Market Gear is an incredibly powerful stock trading tool to help make you a better trader. In this review, we take a look at this comprehensive stock trading tool to see what it can do.

Market Gear is a relatively new stock trading software from iVest+ which is a big player in the world of trading platforms for educators and retail investors.

We think Macs are great for trading and among the many things we really like about Market Gear is that it’s one of the few with a Mac desktop client even though it can be used online in any browser too.

We voted it one of the best stock trading software for Mac especially for professional traders thanks to its incredibly comprehensive set of tools and clever integration across the board.

In particular, the Options trading features in Market Gear are one of the most advanced we’ve seen on any stock trading app.

It’s also one of the few stock trading software that allows you to use multiple brokers within the app so you can trade without ever leaving it.

In this review, we take a closer look at what it can do.

You May Also Like:

- The Best Stock Trading Software For Mac

- The Best Trading Platforms For Mac

- TradingView Review

- Why Macs Are Great For Trading

Table of Contents

- Market Gear Overview

- Market Gear on Mac & Online

- Market Gear Dashboard

- Market Gear Charting

- Market Gear Trade Journal

- Market Gear Research

- Market Gear Scanners

- Market Gear Screener

- Market Gear Options Trading

- Market Gear Broker Integration

- Market Gear Share Trading

- Market Gear News Feed

- Market Gear Downsides

- Market Gear Pricing

Market Gear Overview

Market Gear doesn’t have a free version like TradingView does but it offers a lot of features that you’ll have to pay a lot more money for elsewhere.

Market Gear is less focused on “social trading” than tools like TradingView but focuses on helping you be a better organized, informed and smarter trader.

Market Gear has charting, watch lists, deep fundamentals, and more out of the box.

The basic Essentials Kit ($45 monthly or $38/month annually) is very reasonably priced for a professional stock trading software on this level and offers a lot of bang for your buck.

It cleverly integrates a huge range of stock tracking tools into one platform and considering what you get, we think it’s extremely good value for money.

Even better, Market Gear is one of the only stock trading tools that can link to multiple brokerage accounts.

So for example, if you’ve got both a TD Ameritrade and an eTrade account, you can switch between them instantly within Market Gear.

Market Gear on Mac & Online

The first thing you notice is that everything about the Market Gear platform is snappy.

You can use Market Gear in any browser but there’s also a convenient Mac desktop app which allows you to do everything you can in the web version.

You can load up charts and fundamentals and more in just a few quick clicks in both versions. Everything is almost instant because the platform was built on the latest Javascript, HTML5 and CSS standards.

The Mac version adds features that utilize the touch bar, but even the browser version stores a lot of information locally so it can display things you check often very quickly.

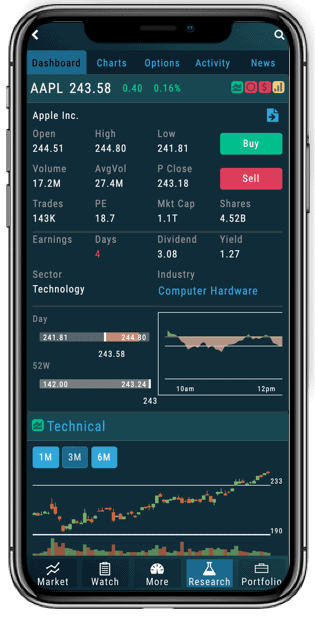

There are also complementary Market Gear iPhone and iPad apps that can do almost everything the desktop versions offer, with a few minor differences for screen real estate.

With Apps for iOS and Mac plus browser access, you have quick access from anywhere, and all of your data and watchlists are synced across all devices.

Market Gear Dashboard

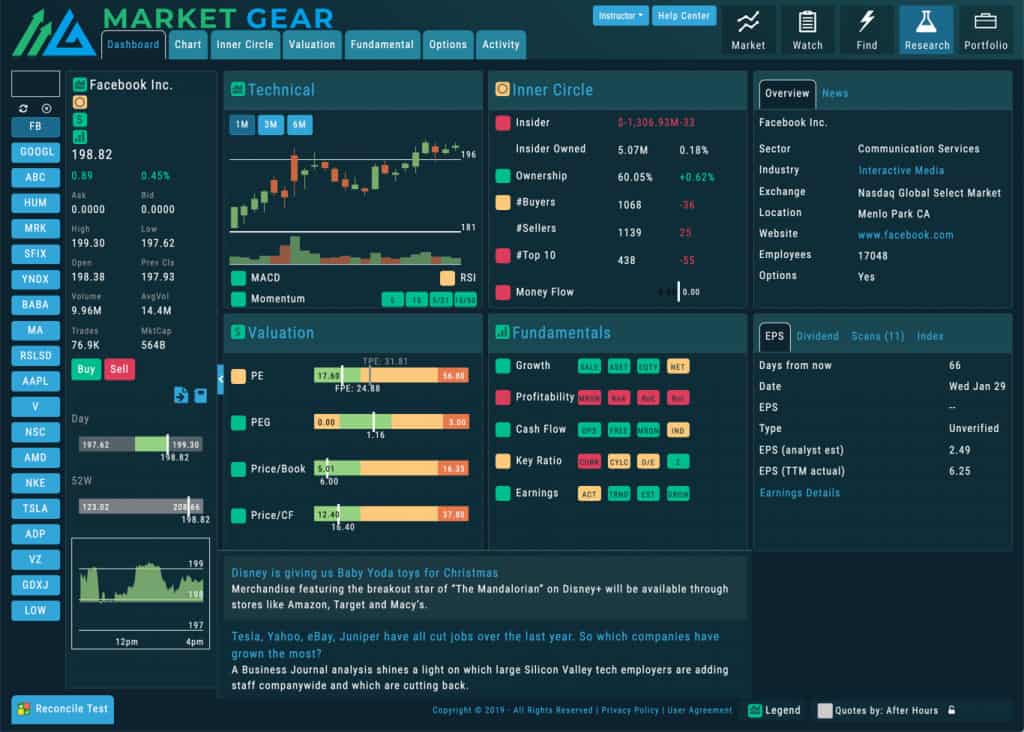

The Market Gear dashboard is called Market Gear Central and highly customizable allowing you to customize the homepage with easy access to watchlists.

You can choose your Watchlist and then select from charts, quotes, and news pods to view the markets the way you like it.

For example, you can assign a chart to an area of Market Gear Central and configure if the symbol is sticky or linked to a watchlist.

You can click the action arrows from a watchlist or anywhere in the platform and get right to placing a trading, doing research, pulling up a chart, and more.

Watchlists can be your own list of stocks (no limit to how many you can make) or be about today’s biggest winners and losers, etc.

You can add and rearrange these “pods” easily and link up to 100 charts to your dashboard.

Everything about the platform is designed to give you quick but unique visuals that tell you what you want to know.

You can drag your mouse across the screen in the fundamentals area and see what the company you are viewing has done.

You can compare earnings, PnL, or look deeper at a full spreadsheet of profitability or cash flow tables as a spreadsheet.

Market Gear Charting

In general charting and setting your defaults is very easy in Market Gear.

You can analyze customizable indicators, view trades, draw permanent trendlines, review past trades and more.

We like the fact that you can select from an array of timeframes ranging from a 1-minute chart all the way up to a monthly chart.

All tools, indicators, and trendlines carry between timeframes.

You can choose from over 80 indicators, add colors, stack them and customize every data point to view the market.

With just a few clicks, you can add from a list of the usual indicators, or pick a few unique ones, and then set your parameters.

Saving your preferred options on a chart is easy (you can save as many profiles as you want) and you can then hide and move indicators by dragging.

You can draw trendlines as time moves forward, view your cost basis in real-time and view multiple indicators not just based on price or Open/High/Low/Close.

We also like the way you can overlay your trades on charts, get a snapshot of where a staged trade would put your cost, and review previous trades in the the Trade Journal.

Market Gear Trade Journal

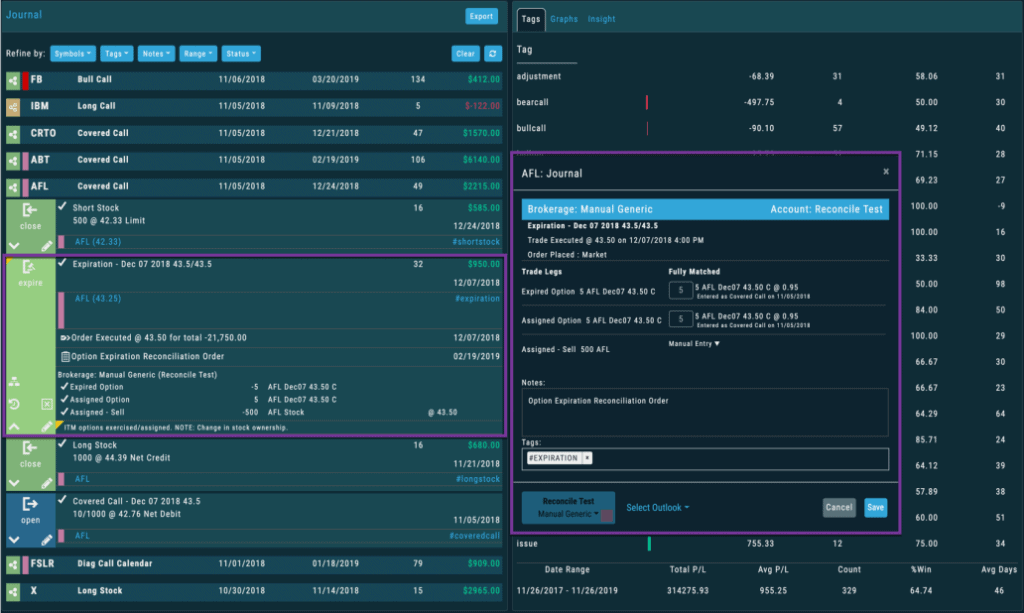

Documenting your trades is one of the most underrated and unpracticed stock trading tips but it adds an extra step to trading that many either don’t have the time for or can’t be bothered to do.

The trade journal uses algorithms and AI to help you learn which trades work through an automatically curated analysis of your most successful strategies.

The Trade Journal is designed to automate your market research with cross-tabulated fundamental data from earnings to cash flow to insider trading to institutional ownership, and you can dig as deep as you want with just a few clicks.

The Trade Journal is one of the most useful features of Market Gear because when you place trades through the platform, it will create a journal entry for you automatically.

While most brokers offer a PnL report so you can see what you made for the year, these tags categorize all of your trades.

Think #longstock or #bearput. And you can also add your own notes and tags, such as #wsj if you got the idea from the Wall Street Journal or #madmoney if you listened to Kramer on CNBC.

The system then automatically compiles your results so you can visually (again) see where you made and lost money.

Think you are good at trading bull call spreads? Awesome, but your results might not show that. At the end of the day, do more of what is making you money and less of what isn’t. Your broker’s PnL report doesn’t show you that.

You can find stock journaling software that cost anything up to $125 a month, most of which generally require you to manually enter your trades or manually import them via CSV file.

There are certainly none that we have seen do a great job with options apart from Market Gear.

Even tracking adjustments like rolling or leg buybacks or showing overall profitability of the entire trade from start to finish are built-in features. Market Gear does this for you automatically if you trade through the platform.

Market Gear Research

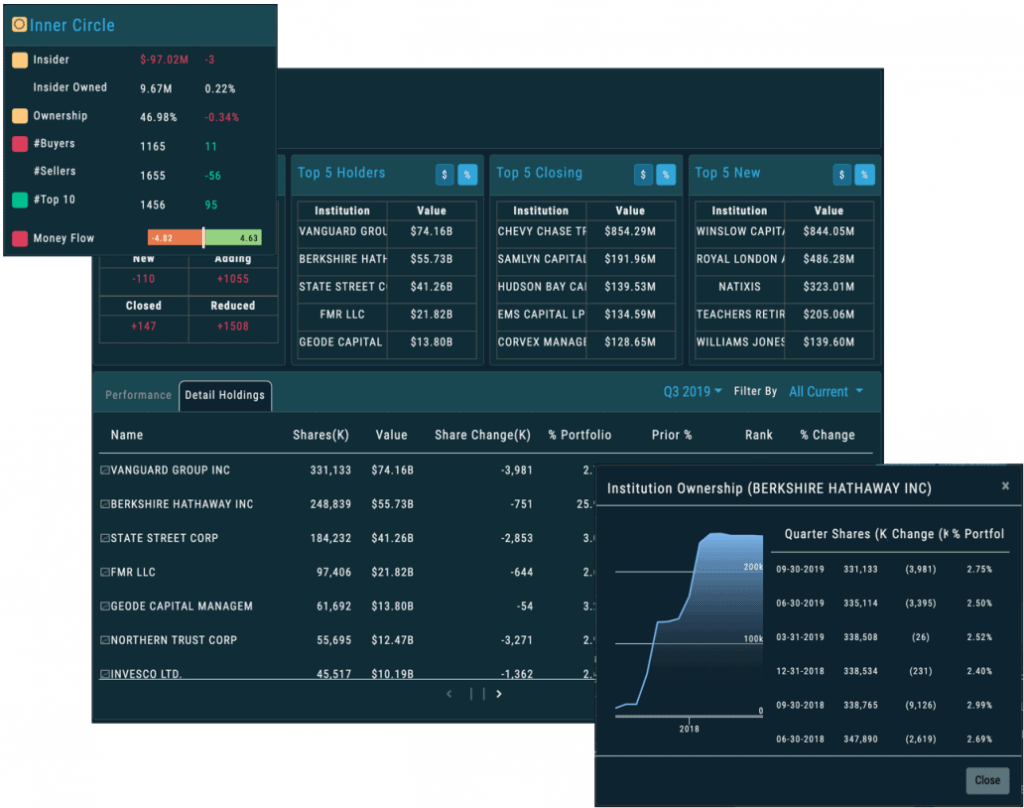

Market Gear allows you to conduct in-depth research into companies and stocks.

Market Gear allows you to read cross-tabulated fundamental data to everything from earnings and cash flow to insider trading and institutional ownership.

You can quickly drill down data to find the most stable companies with the biggest earnings, revenue growth, and projections.

Market Gear Scanners

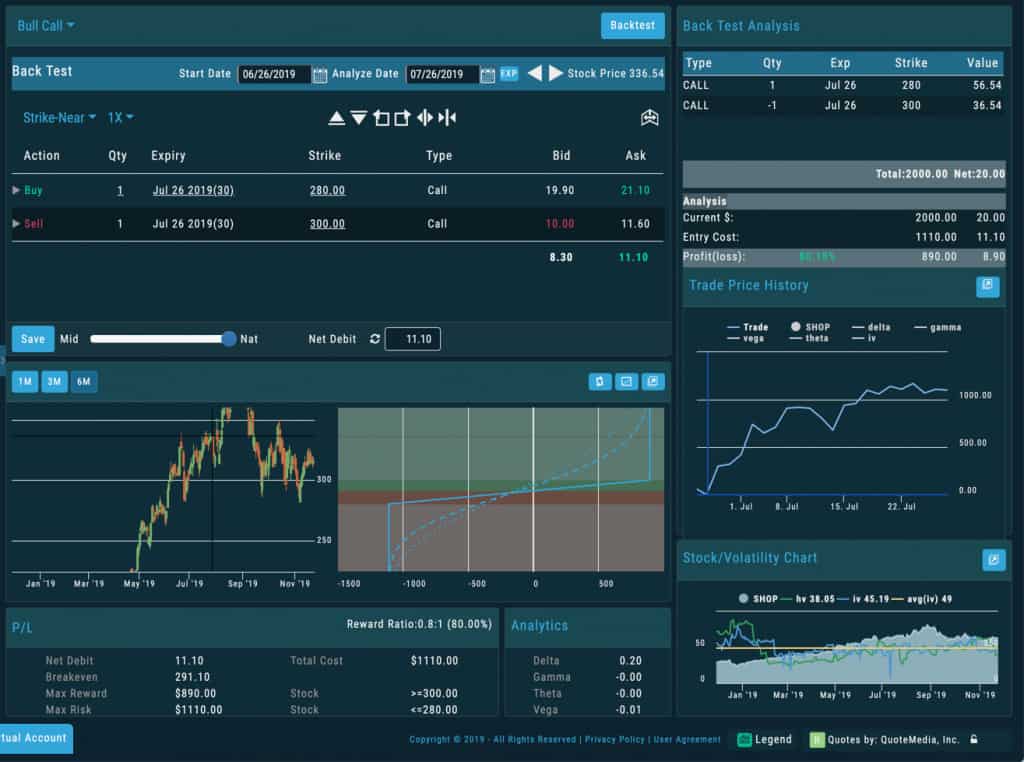

Market Gear has preset scans for different types of trades, and a full backtesting mode for stocks and options.

You can take a strategy, pick a stock, go back up to 20 years, pick a start date and which options contracts you would have wanted, and see how it would have played out.

You can select up to 100 customizable technical indicators and scan the markets with no limit on how many scans you want to perform.

We like the way that you can click straight into making a trade with your broker from scans or save a trade for later when the pricing and parameters you set are right.

While you can sort by price and volume like most screeners, Market Gear’s screener also includes “time of day” volume, which means you can look for anything as detailed as stocks that are trading more volume than usual for that time of day.

Once you pick all of the data points that you want to screen, it’s a simple matter of using sliders to pick the high and low of each item that you want.

The Signature Kit plan includes basically the full-featured version of everything in the platform at $75 a month ($65/month paid annually), and you could basically justify that in the screener and the options templates alone, plus the ease of use of everything else.

Market Gear Screener

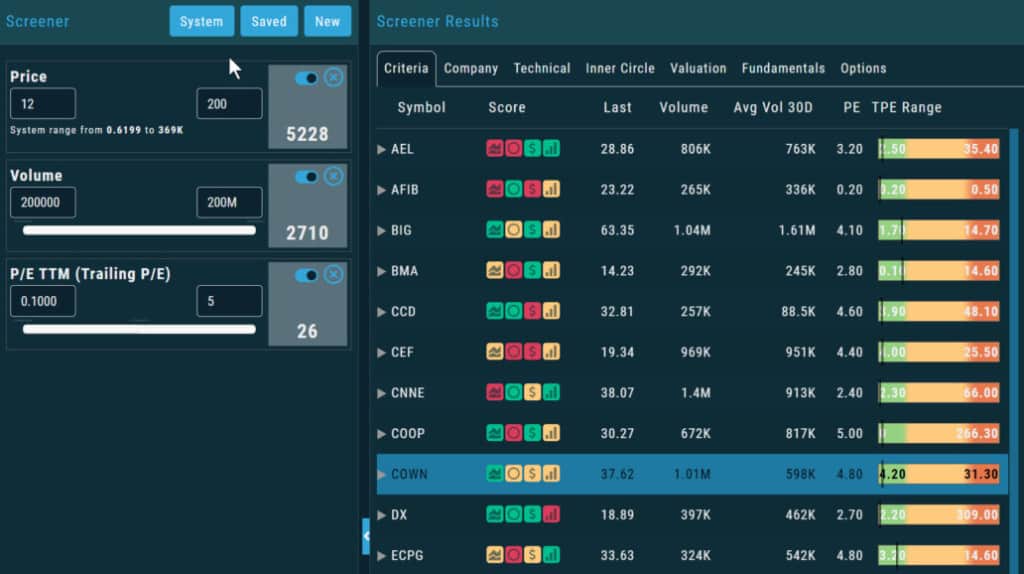

When using pre-set scans doesn’t give you the detail you want, Market Gear also offers an incredibly fast and powerful screener that allows you to pick from over 200 data points and set the criteria that you want to narrow your own searches.

As with the rest of the product, the screener is powerful while being quick and easy to use.

The data points range from Company Information (What sector is the stock in? What exchange does it trade on?) to Fundamental data (EPS, etc.).

It also includes other things such as Technical data (Price Compared to various moving averages, stochastic, and more) to Options Data (real-time Implied Volatility comparisons) and much more.

Once you select the data points that you want to use, you can then slide, select, and type in your parameters.

As you change each item, you’ll get real-time instant feedback on how many stocks meet that criteria so you can either keep narrowing the data or find additional data points to use.

Once done, a click of the Run Screener button brings up all of the stocks that meet your criteria with columns that show your criteria, but also tabs that expand to show all other data points for those stocks.

You can then move all or some of the stocks to a Watch List with ease and do your own Fundamental Research and Charting to make your final decisions.

It’s one of the fastest and most powerful screeners we’ve seen in any stock screener on the market and you can read more about the Market Gear Screener here.

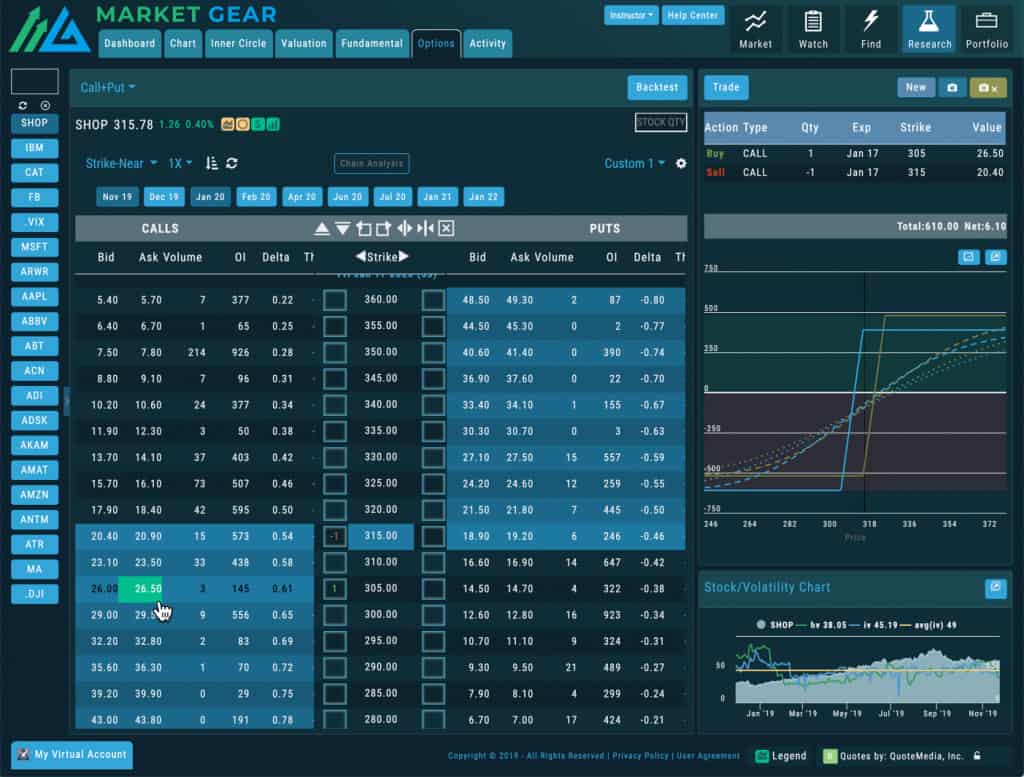

Market Gear Options Trading

The options scanning tools in Market Gear are easily some of the best we’ve seen in any stock analysis app.

For options traders, you can pick an options template and the platform will keep you within the parameters of that template while you lay out your strategy.

In other words, if you want to put on a bull call spread, you can analyze where you will make and lose money and make quick adjustments with a click or two, but you can’t break the concept of the bull call spread.

This is amazing for newer options traders that want to learn multi-leg strategies. It would be easy to make a mistake on one leg, but Market Gear just won’t let you.

The fact that you can turn the typical options risk graph on its side to line up with the stock price is also a dramatic improvement over most platforms.

You can see how Market Gear can be used to analyze options on popular stocks such as GameStop (GME) here.

Market Gear Broker Integration

One of the other standout features of Market Gear is that you can link it to as many brokerage accounts as you want to the platform, including eTrade, TD Ameritrade, ChoiceTrade, and Ally Invest with more in the pipeline.

The great thing about this is if you have issues with a broker going down and need to make a quick trade, you can instantly switch to another account all from within Market Gear.

If only RobinHood traders had Market Gear when the platform stopped trading on Gamestop shares, they could have instantly switched to another platform and ridden that wave.

You simply can’t do this with most trading platforms, especially your broker’s.

Market Gear is very popular with educators and once of the reasons for this is the share trading feature. Note that this isn’t quite like the kind of copy trading you get in stock trading platforms like eToro.

Copy trading has become a huge deal in recent years as beginners flock to stock trading platforms knowing that they can simply copy top traders and profit.

Market Gear has a neat Trade Sharing features which you can share with friends or an educator so that others can see what you’ve traded.

Although it doesn’t automatically copy trades, you can manually copy the same trade yourself if you wish.

There’s also Trade Staging which allows one trader to send a trade idea to another for analysis. With a couple of clicks, you can join them in the trade after viewing it on the charts, including multi-leg options trades.

There’s no need to try to enter all of the legs yourself with Trade Staging as your friend has already done the work for you.

Market Gear News Feed

If you need the best news in the world for your trading to jump on the latest mover, you’ll need to subscribe to Market Gear’s Master Kit plan to get real-time streaming news from Benzinga.

This is integrated into the main Market Gear dashboard and includes Benzinga’s live news desk squawk service.

With the Benzinga news feed integrated into Market Gear, you get:

- Dividend News

- M&A News

- Earnings News

- Management Changes News

- Why Is it Moving Today?

- Analyst Ratings News

- Insider Trades News

- Trading Ideas News

- Media reports News

This is an exclusive feature of Market Gear as it’s currently the only platform that offers the service outside of Benzinga “on the go” meaning you can stream the audio from the Benzinga news desk on your phone.

Market Gear Downsides

At the moment, Market Gear does not support futures and crypto trading. However, according to the developers iVest+ both instruments are in the works and will be added soon.

The Benzinga News Feed is also limited to the Master Kit. Although the other plans have a news feed, it’s not as good or as fast as Benzinga’s.

You can try a free two week trial of Market Gear to see what you think for yourself.

There’s also a free virtual demo account to play with too which we always recommend trying first with any stock trading tool.

Market Gear Pricing

Market Gear pricing is divided into 3 plans.

The big advantage of the Master Kit is that you get the Benzinga news feed included for faster real time financial news.

- Essential Kit – $45/mo or $38/mo if billed annually

- Signature Kit – $75/mo or $65/mo if billed annually

- Master Kit – $145/mo or $125/mo if billed annually

You can try Market Gear for free and also currently get 50% off your first month of Market Gear.