While we can’t promise to turn you into the Wolf of Wall Street overnight, we can show you the best stock trading software for Mac in 2026, including professional desktop tools and Mac-compatible trading platforms that work reliably on macOS.

We’ve spent years testing trading software on both Apple Silicon and Intel Macs, and while there are fewer native options than on Windows, there are still excellent Mac trading software and platforms available for stocks, ETFs, crypto, and forex.

This guide focuses primarily on stock trading software for macOS – meaning professional charting and analysis tools while also covering the best Mac-compatible trading platforms where placing trades with a broker is the priority.

After extensive testing, we found that TradingView is the most complete stock trading software for Mac overall, combining professional charting with broker integration, while platforms like MotiveWave and Interactive Brokers are better suited to advanced or professional traders.

Disclaimer: This guide is for educational purposes only and does not constitute financial advice.

Table of Contents

- Who This Guide Is For

- What We Looked For in Stock Trading Software for Mac

- Best Stock Trading Software for Mac (Desktop & Advanced Tools)

- 1. TradingView (Best Overall)

- 2. MotiveWave (Best Advanced Analysis)

- 3. thinkorswim (Best Desktop Experience)

- 4. Interactive Brokers (Best For Pro Trading Platform & Software)

- 5. TrendSpider (Best For AI Trading)

- 6. TC2000 (Best For Trading & Brokerage)

- Best Trading Platforms for Mac (Broker-Based)

- 7. eToro (Best For Beginners)

- 8. RobinHood (Best For Casual Traders)

- 9. Fidelity (Best for Long-Term Investors)

- 10. IG (Best For UK Traders)

- Trading Software vs Trading Platforms on macOS

- Important Broker Details Mac Users Should Know

- Regional Restrictions to Be Aware Of

- Can You Use iPad-Only Trading Apps on a Mac?

- Frequently Asked Questions

Who This Guide Is For

This guide is designed for Mac users who want to trade stocks reliably on macOS, whether for analysis, active trading, or long-term investing.

It’s ideal if you:

- ✅ Want stock trading software for Mac with advanced charting and technical analysis

- ✅ Use an Apple Silicon (M-series) or Intel Mac and want native or Mac-optimized tools

- ✅ Prefer desktop or browser-based trading software, not mobile-only apps

- ✅ Want access to paper trading or simulators before risking real money

- ✅ Need a Mac-compatible trading platform to place trades with a regulated broker

This guide is less suitable if you only want:

- ❌ A mobile-focused trading app with minimal charting

- ❌ A Windows-only trading platform without using virtual machines

What We Looked For in Stock Trading Software for Mac

In shortlisting the best stock trading software and trading platforms for Mac, we gave preference to tools that offered the following features:

Native macOS Compatibility

Where possible, we prioritized trading software that offers a native Mac desktop app, rather than requiring Windows emulation. Extra weight was given to platforms that fully support Apple Silicon (M-series) Macs as well as Intel-based Macs.

Advanced Charting & Technical Analysis

High-quality charts, custom indicators, drawing tools, and multi-timeframe analysis are essential for active traders and investors using Mac trading software.

Chart Trading & Order Management

The ability to place trades directly from charts, along with advanced order types such as stop-losses and take-profit targets, is especially important for day traders and swing traders.

Backtesting & Data Replay

We looked for trading software that allows historical data replay or backtesting, enabling traders to refine and test strategies before committing real capital.

Execution Speed & Reliability

Fast and stable performance is critical. Poorly optimized Mac trading platforms can result in delays or missed trades, particularly during volatile market conditions.

Paper Trading & Simulators

The best stock trading software for Mac allows users to practise with simulated money, helping beginners learn the platform and experienced traders test new strategies risk-free.

Availability by Region

All platforms listed are available to users in the USA, unless otherwise stated. Where relevant, we also highlight options suitable for UK traders.

Portfolio & Investment Tracking

Preference was given to platforms that integrate with, or complement, investment tracking and personal finance software on macOS.

Best Stock Trading Software for Mac (Desktop & Advanced Tools)

This section focuses on the best stock trading software for Mac users who want powerful analysis tools, advanced charting, and professional-grade functionality. These platforms are ideal for active traders, technical analysts, and anyone who wants more control than a basic broker interface provides.

Comparison Table: Stock Trading Software for Mac (Analysis & Charting)

| Software | macOS Compatible | Type | Pricing (from) | Best For |

|---|---|---|---|---|

| TradingView | ✅ Native + Web | Trading Software | Free / $13.99 | All-round trading software |

| MotiveWave | ✅ Native | Trading Software | Free / $24 | Advanced technical analysis |

| thinkorswim | ✅ Native | Trading Software | Free | Pro traders & options |

| Interactive Brokers (TWS / IBKR Desktop) | ✅ Native | Trading Software | Commission-based | Professional traders |

| TrendSpider | ✅ Web | Trading Software | $39 | Automated analysis |

| TC2000 | ⚠️ Web / VM | Trading Software | $20.82 | Charting & workflows |

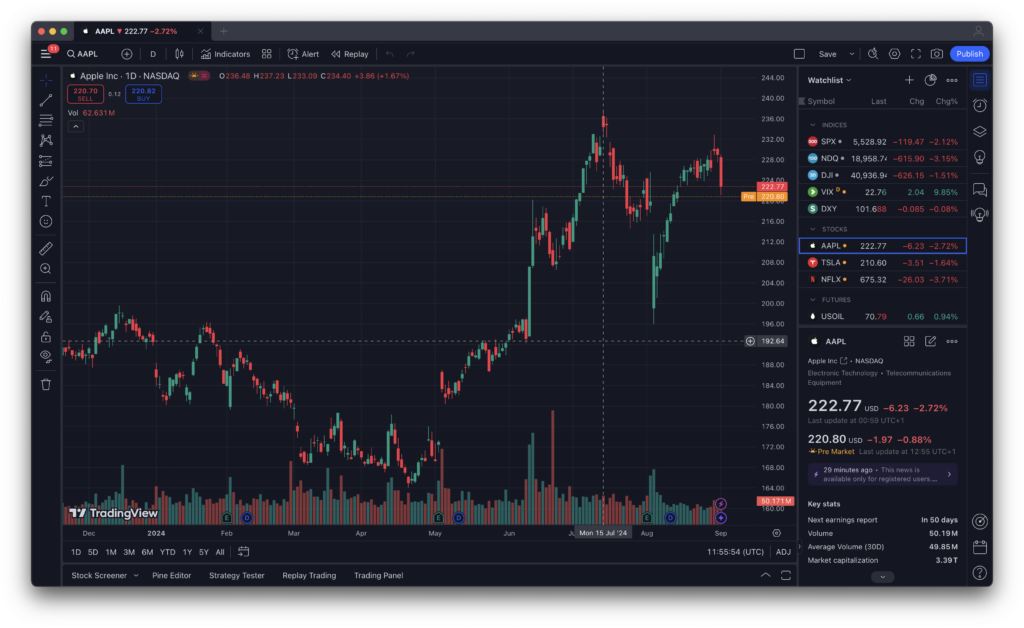

1. TradingView (Best Overall)

Why we like it: TradingView is a powerful, community-driven charting platform that’s great for both beginners and pros.

Key Features:

- Community-driven: Learn and share strategies with millions of traders

- Beginner-friendly: Easy to get started

- Professional tools: Advanced charting and indicators

- Mac-native: Works on Intel and Apple Silicon Macs

- Free plan: Most features available at no cost

- Pro upgrades: More charts, indicators, real-time data, ad-free

- Broker integration: Trade via Oanda, TradeStation, Interactive Brokers, and others

- TradingView Mac keyboard shortcuts: Speeds up trading

Pricing: Free for one chart and indicator, Paid plans start at $13.99/month with up to 17% off if paid annually

More Info: See our full TradingView for Mac review

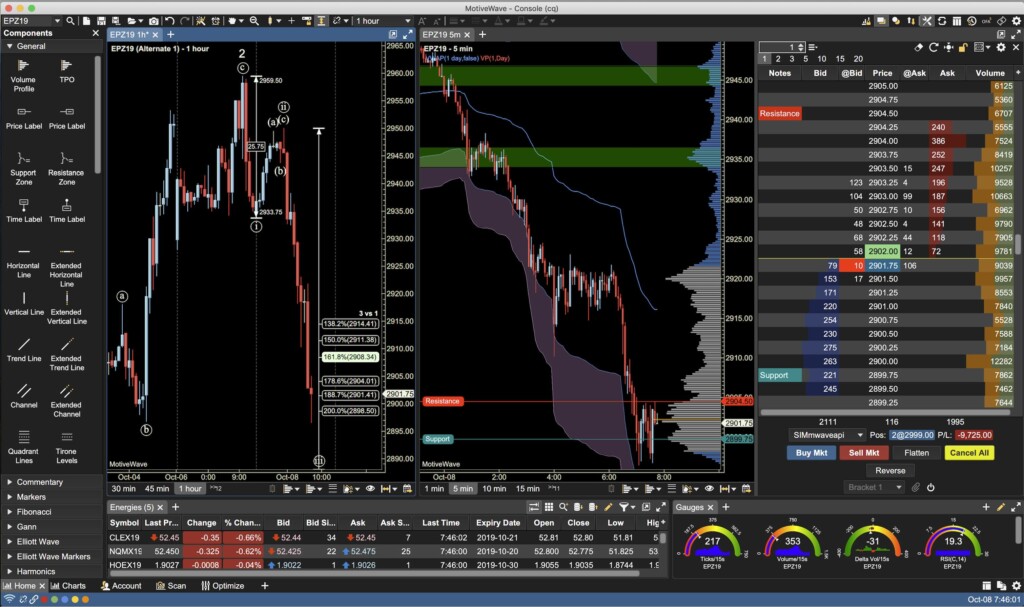

2. MotiveWave (Best Advanced Analysis)

Why we like it: MotiveWave is a powerful desktop trading platform for Mac, ideal for technical analysis and multi-asset trading.

Key Features:

- Broker integration: Connects to Oanda, TD Ameritrade, Forex.com, Cannon Trading, GAIN, GFX Brokers, Interactive Brokers, Meintrade, and more via Gateway Connectors (Rithmic, CQG)

- Advanced pattern recognition: Automatically detects Elliott Wave Patterns and Gartley Harmonic Shapes

- Rithmic Level 2 data: Gain deep insights into stock price action

- Advanced tools: Replay Mode, Advanced Alerts, Component Alerts, Multiple Monitor Support

- Free trial & Community Edition: Try all features for free; Community Edition remains free with limited functionality

Pricing: Limited free Community Edition; Paid plans start at $24/month

More Info: See our full MotiveWave review

3. thinkorswim (Best Desktop Experience)

Why we like it: Charles Schwab now owns TD Ameritrade but retains the popular thinkorswim (TOS) platform, including the Mac desktop app. It’s beginner-friendly yet powerful enough for advanced traders.

thinkorswim is technically a broker platform, but its desktop app offers charting tools that rival dedicated trading software.

Key Features:

- Mac desktop app: Fully supported with intuitive interface

- Educational resources: How-to guides, live training, and lessons (e.g., Options trading)

- Extensive data sources: Morningstar, Federal Reserve Economic Database, and more

- Paper trading: Practice with a virtual account before trading real money

- Focused platform: Schwab retired OptionsExpress to concentrate on TOS

Pricing: 0% commission on stocks & ETFs; $0.65 per options contract

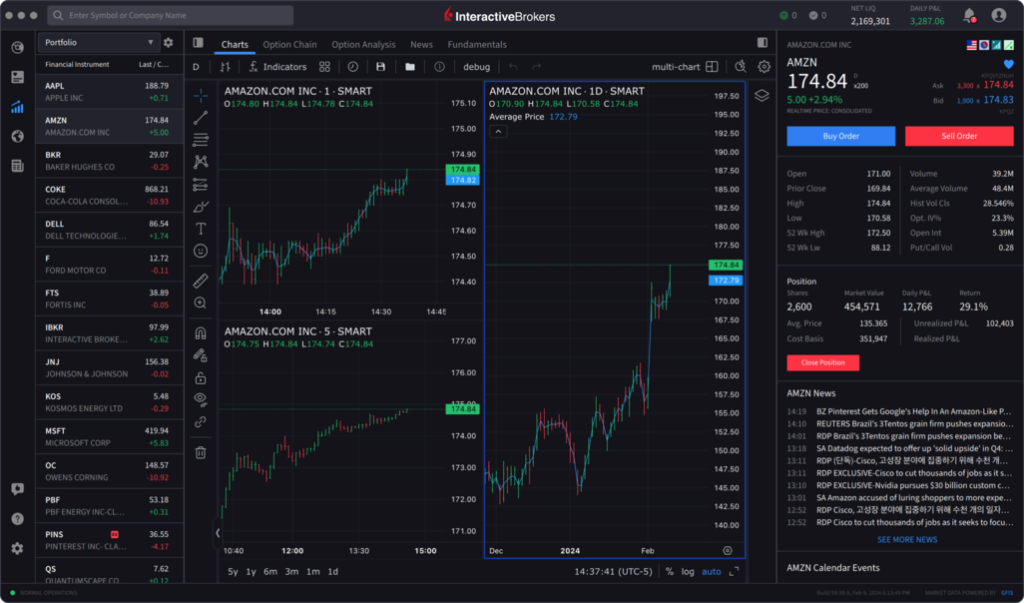

4. Interactive Brokers (Best For Pro Trading Platform & Software)

Why we like it: Low-cost trading platform with professional-grade tools for active investors on Mac.

Interactive Brokers offers both a professional trading platform and standalone trading software, so it crosses both categories.

Key Features:

- IBKR Desktop: A downloadable native macOS app that offers highly customizable layouts. It has advanced charting, technical and fundamental analysis tools, and sophisticated order types.

- IBKR Trader Workstation (TWS): IBKR also offers a sophisticated TWS for Mac, which has extensive capabilities for experienced traders. It provides access to a huge range of asset classes, including stocks, options, futures, and forex.

- Performance: The platform runs natively on Apple Silicon (M-series) and Intel-based Macs, for stable performance without relying on virtual machines.

Pricing: Variable commission and margins depending on asset class

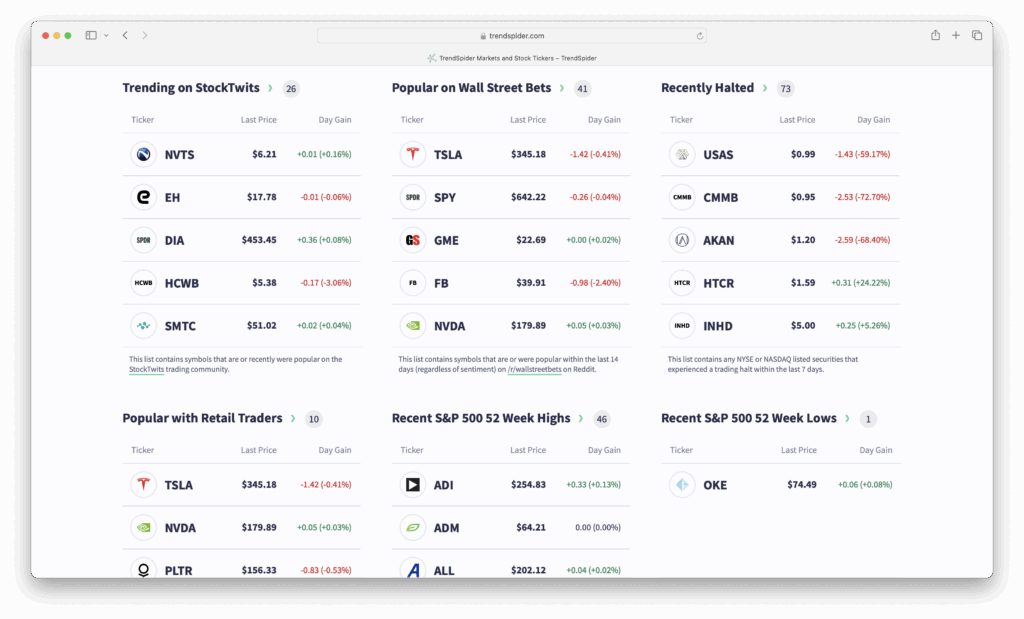

5. TrendSpider (Best For AI Trading)

Why we like it: TrendSpider is a web-based platform offering automated, AI-driven charting and technical analysis, accessible on any Mac browser.

Key Features:

- Web-based: No installation needed; works in any browser on Mac

- AI-powered tools: Pattern recognition, multi-timeframe analysis, backtesting

- Comprehensive dashboard: Charts, indicators, market scanners, watchlists, alerts, strategy testers

- Broker integration: Trade directly via supported brokers (no built-in brokerage)

- Innovative platform: Cutting-edge tools for technical traders

Pricing: Starts at $39/month (paid annually)

More Info: Read our full TrendSpider review

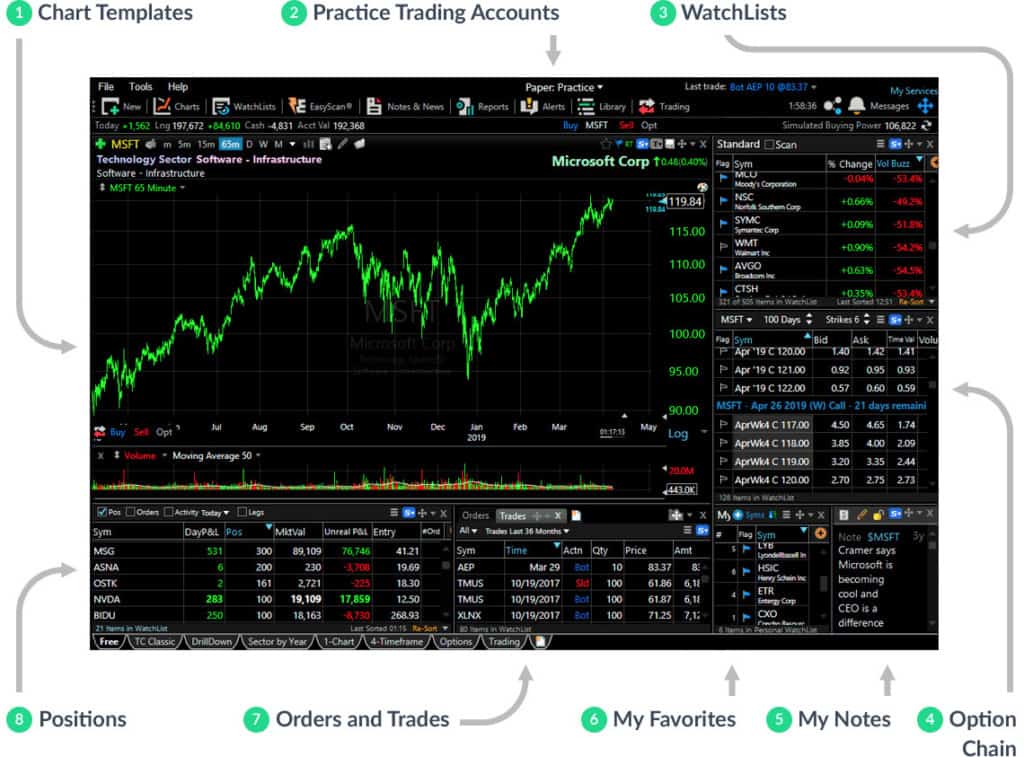

6. TC2000 (Best For Trading & Brokerage)

Why we like it: TC2000 is a trusted, comprehensive trading platform now fully accessible on Mac via web, virtual machine or remote access, offering advanced charts and tools for US stocks and options.

TC2000 sits somewhere between trading software and a broker platform, combining advanced charting with its own integrated brokerage.

Key Features:

- Mac access: Use via web browser, virtual machine or remote connection

- Comprehensive dashboard: Charts, indicators, streaming data, option chains, trading windows, notepad, and favorites watchlist

- Brokerage account: Built-in brokerage service with reasonable margin rates (external broker integration not supported)

- All-in-one platform: Combines trading tools and brokerage in one package

Pricing: Starts at $20.82/month (paid annually)

Best Trading Platforms for Mac (Broker-Based)

Trading platforms are typically provided by brokers and are designed primarily for executing trades, managing accounts, and accessing markets, rather than deep technical analysis.

Most modern trading platforms are web-based, meaning they work well on Macs without requiring Windows or virtual machines.

Comparison Table: Broker Trading Platforms for Mac (Execution & Accounts)

| Platform | macOS Compatible | Platform Type | Trading Fees | Best For |

|---|---|---|---|---|

| eToro | ✅ Web | Broker Platform | Spread-based | Beginners & social trading |

| Robinhood | ✅ Web | Broker Platform | Commission-free | Casual traders |

| Fidelity | ✅ Web | Broker Platform | Commission-free | Long-term investors |

| IG | ✅ Web / App | Broker Platform | Spread / Commission | UK traders |

7. eToro (Best For Beginners)

Why we like it: eToro combines social trading with a Mac-friendly interface, making it ideal for beginners and casual investors.

Key Features:

- Commission-free trading: Stocks and ETFs

- Copy trading: Mirror top investors

- Real-time charts & news feeds

- Web & mobile apps: Fully compatible with macOS

Pricing: Free to open; spreads vary per instrument

Best for: Beginners who want a simple platform with social trading features

Sign-up Disclaimer: Capital at risk

8. RobinHood (Best For Casual Traders)

Why we like it: Robinhood is a commission-free platform with a clean, simple interface that makes trading accessible for beginners.

Key Features:

- Commission-free: Stocks, options, and cryptocurrencies

- Beginner-friendly: Easy-to-use design, ideal for first-time investors

- Apple-optimized: Web platform and iOS apps work seamlessly on Mac/iPhone

- Limitations: Few advanced charting tools; less suitable for technical traders

Pricing: Commission-free (other fees may apply)

9. Fidelity (Best for Long-Term Investors)

Why we like it: Reliable platform for research, retirement planning, and long-term investing on Mac.

Key Features:

- Easy-to-use Mac web interface

- Research tools and portfolio planning

- Commission-free trading for most stocks & ETFs

- Excellent customer support

Pricing: Commission-free for most trades

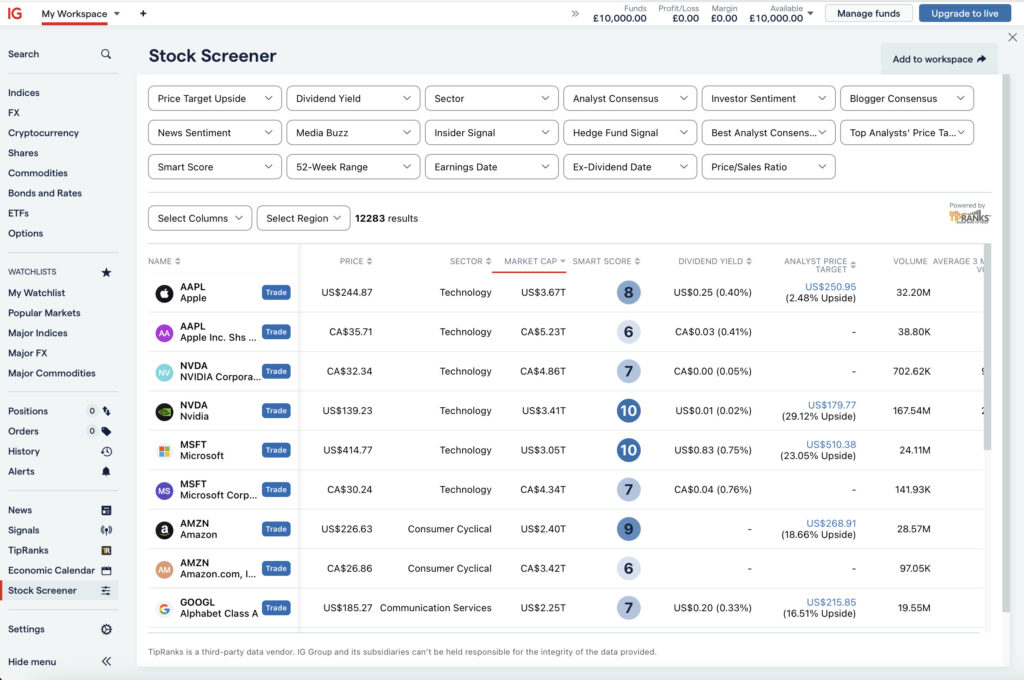

10. IG (Best For UK Traders)

IG Disclaimer: Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Why we like it: IG is a well-established UK based trading platform offering access to over 17,000 markets, and since January 2026, no longer charges any platform fees.

Key Features:

- Wide market access: Forex, stocks, indices, commodities, cryptocurrencies

- Trading options: CFDs, spread betting (UK only), share dealing

- Educational resources: Extensive guides and tutorials for traders

- Risk management: Guaranteed stop-loss orders (GSLOs)

- Mac access: Use via MT4 for Mac (no native desktop app)

- Regulated platform: FCA (UK), ASIC (Australia), NFA (U.S.)

- Market news & analysis: Helps make informed trading decisions

Pricing/Special Offer: Free Demo Account. Until January 16th 2026, new clients can get 7.5% AER variable interest on up to £10,000 of un-invested cash. Spreads starting from 0.6 pips on forex and commission-free trading on U.S. shares. IG no longer charges a quarterly platform or custodian fee which was previously £24 per quarter.

Trading Software vs Trading Platforms on macOS

When searching for stock trading software for Mac or a trading platform for Mac, people often mean different things. Some want advanced charting and analysis, while others want a broker app to place trades.

Understanding the difference helps you choose the right tool for your Mac.

Trading Software (Analysis & Charting Tools)

Trading software focuses on market analysis rather than order execution. These tools are popular with technical traders, swing traders, and anyone who wants powerful charting on macOS.

They are best for:

- Analysing price trends and patterns

- Drawing trendlines and support/resistance

- Using indicators like RSI, MACD, Bollinger Bands, and Ichimoku

- Backtesting strategies and scanning markets

Some trading software connects to brokers, but placing trades is not always the main focus.

Commonly referred to as:

- Stock charting software

- Trading analysis software

- Day trading tools

Mac-compatible examples:

- TradingView (native Mac app + web, broker integrations available)

- TrendSpider (browser-based, analysis-first)

- MotiveWave (native Mac app with optional broker connections)

Trading Platforms (Broker & Execution Apps)

Trading platforms are provided by regulated brokers and are designed primarily for executing trades.

They allow you to:

- Buy and sell stocks, ETFs, options, crypto, or forex

- Manage your portfolio and account

- Place advanced order types (limit, stop, trailing stops)

Most platforms include basic charting, but these tools are often less flexible than dedicated trading software.

On macOS, trading platforms typically come in three forms:

- Web-based platforms (e.g. Charles Schwab, Robinhood)

- Mac-native apps (e.g. thinkorswim, TradingView)

- Windows-only platforms run on a Mac via Parallels or CrossOver (e.g. NinjaTrader, MetaTrader)

Where the Lines Blur

Many modern tools now combine analysis + execution, which is why the terminology can be confusing.

For example:

- TradingView is primarily trading software, but supports trade execution with some brokers

- thinkorswim is a broker platform with very strong charting

- MotiveWave is an advanced analysis software with broker integrations

This is why you’ll see some apps appear in both categories throughout this guide.

Important Broker Details Mac Users Should Know

Before choosing a trading platform, there are a few things worth understanding.

Minimum Deposits

- Most platforms are free to sign up for

- Trading usually requires a minimum deposit, often between $50–$250

- Active trading or margin accounts may require higher balances

Bonuses & Promotions (UK/EU)

- UK and EU brokers cannot offer cash bonuses due to MiFID II regulations

- This is designed to protect retail investors from high-risk incentives

How Brokers Make Money

- Commission-based fees (fixed or per trade)

- Commission-free trading funded by wider spreads

- Payment for Order Flow (PFOF) — common in the US (e.g. Robinhood), restricted or banned elsewhere

- Margin interest if you borrow money to trade

Demo & Paper Trading Accounts

- Many platforms offer paper trading

- This lets you test charting tools and order types on macOS without risking real money

- Highly recommended for Mac users trying a platform for the first time

Regional Restrictions to Be Aware Of

- CFDs are not legal for retail traders in the US

- Some US platforms are unavailable internationally

- Some non-US brokers restrict US residents

Always check regional availability before opening an account.

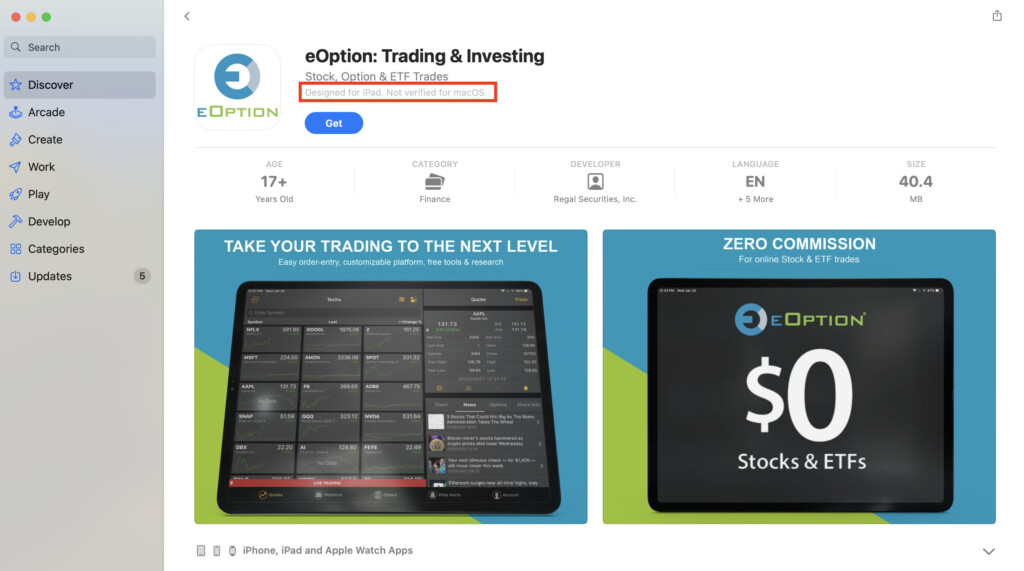

Can You Use iPad-Only Trading Apps on a Mac?

Some iPad trading apps appear in the Mac App Store, but this doesn’t mean they’re fully Mac-optimized.

For example:

- The eOption iPad app can be installed on macOS

- It is labelled “Not verified for macOS”

- This usually means poor keyboard/mouse support and awkward scaling

For serious trading, native Mac apps or browser-based platforms are a better choice.

Frequently Asked Questions

What is the best stock trading software for Mac?

For most Mac users, TradingView is the best stock trading software for Mac overall. It offers professional-grade charting, works natively on Apple Silicon and Intel Macs, supports paper trading, and integrates with multiple brokers for trade execution.

Advanced traders may prefer MotiveWave or Interactive Brokers, depending on their strategy and asset class.

Is there any truly native trading software for Apple Silicon Macs?

Yes. Several platforms now run natively on Apple Silicon Macs without requiring Windows emulation, including:

- TradingView (Mac desktop app)

- MotiveWave

- thinkorswim

- Interactive Brokers IBKR Desktop & Trader Workstation

These provide better performance and stability than running Windows trading software via Parallels.

What’s the difference between stock trading software and a trading platform?

- Stock trading software focuses on analysis and charting, such as indicators, drawing tools, backtesting, and market scanning.

- Trading platforms are provided by brokers and focus on placing trades, managing accounts, and accessing markets.

Some tools, like TradingView and thinkorswim, combine both, which is why the terms are often used interchangeably.

Can you trade stocks on a Mac without Windows?

Yes. Most modern trading software and platforms are now web-based or Mac-native, meaning you can trade stocks on macOS without installing Windows or using virtual machines.

Only a small number of legacy platforms (such as NinjaTrader or some MetaTrader setups) still require Windows.

Is TradingView a broker or trading software?

TradingView is primarily stock trading software, not a broker. It focuses on charting and technical analysis but allows you to place trades by connecting to supported brokers such as Interactive Brokers, TradeStation, and Oanda.

Are there free stock trading platforms for Mac?

Yes. Several platforms offer free access:

- TradingView has a generous free plan

- thinkorswim is free with a Schwab account

- Fidelity and Robinhood offer commission-free trading via web platforms

However, advanced features, real-time data, or professional tools often require paid plans.

Can iPad-only trading apps replace Mac trading software?

Not really. While some iPad trading apps can run on Macs, they are often not optimized for keyboard, mouse, or large screens, making them unsuitable for serious trading.

For long sessions, analysis, and multi-chart setups, native Mac apps or browser-based platforms are a better choice.