If you run a business on a Mac, chances are you’re juggling expense reports, credit card statements, and subscription renewals across half a dozen apps.

That’s where Ramp comes in, promising to streamline spend management, issue corporate cards, and automate expense tracking on a Mac.

But does it live up to the hype?

We’ve looked at Ramp extensively from the perspective of a Mac-using business, and here’s everything you need to know before diving in.

Note that Ramp is not to be confused with Revolut Ramp which is a crypto purchasing platform offered by Revolut.

Table of Contents

What Is Ramp?

Ramp is a finance automation platform designed to help businesses control spending, track expenses, and save money without needing an accounting degree.

It combines corporate cards, expense management, bill payments, procurement, and integrations into one centralized system.

Unlike traditional credit card providers and accounting software, Ramp leans heavily on automation and AI-driven insights to reduce manual work and reveal savings opportunities.

One of the biggest attractions of Ramp however is that it is totally free for small businesses with paid plans for more advanced automated features.

Does Ramp Work Well on a Mac?

Even though it’s web based, Ramp feels tailor-made for Mac users.

The web app runs smoothly on Safari, Chrome, and Firefox on macOS. There’s no native Mac app (yet), but I really don’t think Ramp needs one.

Its cloud-based dashboard is responsive, intuitive, and far more pleasant to use than many finance software with bloated software or outdated interfaces.

If you’re using an Apple Silicon Mac, Ramp’s performance is slick and efficient, with no lag or compatibility issues.

It also plays nicely with Gmail and Slack, which many Mac-based teams rely on heavily.

Key Features

1. Smart Corporate Cards

Ramp’s corporate cards aren’t just for tracking purchases, they’re programmable.

You can set daily, monthly, or custom spend limits, restrict categories (like travel or software), and auto-decline out-of-policy charges.

You can issue unlimited virtual cards to your team with unique names (e.g. “Notion subscription” or “Freelancer payments”), which makes vendor management and fraud detection far easier.

Virtual cards can also be added straight into Apple Wallet, which makes in-store or mobile purchases smoother.

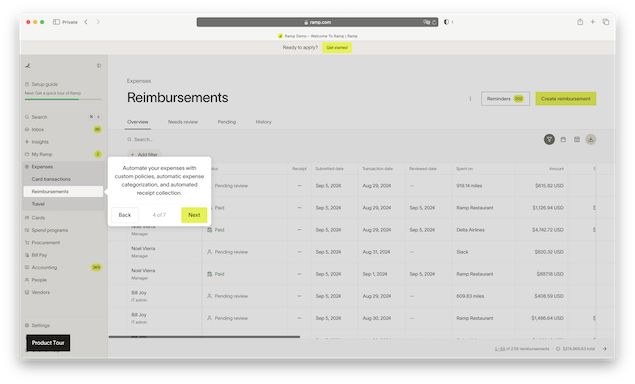

2. Expense Automation

Forget manual receipt chasing. Ramp uses email parsing and OCR (optical character recognition) to automatically match receipts with purchases. It even nudges employees via Slack or email if a receipt is missing.

When tested with a Gmail-connected account on Safari, Ramp successfully auto-matched receipts with 90% accuracy, something that’s notoriously hit-or-miss in other platforms like Expensify or QuickBooks.

3. Real-Time Insights and “Ramp Savings”

Ramp reveals inefficiencies you might miss, like overlapping subscriptions, underused SaaS licenses, or inflated vendor costs.

It’ll flag when you’re paying for Zoom licenses no one uses or when you’ve been charged twice by a supplier.

This is a nice touch to help you spot where money is going to waste in your business.

4. Bill Pay and Vendor Management

Ramp’s Bill Pay lets you upload or forward invoices, schedule payments (via ACH or check), and track approvals, all without needing a separate tool like Bill.com.

It doesn’t yet integrate directly with Apple Mail, but works flawlessly with Gmail and can be used in Safari via drag-and-drop invoice uploads.

5. Integrations

Ramp integrates with:

- Accounting software such as QuickBooks and Xero

- NetSuite

- Slack

- Google Workspace

- Microsoft 365

- Sage Intacct

- and a growing list of CRMs and HR platforms

While there’s no macOS-specific integration, everything works smoothly from a Mac, no extra apps needed.

What’s Missing?

Ramp isn’t perfect and there are some drawbacks to be aware of.

No Native Mac or iOS App (Yet)

Ramp offers a lightweight mobile app for receipt capture and transaction reviews, but the iOS app lacks the full desktop experience.

You can’t manage vendors or dig into analytics deeply on mobile, which could be limiting if you’re running things from an iPad or iPhone on the go.

No Multi-Currency Support

At the time of writing, Ramp only supports USD. If you work with international teams or clients, this will definitely be an issue.

⛔ U.S. Only

Ramp is currently only available to U.S.-registered businesses with U.S. bank accounts. That rules it out for international users for now.

Is Ramp Really Free?

Yes, the basic plan is 100% free to use.

Ramp doesn’t charge users for cards, expense management, or the platform itself. Instead, it earns money through interchange fees from card transactions.

That means no subscription fee, no implementation fee, and no minimum spend.

But it’s worth noting that Ramp is not a bank. Cards are issued through partner banks like Sutton Bank or Celtic Bank, and deposits aren’t FDIC-insured through Ramp directly.

For automated features then there is a Plus edition for $15 per user per month which supports features such as auto locking of cards, advanced approval policies and the ability to set spend limits in local currencies.

There are also Enterprise plans for those companies that need direct and custom ERP integrations.

Who Should Use Ramp?

Ramp is ideal for:

- Startups and scaleups who need spend control without bureaucracy

- Remote or hybrid teams who rely on virtual tools

- Mac-based teams who want a clean, web-first interface

- Founders tired of reconciling credit card spreadsheets

It’s probably not right for:

- Freelancers or solo founders (you need a registered U.S. business)

- Teams needing multi-currency or global support

- Companies tied to legacy systems like SAP