Quicken is still one of the most popular personal finance software on the market and in this Quicken Classic For Mac review, we take a closer look at what it can do.

Although we think there are much better alternatives to Quicken for Mac on the market nowadays such as the excellent Empower (FREE) , it’s still a powerful budgeting tool that’s easily still one of the most widely used personal finance packages out there.

What Is Quicken Classic?

Quicken rebranded its Quicken products to “Quicken Classic” as a nod to celebrating 40 years of Quicken and to distinguish it from its more simplified “Quicken Simplifi” personal finance software.

Previously, there were annual releases of Quicken such as with Quicken 2018 For Mac and Quicken 2019 For Mac but that’s no longer the case.

The rebranding involved giving the product a fresh new look in October 2023 although sadly for Mac users, this didn’t finally mean parity with the Windows version.

A result of this rebranding is that Quicken now confusingly refers to the desktop products of Quicken as “Quicken Classic” which embraces the Deluxe, Premier and more recently Personal & Business versions.

Quicken has also switched to a subscription pricing model with improvements and updates rolled out on a continual basis – there’s no one time purchase version available anymore.

We’d love to say that using Quicken Classic on a Mac has finally caught up with the Windows version but as we found, unfortunately there’s still a long way to go.

Here we’ll take a closer look at Quicken Classic for Mac and see where its at compared to the Windows version.

You May Also Like:

Table of Contents

- What Is Quicken?

- Quicken For Mac vs Quicken For Windows

- Quicken On The Web

- Does Quicken For Mac Support Direct Connect?

- Quicken For Mac Improvements

- Quicken For Mac Pricing

- Quicken For Mac Versions Compared

- Is Quicken Classic Safe To Use?

- Is It Worth Getting Quicken Classic For Mac?

- Can You Pay Monthly For Quicken?

- What Happens If I Stop Subscribing?

- Is There A Free Quicken Mac App?

- Does Quicken Work On Apple Silicon Macs?

- Quicken For Mac Alternatives

What Is Quicken?

Quicken is a personal finance management application that was first released back in 1984.

Over the past 40 years, it’s become one of the most widely used personal finance and budgeting software on both macOS and Windows.

Quicken used to be owned by Intuit but was purchased by H.I.G Capital in 2016.

Quicken is still very popular with Windows users although the Mac version of it has never been as good leading many Mac users to ditch the product in favor of alternatives.

Quicken For Mac vs Quicken For Windows

Quicken Classic is available both as a desktop version for Mac and Windows but also in a more limited Cloud and mobile version.

You don’t have to sync Quicken desktop with the Cloud and mobile versions but the option is there if you want to access Quicken in a browser.

On the plus side, the latest version of Quicken Classic has brought it a little closer to the Windows version.

In fact, in terms of looks and stability, it’s much better than the Windows product.

Quicken Classic for Mac is less cluttered and makes it easier to find things compared to the Windows version.

However, it’s the functionality where it still lags behind its PC counterpart.

Some of the features that are still missing from Quicken For Mac compared to the Windows version are:

- Excel export support: Available for certain reports, but still more limited compared to Windows versions.

- You can’t compare buy and hold options: The comparison tools remain limited for Mac users.

- No Debt Reduction Plan tools

- No property value tracking

- No loan amortization tracking

- No credit score reports

- No paystub tracking

- No retirement planning (which means you can’t connect 401K retirement accounts in Quicken Classic for Mac)

- Asset allocation views: This has been improved slightly but still limited compared to Windows.

- No true multi-currency support

- Reporting is far more limited especially when it comes to reports on transfers

- The bills and payees statuses can be confusing with debts often showing where bills have already been paid

- Less banks are supported in the Mac version of Quicken when it comes to connecting and syncing accounts. This is partly because banks are phasing-out Direct Connect which is used by Quicken to connect to financial institutions.

- Limited investment tracking such as lack of the Morningstar Portfolio X-ray tool and lack of cost-basis calculations.

- The Rental Property Manager is only available in the Windows Quicken Personal & Business version.

If you request these features to be added to the Mac version of Quicken, the standard reply is that if enough users vote for it, it will be added in the next version.

Finally, although Quicken does import Quicken for Windows files into the Mac version, the results can be extremely messy.

Because there are many features missing from the Mac version, importing Quicken files between the platforms isn’t as smooth as it should be and you may find yourself spending a lot of time cleaning them up.

Quicken Classic has however introduced exporting investment accounts so if you want to go back the Windows version with your investment tracking data, you can.

One advantage of Quicken for Mac over Quicken for Windows is for those that have financial accounts in both Canada and the USA.

The Mac version of Quicken can sync simultaneously with Canadian and US financial institutions whereas the Windows version can only sync with one country at a time.

This will obviously only be an advantage for a limited number of users that have accounts in both Canada and the USA.

For more, check out our in-depth look at Quicken For Mac vs Windows.

For an in-depth look at the difference between Quicken Deluxe and Premier for Mac, check out our look at Quicken Deluxe vs Premier.

Quicken On The Web

There’s also a limited cloud version of Quicken called Quicken On The Web which offers some of the features that are in the desktop version.

Quicken On The Web is integrated with the desktop version of Quicken For Mac and all changes are synced via the Cloud.

In the online version of Quicken, you can do all the essentials including:

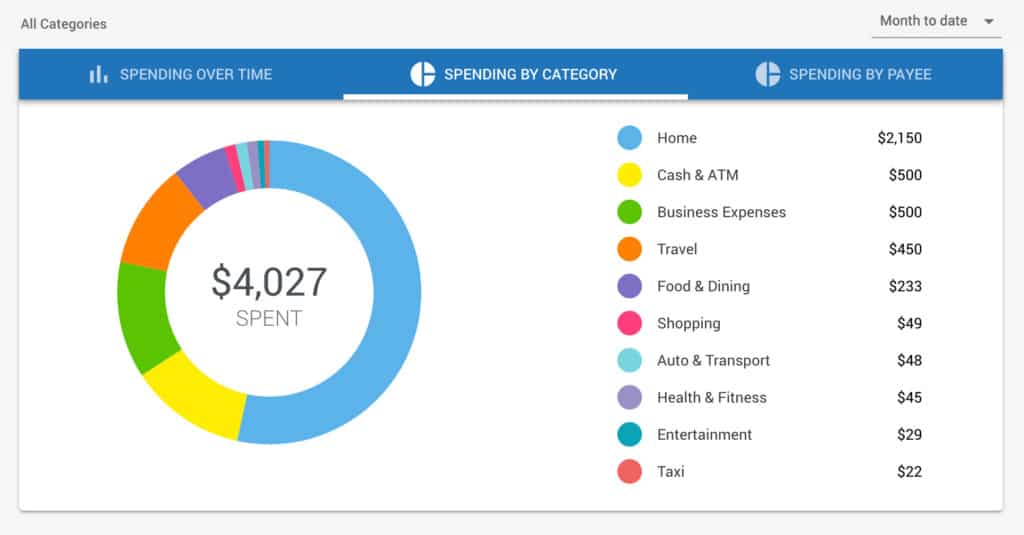

- See balances, transactions, accounts, budgets and investments

- Track investment performance

- Track spending and expenses

You don’t have to sync your accounts with the Cloud version however.

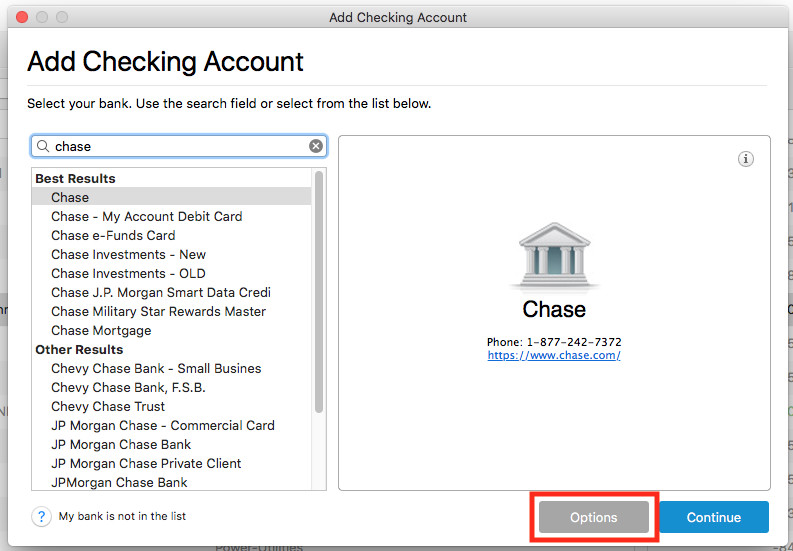

Does Quicken For Mac Support Direct Connect?

Quicken Classic For Mac does support Direct Connect which also supports Bill Pay.

Direct Connect provides a convenient way for Quicken to automatically import your bank statements, transactions and credit card movements from your bank account to help you manage your finances better.

Not only this but compared to other connection protocols, Direct Connect allows you full control over your funds including the ability to pay bills via Quicken Bill Pay and transfer funds between accounts.

This ability for Quicken to connect directly to your bank via Direct Connect has many advantages including:

- Allows the app to help you manage your finances in real time, spot spending trends and advise you.

- Allows bills to be paid and reconciled automatically in the app via Bill Pay

- Allows you to transfer funds between accounts including loans, credit cards, savings and checking accounts.

- Allows you to track the performance of 401K retirement funds.

- Reduces the need to keep logging-into your online banking to keep an eye on your finances.

- Brings together accounts from different banks into one place.

- Allows you to edit your lists of payees by adding or removing payments quickly in Quicken without having to log into your bank account online.

However, it’s important be aware that Direct Connect is slowly being phased-out by banks and in most cases being replaced by Express Web Connect+ (EWC+).

In the Mac version, Quicken supports:

- Express Web Connect (Quicken Connect in Quicken for Mac)

- Express Web Connect Plus

- Direct Connect

- Web Connect

EWC+ still allows you to sync transactions but does not support Bill Pay or allow you to transfer funds between accounts.

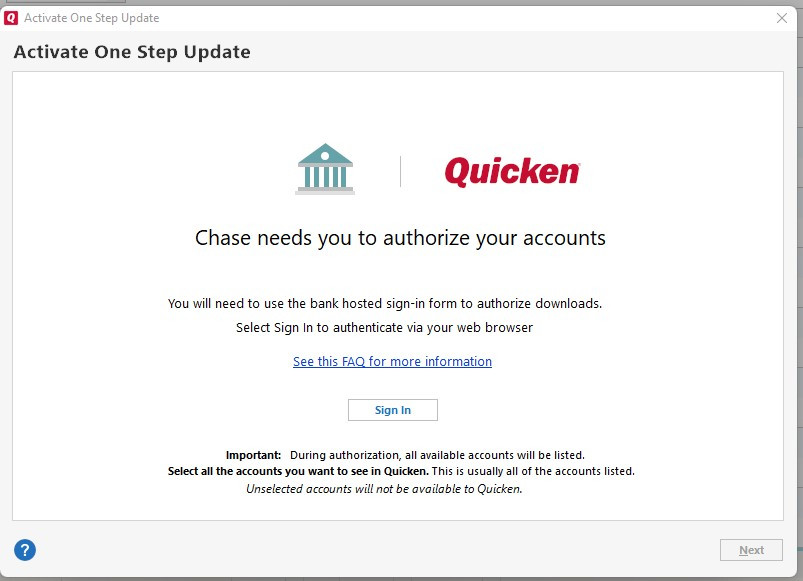

EWC+ also uses a slightly different authentication system to Direct Connect.

The first time you connect via EWC+, it takes you from Quicken to your bank’s website where you have to log into it so that Quicken can receive a secure token.

Your bank login details are then securely stored by Quicken For Mac in this token but you can revoke it from Quicken at any time.

You may have to repeat this authorization method for EWC+ periodically depending on your bank’s policy.

Some argue that this is less secure than Direct Connect+ as Quicken stores your bank login details on its Cloud servers whereas Direct Connect stores then offline on your computer.

On the plus side, all banks offer EWC+ for free whereas some charge for Direct Connect.

For more on this, check out our look at Direct Connect vs EWC+.

Quicken For Mac Improvements

The most noticeable improvement in the latest version of Quicken Classic For Mac is the design and stability of the application.

Quicken Classic For Mac launches much quicker than ever before with charts and graphs also loading faster than previous versions.

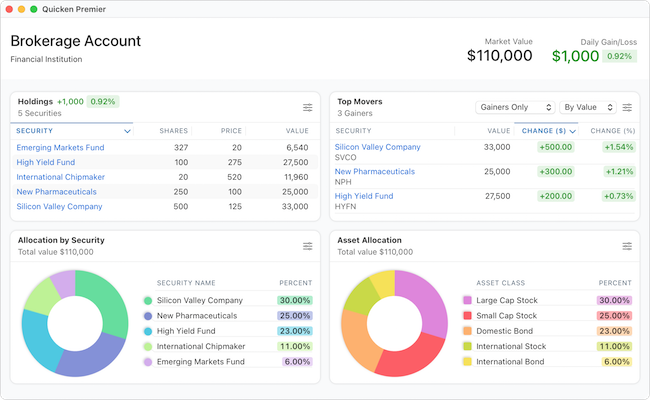

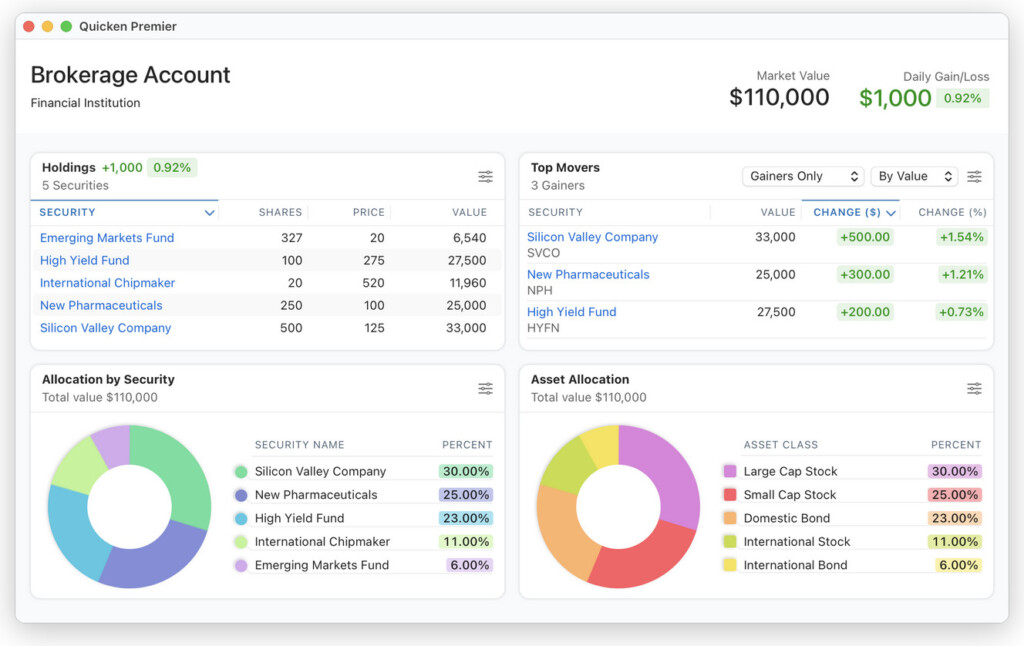

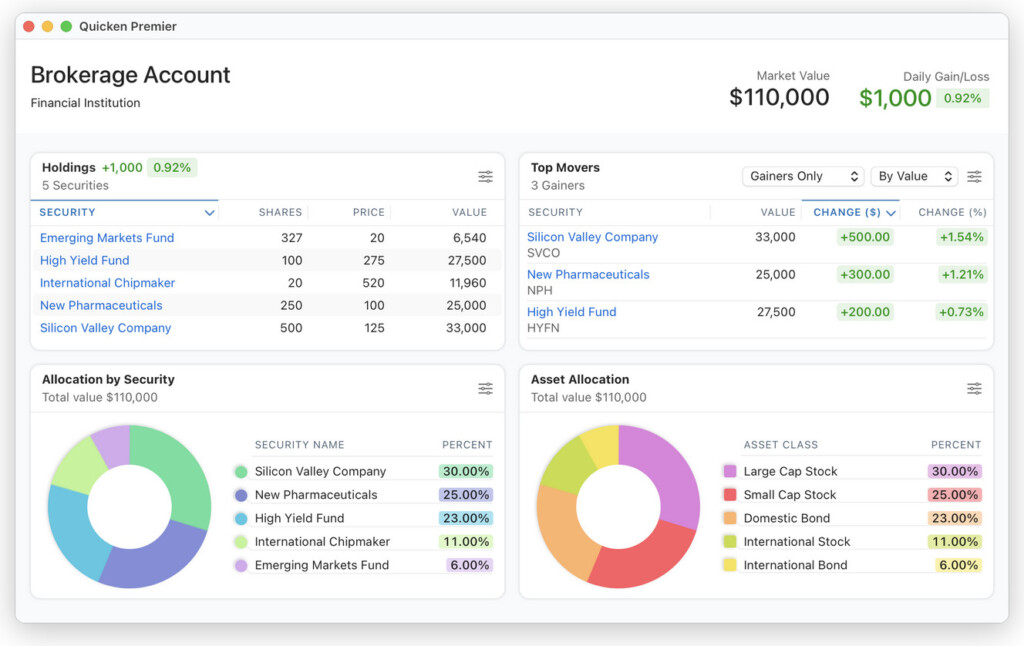

One of the most welcome improvements to the latest edition of Quicken for Mac however is the improved investment portfolio view.

Quicken has never been the best at investment tracking on Macs but the new portfolio view is a big improvement on previous versions.

Source: Quicken

The improved investment dashboard allows you to select account by type (such as Brokerage, Retirement or Education) and then view snapshots of holdings by Type, Security Type and Asset Class.

This makes it much easier for Mac users to use Quicken to balance their portfolio according to risk profile and market movements.

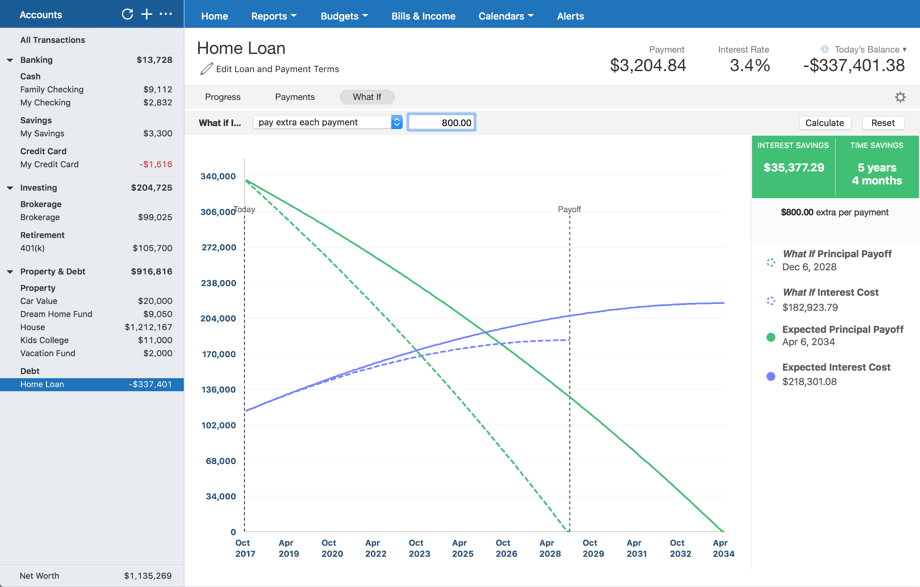

Depending on which subscription you have, the desktop version of Quicken Classic For Mac also includes:

- Bill center dashboard and PDF download of bills

- Improved ability to track the principal and interest on your loans

- What-if analysis on loans

- Customizable investment portfolio with IRR and ROI

- Tax optimization on investment sales

- Free bill pay with Quicken Bill Pay (Quicken Premier for Mac and above) which offers an alternative to Direct Connect Bill Pay which is now being phased-out by many banks.

- Priority customer support access

- Check printing

Previous to this release, all versions of Quicken were been improved with the following features:

- Backups that are around four times faster than previous versions

- Over 500 customer requested improvements or reliability fixes

- Now supports connecting to over 14,500 financial institutions

- 11,000 online bill payment providers with PDF download of bills

- New look bills and income section

- 5GB of free Dropbox offline backup

Quicken For Mac Pricing

Quicken Classic For Mac is available in 3 versions:

- Quicken Classic For Mac Premier ($7.99/m)

- Quicken Classic For Mac Deluxe ($5.99/m)

- Quicken Personal & Business ($10.99/m)

It’s not exactly clear on the Quicken website what’s the difference between the Mac versions of Deluxe and Premier so check out our look at Quicken Deluxe vs Premier for Mac.

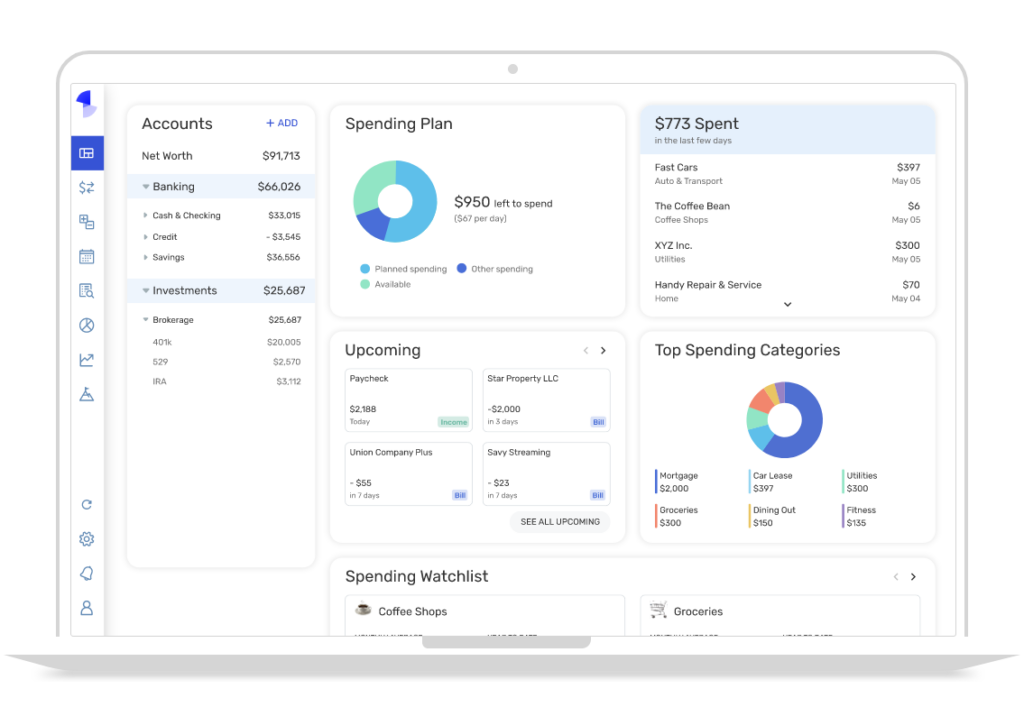

There is also the more recently released Quicken Simplifi ($5.99/m) which, as the name suggests, is supposed to be a simpler way of managing your finances quickly on web or mobile.

Simplfi is the main reason Quicken has branded the older desktop product “Classic” in an attempt to distinguish it further from its more modern (and far more basic) cousin, Simplifi.

Simplifi only works in any browser on a Mac – it is not available as a desktop version on macOS.

It’s a long term replacement for the old Quicken Starter edition which is now no longer available.

The Simplifi app is more of an alternative to Mint for Mac than Quicken and is designed to help you keep on top of your finances in “under 5 minutes per week”.

It’s basically a stripped-down version of Quicken that’s frequently heavily discounted by Quicken to get it off the ground.

Quicken Personal & Business replaces the old Quicken Home & Business which used to be Windows only but is now available on both platforms.

Note that Quicken does not offer monthly payment subscriptions. All subscriptions are paid annually in advance.

If you fail to renew your subscription after a year, you’ll still have access to your account and be able to enter transactions manually but you won’t get any future product updates or sync your accounts.

There are also free Quicken mobile apps available for iPad, iPhone and Android devices for all Quicken versions.

All Quicken products can be tried free for 30 days before you have to pay for a subscription.

Quicken also frequently offers discounts on its products of up to 50% off.

You can see how the different versions of Quicken For Mac compare below.

Quicken For Mac Versions Compared

| Quicken Simplifi | Quicken Classic For Mac Deluxe | Quicken Classic For Mac Premier | |

|---|---|---|---|

| Mac App, Cloud & Mobile | |||

| One Month Budgeting | |||

| Tracks Spending | |||

| Bill Categorizing | |||

| Import Accounts From Quicken | |||

| 12 Month Budgeting | |||

| Principle and Loan Interest Tracking | |||

| What If Analysis on Loans, Investment, Retirement | |||

| Realized & Unrealized Gains | |||

| Cost Basis & Schedule D Tax Reports | |||

| Investment Tracking | |||

| Tax Optimization | |||

| Quicken Bill Pay | |||

| FBAR Reports | |||

| Priority Customer Support | |||

| Price | $5.99/month | $5.99/month | $7.99/month |

Is Quicken Classic Safe To Use?

Like all personal finance apps, Quicken uses high grade encryption to manage your accounts and connect to financial institutions.

Quicken is perfectly safe to use and doesn’t actually “touch” your money so it can’t actually move your money apart from instruct your bank to pay bills using Quicken Bill Pay.

Is It Worth Getting Quicken Classic For Mac?

If you’ve got years of transactions in previous versions of Quicken for Mac then Quicken Classic For Mac is still worth getting.

Although some other personal finance apps can import Quicken data, they often do a poor job and you’re much better sticking with Quicken in that case.

However, if you’re expecting the same product as the Windows version or need investment tracking, there are much better alternatives worth considering.

Can You Pay Monthly For Quicken?

No, Quicken subscriptions must be paid for annually, up-front.

What Happens If I Stop Subscribing?

If you cancel your Quicken subscription after a year, you can still view your transactions and manually enter data. However, your accounts will not sync with Quicken anymore and you won’t receive any updates.

Is There A Free Quicken Mac App?

No you can only download the Quicken Classic For Mac app once you’ve paid for a subscription.

There are free Quicken apps from the iOS and Android App Store that you can download though but you’ll need a subscription.

However, you’ll need to buy a desktop Quicken subscription to use them and activate them with your Quicken ID.

Does Quicken Work On Apple Silicon Macs?

The latest version of Quicken For Mac works natively on the latest Apple Silicon Macs and this is one of the reasons it’s much faster than previous versions.

Previously, Quicken for Mac still worked on M-series Macs running thanks to a free tool in macOS called Rosetta which automatically translates Intel only apps to work on M-series chips.

However, this is a slightly slower process and Quicken is not optimized for it.

If you’re still working on Quicken 2007 however, it will still convert them to work on newer versions of QWuicken.

Quicken For Mac Alternatives

Quicken is still one of the most widely used budgeting tools on the market but there are much better personal finance software on the market nowadays.

One of the poorest aspects to Quicken is the investment tracking.

Especially if you invest in cryptos on your Mac, there’s no support for crypto investment tracking in either Quicken For Mac or Windows.

In this respect, Empower is free to use and the best personal finance software for Mac on the market with far superior net worth tracking and investment management.

You can read our full Empower review for more.

Alternatively, if it’s just budgeting you want to focus on, you may want to to give Moneydance a try.

Moneydance is a Mac desktop personal finance software with some really robust budgeting tools and no subscription.

You can also check out our guide to the best Quicken for Mac alternatives for more.