Quicken 2017 for Mac is here and may finally be the Quicken that Mac users have been demanding for years with a fully functional Bill Pay, new interface and enhanced reporting features.

After many years of having to endure an inferior product, Quicken for Mac is now finally much closer to the Windows version although shortcomings still remain.

The fact that Intuit recently sold Quicken to H.I.G Capital in March has definitely breathed new life into a woefully neglected product by Intuit who were unable or simply unwilling to bring Quicken for Mac up to speed with the Windows version leaving many Mac users switching to alternatives such as the excellent and free Empower.

With more investment in the Mac version and a new dedicated Quicken for Mac product manager however, the new owners seem to be putting more effort into Quicken for Mac. After the disappointment of Quicken 2015 and Quicken 2016 on Mac, Quicken has delivered a Mac version of Quicken that’s considerably closer to the Windows version so here we take a closer look at Quicken 2017 for Mac.

Quick Navigation

- What’s New In Quicken 2017 For Mac?

- Quicken Bill Pay Is Finally Here

- New Interface

- Importing Files

- Connecting Accounts Online

- Spending

- Investing

- Budgeting

- Report Types

- Quicken 2017 Goes More Mobile

- What’s Missing?

- How To Get Quicken 2017 For Mac

- Updates to Quicken for Mac 2017

- And Finally: Is Quicken Moving To A Subscription Payment Model?

What’s New In Quicken 2017 For Mac?

In a nutshell, the most significant improvements in Quicken 2017 for Mac can be summarized as:

- The introduction of a fully functional Quicken Bill Pay like in the Windows version of Quicken

- A Modernized and Standardized Interface comparable with the Windows version

- Enhanced Budgeting (12 month budgets, although this was also introduced in an update to Quicken 2016), Investment and Reporting features

- A More Powerful Mobile App

We’ll now look at these improvements and some of the shortcomings that still remain in more detail.

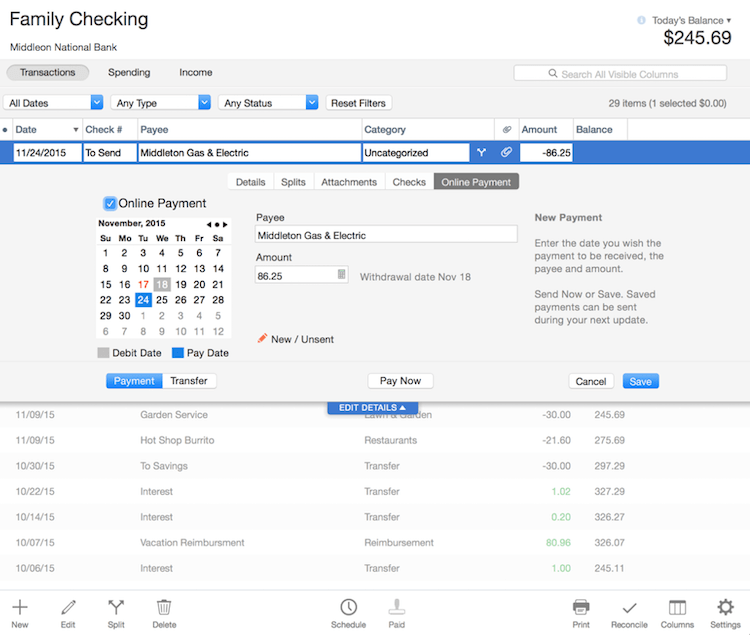

Quicken Bill Pay Is Finally Here

After Mac users were let down by a lite version of Bill Pay in Quicken 2016 for Mac, it seems that the new product development team at Quicken have finally listened to the complaints of Mac users and added a fully functional Quicken Bill Pay for Mac in Quicken for Mac 2017. Bill Pay is arguably the most requested feature in Quicken for Mac after it was inexplicably removed from Quicken 2007 for Mac and for that alone, will be worth the upgrade for many users. The enhanced Bill Pay in Quicken 2017 for Mac means that Mac users can finally pay their bills from most banks within Quicken, including small and regional banks.

The Bill Payment Services are provided by the same handlers as on Windows – Metavante Payment Services – and Bill Pay works just as well on Mac as on Windows now. Quicken Bill Pay on Mac also allows you to transfer funds between accounts at the same bank and pay all of your bills, just as on Windows. Note that there are bound to be some banks and institutions that still don’t work with Quicken Bill Pay (some may also charge application approval fees) but this is often due to problems on the bank’s side and not Quicken so you should always check with your financial institution first to make sure it is supported. Quicken claims to be supported by 14,500 different financial institutions though so it’s safe to say, you should be fine. Even when it is supported, you should still be careful with it when making bill payments as payments can fail for no apparent reason without any kind of notification and it’s often hard to work out if the problem is on the bank’s side or Quicken’s side.

Note that Quicken Bill Pay isn’t free as you must pay subscription for it. Quicken Bill Pay currently costs $9.99 per month for the first 20 payments with every 5 payments after that charged at $2.49 per batch. Quicken Bill Pay also includes Direct Connect Bill Pay (which was already included in Quicken 2016 for Mac) and supports around 450 financial institutions.

New Interface

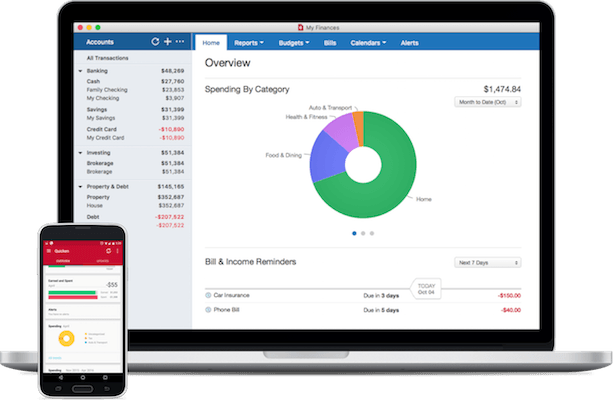

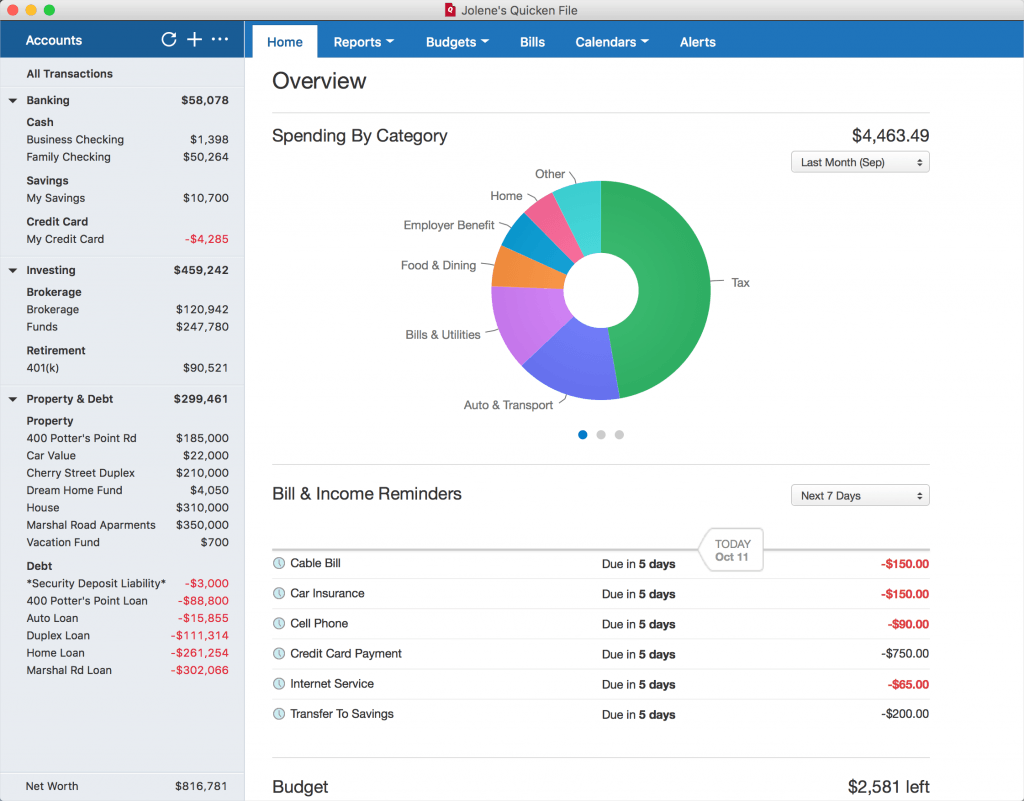

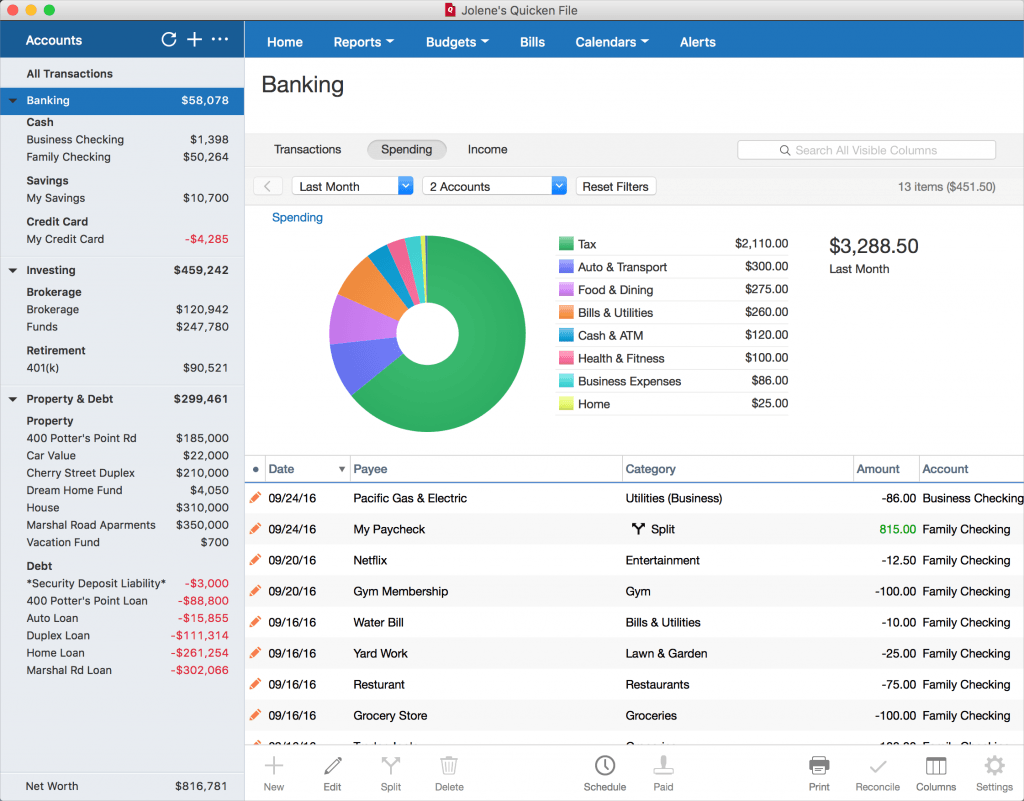

The most notable visual change to the Quicken 2017 for Mac interface is not only a fresher, newer OS X style look but it’s now consistent with the Windows interface. Before, switching from Quicken for Windows to Quicken for Mac was more confusing than it should be, partly due to the fact that the interfaces were quite different. As a result, it’s now much easier to migrate between platforms.

For example, this is how the new look Quicken 2017 for Mac Home tab looks:

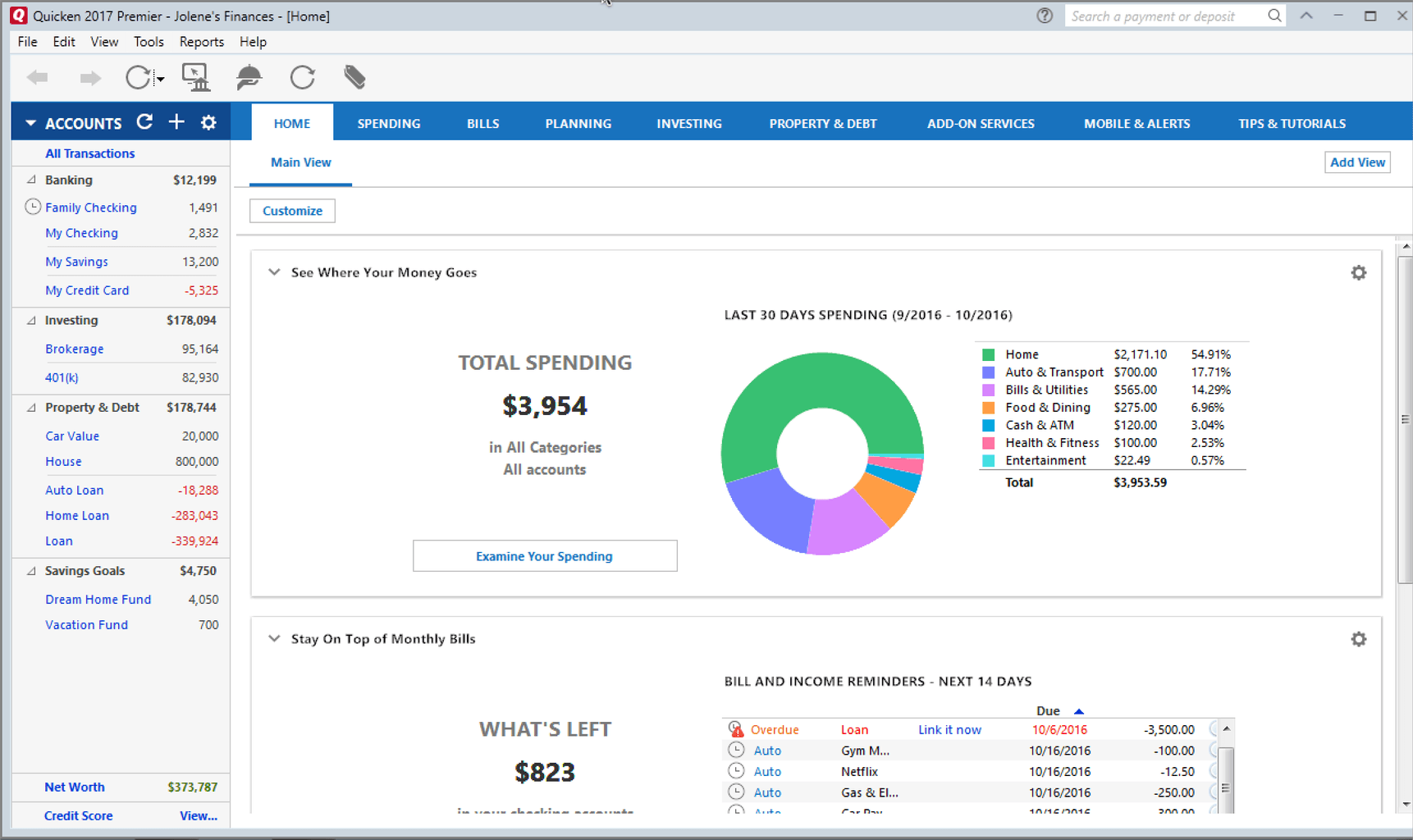

And this is the same screen on Windows:

Quicken 2017 also looks sharper than previous versions of Quicken too, partly due to the fact that it’s finally been optimized for high resolution displays also.

In general, Quicken 2017 does a much better job of bringing all of your essential data together in one place via the Home tab than previous versions. It’s now easier to see the state of your checking, savings, credit cards, investments, retirement, loans in one place. All of this information is updated in real time as Quicken updates it from your financial institutions.

While Quicken has definitely made the interfaces on Quicken for Mac and PC more similar however, the range of features is still not the same on Mac as it is on Windows (more on this later). In addition, the Mac interface still isn’t as easy to customize as on Windows – simple dragging and reshaping of reports and transactions is very limited compared to Quicken for PC.

Importing Files

The first thing you’re likely to want to do after installing Quicken 2017 is import a file. You can import data from previous versions of Quicken including Quicken For Mac 2007 – 2016, Quicken Essentials, and Quicken for Windows. However, this isn’t all plain sailing depending on the version of Quicken you want to import from.

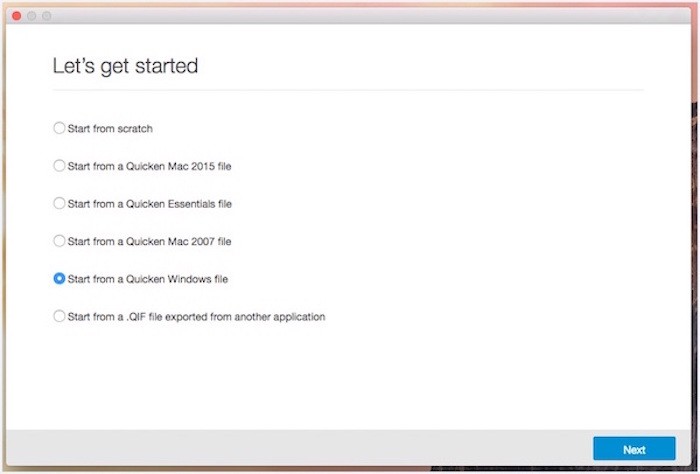

When you start Quicken 2017 for the first time, you’ll be presented with the import options: Start a new account from scratch, Quicken 2015 & 2016 for Mac, Quicken Essentials, Quicken Mac 2007, Quicken Windows or a .QIF file from another financial software for Mac.

If you’re importing from either Quicken 2015 for Mac or Quicken 2016 for Mac, you should have no problems. Just make sure all your accounts are up to date in either Quicken 2015 or Quicken 2016 and Quicken 2017 will automatically convert and import your accounts in their entirety and accurately. If you’re importing from Quicken Essentials, Quicken 2017 will also import everything including all accounts, transactions, tags, budgets, bill reminders, investing accounts etc. However, since Quicken 2017 for Mac has supports considerably more features such as more detailed investment tracking of lots as well as holdings), it may be easier to start from scratch and then re-add investing accounts manually.

Importing from Quicken 2007 is another story however. Although most account data will import, budgets and transaction attachments do not. There are also features that were part of Quicken 2007 that aren’t part of Quicken 2017 that will not import including loan amortization schedules, home inventory, emergency records data, explicit lot assignments and securities watch lists. The absence of loan amortization schedules in Quicken 2017 is a particularly disappointing oversight as it seems crazy that you can’t easily track something as simple as mortgage repayments or car loans in a personal accounting software for Mac as big as Quicken. In addition, at the end of the import you’ll need to reestablish all of your online banking downloads by going to “Accounts > Setup transaction download”.

There are even more issues when importing Quicken for Windows 2010 files or higher. All account data will import except budgets and transaction attachments. And again, features that are not part of Quicken 2017 for Mac including loan amortization schedules, home inventory, emergency records data, explicit lot assignments, securities watch lists, address book and lifetime planners won’t import. Quicken has confirmed that ESPP and Incentive Stock options will transfer but only as a standard holding without tax related information such as strike prices. In addition, Quicken Windows Rental Property Manager users won’t be able to import property specific data (tenants, rents etc) and Quicken Windows Home and Business will not be able to import business specific invoicing data. And finally, as with importing Quicken 2007 data, you’ll need to re-establish online banking downloads manually again.

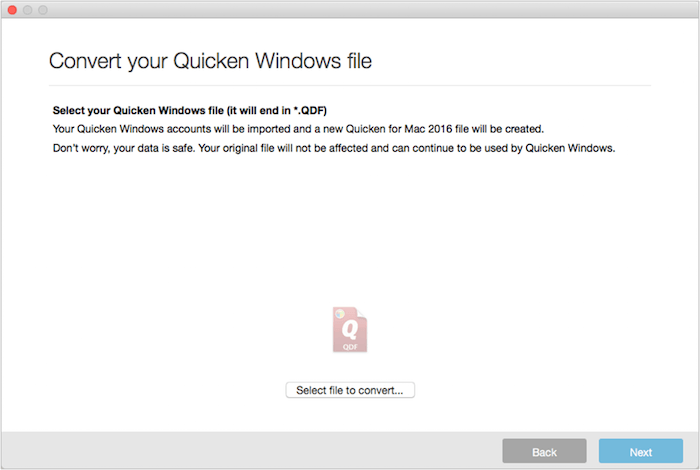

Confusingly, if you buy Quicken 2017 from the Mac App Store you will need to convert Quicken for Windows files first on a PC and convert from a Quicken Data File (QDF) to QXF format before you can import them into Quicken 2017:

Finally, the QIF import feature is for if you want to import your accounts from other personal finance apps such as Banktivity, Microsoft Money or Moneydance. You simply need to export it in QIF format first and then import it into Quicken 2017 (if you’re interested in running MS Money on your Mac by the way, you can find full instructions how to get Microsoft Money on Mac here.)

Whichever method you choose for importing, it can take a while depending on the size of your accounts but you can expect something in the region of around one minute for every year of accounts you are importing. You should always make sure the accounts you are importing are up to date and always check the account balances afterwards to make sure they are the same.

In general, the import tool works efficiently with some manual cleanup needed but as you can see, it very much depends on which software you’re importing from. The inability to import certain things from Quicken for Windows either due to technical issues or simply because those features are not available in Quicken 2017 for Mac is disappointing and will no doubt infuriate some users.

Connecting Accounts Online

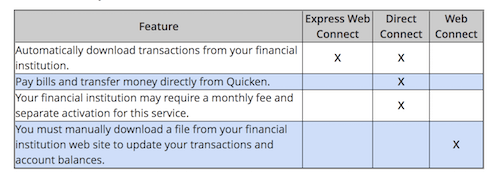

The next thing most people do is connect Quicken to their bank account. Quicken connects three ways depending on the system your bank supports: Quicken Connect (Express Web Connect on Windows), Direct Connect and Web Connect. The good news is that also seems to have been significantly improved in Quicken 2017. There is a slight difference between each method though as you can see below:

Previously, connecting to and downloading data from financial institutions could either be highly unreliable or resulted in messed up account ledgers, broken connections and general headaches. We tried with a SunTrust account and syncing was surprisingly smooth and credit card, savings and current accounts downloaded and synced with Quicken 2017 correctly. You will have to do some manual renaming of accounts but in general, the online bank account syncing compared with previous versions works far better. However, we’ve heard mixed reports for Wells Fargo but the good thing is that the Quicken for Mac team are proving surprisingly responsive at investigating and fixing issues with specific banks (see the “Updates To Quicken For Mac 2017” section below).

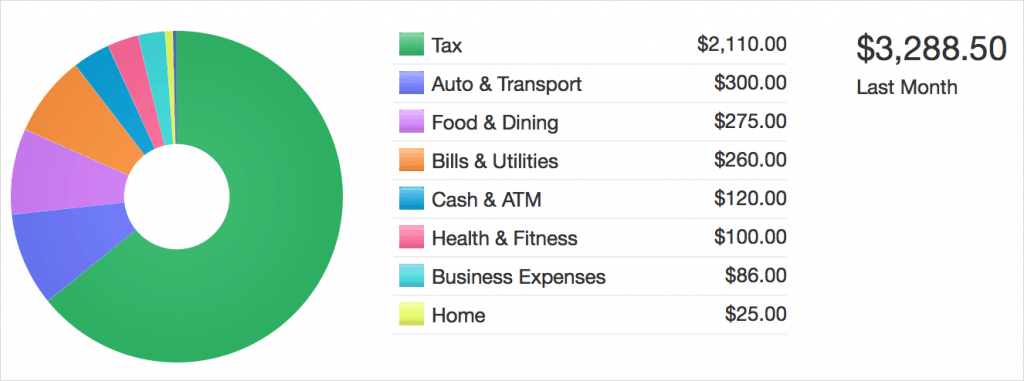

Spending

Quicken 2017 categorizes transactions and makes it easier to see where your money is going. You can choose to view spending by category or over time to help you keep tabs on where your cash is being spent. Spending year-on-year comparison reports were one of the most requested features in Quicken for Mac and they’ve now finally been added in Quicken 2017. Quicken also tries to help soften the blow of bills via Bill Reminders which show you the impact of of forthcoming bills before you get them to help you make sure you’ve got enough funds to cover them or avoid late fees or overdraft costs. One other neat addition to Quicken for Mac is the Spending Cloud which shows via words where the majority of you’re money is going – the bigger the word appears in the Spending Cloud, the more money you are spending on it. Useful if you just want to see what’s costing you the most without needing to see the amounts or dates of transactions. You can also setup Spending Alerts which are triggered when a large purchase or certain balance has been reached to make you more aware of spending in real time. These appear at the top of your Dashboard and can also be sent to you via email. It’s also now possible to use tags and categories to filter spending reports and see sub-totals for those tags and categories which hasn’t been a feature of Quicken for Mac since Quicken 2007 for Mac. Quicken 2017 also now allows you to export category and tax summary reports to CSV.

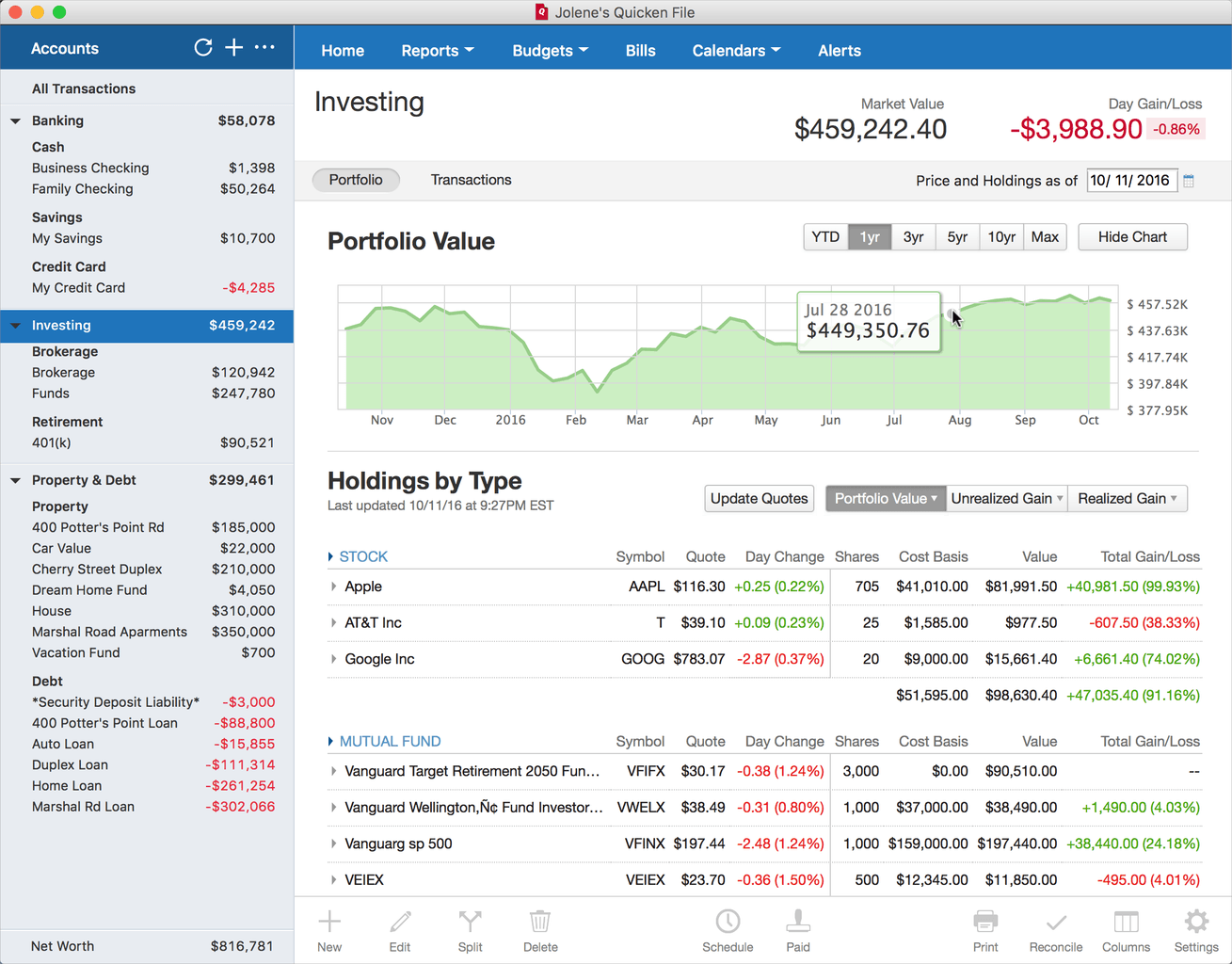

Investing

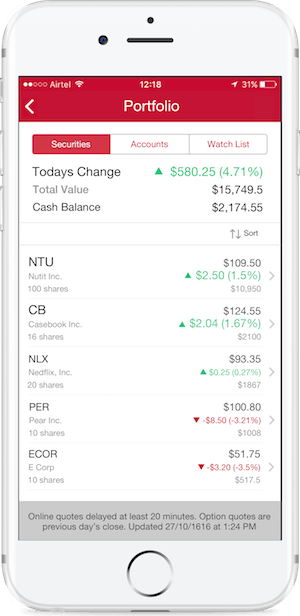

Investment tracking has been enhanced in Quicken 2017 for Mac allowing you to organize and optimize your investment portfolio with more detailed, lot-level investment tracking. You can quickly see your investment transactions and realized gain and view a Schedule D report to see short-term or long-term profit and losses. The ability to view Portfolios by statement date (Portfolio time machine) was missing from Quicken 2016 and is another addition to the 2017 edition. In Quicken 2017 for Mac, you can also sync your investment holdings to the Quicken mobile or tablet app to see your portfolio and monitor changes throughout the trading day. If you need to, you can still download holdings, balances, and transactions in Quicken 2017.

You can sync your online investment accounts with Quicken 2017 for Mac but we do recommend checking whether your investment institution supports it. For example, investment house T Rowe Price does not support Quicken for Mac because it requires betters support for single-mutual fund accounts.

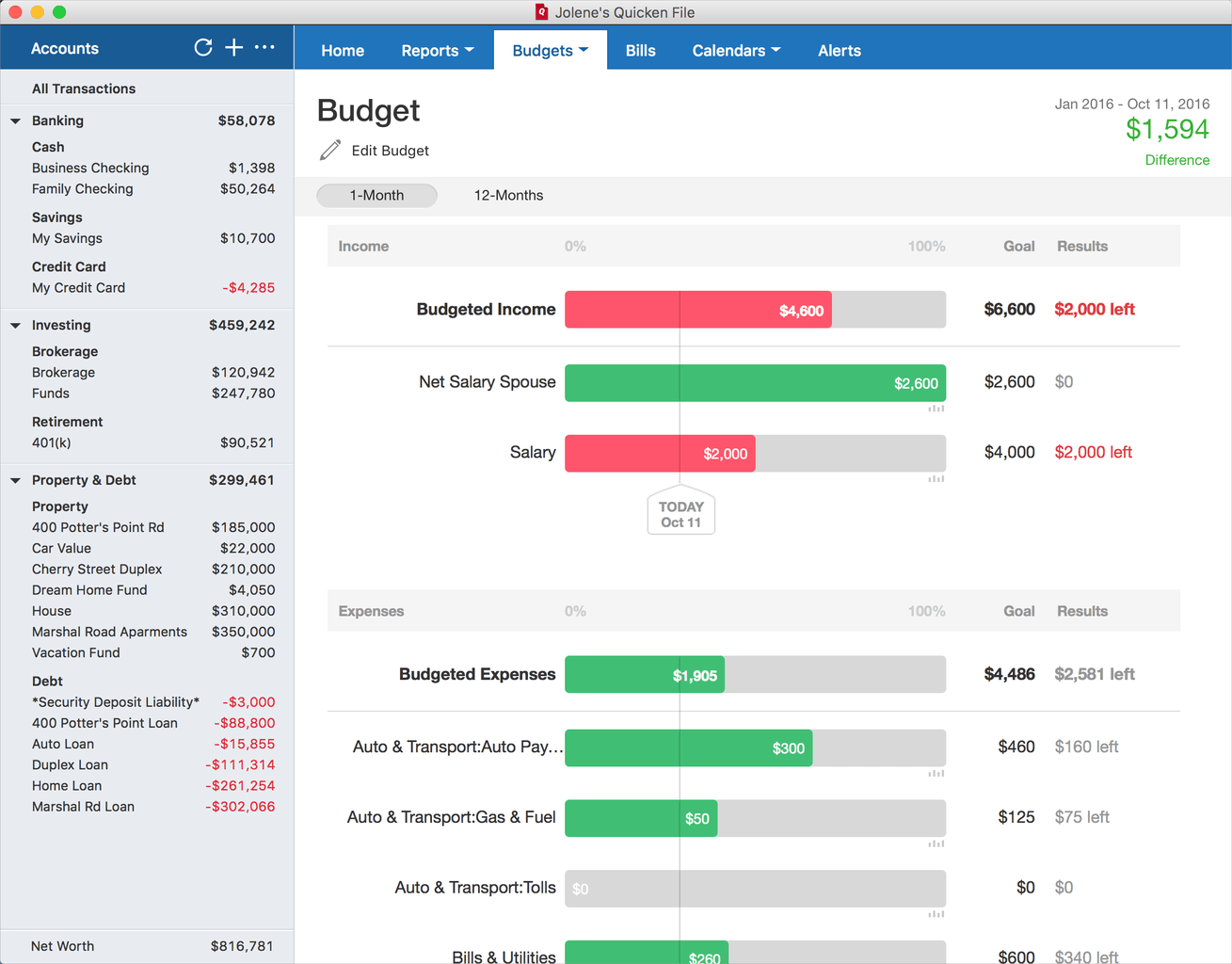

Budgeting

One of the other most wanted features in Quicken 2016 was 12 month budgeting. This was another inexplicable abscence from Quicken 2015 for Mac and Quicken 2016 for Mac but has finally been added to Quicken 2017. The 12-month budgeting tool helps you to setup a realistic 12-month budget based on your spending history. You can then tweak and customize your budget and set budget goals until you’re satsified with something you think you can stick to. The Budgeting tool will then track your progress throughout the year and you can check it any time to see how you’re doing via the Quicken mobile app.

Report Types

There are several new report types in Quicken 2017 for Mac compared to previous versions of Quicken on Mac and the reporting capabilities have been enhanced. Most reports you can filter by account, category, payee, date and tag (called “classes” in Quicken 2007 for Mac) and then save your customized reports. Reports possible in Quicken 2017 include:

- Account Summary

- Activity Last Month

- Activity This Month

- Calendar (with reminders, transactions, and balances)

- Cash Flow/Projected Balanced Forecast Chart

- Category Summary Report (Spending by category)

- Tag Summary Report (Spending by tag)

- Year over year category, payee and tag comparison reports

- Net Income Graph

- Net Worth Over Time report

- Payee Report

- Spending Cloud Report

- Spending Over Time

- Tax Schedule reports (Schedule A, B, C, D). You can also add customized categories for any other federal tax schedule, such as Schedule E.

Although some account “views” are not included as “reports” in Quicken 2017, you can choose different views to reveal things such as a 1 month and 12 month budgets as well as an Investment Performance views to show portfolio value, cost basis, and gains. You can generate reports from any day of the year via the Quicken calendar too.

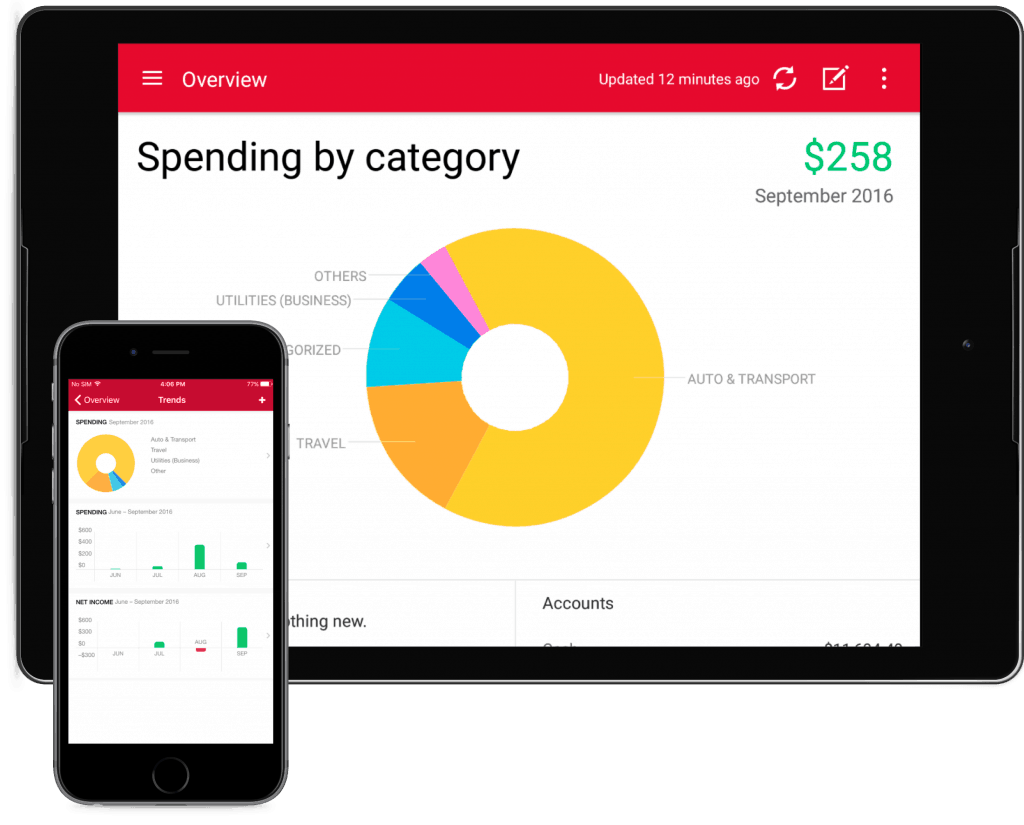

Quicken 2017 Goes More Mobile

Quicken 2017 features an upgrade to the free Quicken Mobile App for both iOS and Android. The iOS mobile app works on iOS 8.0+ and Android 3.0+ – Blackberry but Windows Phones are not supported. Any new transactions or changes you make on your mobile device are still automatically synced with the desktop version but users now have slightly more detailed account information at their fingertips. Editing data is still extremely limited compared to the desktop app although you can still take photos of receipts and sync them with the desktop app. The Quicken mobile app is probably most useful for tracking investments and transactions or searching transactions, checking, savings and credit card purchases on the go.

For the first time, you can also now see a full history of your transactions when you sync data with the desktop version of Quicken 2017. This is particularly useful for investment holdings as you can sync them to see your portfolio and monitor trading fluctuations and movement throughout the day.

Finally on iOS, Quicken has also introduced fingerprint ID in the mobile app for faster and more secure access. In fact, security in general has been enhanced in all Quicken 2017 products with two factor authentication introduced.

Despite these improvements, the Quicken mobile app is still very limited whether you’re a Mac or Windows user. Basic information such as cash flow and credit card transactions are better organized and accessible but other useful data such as scheduled transactions and loan data is still not accessible for some reason.

What’s Missing?

There’s no doubt that Quicken 2017 for Mac is a step forward but frustratingly, it still lacks behind the Windows version in terms of features. There are several financial features still missing compared to the Windows version too, most of which we highlighted earlier when looking at problems importing Quicken for Windows files into Quicken 2017 for Mac. The most notable missing features include debt reduction and savings plans, portfolio analysis, investment tax analysis, loan amortization schedules, forecasting, lot management, multi-currency support and some budgeting features. There’s still no QuickMath, basic profit and loss or balance sheet reports available and investment reports, IRR, ROI and investment allocation views are all missing. There’s also a lack of automated features compared to the Windows version such as automatic reconciliation, automatic backups and automatic linking of online bills so that you can easily see the due date and amount due in Quicken. Finally, although it’s not an essential feature, you still can’t access

It’s hard to understand why many of these quite basic features still aren’t part of the Mac product, especially something as essential as loan amortization in a personal finance software such as Quicken. Another shortcoming for home owners is that Quicken for Windows users get automatic updates of their home values, which gives a more up-to-date overview of their net worth whereas Mac users don’t since home valuation isn’t part of the product. It is possible that Quicken will add these features via updates to Quicken 2017 for Mac over the next few months as Quicken are at least allowing Mac users to vote on features they’d like to see added to Quicken 2017 for Mac.

Quicken product availability in general for Mac users still remains very limited however and it’s hard to see that changing anytime soon. Windows users can also use Quicken Premier, Quicken Home & Business and Quicken Rental Property Manager alongside Quicken 2017 but none of these program are even available to Mac users.

If you do encounter a problem with Quicken 2017, the good news is that they’ve finally provided phone support. Previously, Quicken for Mac help was online Live Chat only and notoriously poor. The fact that you can now speak to someone (based in the USA too) is long overdue and shows that Quicken has again listened to the deluge of complaints from Mac users about previous versions. You can contact Quicken support on 1-888-311-7276 Mon–Fri 5am-5pm PST.

How To Get Quicken 2017 For Mac

Quicken 2017 for Mac was originally launched on the Mac App Store for $74.99 although due to strong competition from Amazon, Quicken slashed 40% off until January 10th 2017. It’s now back at it’s original price of $74.99 from the Mac App Store but the good news is you can get it from Amazon for as little as $43.71 although it’s frequently out of stock.

Note that if you buy the Mac App Store version, due to technical limitations you’ll have to convert Quicken Windows files first on a PC before you can import them whereas the Amazon version does not have this restriction. The Quicken mobile app for iPad and iPhone is still free.

Although there is no Quicken 2017 for Mac free trial, you do get a 60 day money back guarantee if you’re dissatisfied. Quicken promise free feature updates until September 2017 (after which presumably you’ll have to update to Quicken 2018) and free support and security updates up to April 2020. You can also install one purchase of Quicken 2017 on three different Macs under the same license. The system requirements for Quicken for Mac are OS X 10.10 Yosemite or higher including OS X 10.11 El Capitan and OS X 10.12 Sierra. Note that Quicken for Mac is the only version of Quicken available for Mac: Quicken Starter Edition, Quicken Deluxe, Quicken Premier, Quicken Home & Business and Quicken Rental Property Manager are all Windows only products.

Updates to Quicken for Mac 2017

In previous releases of Quicken for Mac, bug fixes and updates to the product were few and far between but since the takeover by H.I.G. Capital, updates to Quicken for Mac 2017 have been much faster. In fact within a few months of the original release, Quicken for Mac 2017 was already updated with fixes and new features, most of which have been demanded by users.

Update 4.3 was released a few months after the release of Quicken 2017 for Mac and included:

- Custom report drill down: Click on numbers in a custom report to see the transaction details that make up that number.

- 12-Month budget printing & currency: Basic 12-Month budget printing plus ability to set currency.

- Transfer shortcut feature: Brought back from Quicken 2007 for Mac and already in Quicken for Windows. Allows you to enter a transfer in the category field by typing a bracket “[“. Enables you to hide the Transfer field so it doesn’t take-up space.

There were also some bug fixes including a schedule transaction bug fix, report payee filter fix, custom report bug fixes and bug fixes that caused double counting of cash accounts in investments.

More recently, the latest update to Quicken 2017 on Mac (Update 4.4.1) was released and now includes:

- New Transaction Sidebar Indicator: After updating connected accounts, a blue dot now appears on the sidebar, next to all accounts on the sidebar that have new transactions.

- Auto-Backup: Much demanded feature to backup files (five at a time) to a designated location after logging out of the app. You can’t choose how many backup copies yet though.

- Orange Pencil Fix: You can mark items in orange pencil as removed and delete them.

- Export or Copy Reports: You can now export or copy the comparison or summary report to a spreadsheet which makes it a bit easier to analyze the data or print it.

- Deactivate Auto-Opening Splits: Ability to turn off auto-opening of splits in the registers or the reconcile screen.

- Report Comparison Customization: You can now more easily compare the current and previous period including quarterly and monthly.

- New Total Column: The summary report now has a much demanded Total column.

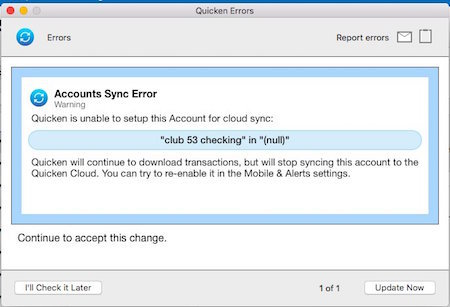

This was closely followed by a critical 4.4.2 update on January 13th 2017 in anticipation of an update to Quicken cloud to ensure continued compatibility with Quicken for Mac. The latest update was a bug fix update 4.4.3 on 25th January 2017 including a fix for a non-standard character problem with online bill payments. However, it should be noted that Cloud syncing can still be temperamental on Mac with Quicken sometimes unable to setup syncing for accounts:

In general, the rapid speed at which Quicken has rolled-out these free updates to Quicken on Mac seems like an encouraging and long overdue effort by the company to finally start responding to Mac users with the same level of support that Windows users already enjoy. Note that those who purchased Quicken from Amazon or direct from Quicken will be able to get updates quicker than those who purchased via the Mac App Store which has to approve all updates before pushing them to users. You can read the full update history and release notes of Quicken 2017 for Mac here.

To get a good overview of the most important features, functions and updates covered in this Quicken for Mac 2017 review, we recommend also watching the video below.

And Finally: Is Quicken Moving To A Subscription Payment Model?

One final thing to be aware of is that Quicken 2017 could be the last version of Quicken that you can buy with a one off payment in the USA. The Canadian version of Quicken 2017 was released shortly after the US version and is exactly the same but with the crucial difference that it is subscription payment only. In addition, Quicken stated in the FAQ for the product that all future Quicken products will be subscription payment only although after a substantial outcry from the Quicken community, it later revised this to specify it was referring to Quicken Canada products only. The FAQ does go on to state however that if Canadian users don’t renew the subscription every year, they will no longer be able to update their accounts using Quicken and the application will become read only on both Mac and PC.

This is obviously an important move that Intuit has quietly slipped into the Canadian version and it remains to be seen whether it will be rolled out in the US version. There has been a considerable outcry by Quicken users about this move and you can read more about Intuit’s decision to make future versions of Quicken subscription payment only here. If this is a deal breaker for you, check out our guide to the best Quicken for Mac alternatives as there are some excellent equivalents to Quicken on Mac such as the free version of Empower.

If after reading this you still want to use the Windows version of Quicken on your Mac, then also check out our article on ways to run Windows on Mac.

Discover more from MacHow2

Subscribe to get the latest posts sent to your email.