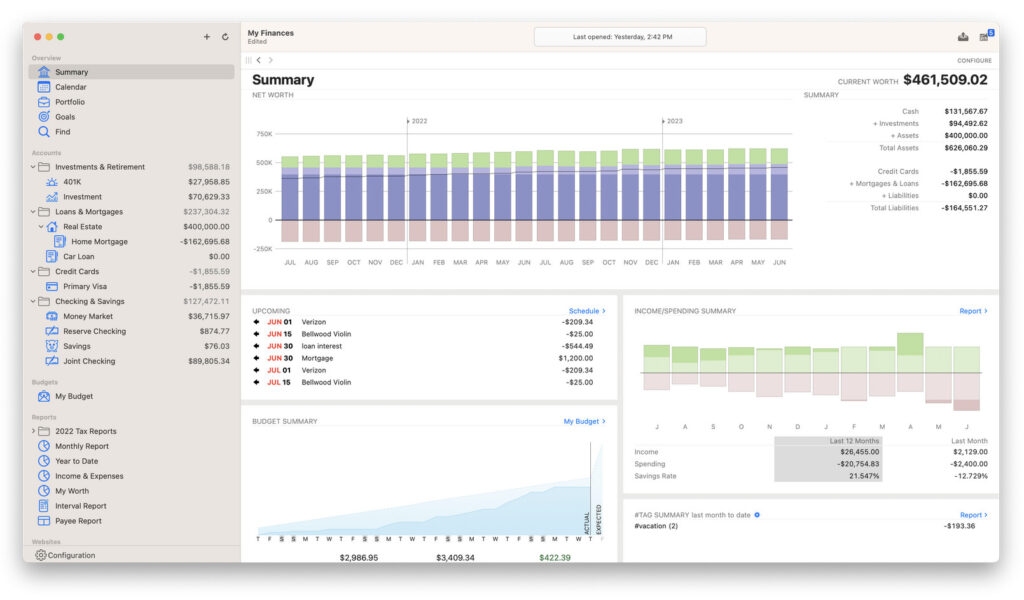

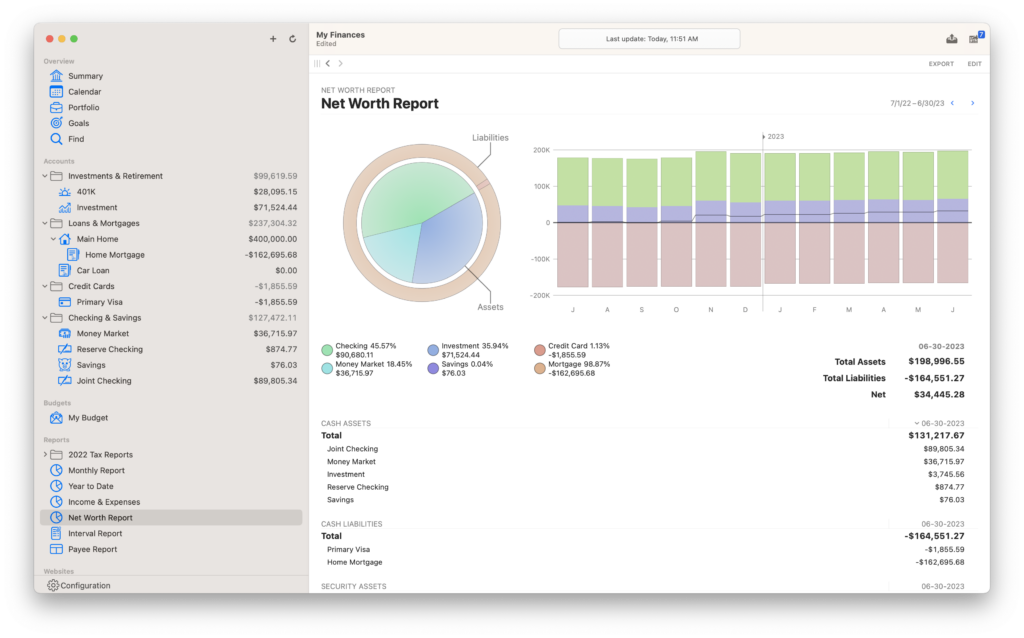

3. Banktivity

Banktivity (formerly iBank) is a popular personal finance application with a desktop app for macOS.

In fact Banktivity is designed exclusively for Apple devices and the only budgeting software for Mac which works across Mac, iPad, iPhone and even Apple Watch.

Banktivity can automatically download transactions from your Bank either via its own Direct Access service (although this costs extra) or by using Banktivity’s built-in browser.

Its Direct Access service supports around 10,000 banks although the reliability of this service often depends on changes your bank makes to security regarding access by third-party apps and type of account.

401K accounts for example are known to be particularly fussy about connectivity with external apps.

Banktivity can track investments, credit cards, savings accounts, mortgages and pretty much most standard types of financial interest you have.

You can attach receipts to transactions, print checks and using the Direct Access service, pay bills automatically.

You can also generate some quite detailed reports based on your net worth to see exactly where your money is going.

There’s also an iOS app which allows you to track and manage your net worth on the move and syncs with Banktivity’s cloud sync server.

Banktivity Bronze starts at $4.99 per month but bear in mind if a Direct Access subscription costs an extra $44.99 annually on top.

There is also a Silver plan which includes investment and real estate tracking ($6.67 per month) and Gold plan ($9.33 per month) which supports international currencies and investments.

We recommend trying a 30 day subscription first to ensure that everything works smoothly with your bank.

You can try a free trial of Banktivity to see for yourself.

You can also check out our full review of Banktivity for a more in-depth look.

Pricing: Plans starting from $4.99/month

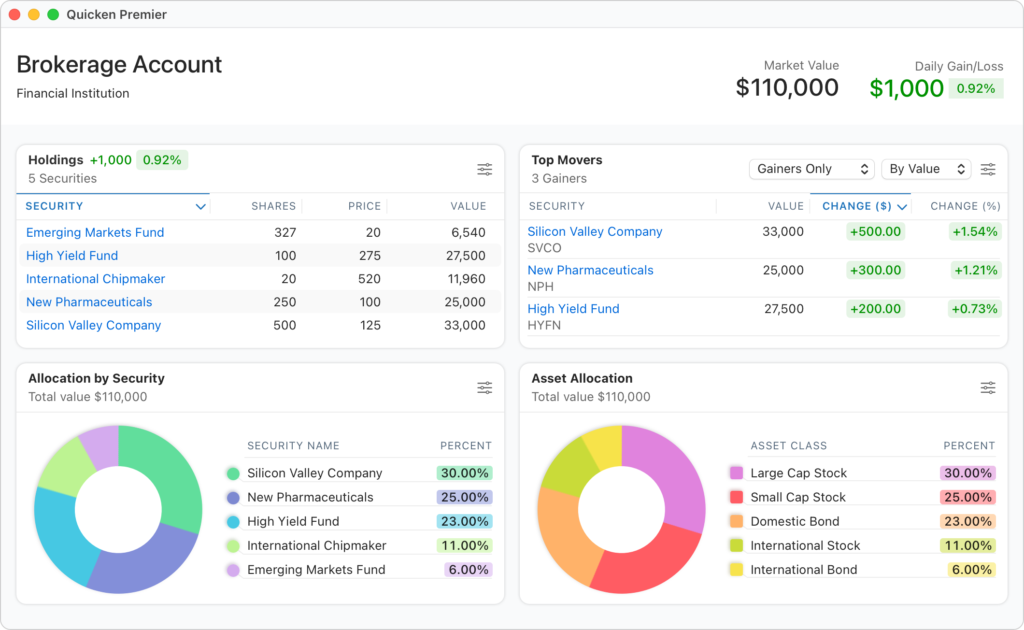

4. Quicken Classic For Mac

For many years, Quicken for Mac had a rocky ride with Mac users when it was owned by Intuit but under new ownership, recent versions of Quicken on macOS have been considerable improvements.

Quicken is probably the most popular personal finance application out there for Windows users although the Mac version has always lagged behind.

Quicken 2018 finally made it somewhat comparable with the Windows version although there are various features it still lacks and it’s not exactly the same product (check out out look at Quicken For Mac vs Windows for more).

One of the biggest recent improvements to the newly branded Quicken “Classic” For Mac has been the introduction of Bill Pay so that you can automatically manage and pay bills online (this is a paid add-on in the Deluxe version but free in the Premier version).

Reporting has also been improved although it is still behind the Windows version of Quicken.

The overall interface and speed has been improved to make it look better in macOS too.

If you’re interested in learning more, you should check out our review of Quicken Classic for Mac.

Note that there are some differences between the Deluxe and Premier versions for Mac which aren’t made very clear by Quicken and you can read our analysis of Quicken Deluxe vs Premier here.

Pricing: Plans starting from $5.99/month

5. Tiller

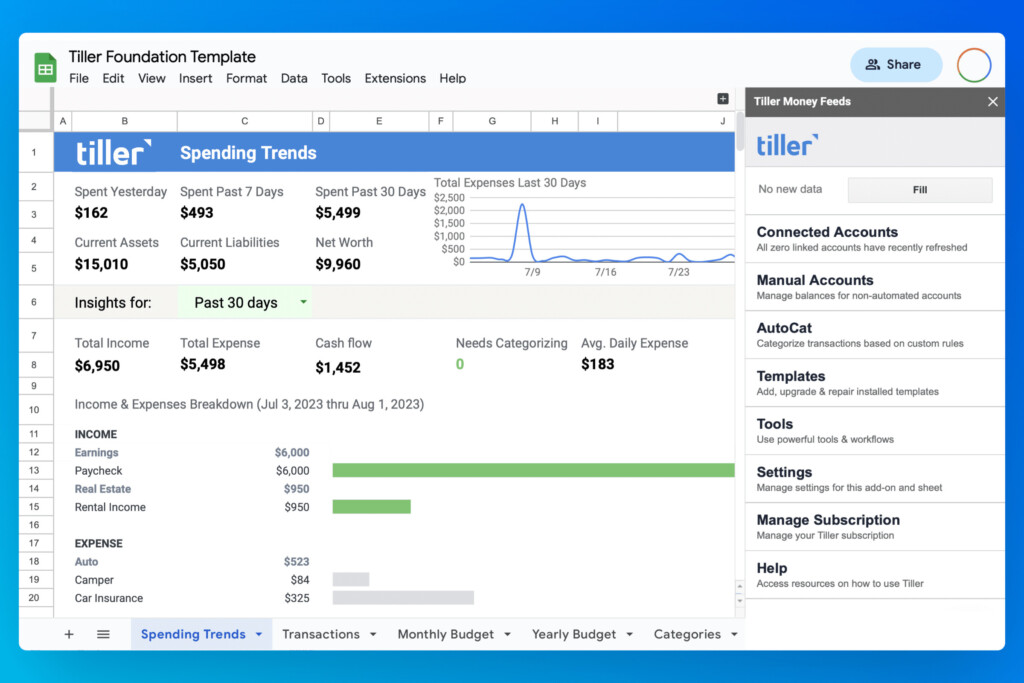

If want a spreadsheet alternative to Microsoft Money then take a look at Tiller.

Tiller is an automated spreadsheet software that automatically fills in spreadsheet budgets as you fill it in with your financial data.

If you like to use Microsoft Excel or Google Sheets to track your net worth, Tiller can automatically extract data from them and then correlate and organize them into budget spreadsheets and dashboards.

Microsoft have even recommended Tiller to those that use Money in Excel or Microsoft 365 subscribers (formerly Office 365) as a way of processing financial planning data in its apps.

The software provides a range of templates to get you started or if you’re already spreadsheet savvy, you can start from scratch.

Tiller can be used to track almost any financial data you want from your net worth to budgets.

It does take some time to setup and use, especially if you don’t use one of the templates but it’s extremely customizable compared to Microsoft Money as you can track anything in it.

Tiller can also be used to generate reports and dashboards rather than having to pour through data heavy spreadsheets.

Most recently the app has added a Spending Trends dashboard to keep a track of where your money is going with useful dashboards for annual and monthly budgets.

Like as with Microsoft Money, none of your data is stored in the Cloud with Tiller – it’s all processed in a spreadsheet on your desktop.

If like the spreadsheet approach to budgeting then Tiller is an excellent alternative to Microsoft Money for Mac.

You can try a 30 day free trial of Tiller.

You can also check out our full Tiller review for more.

Pricing: $6.58/month or $79 per year

6. Money Manager Ex

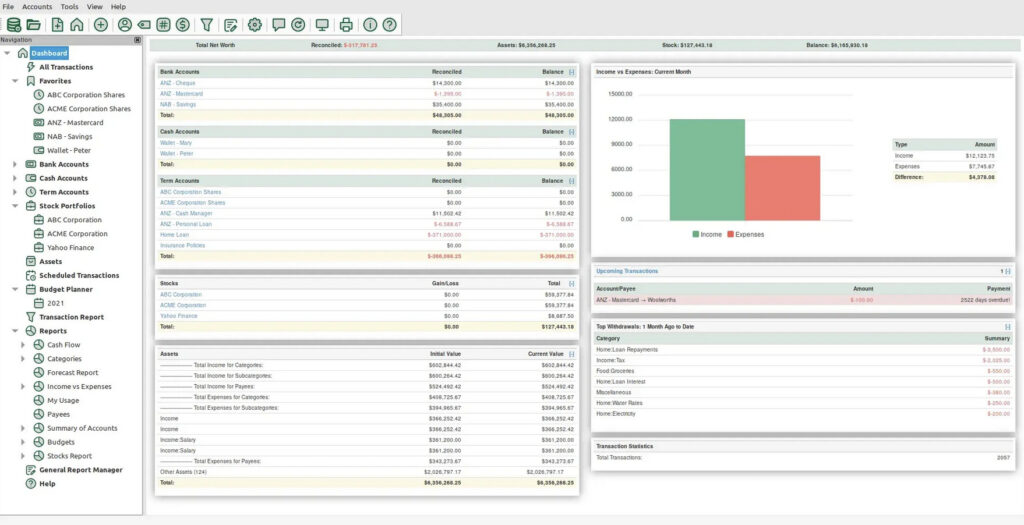

Money Manager Ex (MMEX) is a free, open source personal finance app that keeps your data offline.

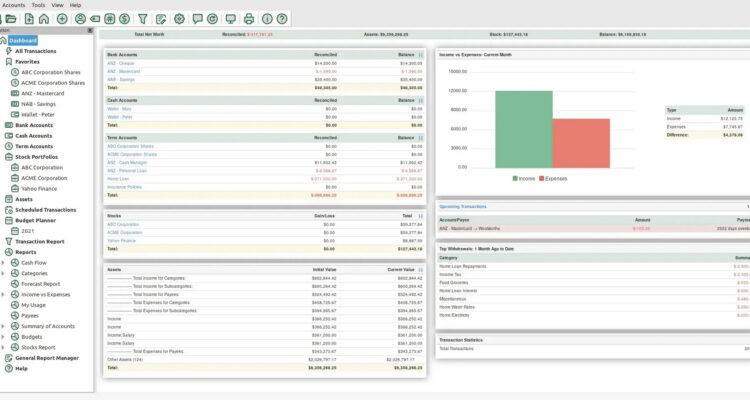

It also has quite a dated interface which even looks and feels a bit like Microsoft Money.

However, considering it’s totally free, there’s not much to complain about apart from a lot of data entry.

Key Features are:

- Data Control: MMEX stores all data locally on your Mac, ensuring complete user control. There is also a Windows, Linux and mobile version.

- Expense and Account Tracking: It can manage bank accounts, record expenses, and categorize transactions with a customizable ledger-style system.

- Budgeting Tools: You can create monthly spending plans and set category limits for better financial planning.

- Investment Management: It also tracks stocks and securities manually, though without automatic market updates.

- Data Import/Export: You can import Quicken QIF files, CSV, and XML formats.

- Cost: Free and open-source with ongoing community development.

For former Microsoft Money users, MMEX offers a comprehensive and reliable alternative that focuses on user control, budgeting, and reporting.

While it lacks some automation, it provides a free solution for those seeking privacy, flexibility, and freedom from subscription fees.

Check our full Money Manager Ex review for more.

Pricing: Free