Black Friday Update: You can currently get 80% off TradingView for Black Friday week.

TradingView won our vote as the best stock trading software for Macs and in this review, we look at why and what this excellent FREE trading software can do.

I’ve been testing trading software on a Mac for over 10 years and can safely say that TradingView is by far the best tool I’ve used for it on macOS.

TradingView is a powerful chart-based platform that provides stock, crypto, forex, and futures charting and analysis tools that’s well-suited for both beginner and advanced traders.

It was established in 2012 and now has close to 90 million users worldwide making it one of the most popular trading tools available for all levels from beginners to experienced traders.

It’s not only for analysis though.

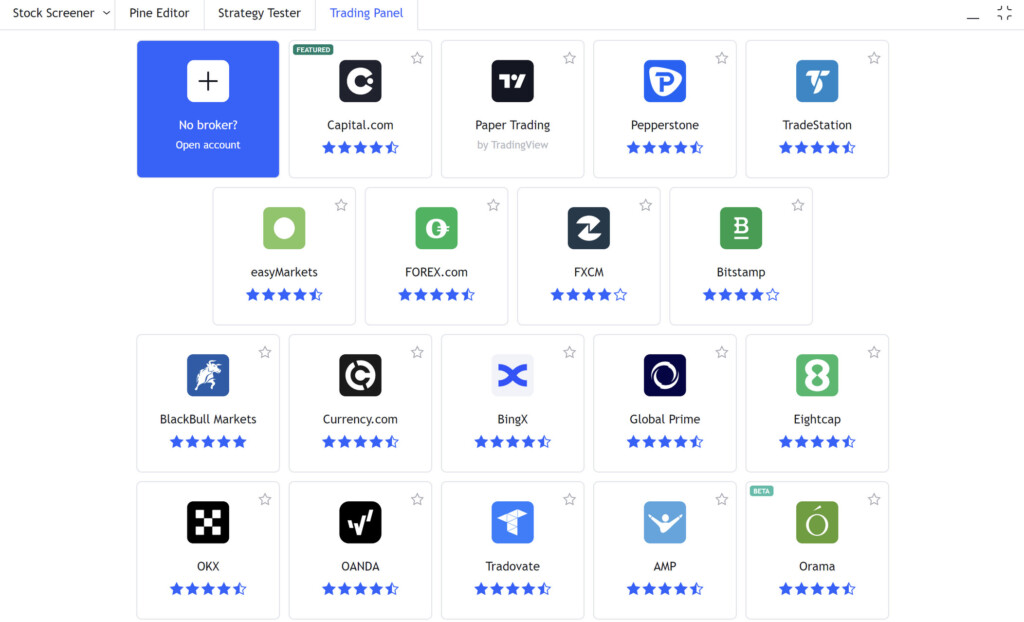

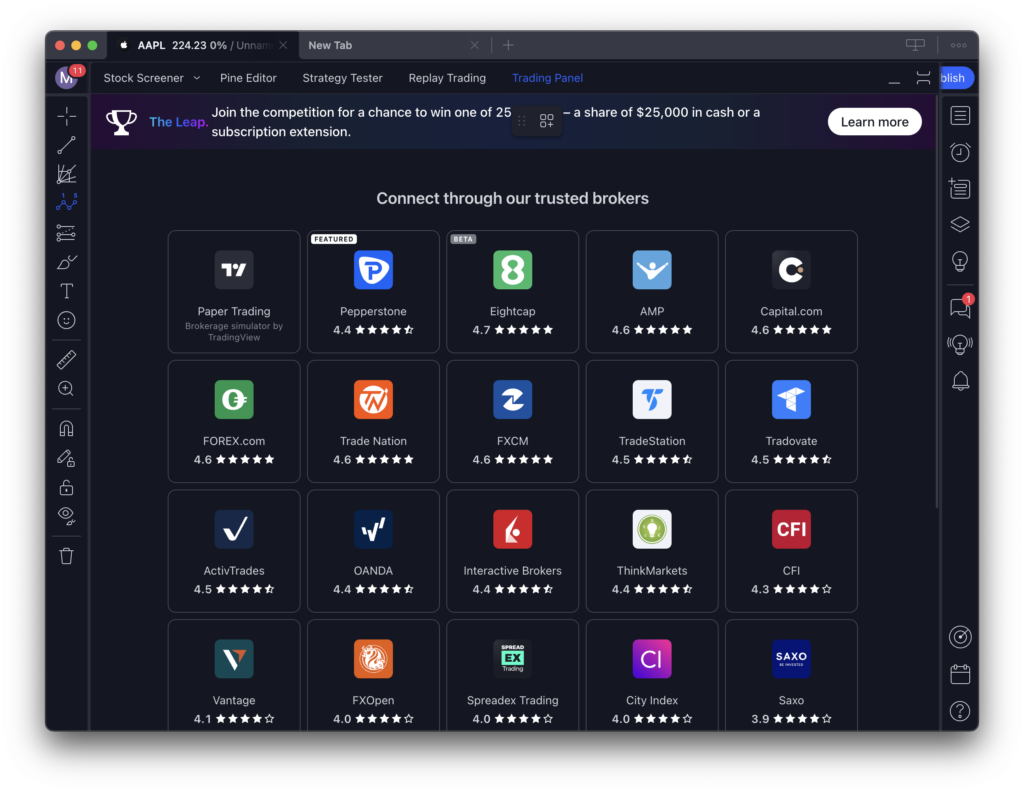

You can link it to your favorite trading platforms such as Pepperston, Oanda, TradeStation, Gemini and FXCM so that you can trade directly from the Mac desktop app itself.

Unfortunately, this isn’t available in all countries and if you’re based outside of the US, you may not be able to link a broker to TradingView.

However, for those that can, it’s a massive advantage over other technical analysis software as it allows you to trade instantly without delay.

The Mac desktop app does everything the Cloud version can do, making it extremely easy to analyze market fluctuations, chart possible outcomes, spot trends or opportunities and execute trades in macOS itself.

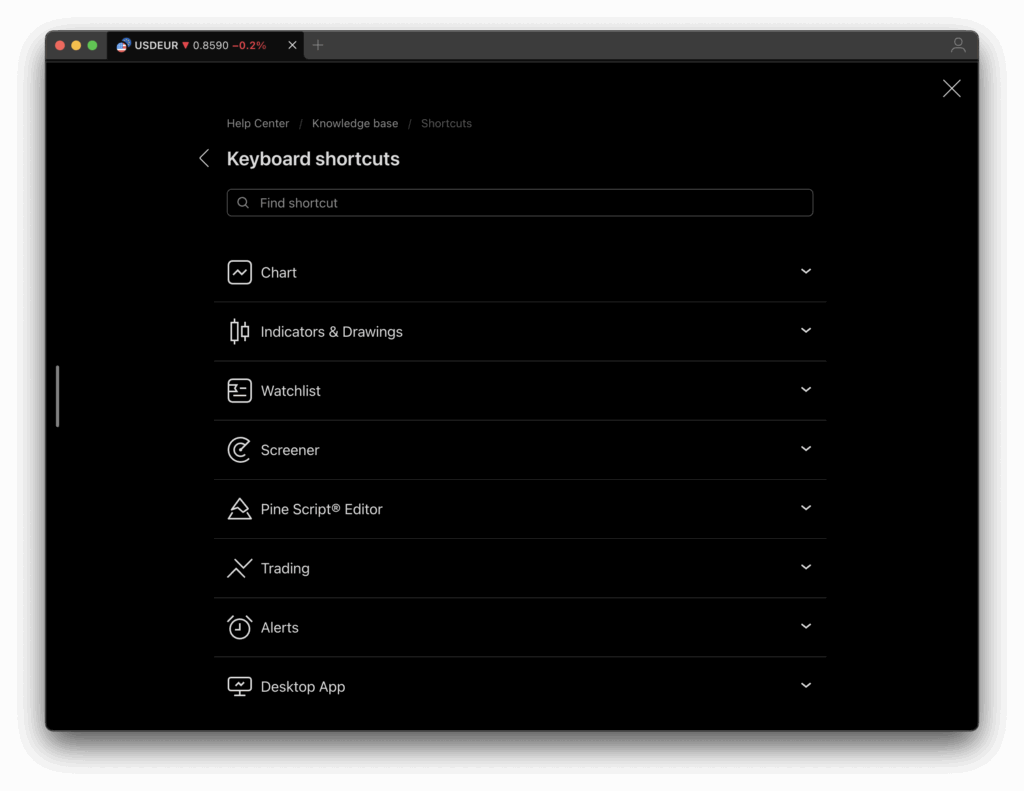

It’s also full of useful keyboard shortcuts that help you keep your focus on trading rather than the app itself.

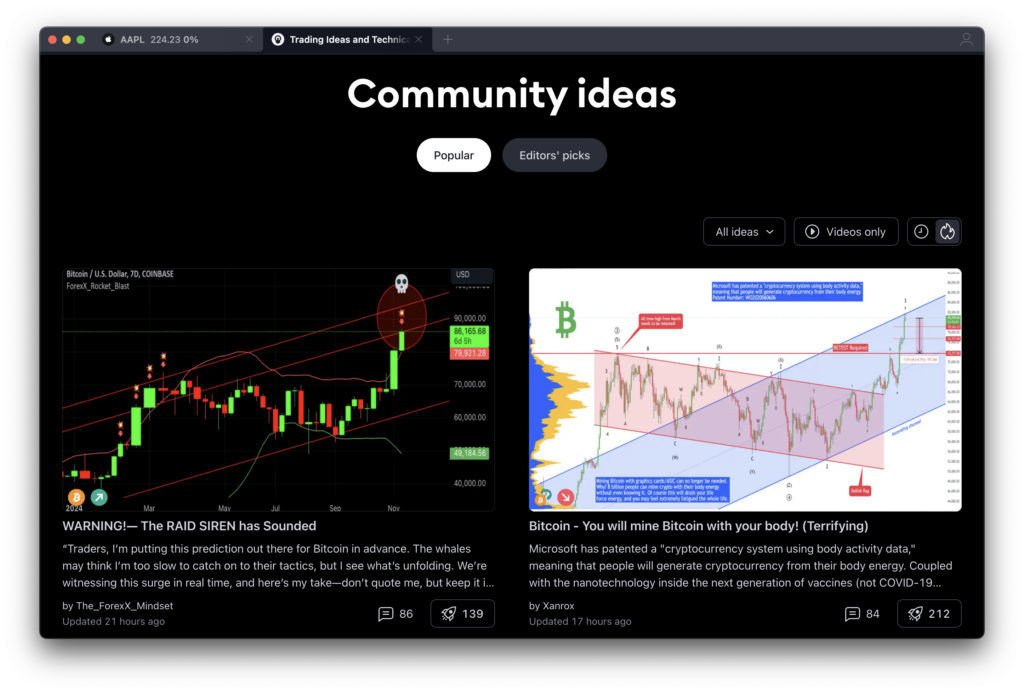

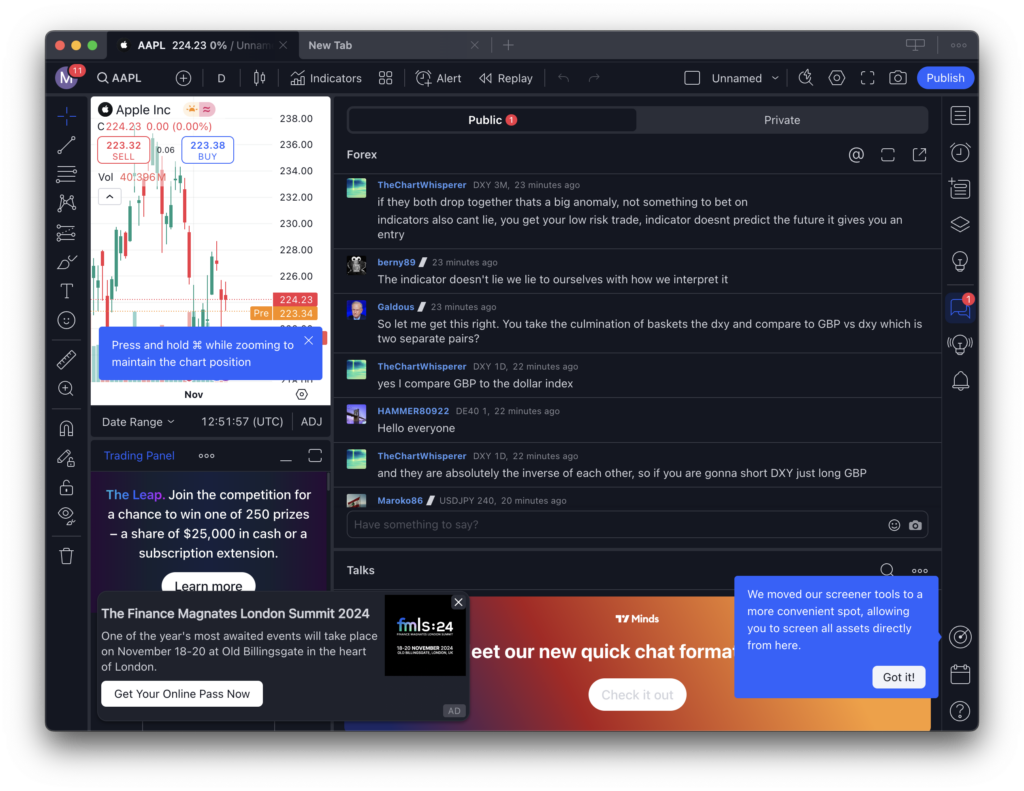

With close to 90 million users, there’s also a thriving community of traders that give TradingView a strong social aspect which makes it both fun and educational compared to more technical stock analysis apps like MotiveWave for Mac.

Best of all, many of the features in TradingView are FREE to use.

Here we take a closer look at using TradingView on a Mac in more detail.

Table of Contents

TradingView Pricing

One of the really outstanding things about TradingView is that you can use it for FREE.

The free version of TradingView can be used for as long you want to view charts, perform technical analysis.

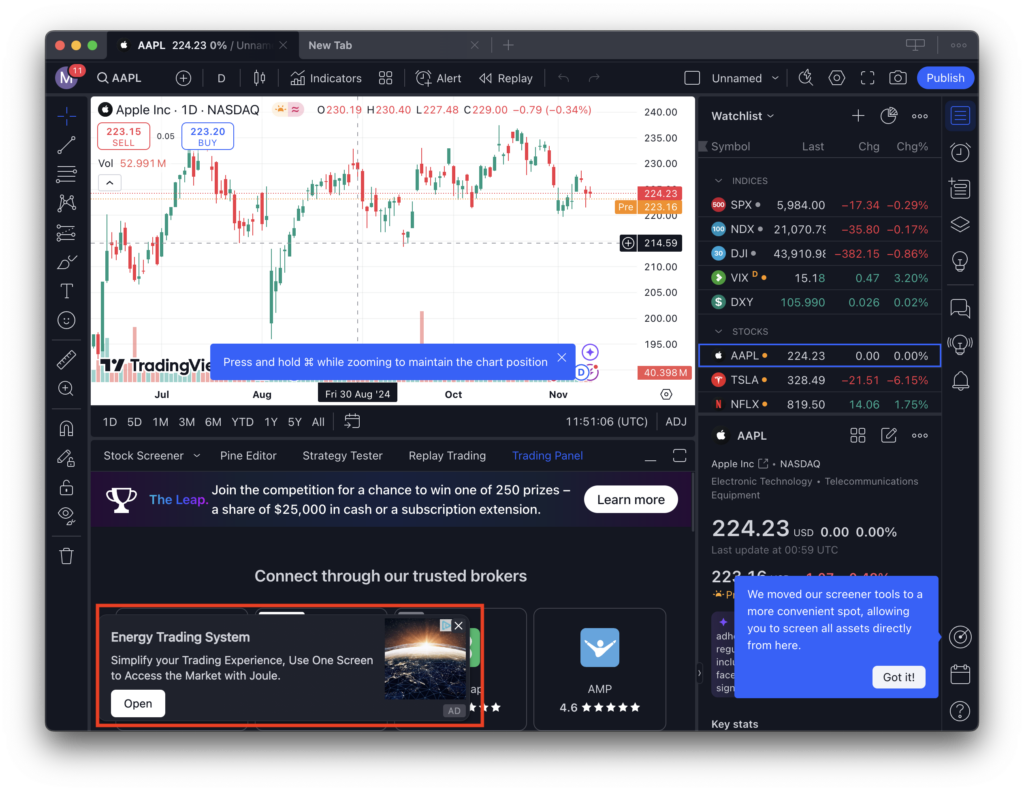

It is ad supported but we found they don’t interfere with the overall experience as they usually pop-up at the bottom and can be ignored or closed easily as you can see below.

The major difference between the free version and the paid plans is how quickly the information you’re seeing is updated, the number of features you can use and the removal of ads.

The paid plans offer additional data from exchanges such as NASDAQ, NYSE, NYSE ARCA, OTC and CME that are updated in real-time.

This is absolutely essential if you’re going to trade seriously.

Note that some of these Exchanges require a small extra fee per month for real time data (more on this shortly).

In addition, you also can’t interact with other traders in the free version – you have to upgrade to a paid plan to unlock the social features.

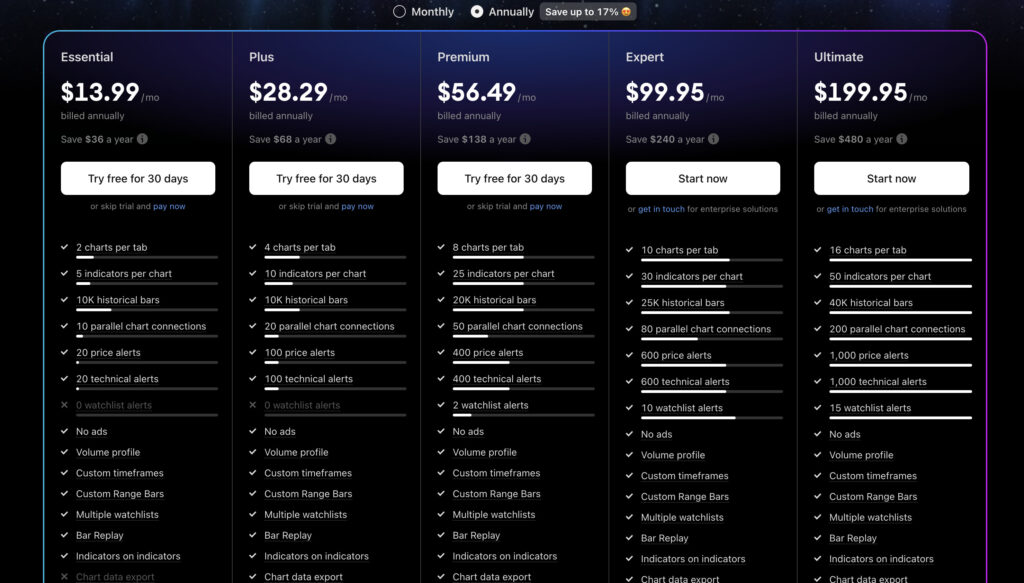

There are 5 TradingView paid plans available – Essential, Plus, Premium, Expert and Ultimate

The main difference between the plans is the number of charts, indicators, historical bars, price alerts, technical alerts and chart connections available.

If you pay annually, you get 17% off meaning each plan costs the following:

- The Essential plan is $13.99 per month

- The Plus Plan is $28.29 per month

- The Premium Plan is $56.49 per month

- The Expert Plan is $99.95 per month

- The Ultimate Plan is $199.95 per month

Pricing is 17% cheaper if you pay annually up front which is the equivalent of around two months free but paying monthly costs a bit extra.

You can cancel subscriptions at any time and you won’t be penalized for cancelling.

However, refunds are only available for annual plans and subscriptions paid with cryptos are also non-refundable.

Note that you can currently get 80% off TradingView for Black Friday week.

Real Time Data Subscriptions

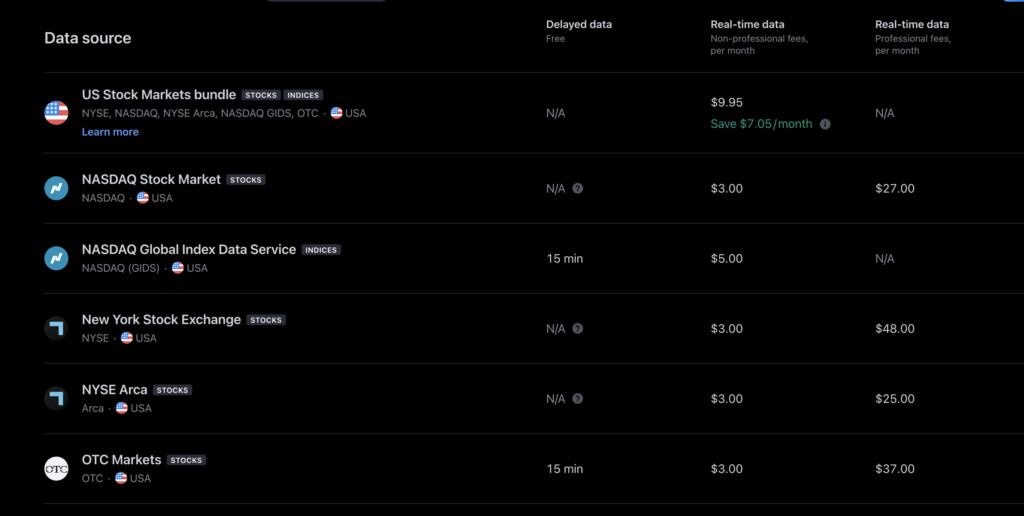

TradingView delivers real-time data for many Exchanges but for some, the data is delayed and you need to pay a small add-on fee.

You can check if data for the chart you’re viewing is delayed by clicking on the market status of a chart where you’ll see a “Data is delayed” message.

This is because TradingView itself has to pay added-fees for real-time data from some Exchanges.

If you want real-time data for specific exchanges such as the NASDAQ or NYSE then there are added monthly fees usually ranging from $3 to $5 for individuals.

You can also buy exchange bundles such as the US Stock Exchange Bundle which includes the NYSE, NASDAQ, NYSE Arca, NASDAQ GIDS and OTC.

Note that real time data fees are divided into lower “non professional” fees for personal use only and higher “professional” fees for businesses, fund managers and asset managers.

TradingView Overview

At the center of TradingView are sleek, customizable charts and a user-friendly interface that offers a wealth of technical analysis tools, ranging from basic indicators like moving averages to advanced strategies involving more complex overlays.

Stock trading and day trading are not easy but a visual tool like TradingView makes it much easier to visualize information to make better trading decisions.

The charts and indicators make it much easier to spot trends and digest complex financial data, thanks in part to millions of user-generated scripts and ideas

In our opinion, TradingView is a much better investment than expensive stock scanning software because its far more effective and gives you much more for your buck.

Even better, the basic stock analysis, research and charting features are free although it’s well worth upgrading for the paid plans to get more real-time information.

As mentioned earlier, not all information is available or updated in real time in the free version and getting up to date information is crucial to trade successfully.

Although TradingView is not an actual stock trading platform, you can link it to brokerages like Pepperstone, Oanda, TradeStation, Gemini and FXCM to make trades.

You can find a full list of supported brokers here and there’s also an API that you can request your current broker to use in order to get added to the list.

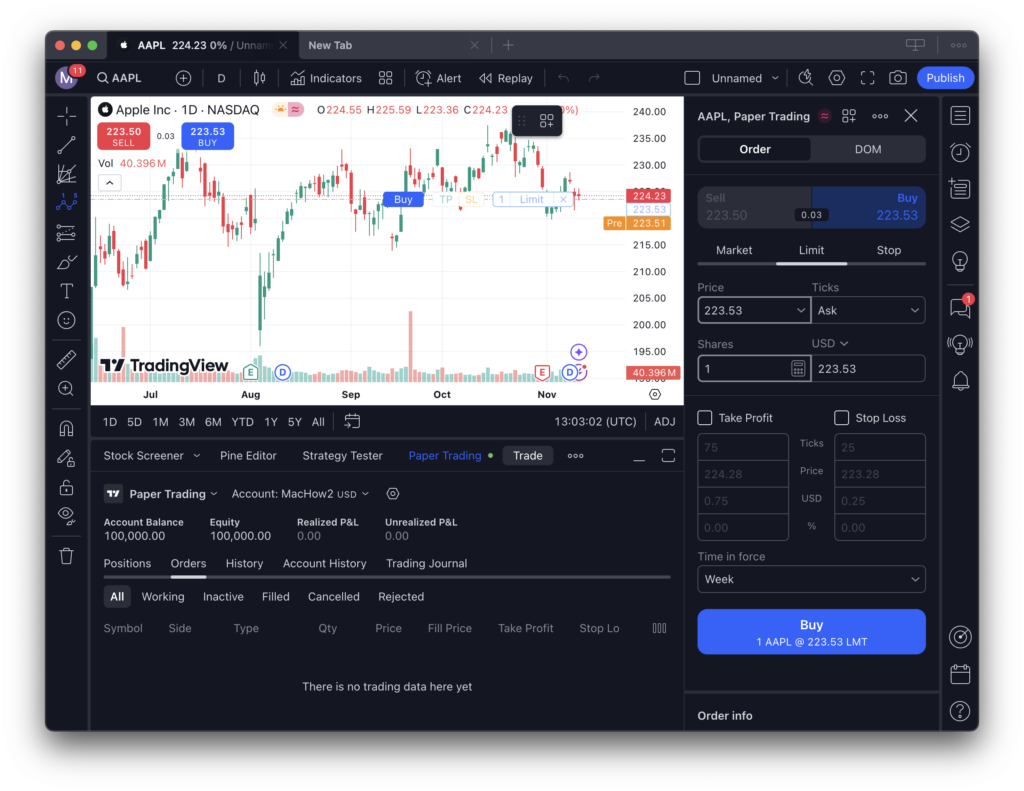

You can also use the TradingView Paper Trading account to practice trading without risking losing any real money first.

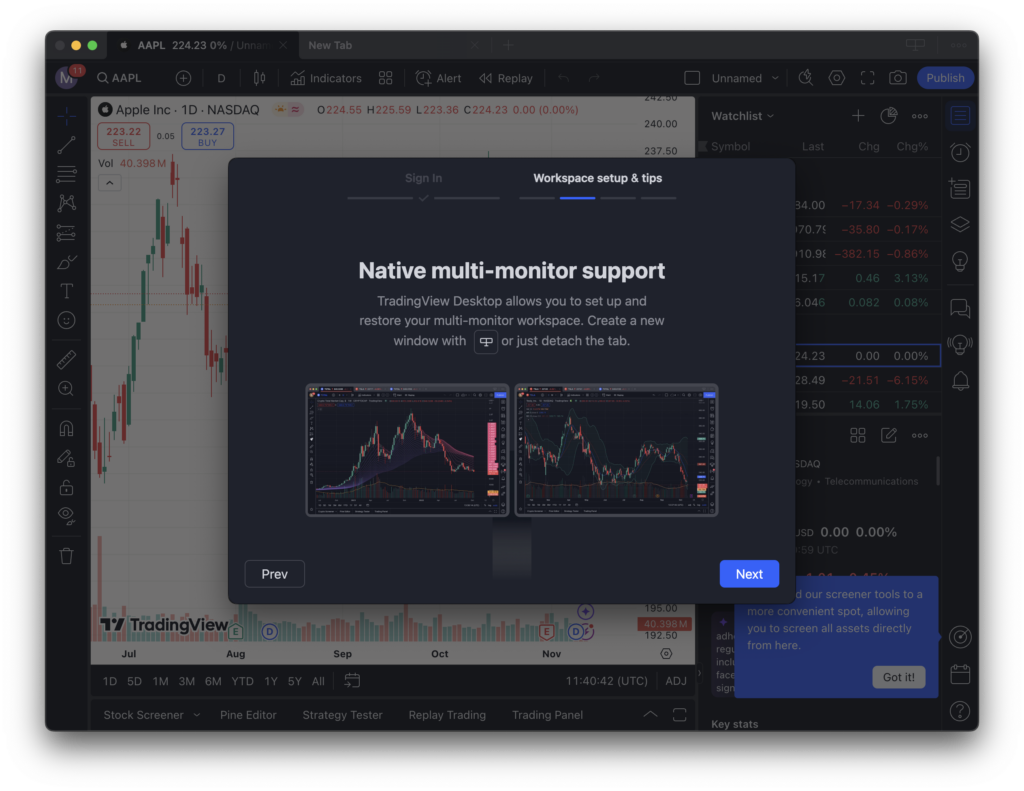

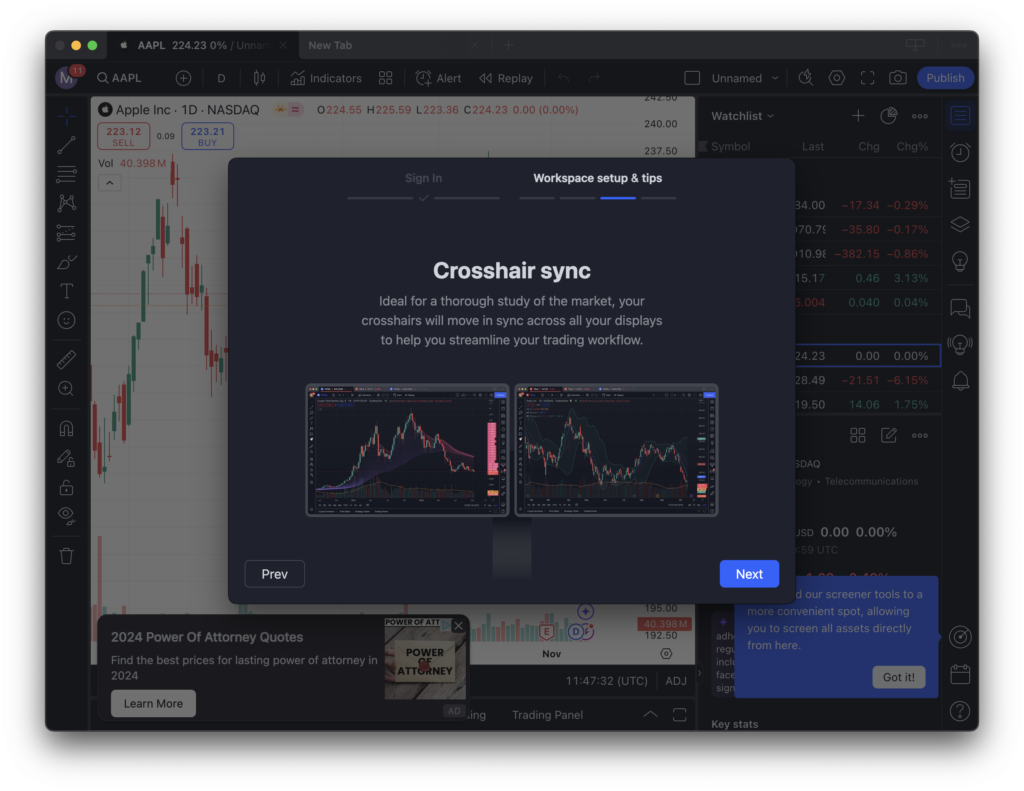

Many traders use an external display with their MacBook and TradingView automatically helps you configure the application to work on multiple displays.

This includes syncing the crosshairs so that it targets accurately on different charts at the same time for in-depth market research.

Highlights Of TradingView

The key features of TradingView for Mac include the following:

- 14 different charts

- Over 20 timeframes to

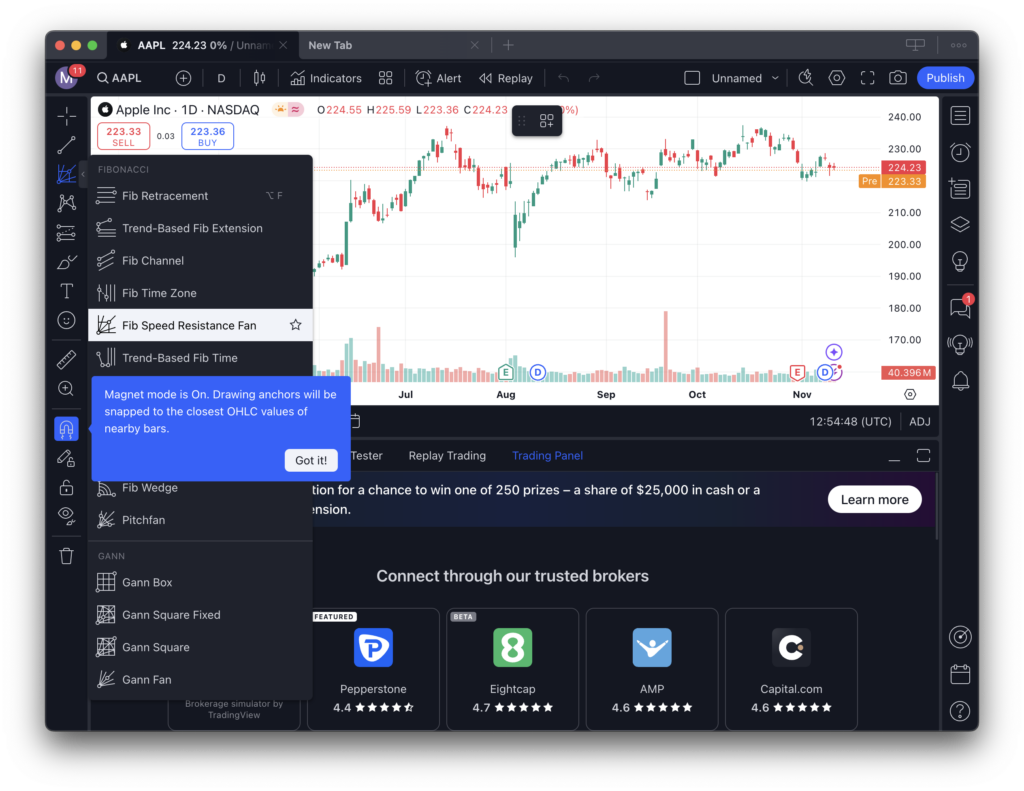

- Over 90 drawing tools

- More than 100 ready-made indicators

- Over 100,000 user-generated indicators

- Support for over 70 exchanges from 50 countries

- Lots of Mac keyboard shortcuts

Here’s a closer look at some of these features.

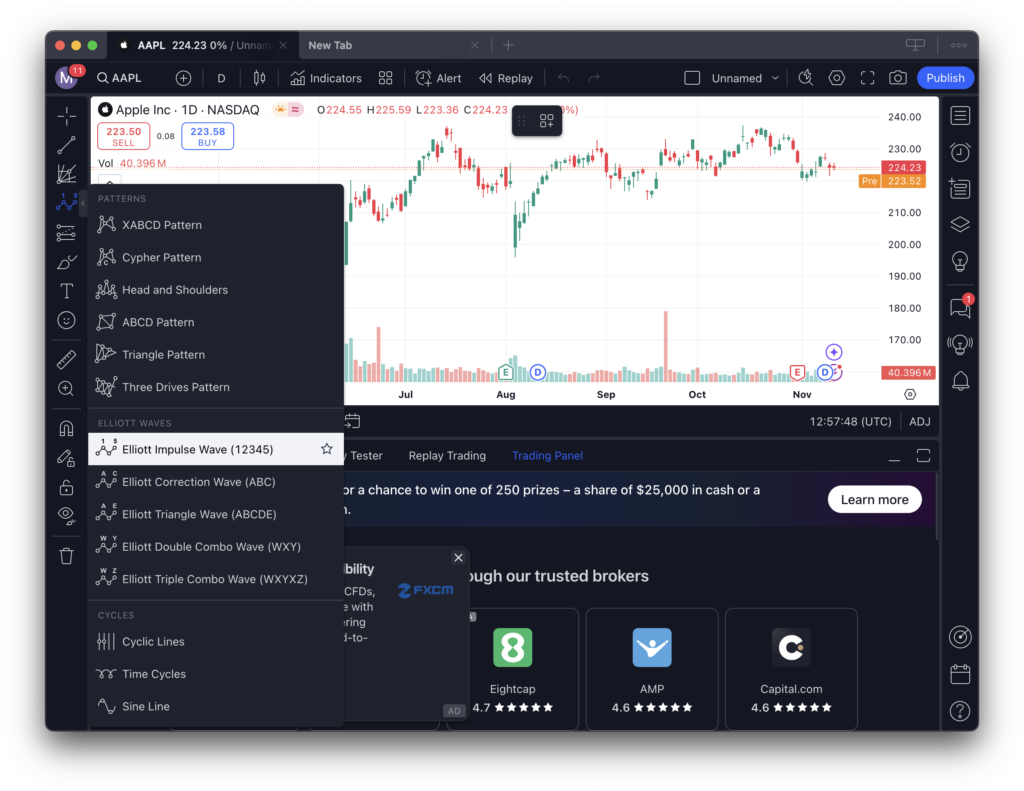

- Superb Charting Features: TradingView is easily the best stock charting tool we’ve used with around 14 different chart types to choose from. The sheer number of ways you can manipulate, edit and customize charts is truly amazing. All charts are in HTML5 so they’re very fast and responsive to work with too. There are a wide range of drawing tools in TradingView including Gannt and Elliott Waves plus an endless number of technical indicators to help you analyze price actions.

- Broker Integration: You can make trades in real time without ever leaving TradingView by connecting it to a stock broker platform. TradingView works with most major brokers including Oanda, Pepperstone, TradeStation (which supports Options trading too), Gemini and FXCM. TradingView also recently added support for the Indian broker Dhan making an excellent choice for Indian based Mac users looking for stock trading software.

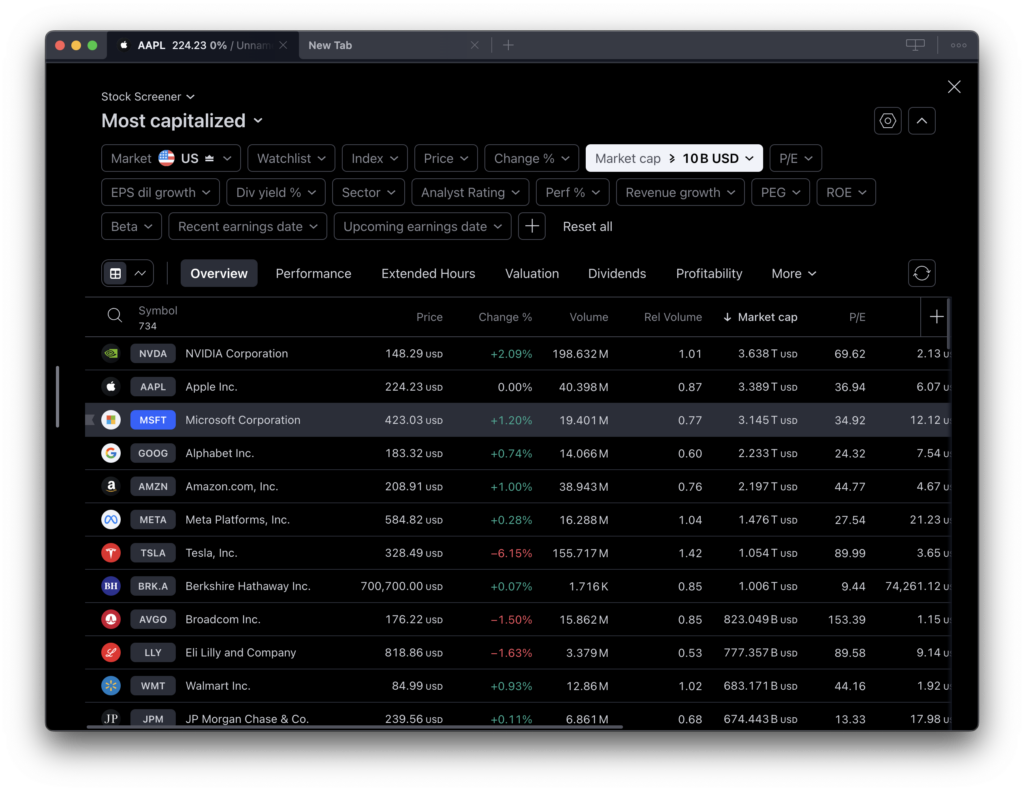

- Stock Screener: There are three stock screeners in TradingView for stocks, forex and crypto. You set the criteria (such as overbought RSI) and TradingView helps you find the stocks. This includes TradingView’s own “Strong Sell or Strong Buy” signal assessment based on its analysis of various indicators. This makes it extremely easy to find potentially profitable trades based on over 100 different criteria. TradingView estimates there are over 2 million instruments available so its safe to say, pretty much everything is covered.

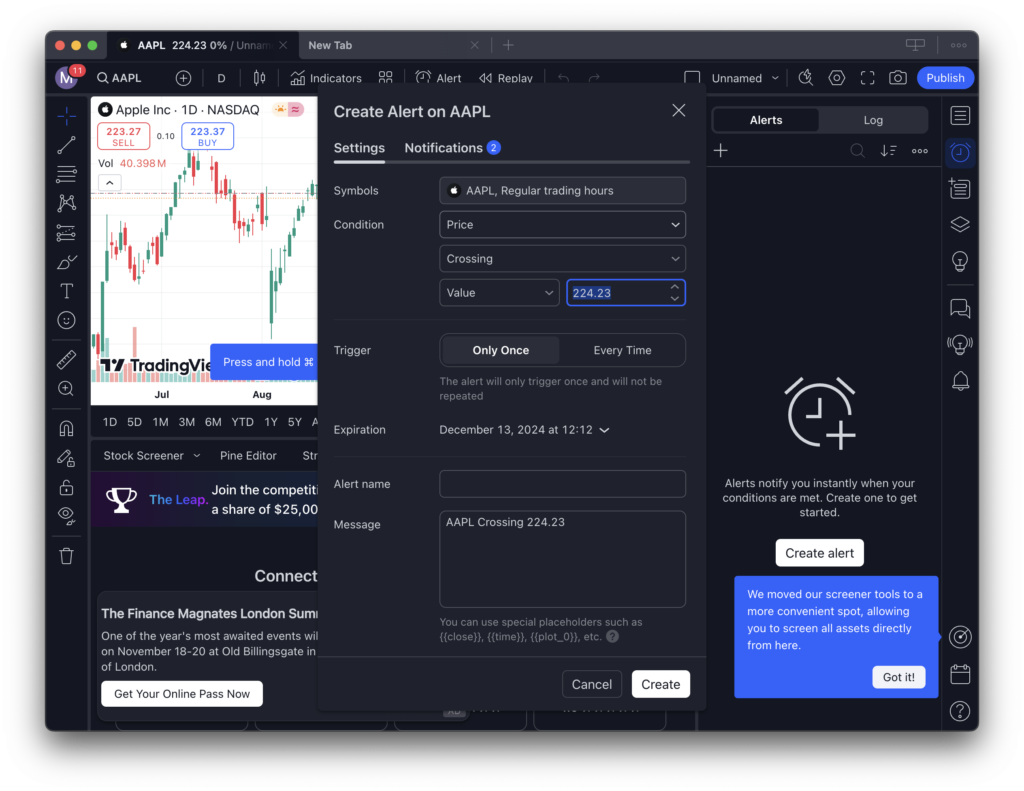

- Alerts: You can set up up to 12 alerts to be displayed on your desktop or even sent to your mobile device when certain trading conditions are met. This prevents you getting overwhelmed by trying to track everything that’s happening on your watchlist. Note that the number of alerts you can set are limited unless you upgrade to a paid plan which we strongly recommend.

- Watchlists: You can configure watchlists of your favorite currency pairs and see real-time price updates. However, I preferred using the alerts to keep track of important movements as the watchlist gets very long, very quickly!

- Paper Trading: TradingView has a virtual trading account with $100,000 virtual credit which allows you to practice trading without losing any money. If you’re new to trading, we strong recommend doing this first. Note that the information you see in this is delayed so its not all real-time.

- Coverage: TradingView covers data from Europe, US, Asia and Russia with more than 30,000 trading instruments in over 70 different exchanges. If it’s tradable, it’s probably in TradingView.

- Social Community: There’s a very active, thriving and knowledgeable social community in TradingView that offer tips, advice and trading thoughts for free. You can interact with these traders, ask questions and talk trading tactics to become a better trader.

- Chart Customization: TradingView has its own programming language Pine which allows you to customize charts to your specific needs. This is an advanced feature but well worth learning Pine for professional traders as it gives you a level of control not normally possible with trading charts.

- Mobile Apps: There are apps for iPhone, iPad and Android devices which allow you to do everything you can on the desktop version plus receive alerts for stock movements. Note that the layout of the mobile app interface is a bit different to the web interface and it can be a bit confusing to set up or find things. You can however also use your mobile web browser to access TradingView in the Cloud too.

- Widgets: You can create widgets of charts, tickers and other data in TradingView that you can then embed into any website or app that you want to integrate it with.

- Keyboard Shortcuts: Keyboard shortcuts in TradingView are one of my favorite features because they dramatically speed up chart analysis and trade planning. Instead of navigating menus, you can instantly add trendlines, switch tools, change timeframes, or manage watchlists with a single keystroke, keeping your focus on market movements. It’s the number of shortcuts on TradingView that impressed me and you can find out more in my post on my favorite TradingView Mac keyboard shortcuts.

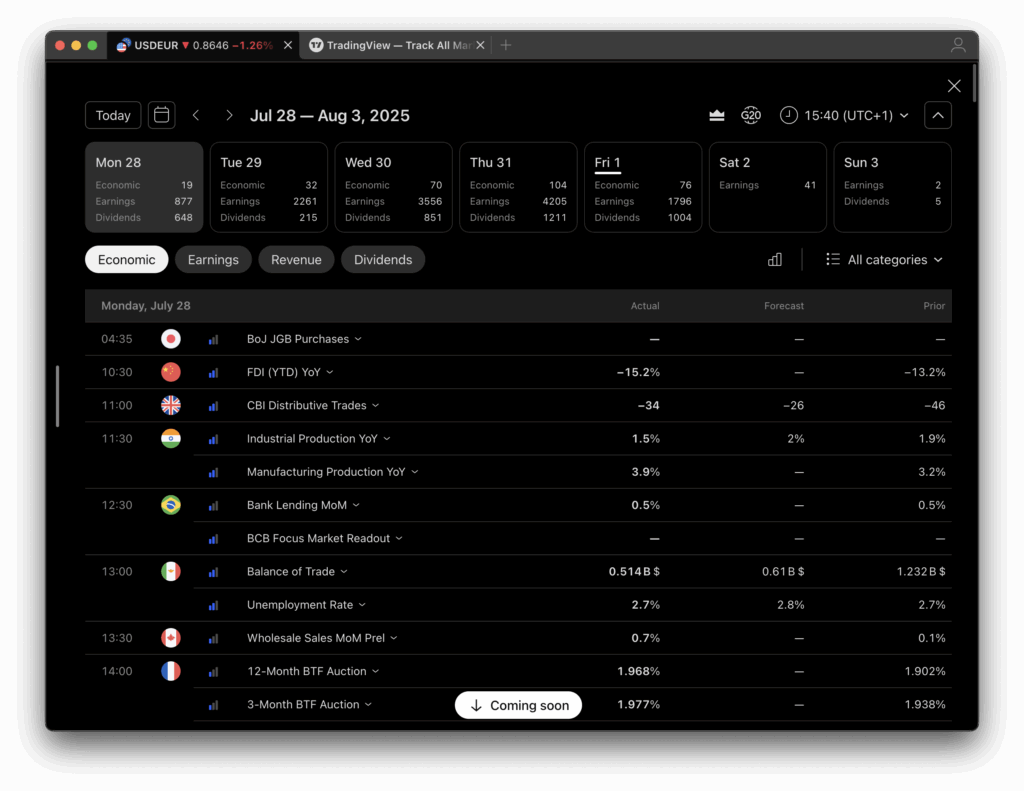

These are some of the features we liked the most but there are others we haven’t covered including Bar replays, fundamental stock data, back testing, heat maps, real-time global news and an economic events calendar.

TradingView vs MT4

Many Forex traders use MT4 or MT5 for analyzing currency fluctuations but we actually think TradingView is far better than MT4 anyway.

This is particularly true for Mac users since neither MT4 or MT5 are available for Macs.

Although there are ways to run MetaTrader on a Mac, in our opinion, TradingView blows it out of the water in terms of usability and features as you can read here.

TradingView Downsides

One of the main downsides of TradingView is that the number of brokers you can connect it to is still quite limited, especially outside of the USA.

It’s also quite frustrating that you’re limited to one chart at a time in the Basic free version as having multiple charts open is an essential for serious trading.

The lack of real-time chart updating in the free version is also a big disadvantage and so it’s definitely worth the modest investment to upgrade to a paid plan.

The add-on fees for certain Exchanges is also annoying as you’d expect this to be covered by the subscription.

However, the fees are just a few dollars with bundles available for multiple exchanges and well worth it for serious trading.

FAQ

Can I use TradingView really be used for Free?

- Yes, you can use TradingView for free for as long as you want but it is limited to one chart, only 3 indicators per chart, no ability to set customized time intervals, delayed data etc. It’s worth upgrading to a paid plan to remove these limitations.

Can I use TradingView on multiple devices?

- Yes, TradingView works on any web browser and syncs across devices. You can seamlessly switch from Mac to mobile without losing data.

Is TradingView suitable for complete beginners?

- TradingView’s free version is accessible for beginners, but the array of tools may be overwhelming at first. Exploring tutorials and the community forum can help ease the learning curve.

Can you pay for TradingView with Cryptos?

- Yes you can pay for a annual TradingView subscriptions with the following cryptos: BTC, ETH, USDC, USDT, BCH, LTC, DOGE, DAI and Matic.

Can TradingView connect to brokers for live trading?

- Yes, TradingView supports live trading through select brokers, though this requires a Pro account or higher. Check the list of compatible brokers on the platform.

How does TradingView’s paper trading work?

- Paper trading lets you practice trades without real money, which is great for learning. However, it’s limited to TradingView’s market data, so prices might not match real-time broker data exactly.

Are there any free alternatives to TradingView?

- For basic charting and analysis, platforms like StockCharts or Investing.com offer some free tools, but they don’t match the depth and customization of TradingView. If you have a TD Ameritrade brokerage account, its thinkorswim platform is also free.