f you’re a freelancer, sole trader, or small business owner on a budget, there’s good news: there are several free accounting tools available that work well on a Mac.

While the best accounting software for Mac like Xero, QuickBooks and FreshBooks offer more powerful and scalable solutions, these free alternatives can be a great starting point if you’re just getting your finances organized or managing a side hustle.

However, the following apps are only suitable for small to medium sized businesses (SMB), sole-proprietors and the self-employed who need a simple accounting solution instead of using spreadsheets such as Excel.

They’re all free forever though meaning they’re effectively free for a lifetime with no need to pay unless you need added functionality and features.

Table of Contents

- Free vs Paid Accounting Software For Mac

- 1. Zoho Books Free Plan (Best Overall)

- 2. GnuCash (Best Offline App)

- 3. MoneyWorks Cashbook (Best For Bookkeeping)

- 4. ZipBooks (Best For Payment Processing)

- 5. Wave (Best For USA & Canada)

- 6. Bx (Best For UK)

- 7. Brightbook (Best For Simplicity)

- 8. Odoo Community Edition (Best For Scaling-Up)

- 9. Manager.io (Best Interface)

- Comparison Table

- Frequently Asked Questions

Free vs Paid Accounting Software For Mac

Before we dive in, it’s important to understand the differences between free and paid options:

- Free accounting software typically offers basic features like invoicing and expense tracking. They’re ideal for small operations but may lack more advanced features like tax support, payroll integration, and multi-user access. Free accounting tools can often suddenly stop supporting certain features or regions leaving you in limbo. This happened to Wave accounting software users in the UK when it suddenly announced it would no longer support users outside of the USA and Canada anymore.

- Paid tools often include better customer support, smoother upgrades, accountant collaboration, and integrations with banking and CRM platforms. They’re also easier to scale as your business grows.

It’s also worth noting that switching from a free tool to a paid one later can be tricky. Features such as invoicing, expense tracking and tax filing are the kind of things free software don’t support. Data migration also isn’t always seamless, and it may cost time and money to make the switch.

That said, if you’re looking to avoid monthly subscriptions for now, here are the best free accounting apps for Mac users in 2025.

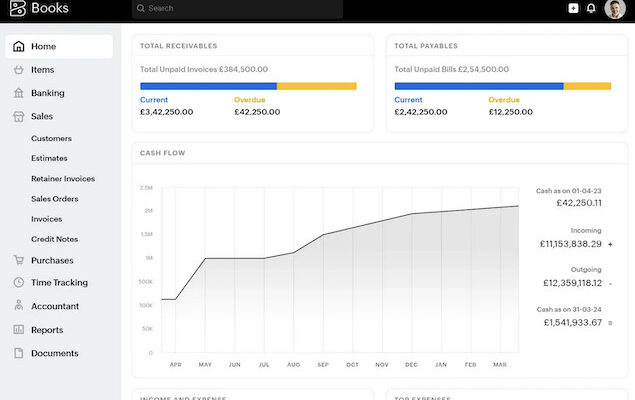

1. Zoho Books Free Plan (Best Overall)

Best For: Freelancers and small businesses that want a polished, cloud-based solution.

Why We Picked It:

Zoho Books offers one of the most comprehensive free accounting plans available, especially for small businesses with revenue under $50K/year.

The free tier includes invoicing, expense tracking, mileage logging, and bank reconciliation—all wrapped in an intuitive interface that works beautifully on Macs via browser.

It’s also backed-up with Zoho’s huge range of other products include project management and spreadsheet software meaning you can expand functionality with other Zoho apps as your business grows.

The automation tools for recurring invoices and reminders are especially helpful for freelancers. Its customer support is also notably strong for a free plan.

Pros:

- Professional, user-friendly interface

- Mobile app available

- Built-in automation tools

- Integrates with other Zoho apps (CRM, Inventory, etc.)

- Customer support, even for free plan

Cons:

- Free plan limited to businesses under $50K in annual revenue

- Features like project tracking are limited to paid tiers

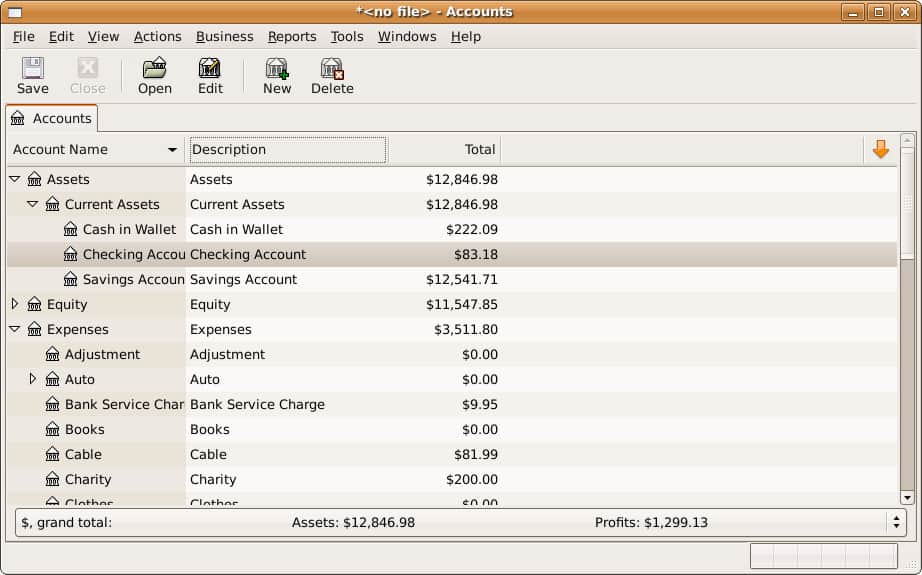

2. GnuCash (Best Offline App)

Best For: Offline accounting and personal finance

Why We Picked It:

GnuCash is a powerful, open-source desktop accounting tool that works offline on Mac. It’s ideal for those who prefer to keep financial data local rather than in the cloud. While the interface is dated, its double-entry accounting engine makes it suitable for advanced users.

GnuCash is quite complex and the interface isn’t exactly refined for Macs but if you’re comfortable with double-entry ledgers and bookkeeping, it’s definitely worth time investing in learning how to use it.

It’s also designed to be used not only as an accounting app, but also a personal budgeting tool with support for stocks and mutual fund accounts.

There are many powerful aspects to GnuCash including a Checkbook-Style register, Scheduled Transactions, Reports, Statement Reconciliation, Income and Expense account types and more.

Pros:

- Completely free and open source

- Strong double-entry accounting features

- Works offline (no internet required)

- Multi-currency support

- QIF import support

- Suitable for both accounting and personal finance

- Lots of tutorials

Cons:

- Outdated user interface

- Steep learning curve

- No mobile or web app

- Lacks online banking integration

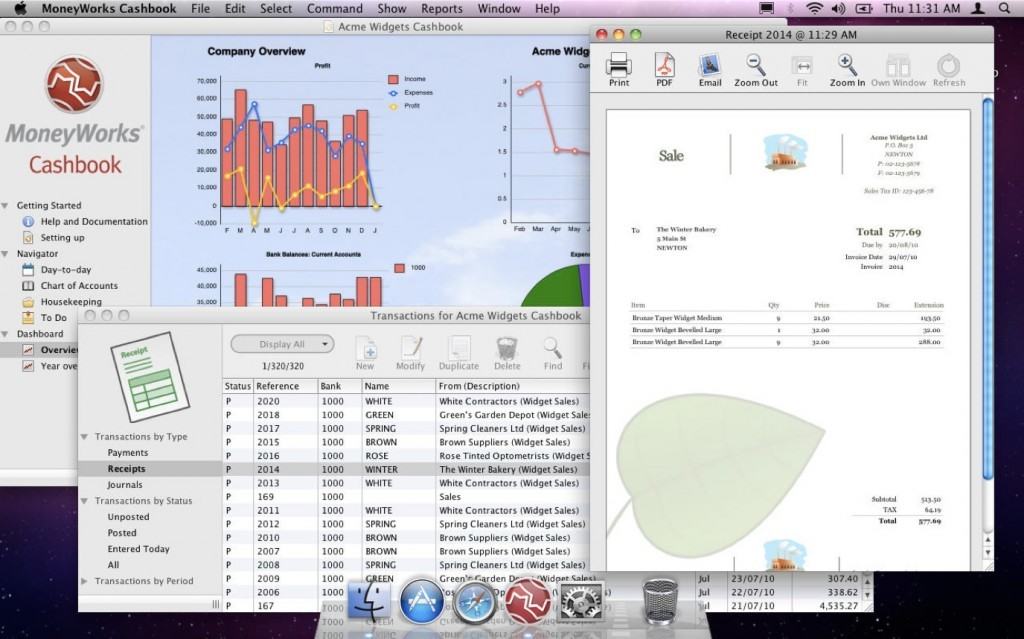

3. MoneyWorks Cashbook (Best For Bookkeeping)

Best For: Bookkeeping on a Mac desktop

Why We Picked It:

This stripped-down version of MoneyWorks Gold focuses on cashbook and ledger management, making it a solid option for nonprofits and small businesses that need basic accounting functions without the bells and whistles.

It’s completely free to use although you need to sign-up for a free online subscription.

MoneyWorks Cashbook gives you a clear overview of how your business is doing with revenue, profit and costs clearly displayed in graphs and charts.

Although MoneyWorks Cashbook is designed more as a bookkeeping solution for non profits such as clubs, societies, charities and associations, small businesses and freelancers can also adapt it for their needs.

Pros:

- Designed specifically for macOS

- Desktop app

- Supports double entry ledgers

- Customized for regional taxes (USA, Canada, UK)

- Supports online banking (depends on region)

Cons:

- Not suitable for more complex accounting needs

- Doesn’t support multi-users

- Interface a bit dated

- No mobile app

- Requires signing-up for a subscription (free)

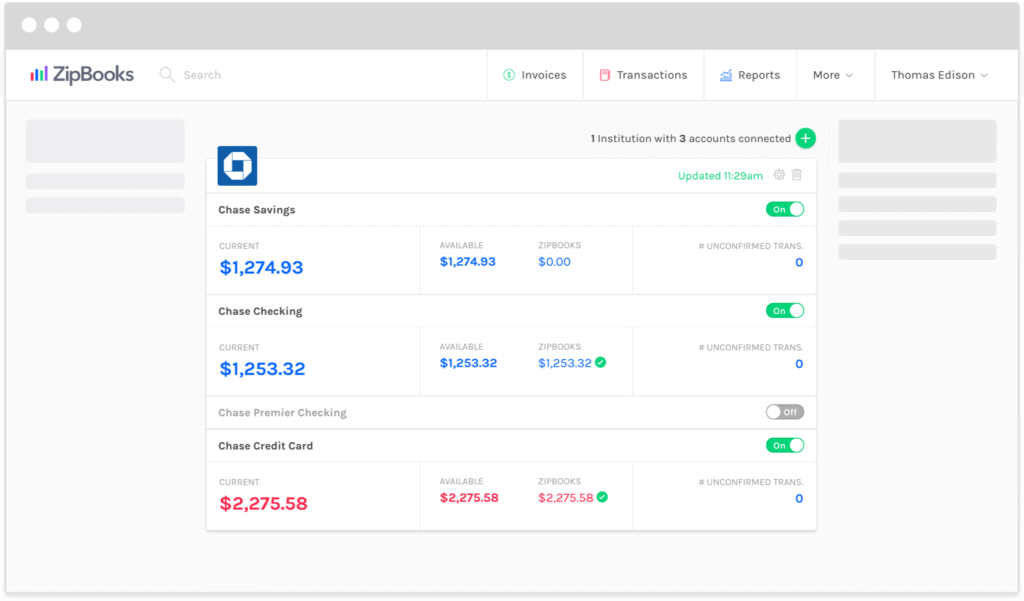

4. ZipBooks (Best For Payment Processing)

Best For: Payment processing and invoicing

Why We Picked It:

ZipBooks provides essential accounting features such as invoicing, expense tracking, and payment integrations. The free tier is somewhat limited, but it’s a great choice for very small businesses that need to send professional invoices and track payments.

Although its marketed as a free alternative to both QuickBooks and FreshBooks, the reality is any serious freelancer or small business would have to upgrade to the Smarter plan for $15 per month to get anything on the same level as QuickBooks or FreshBooks.

The free version does however allow you to do everything you’d expect from a simple accounting solution such as invoice, track expenses, and generally keep your own books in order for tax season.

It allows you to bill by project, task, staff rate, or a flat amount. You can assign different projects to different team members by checking the box next to their user names.

ZipBooks allows you to sync your bank account to add expenses automatically or add a new expense manually by entering the date, amount, vendor, expense category, and the customer you will bill.

You can also integrate payment from PayPal, Visa, Mastercard and American Express although it does charge a payment fee processing charge.

Pros:

- Great for invoicing

- Good expense tracking tools

- Very easy to use

- Supports payment processing

Cons:

- No native desktop app

- No proper data import or export options

- Costs per transaction via credit card or PayPal

5. Wave (Best For USA & Canada)

Best For: Small businesses in the USA and Canada

Why We Picked It:

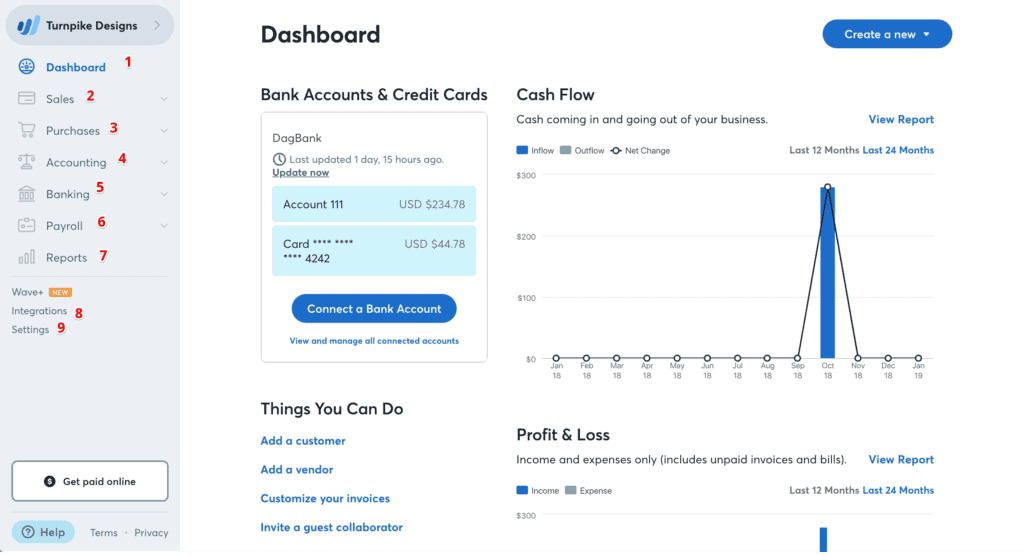

Wave offers impressive features like double-entry accounting, invoicing, and receipt scanning—all for free. However, it is now only available to users in the USA and Canada, limiting its appeal internationally.

Wave presents a clear overview of your accounts so that you can manage your income and expenses clearly.

You can also connect to other Wave products such as automated payroll and payments although it charges processing fees for this.

On the downside, the number of reports available in Wave is limited as are the personal budgeting features.

However, the free version of Wave also comes with 60 days free chat support and if you’re based in the USA or Canada and need a modern, free accounting solution that’s strong on invoicing, Wave is one of the best free accounting platforms out there.

Pros:

- Cloud-based and free to use

- 60-day free chat support

- Easy-to-use interface

- Double entry accounting

- Good invoicing tools

- Scans and uploads receipts

Cons:

- No support outside North America

- Limited reporting and budgeting tools

- Fees for payment and payroll services

- No time tracking

- Doesn’t track accounts payable

6. Bx (Best For UK)

Best For: UK-based users needing MTD-compliant software

Why We Picked It:

Bx is one of the few free tools designed specifically for UK tax regulations, including Making Tax Digital (MTD).

Bx works via modules which you can add and remove depending on your needs such as invoicing, time tracking and even project management.

The platform regularly adds new modules and allows UK users to submit VAT tax returns to HMRC directly and even has a handy Excel plugin to help you extract data.

The invoice templates in Bx are really tasteful and even allow you to send invoices to customers via WhatApp or SMS.

If you’re looking for a highly customizable free accounting solution on your Mac that includes project management tools, Bx is an interesting and modern small business solution.

Pros:

- MTD and HMRC-compliant

- Modern, modular design

- Works in any browser

- Includes Project management modules

Cons:

- Best suited to UK users

- Module-based system can be complex at first

- Requires Javascript to run

7. Brightbook (Best For Simplicity)

Best For: Freelancers who want simplicity

Why We Picked It:

Brightbook is a lightweight, browser-based accounting solution that’s easy to use and completely free.

It supports multi-currency, invoicing, and tax estimates, making it perfect for digital nomads or freelancers.

The minimalistic design removes unnecessary clutter, helping you focus on the essentials. Brightbook doesn’t require technical expertise, which is great for non-accountants.

While it lacks mobile support, its no-nonsense approach keeps bookkeeping straightforward and stress-free.

Pros:

- 100% free with no paid tiers

- Easy to navigate

- Good for international invoicing

Cons:

- Very limited features

- No mobile or desktop apps

- Interface is a bit dated

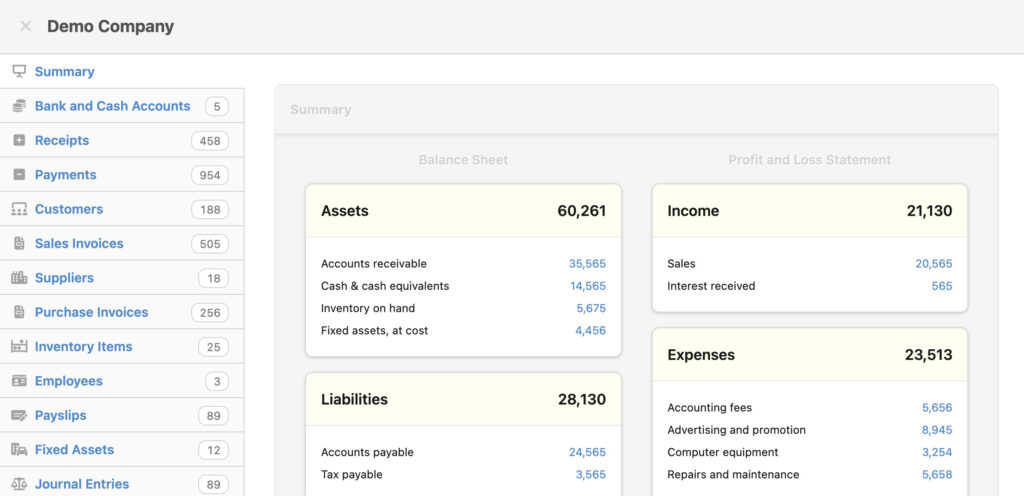

8. Odoo Community Edition (Best For Scaling-Up)

Best For: Growing businesses that want an all-in-one ERP

Why We Picked It:

Odoo is an open-source business management suite that includes accounting, CRM, inventory, and more. The Community Edition is free and works on Mac, though it’s best for users with some technical knowledge.

It’s ideal for businesses that want customizable modules and a single platform to handle operations.

You can start with basic features and activate others—like sales or inventory—when you need them.

Although setup takes time, the long-term flexibility is the best we’ve seen for a free solution outside of Zoho Books.

Pros:

- Modular system includes much more than accounting

- Open-source and customizable

- Ideal for scaling businesses

Cons:

- Requires some setup and tech expertise

- Steeper learning curve

9. Manager.io (Best Interface)

Best For: Offline desktop accounting with a modern UI

Why We Picked It:

Manager.io is a sleek, cross-platform desktop accounting software that offers a surprisingly comprehensive free version. It works offline and has a modern UI, making it a great choice for local bookkeeping.

It includes modules for everything from invoicing to depreciation tracking, all built into the desktop app.

Frequent updates and a helpful user forum make it easier to troubleshoot and learn.

For small businesses that prefer not to rely on cloud solutions, Manager.io is a powerful offline option.

Pros:

- Works offline on Mac

- Modern interface

- Free forever with full functionality

Cons:

- No cloud features unless you upgrade

- No mobile version

These free accounting tools offer a solid starting point if you’re not quite ready for a paid solution. However, if you’re growing fast or need to share data with an accountant, it’s often worth investing in a paid option early on to avoid headaches down the line.

For more advanced tools, check out our full guide to the best accounting software for Mac and our personal finance apps for Mac if you’re managing household budgets.

Comparison Table

| Software | Best For | Works Offline | Invoicing | Bank Reconciliation |

|---|---|---|---|---|

| Zoho Books | Freelancers & small businesses | ❌ | ✅ | ✅ |

| GnuCash | Offline accounting & personal finance | ✅ | ✅ | ✅ |

| MoneyWorks Cashbook | Mac-based bookkeeping | ✅ | ✅ | ✅ |

| ZipBooks | Invoicing & payment tracking | ❌ | ✅ | ✅ (manual import) |

| Wave Accounting | North American small businesses | ❌ | ✅ | ✅ |

| Bx | UK tax compliance (MTD) | ❌ | ✅ | ✅ |

| Brightbook | Freelancers & digital nomads | ❌ | ✅ | ✅ |

| Odoo Community | Scalable ERP needs | ✅ (self-hosted) | ✅ | ✅ |

| Manager.io | Offline accounting with modern UI | ✅ | ✅ | ✅ |

Frequently Asked Questions

How does free accounting software work on Macs?

Most free accounting software for Mac is either web-based (accessed via your browser) or available as a downloadable desktop app compatible with macOS. These tools typically support key functions like invoicing, expense tracking, and financial reporting. Some, like Zoho Books or Wave, operate in the cloud, while others like GnuCash and Manager.io work entirely offline.

What free features should a free accounting app include?

At a minimum, a solid free accounting app should offer invoicing, expense tracking, bank reconciliation, and basic reporting. Other valuable features to look for include multi-currency support, mileage tracking, and tax calculation. Cloud storage, automation (like recurring invoices), and integration with payment processors or CRMs can also be helpful, even in free plans.

Does my business need free accounting software?

If you’re a freelancer, sole trader, or running a side hustle, free accounting software can be more than enough to track your finances efficiently. It’s especially useful if you’re not ready to invest in paid software or only need basic bookkeeping. However, as your business scales or becomes more complex, you may need to transition to a paid solution with more robust features.

Is free accounting software safe to use?

Generally, yes—but it depends on the provider. Cloud-based tools should use encryption and secure data storage practices, while desktop apps rely on your computer’s security. Always choose tools from reputable developers and back up your data regularly if you’re using offline software.

Can I switch from free to paid accounting software later?

Yes, but it may involve some challenges. Not all free tools offer smooth data export or migration options, and formats may not be compatible across platforms. It’s best to choose a free tool that also offers a paid tier (like Zoho Books or Wave) or supports data export in standard formats like CSV.

Do any of these free tools support multiple users?

Some tools do, but it’s limited. For example, Zoho Books’ free plan allows for accountant access, while Odoo Community Edition can be configured for multi-user environments if you have the technical know-how. Most free tools are designed for single users to keep things simple.

What’s the best free accounting software for international users?

Brightbook and Manager.io both support multiple currencies and work globally. However, many of the best free cloud options—like Wave—are restricted to North America, and some UK-specific tools like Bx focus on regional compliance. Always check for tax and compliance features relevant to your country.