If you use any personal finance software on your Mac or Windows PC, then chances are it uses Direct Connect to connect to your accounts, retrieve transactions and pay bills.

The most popular personal finance software that relies on the OFX Direct Connect protocol is Quicken For Mac although other money management tools such as Moneydance also use it.

However, more banks and financial institutions are choosing to drop Direct Connect in favor of their own versions of it or by using other systems such as Express Web Connect+.

Others personal finance and investment tracking apps such as Empower (FREE) which we rated the best personal finance software for Mac use Plaid which is an increasingly popular alternative to Direct Connect among banks.

As a result, many Mac users have found that budgeting apps such as Quicken are suddenly unable to connect to their bank accounts, pay bills via Bill Pay or transfer funds between accounts using Direct Connect.

The same applies to accounting software for Mac such as Intuit’s QuickBooks For Mac which also uses Direct Connect to connect to business banking accounts, pay bills and transfer funds.

Although most banks provide an alternative method to connect to Quicken – the most popular being Express Web Connect+ (EWC+) – most of them don’t support Bill Pay or transferring funds between accounts.

You May Also Like:

- Best Personal Finance Software For Mac

- Best Investment Software For Mac

- Best Retirement Planning Software For Mac

Table of Contents

What’s The Advantage Of Direct Connect?

Direct Connect provides a convenient way for personal finance software to automatically import your bank statements, transactions and credit card movements from your bank account to help you manage your finances better.

Not only this but compared to other connection protocols, Direct Connect allows you full control over your funds including the ability to pay bills and transfer between accounts.

This ability for personal finance software to connect directly to your bank via Direct Connect has many advantages including:

- Allows the app to help you manage your finances in real time, spot spending trends and advise you.

- Allows bills to be paid and reconciled automatically in the app via Bill Pay which is also supported by Direct Connect.

- Allows you to transfer funds between accounts including loans, credit cards, savings and checking accounts.

- Allows you to track the performance of 401K retirement funds.

- Reduces the need to keep logging-into your online banking to keep an eye on your finances.

- Brings together accounts from different banks into one place.

- Allows you to edit your lists of payees by adding or removing payments quickly in Quicken without having to log into your bank account online.

Is Direct Connect Free?

Most banks and financial institutions allow Direct Connect to connect to your accounts for free although some may charge a monthly fee for it.

The only way to know for sure is to check with your bank as each one has a different policy on this.

Is Direct Connect Being Discontinued?

The OFX Direct Connect protocol isn’t being discontinued but many banks and financial institutions are now moving away from it as a way to allow personal finance software to access them.

The usual reason for this is the banks can provide a faster, more reliable and secure system for apps to access them either by using their own connection software or via other providers.

In October 2022 for example, Quicken for Mac had to inform users that Bank of America (BofA) was dropping Direct Connect in favor of Express Web Connect + (EWC+).

You can see which banks still support Quicken Direct Connect here.

Some users have assumed that Quicken is being phased out because Direct Connect is but this isn’t true. Quicken has discontinued some of its products and desktop versions but Quicken is still being developed as a product.

Which Banks Have Dropped Direct Connect?

So far the biggest banks that have announced they will no longer support Direct Connect or plan to phase it out are Bank of America, American Express, Chase and Charles Schwab but there are many others too.

All of these are using or plan to use Express Web Connect + (EWC+) instead and some may offer alternatives too such as Plaid.

Direct Connect vs Express Web Connect+

EWC+ is similar to Direct Connect but isn’t as seamless and it doesn’t support Bill Pay.

The main difference between Direct Connect and EWC+ is the way the bank authenticates personal finance software access to it.

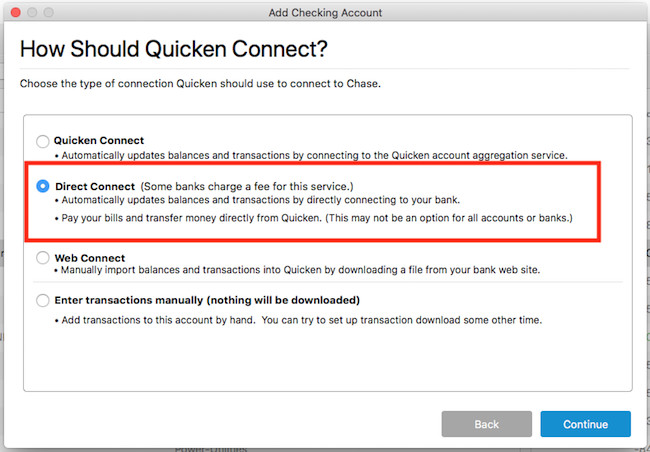

In the case of Quicken, Direct Connect provides direct two-way access between Quicken for Mac and your banks.

Your bank login details are securely stored on your computer and only sent by Quicken For Mac to your bank when it needs to connect to it.

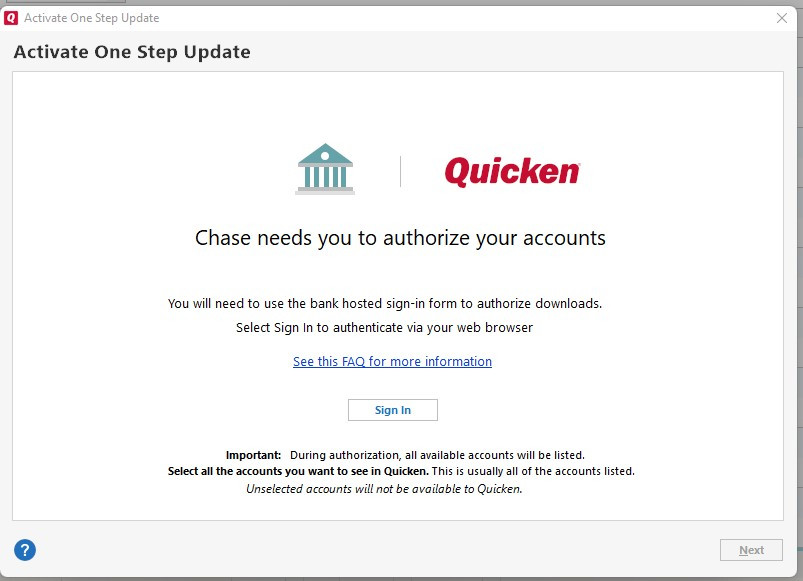

EWC+ uses a slightly different authentication system.

The first time you connect via EWC+, it takes you from Quicken to your bank’s website where you have to log into it so that Quicken can receive a secure token.

Your bank login details are then securely stored by Quicken For Mac in this token but you can revoke it from Quicken at any time.

You may have to repeat this authorization method for EWC+ periodically depending on your bank’s policy.

Some argue that this is less secure than Direct Connect+ as Quicken stores your bank login details on its Cloud servers whereas Direct Connect stores then offline on your computer.

In terms of functionality, both Direct Connect and EWC+ automatically import transactions into Quicken for Mac.

However, EWC+ is not as flexible as Direct Connect as it’s a one-way connection.

The biggest disadvantage is that EWC+ does not support Bill Pay which means you can’t use it to pay bills directly from your account.

It also doesn’t allow you to transfer funds between accounts

On the plus side, all banks offer EWC+ for free whereas some charge for Direct Connect.

How To Change From Direct Connect to EWC+ in Quicken For Mac

If you’ve found that Quicken for Mac has stopped connecting to your Bank or financial institution via Direct Connect, Quicken will usually automatically try to connect via EWC+ instead.

However, if it doesn’t you can change the connection method from Direct Connect to EWC+ by following these instructions:

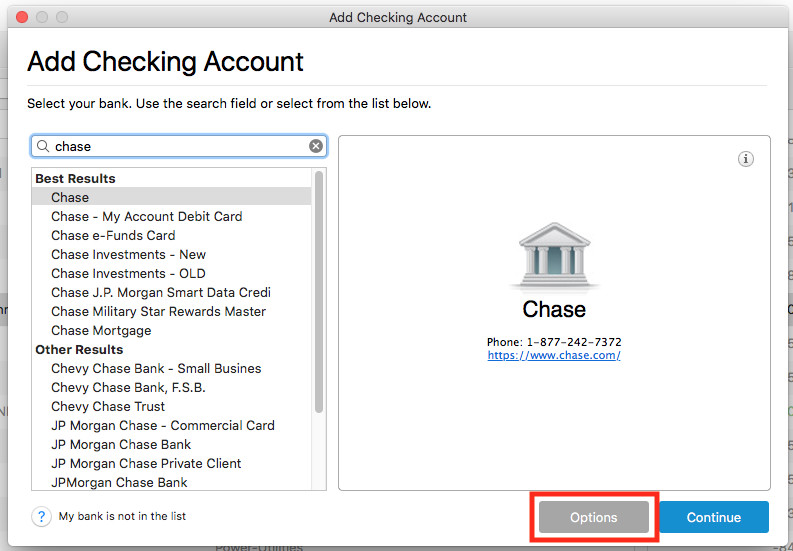

- Click on the account name you want to connect to your bank in the Account toolbar in Quicken.

- Click the Settings icon in the bottom right corner of Quicken.

- Select the Downloads tab.

- Click on Change Connection Type. You’ll only see connection protocols that your bank supports so if EWC+ isn’t in there, then it doesn’t support it. You can also click on Options to see the connection methods available.

- Then just follow the prompts to continue the account linking setup between your bank and Quicken.

Alternatives To Quicken & Direct Connect

As a result of the move away from Direct Connect, many users are choosing to switch their personal finance software rather than their bank.

Empower, which is our pick as the best personal software for Mac uses Plaid to connect to external bank accounts.

Most major banks support Plaid and it’s renowned as a very reliable and secure way to connect to banking institutions.

However, like most alternatives to Direct Connect, it does not support Bill Pay so you have to configure bill payments in your banking online rather than in Empower.