We ranked QuickBooks Payroll the best payroll software and in this QuickBooks Payroll review, we take a closer look at what it can do.

QuickBooks Payroll is made by Intuit who also make Quickbooks one of the best accounting software for Mac.

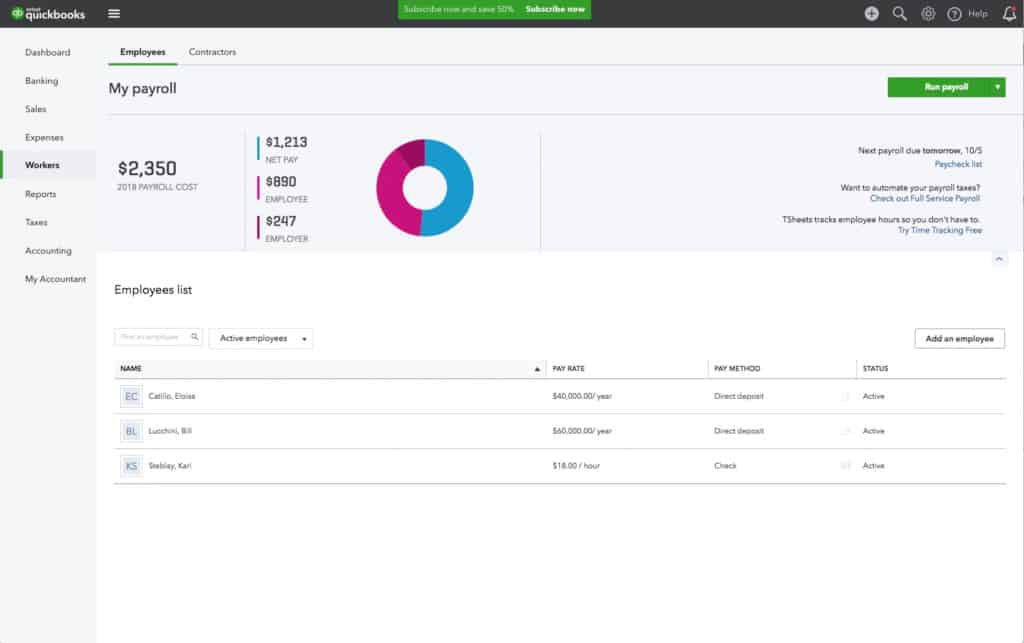

Using QuickBooks payroll alongside QuickBooks definitely makes it easier to post payrolls in your general ledger but it’s not essential to be a QuickBooks user.

Although QuickBooks Payroll is designed to integrate with QuickBooks own accounting software, it can be used as a standalone product alongside any other accounting software.

Here we look at QuickBooks Payroll for Mac, Windows and mobile in more detail.

Table of Contents

QuickBooks Payroll Cost

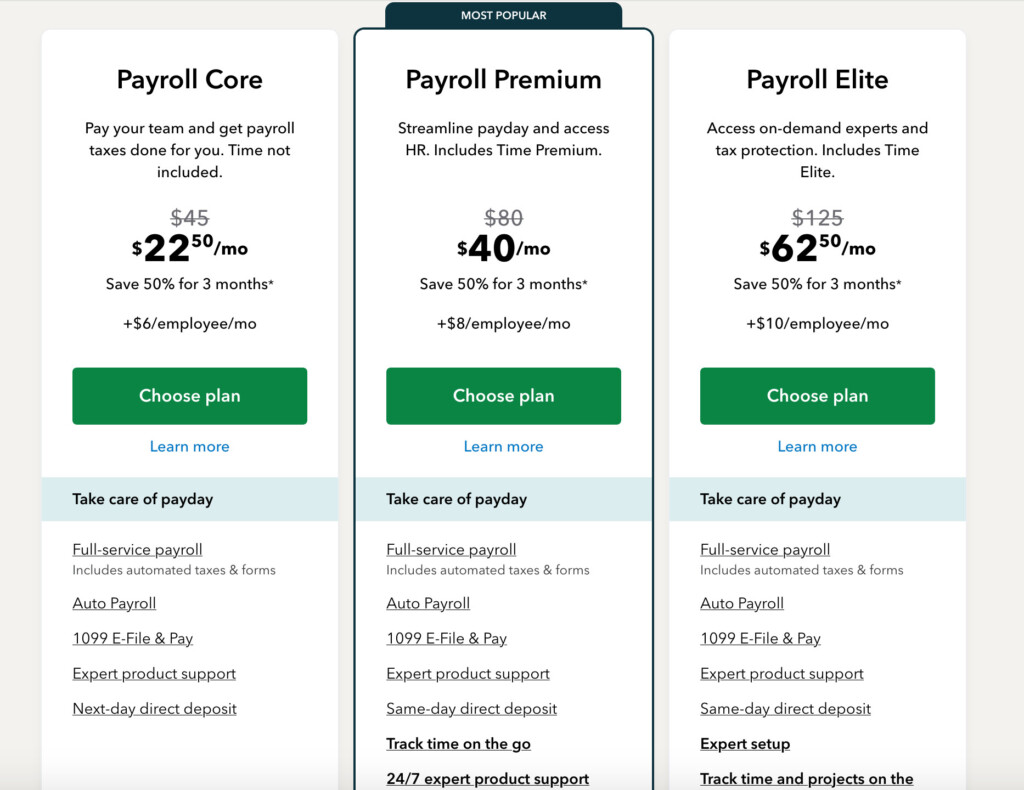

QuickBooks Payroll requires a subscription but at the moment you can get 50% off any plan.

This makes it easily one of the most affordable payroll software on the market and certainly cheaper than employing a Payroll department.

One of the things that makes QuickBooks Payroll stand out from the competition is that it offers a lot of payroll features as standard in ALL plans including:

- Unlimited payroll runs

- Paycheck and tax calculations

- Automated tax and forms for 50 US states

- Workforce portal

- Available in all 50 states

- Manage garnishments and deductions

- Payroll reports

There are 3 QuickBooks Payroll Plans:

- Core ($22.50 + $6 per employee/month) which is suitable for small teams but only pays taxes for employees in one state, not multiple states.

- Premium ($40.00 + $8 per employee/month) which is aimed at small to medium sized businesses that also need HR support and same day deposits. It also provides access to the HR Support Center which includes onboarding tools, state and federal overtime laws, job descriptions etc.

- Elite ($62.50 + $10 per employee/month) which is aimed at large businesses also seeking tax penalty protection and a personal HR advisor. It also supports payments to employees in multiple states.

To all QuickBooks Payroll plans, you can add QuickBooks Accounting software and also get 50% off.

Subscriptions are billed on a monthly basis with no annual contracts.

The most complete services are the Premium and Elite plans which will automatically migrate you to QuickBooks Payroll from another payroll provider.

The Elite plan also offers a no tax penalty guarantee which means if QuickBooks Payroll makes a mistake, Intuit will pay any penalties that you incur (subject to terms and conditions).

You can currently get 50% Off QuickBooks Payroll for a limited period.

Note that if you’re based in Canada can get also get 50% off QuickBooks Payroll from the QuickBooks Canada store.

QuickBooks Payroll Review: Desktop vs Online

One of the confusing things about QuickBook Payroll is whether there is a desktop version.

There is no desktop version of QuickBooks Payroll but there is still a desktop version of QuickBooks Desktop 2021 accounting software for both Mac and Windows PCs that you can activate QuickBooks Payroll in.

However, we do not recommend using the desktop version of QuickBooks desktop as Intuit is slowly discontinuing support for the desktop versions of QuickBooks.

For example, QuickBooks Desktop 2018 is no longer supported by Intuit from June 2021 onwards and Intuit is slowly moving all of its products online.

It’s also a lot more expensive to buy the QuickBooks For Mac or Windows that it is to subscribe to QuickBooks online.

QuickBooks Payroll: Ease of Use

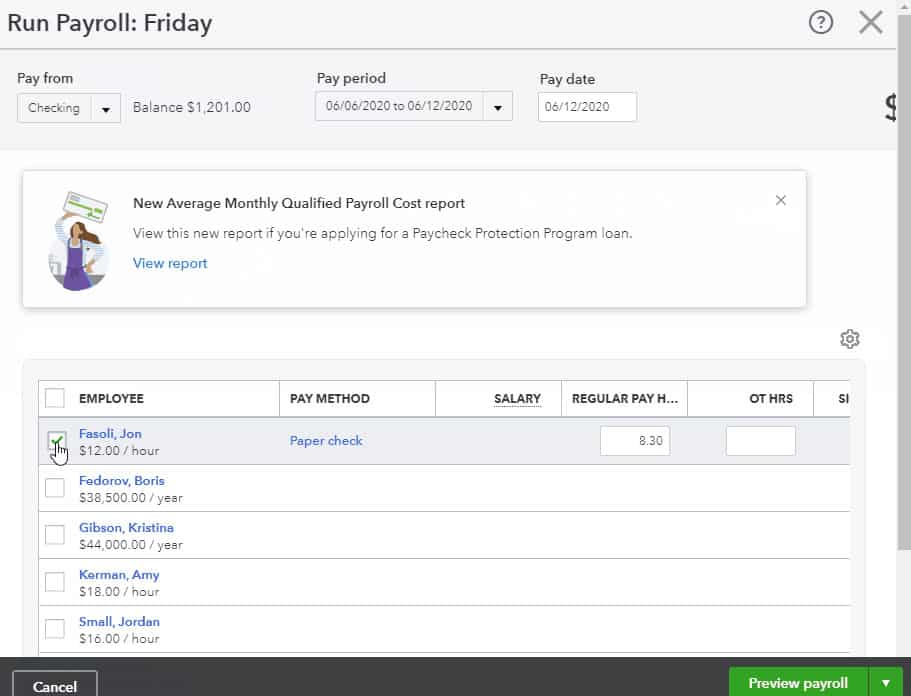

Probably the best and most important thing about QuickBooks Payroll is it makes it very easy to do payrolls even if you don’t have any payroll or accounting experience.

The payroll setup wizard is easy to follow and sets up your payroll runs in minutes. All you need is your employee’s details including federal and state tax ID numbers.

If for any reason you have problems, the Premium and Elite plans offer direct assistance from QuickBooks on fixing any problems.

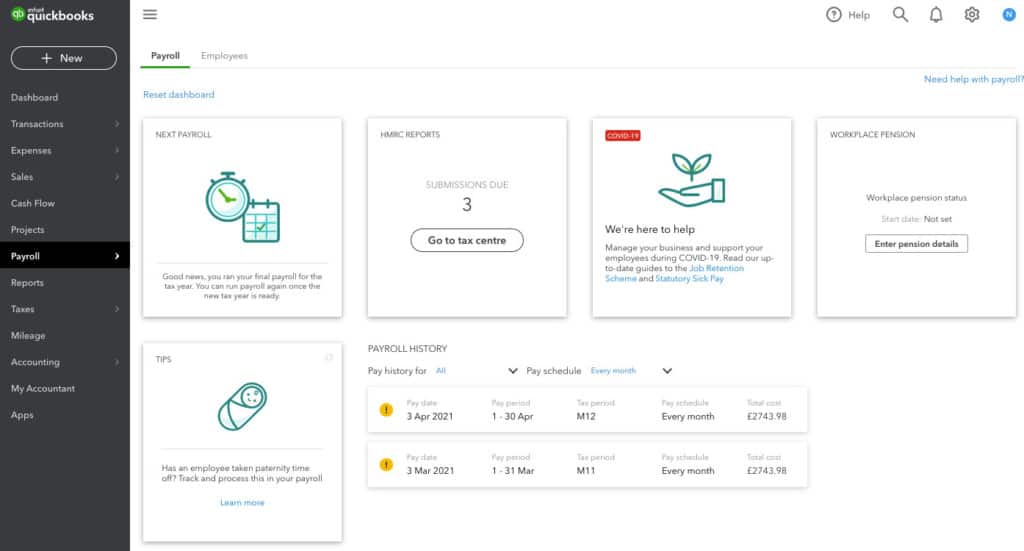

The QuickBook Payroll Hub makes it very easy to manage and administer Payrolls, extract reports, setup pensions and enter paternity or maternity leave.

It’s also possible to run payrolls manually in QuickBooks Payroll although this isn’t as straightforward as it should be.

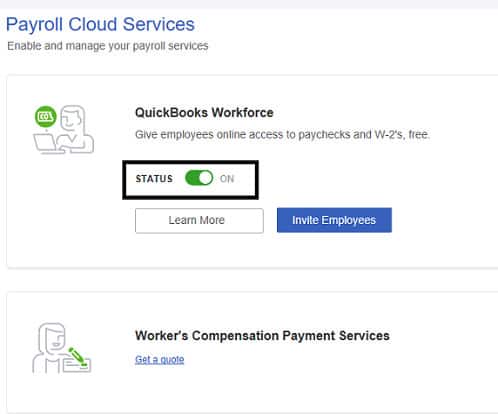

QuickBooks Workforce

QuickBooks Workforce replaces the old Paycheck Records tool in Intuit QuickBooks Online Payroll.

QuickBooks Workforce allows employees to login and access pay stubs, W-2s, year-to-date earnings, deductions, personal tax information and available time off.

This saves valuable HR resources and makes it much faster for staff to employee essential salary data when they need it without having to put in a formal request.

QuickBooks Workforce is accessible from Mac, Windows PCs and mobile phones.

QuickBooks Payroll: Other Highlights

Other useful features in QuickBooks Payroll include:

- Integrated time tracking so it can be used as a billing tool too for contractors.

- Automatic tax liability calculations.

- Free direct deposits to salaried employees (although contractors cost extra)

- Ability to issue Benefits plans for Health, Dental and Vision to employees

- Payroll reports which can also be exported to Excel

- QuickBooks Payroll support includes phone and online chat support during business hours

QuickBooks Payroll Review: Downsides

QuickBooks Payroll does allow you to pay contractors with it although this has to be done manually only salaried employees in the same State can be paid automatically by QuickBooks Payroll.

The free direct deposits are also limited to salaried employees – paying freelancers or contractors costs extra.

The reports in QuickBooks Payroll are also not as detailed as we’d like. While it’s possible to run a wide range of payroll reports from tax liability to annual summaries, there are very few options to filter them in any way.

Finally, if you’re familiar with payroll tax laws, then you can get away with using the basic version of QuickBooks Payroll.

However, the extra payroll tax support is definitely worth upgrading to the Premium or Elite plan especially if you’re paying employees in multiple states as mistakes in this area can be very costly.

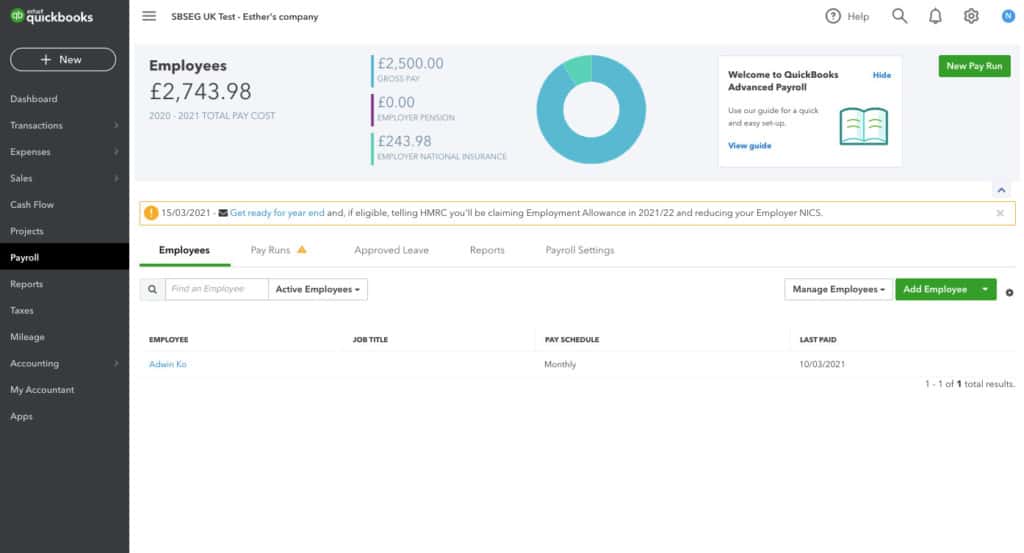

QuickBooks Payroll UK

Although QuickBooks Payroll is aimed at users in the US and Canada, it also has a version tailored for UK businesses.

The UK version of QuickBooks Payroll automatically tracks VAT, is HMRC recognized software and making tax digital (MTD) compliant.

There are some US features missing but for those in the UK that pay an accountant for processing payroll, QuickBooks Payroll could work out a lot cheaper and more convenient.

QuickBooks Payroll Mobile

You also get the useful QuickBooks Payroll mobile app which gives you the power to run payrolls, pay taxes, file forms and view your employee’s salary history.

The ability to execute payroll runs away from your Mac in particular is really useful if you can’t be in the office or at your desk for any reason.

You can also try QuickBooks Payroll for free to judge for yourself.

You can also currently get 50% off QuickBooks Payroll plans.