It’s taken 7 years but Intuit finally released a new Quicken for Mac so we took a look at the good and bad in our Quicken 2015 for Mac review. Note: On 18 Nov 2015, Quicken 2015 for Mac was replaced by Quicken 2016 so go here for a review of the latest version of Quicken on Mac. Firstly, note that there’s no free trial of Quicken 2015 for Mac but you can take advantage of Amazon’s money back guarantee who currently offer the best price for Quicken on Mac at $49. You can also purchase it for $74.95 from the Mac App Store. Secondly, there’s one major issue that you should be aware of before reading any further as it will be a deal breaker for many: Quicken for Mac 2015 still doesn’t support online bill payments. Online payments were bizarrely dropped from Quicken 2007 for Mac onwards and disappointingly, it hasn’t returned in the 2015 version (but has been reintroduced to Quicken 2016 for Mac). Even more bizarrely, you can get many of the features of Quicken 2015 for Mac plus online bill payments support for free in Mint which is also made by the same developer Intuit product! For those that consider online bill payment essential, you’re better off reading our article on The Best Alternatives To Quicken For Mac. Alternatively, you can try going back to Quicken 2007 for Mac which features Quicken Bill Pay but it doesn’t work with all banks and only supports up to OS X 10.7 Lion. If you can live without online bill payment though, read-on to get the full lowdown of the new Quicken for Mac.

Quicken 2015 For Mac Review: The Good & Bad

First the bad news. For the past 7 years, many Mac Quicken users have had to resort to using a virtual machine on their Mac just so they can use the superior Windows version of Quicken 2007. The bad news is that yet again, Quicken 2015 still isn’t up to the standard of the Windows version. For reasons known only to Intuit, many features and reports have been dropped from Quicken 2015 compared with the 2007 version. Most notably, the planning features such as the loan calculator, investment calculator, retirement planner and college planner have all gone. Other features such as comparison reports, budget summaries, tax scheduling (meaning you can’t file taxes with it, although you can export to TurboTax), tax summaries and of course, online bill payments are also missing.

Even worse, don’t expect it to import large amounts of data from Quicken 2007 painlessly. In theory, Quicken 2015 for Mac can import from Quicken Essentials for Mac, Quicken 2007 for Mac and any version of Quicken 2010 for Windows or newer. However, our rather emotional experiences importing from Quicken 2007 left us exhausted and confused. If you’ve got years and years of accounts like most users that have been stuck with the 2007 edition, Quicken 2015 seemingly has a nervous breakdown if you come near it with your accounts. For large files, importing is incredibly slow and triggers the dreaded spinning ball on your Mac before taking anything from half an hour to an hour to final import data.  You must also be extremely careful when deciding whether to sync with online banking accounts during importing as you’ll invariably end up with duplicate entries which is a nightmare to manually correct yourself afterwards. Setting-up bank connections in general is very hit and miss in Quicken 2015 and even if you do manage to successfully import accounts from older versions of Quicken, you’ll have to re-setup all of your connections which is a bit of a pain (more on this below). And whatever you do, do not make the mistake of leaving Quicken 2007 open during the import – the import simply won’t work. Oh, and just for good measure attachments and budgets won’t import at all which is extremely annoying if you have lots of attached receipts and other documents in your historical accounts.

You must also be extremely careful when deciding whether to sync with online banking accounts during importing as you’ll invariably end up with duplicate entries which is a nightmare to manually correct yourself afterwards. Setting-up bank connections in general is very hit and miss in Quicken 2015 and even if you do manage to successfully import accounts from older versions of Quicken, you’ll have to re-setup all of your connections which is a bit of a pain (more on this below). And whatever you do, do not make the mistake of leaving Quicken 2007 open during the import – the import simply won’t work. Oh, and just for good measure attachments and budgets won’t import at all which is extremely annoying if you have lots of attached receipts and other documents in your historical accounts.

But, deep breath, there is some good news.

Intuit has finally recognized that Macs use a completely different operating system to PCs and given Quicken 2015 a much slicker OS X style interface. In fact, it’s the first thing that strikes you when finally get past the rather annoying setup process which requires you to sign-up for an Intuit online account, even if you don’t want any of the services it offers. If you’ve only ever used Quicken 2007, then you’ll see the difference instantly although if you’ve used the much maligned Quicken Essentials for Mac the differences are more modest.

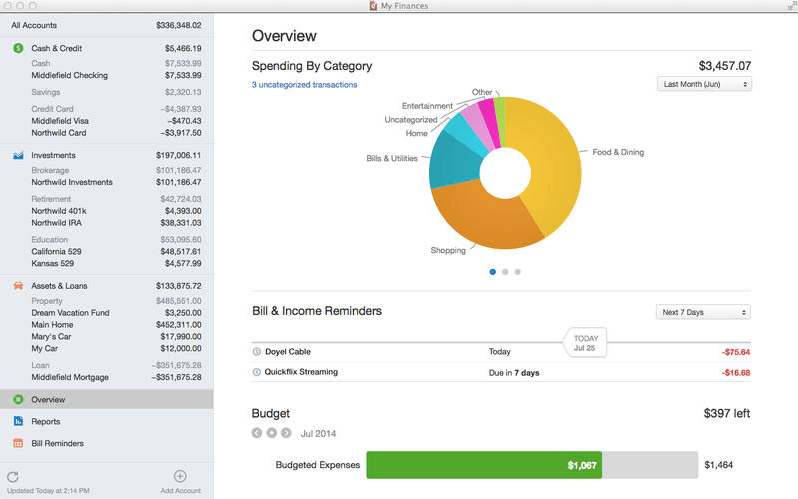

Quicken for Mac 2015 is a definite improvement in terms of presentation and speed and for those that are still chugging along with the 2007 edition, it’s definitely worth the upgrade. From the overall interface to the way Quicken tracks investments and auto saves data to stop you accidentally losing data, Quicken 2015 definitely looks and works better than 2007. In particular, Quicken 2015 gives a much slicker overview of where your money is going with Cash & Credit, Investments and Loans, Reminders and Reports clearly organized.

The Reports section is typically far behind the Windows version with a depressingly limited range of report customization options for those that like full control over how Quicken crunches your finances.

Entering transactions on the other hand is similar to Quicken 2007 but allows much greater detail in the amount of financial information you can enter and attach. However, the intelligent Smart Payees is yet another feature from Quicken 2007 that seems to have been dropped in Quicken 2015. This basically collated transactions from the same shop or business into one entry which you could then expand for more detail. Now, every single transaction you make with that business is treated at a separate entry which is messier to review and keep track of.

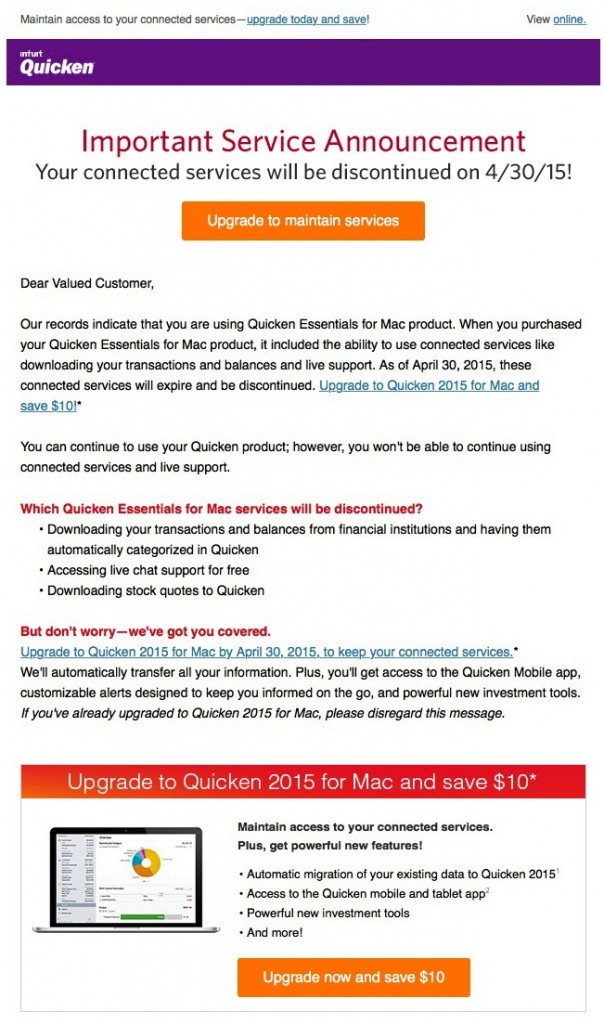

Linking Quicken to your bank account has supposedly been made easier and in theory, Quicken 2015 is supported by several major institutions via Direct Access although many still don’t. Wells Fargo for example supports Quicken 2007 but it doesn’t support this latest version of Quicken. Intuit claim that Wells Fargo users can use their web service Quicken Connect instead but this also does not work. Even on those that do, linking isn’t always as smooth and simple as it should be with connections sometimes timing out when trying to connect. The stress this can cause shouldn’t be estimated and the Quicken forums are littered with customers such as these tearing their hair out over the way Quicken handles syncing with banking transactions. If you’re a Quicken Essentials user thinking you’ll wait until this is resolved before switching however, think again. Intuit recently contacted Quicken Essentials users informing them that Quicken Essentials For Mac will stop supporting online banking and live support on 30 April 2015.  At the time of writing, Intuit promise for all those that upgrade to Quicken 2015, they’ll get $10 off, automatic migration of Quicken data and access to the Quicken Mobile app.

At the time of writing, Intuit promise for all those that upgrade to Quicken 2015, they’ll get $10 off, automatic migration of Quicken data and access to the Quicken Mobile app.

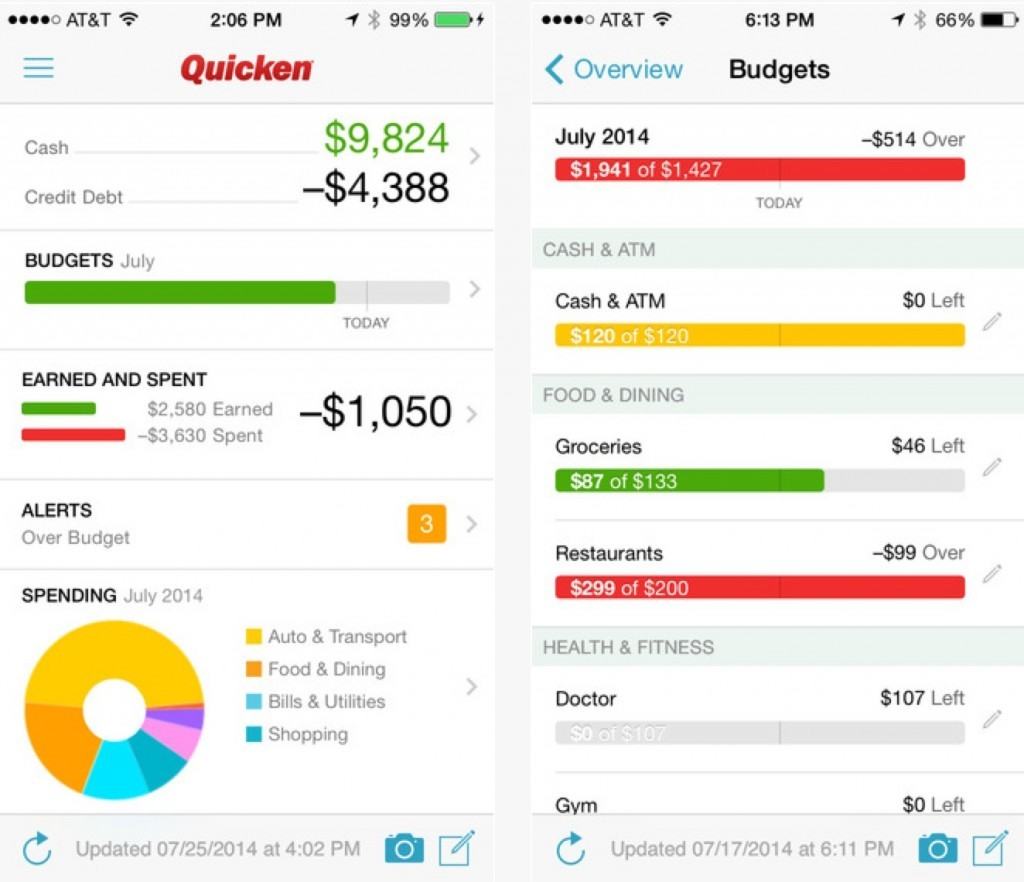

Accounts on the other hand are much easier to keep updated in real time though because Quicken 2015 has finally gone mobile with free iPad/iPhone and Android apps that allow you to sync transactions and take photos of receipts (not exactly something new but a nice bonus anyway). The addition of mobile syncing is undoubtedly a huge improvement although for the security conscious, it’s worth noting that this does mean that your financial data is stored in Quicken’s cloud servers. The mobile apps are also very limited and feature hardly any of the functionality of the desktop app. Simple information such as investment, asset and loan accounts are all missing for example.

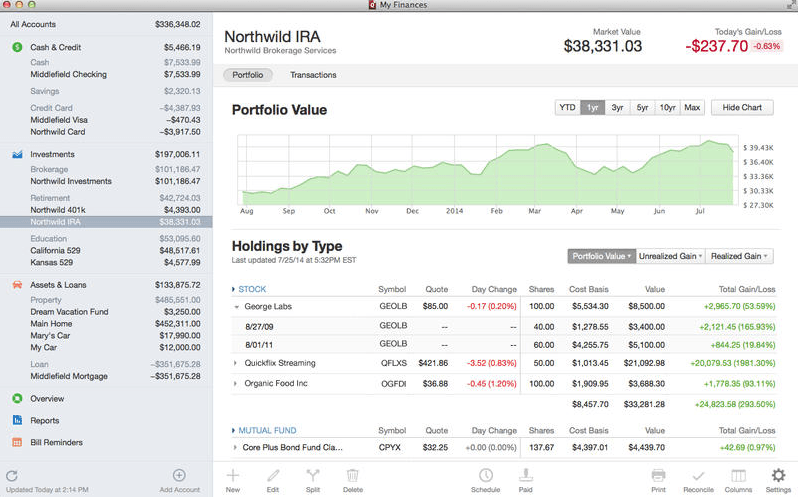

One of the most important improvements in Quicken 2015 however has been investment tracking. The new Quicken for Mac is constantly updated with the latest stock and share information so that the value of your portfolio is always up-to-date. This also makes tracking your tax liability easier as Quicken calculates the current rate of capital gains, unrealized gains etc. Tax information can also be exported to Intuit’s popular TurboTax application for easier filing of tax returns (although TurboTax tax filing was temporarily suspended in February 2015 due to fraud concerns). Again though, there are certain features missing from the investment tracker though such as Performance (IRR) reports and Allocation by Investment. Although the lack of online bill payment is a huge oversight, Quicken 2015 for Mac does make managing bills easier. For instance, you can set reminders and alerts for bills and see whether your income and credits will stretch to cover them before you get caught short.

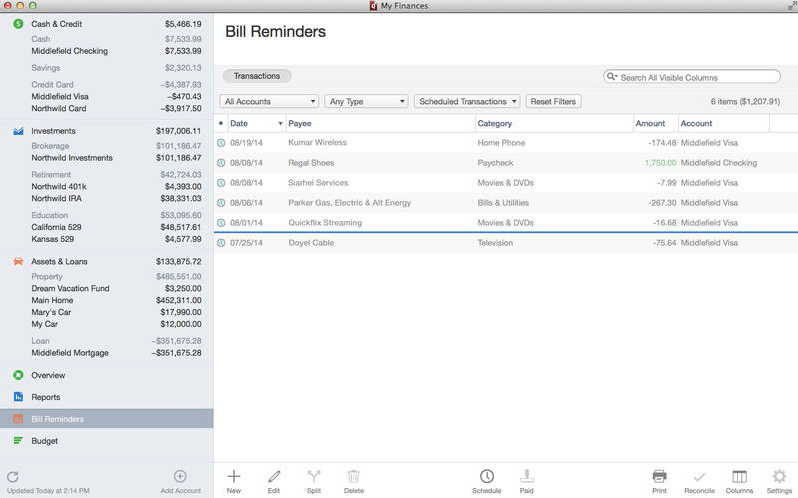

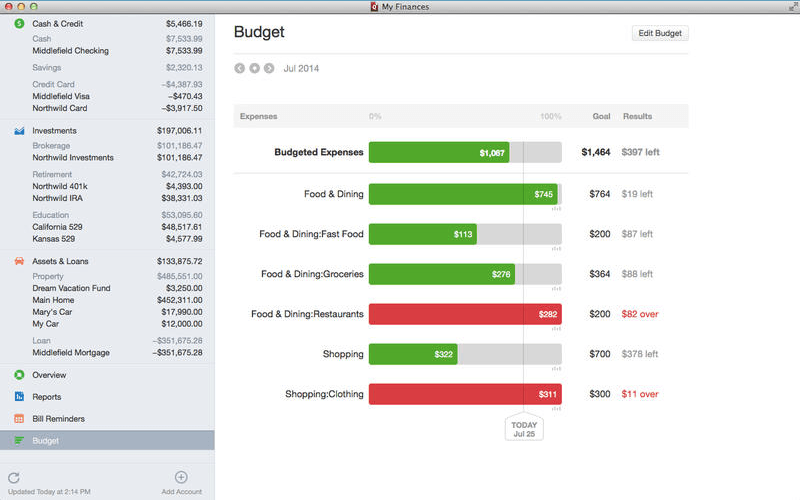

Although the lack of online bill payment is a huge oversight, Quicken 2015 for Mac does make managing bills easier. For instance, you can set reminders and alerts for bills and see whether your income and credits will stretch to cover them before you get caught short. Budgeting in general has also been significantly improved with a budget planner that works on your past spending habits to help you manage your money better.

Budgeting in general has also been significantly improved with a budget planner that works on your past spending habits to help you manage your money better.

Although it’s still clear that Intuit still don’t put as much effort into the Mac version as the PC version, it does seem like its realizing the error of its ways. It finally seem ready to listen to Mac users with this long awaited update. Intuit is finally being transparent on what is and is not included in the Mac version and even more encouraging, is allowing users to vote for which features they’d like to see in future versions.  So if enough users demand it, hopefully Quicken 2015 for Mac will eventually be updated to include all of the features that are in the Windows version. In fact, since it was released in August 2014, there have already been several updates to Quicken 2015 for Mac adding new features and fixing bugs which is a step in the right direction. Although it’s certainly a bit late in the day to get all cozy with Mac users, the important thing is that Intuit finally seems willing to make amends and not bury its head in the sands for another 7 years.

So if enough users demand it, hopefully Quicken 2015 for Mac will eventually be updated to include all of the features that are in the Windows version. In fact, since it was released in August 2014, there have already been several updates to Quicken 2015 for Mac adding new features and fixing bugs which is a step in the right direction. Although it’s certainly a bit late in the day to get all cozy with Mac users, the important thing is that Intuit finally seems willing to make amends and not bury its head in the sands for another 7 years.

For users with high expectations that Quicken for Mac 2015 would finally equal the Windows version, it’s still a case of too little, too late. At $49 from Amazon, although it’s cheaper than the Windows version, you can get many of the features of Quicken 2015 for Mac for free in Mint and many will find it hard to justify upgrading considering all the limitations that still exist. You can purchase Quicken 2015 from Amazon for $74.95 or for $74.95 from the Mac App Store. Be aware too that Intuit customer support can be almost as frustrating as Quicken for Mac itself. The only available support is via “Live Chat” but the problem is you may find you have to wait a long time before any agents are available to help you with your problem.

Quicken 2015 requires OS X 10.7 Lion or higher. If you make the jump, let us know your thoughts below. If our review has left you despairing on Quicken products for Mac, check out our article on Best Alternatives To Quicken For Mac.